Apple FY3Q22 Earnings Recap

Two weeks ago, Apple reported a solid FY3Q22 (April to June) given the tough year-over-year compare and considerable FX headwind. In terms of good news, supply chain issues, component shortages, and COVID-related headwinds appear to have bottomed for Apple. When it comes to bad news, some parts of Apple’s business are getting hit by inflation and slowing economic growth more than others.

Here are Apple’s reported 3Q22 results versus my expectations with brief commentary for each item.

Revenue: $83.0 (vs. my $85.9B estimate). Results missed my estimate due to a larger than expected headwind from FX, a larger than expected supply shortage with Mac, and macro issues impacting Wearables, Home, and Accessories.

EPS: $1.20 (vs. my $1.25).

iPhone revenue: $40.7B (vs. my $39.9B). That’s a good iPhone revenue number that doesn’t raise any yellow or red flags to me.

Services revenue: $19.6B (vs. my $20.1B). Results missed primarily on a larger than expected headwind from FX.

Wearables / Home / Accessories revenue: $8.1B (vs. my $9.4B). This was a weak number which Apple attributed to a “cocktail of headwinds.”

Mac revenue: $7.4B (vs. my $8.9B). Apple experienced major issues with supply as the Mac was the product category impacted the most by COVID lockdowns closing factories in China.

iPad revenue: $7.2B (vs. my $7.6B). Apple experienced ongoing issues with iPad supply.

Overall gross margin: 43.3% (vs. my 43.3%)

Services gross margin: 71.5% (vs. my 72.0%)

Products (HW) gross margin: 34.5% (vs. my 34.5%)

Breaking down the $2.9B revenue miss to my estimate, there were two primary drivers:

$1.5B revenue miss due to Mac supply not being as good as thought.

$1.3B revenue miss due to weaker Wearables, Home, and Accessories.

Even though Apple missed my (elevated) expectations, the company reported a 3Q22 beat to consensus as revenue came in about $2B stronger than sell-side analysts were expecting. The beat was due to stronger iPhone revenue as most analysts were expecting something more like $36B to $38B of iPhone revenue (vs. the $40.7B reported figure). EPS came in $0.04 above consensus as Apple’s margins came in slightly better than consensus thought as well.

An Above Avalon membership is required to continue reading this article. Members can read the full article here.

The full article includes the following sections:

Apple’s 3Q22: The Key Numbers

iPhone Sales Resiliency

Apple Ecosystem Growth Slows

Reading Between the Lines of Apple’s 3Q22 Earnings Q&A With Analysts

Notes From Apple’s 3Q22 10-Q

Tracking Apple’s Paid Subscriptions

Apple's Share Buyback Update

My Revised Apple Financial Estimates

An audio version of the article is available to members who have the podcast add-on attached to their membership. More information about the add-on is found here.

Above Avalon Membership

Become a member by using the following signup forms (starting at $20 per month or $200 per year).

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Apple's WWDC 2022 (Daily Updates Recap)

Earlier this month, I flew out to Cupertino to attend Apple’s in-person WWDC event.

The best way of describing the event at Apple Park was Apple getting back into the swing of hosting in-person events. Excluding the masks and hand sanitizer stations, it felt like a usual in-person Apple event. There was a waiting area for press, hundreds of Apple Retail greeters with an infectiously-positive mood, and a product demo area for the media following the keynote.

My estimate is there were 200 to 250 members of the press and media in attendance, including some international press. That’s a smaller crowd that usual. As for developers, there were approximately 1,000. In terms of Apple employees, my best count was that 2,000, possibly even as many as 2,500, watched the keynote.

The event also served as Apple’s first “open house” for its massive circular ring building at Apple Park. All prior Apple Park events for the press took place at Steve Jobs Theater which is located on the other side of Apple Park. For those events, Apple was careful not to have any visitors stray to other parts of the campus.

The Ring at Apple Park (Above Avalon)

The keynote viewing area, as shown below, was intelligently thought out. Apple opened the giant glass walls found in the employee cafeteria to create an indoor / outdoor venue. This served as an adequate solution for getting a lot of people out of the sun. As for those who were baking in the sun, they were given more comfortable, beach-style chairs in return. For the first time, the best seats in the house at an Apple keynote were in the middle of the audience, seated in the shade.

Inside The Ring at Apple Park (Above Avalon)

Interestingly, Apple began airing the taped keynote three minutes earlier than the public streaming. The delay seemed intentional, possibly as a way to encourage live blogging / tweeting since there didn’t seem to be any other reason for starting it early. The largest screen that Apple relied on to show the presentation was shockingly good – the clearest big screen I have ever come across, while the sound system made it seem like I was in an indoor event.

As for why Apple went through the trouble of having ~1,000 developers come on campus despite having an all-virtual WWDC with labs and sessions occurring online, the company missed the community aspect that had become a WWDC tradition. There are clear benefits found with having a virtual WWDC, such as a significant increase in accessibility. However, the face-to-face interactions and social elements that developers experience have been sorely missed the past two years.

My suspicion is that Apple will rely on the event structure again, including in September with the upcoming product event. Apple likely hopes it will be able to host the event inside Steve Jobs Theater. All-in-all, the format worked well, with meticulous planning and preparation throughout. Apple has gotten really good at putting on these massive events. More importantly, an event structure reminiscent of a movie premiere offers a good combination of virtual benefits such as the well-polished taped presentation with animated transitions that can never be replicated in real time and in-person perks like a product demo area.

An Ecosystem Event

WWDC is all about software updates with new hardware sprinkled in from time to time. As Tim Cook put it when concluding the keynote: “[W]e pushed our software platforms forward in some incredible new ways. Introducing features and capabilities that will enable our developers to do amazing work and provide our users with exciting new experiences."

A different way of thinking about WWDC is that it’s Apple’s annual ecosystem event – the one time each year when Apple shows how it is pushing its entire ecosystem forward.

An Above Avalon membership is required to continue reading this article. Members can read the full article here.

The full article includes the following sections:

Attending the Event

An Ecosystem Event

iOS 16 Takeaways

The New MacBook Air

The iPadOS vs. macOS Debate

The Big Surprise Found With Apple Pay Later

Revisiting Apple’s Credit Kudos Acquisition

CarPlay Mistruths

My Full Notes from the Keynote

Winners and Losers From WWDC 2022

An audio version of the article is available to members who have the podcast add-on attached to their membership. More information about the add-on is found here.

Above Avalon Membership

Become a member by using the following signup forms ($20 per month or $200 per year).

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Member Privileges and Benefits

Receive Exclusive Daily Updates. The cornerstone of Above Avalon membership is access to Neil’s exclusive daily updates about Apple. Updates are sent via email and go over current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Approximately 200 daily updates are published throughout the year. Sample daily updates can be viewed here, here, and here.

Receive Exclusive Reports. Members have access to Neil’s reports, which are in-depth examinations of Apple's business, product, and financial strategy.

Access Private Podcasts. Members have the option of attaching a podcast add-on to their membership in order to receive the daily updates and reports in audio form.

Access Neil’s Earnings Model. Members have access to Neil’s working Apple earnings model (an Excel file that also works in Numbers). The model is fully functional and adjustable and provides the ability to alter earnings drivers.

Email Priority. Receive priority when it comes to having email questions and inquiries answered. Neil personally answers all inquiries, including customer service matters related to your membership.

Archive Access. Read 1,200+ daily updates and reports that have been previously sent to members. The Above Avalon member archive is unmatched in the marketplace in terms of the sheer amount of Apple analysis found in one location. The daily updates archive can be viewed here while the reports archive is available here.

Member Forum Access. Join other Above Avalon members in an active forum containing in-depth discussion and debate. Neil moderates and participates in the forum. The forum is run through Slack and can be accessed here.

Virtual Meet-ups. Talk with Neil about Apple and other related items in virtual meet-ups held via Slack throughout the year.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent source of Apple analysis. Above Avalon is fully sustained by its members.

The iPhone Mini (Above Avalon Report)

An analysis of Apple’s iPhone mini strategy including the model’s lukewarm reception with consumers and difficult time competing against the iPhone SE.

Written by Neil Cybart

The iPhone business is booming. Unit sales are estimated to be at record highs (~270 million units per year) while average selling prices remain at healthy levels ($750+). No Android alternative comes close to matching the iPhone’s success. A major contributor to the iPhone’s success over the years, both in terms of sales and installed base growth, has been Apple’s intelligent approach at diversifying the iPhone line based on feature set and price. Selling a range of iPhone models, including the iPhone mini, has played a key role in Apple reaching a larger customer base.

History

Apple’s iPhone model expansion strategy started relatively straightforward and early on.

An Above Avalon membership is required to continue reading this report. Members can read the full report here. An audio version of this report is available to members who have the podcast add-on attached to their membership. More information about the add-on is found here.

(Members: Reports are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Member Privileges and Benefits

Receive Exclusive Daily Updates. The cornerstone of Above Avalon membership is access to Neil’s exclusive daily updates about Apple. Updates are sent via email and go over current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Approximately 200 daily updates are published throughout the year. Sample daily updates can be viewed here, here, and here.

Receive Exclusive Reports. Members have access to Neil’s reports, which are in-depth examinations of Apple's business, product, and financial strategy.

Access Private Podcasts. Members have the option of attaching a podcast add-on to their membership in order to receive the daily updates and reports in audio form.

Access Neil’s Earnings Model. Members have access to Neil’s working Apple earnings model (an Excel file that also works in Numbers). The model is fully functional and adjustable and provides the ability to alter earnings drivers.

Email Priority. Receive priority when it comes to having email questions and inquiries answered. Neil personally answers all inquiries, including customer service matters related to your membership.

Archive Access. Read 1,200+ daily updates and reports that have been previously sent to members. The Above Avalon member archive is unmatched in the marketplace in terms of the sheer amount of Apple analysis found in one location. The daily updates archive can be viewed here while the reports archive is available here.

Member Forum Access. Join other Above Avalon members in an active forum containing in-depth discussion and debate. Neil moderates and participates in the forum. The forum is run through Slack and can be accessed here.

Virtual Meet-ups. Talk with Neil about Apple and other related items in virtual meet-ups held via Slack throughout the year.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent source of Apple analysis. Above Avalon is fully sustained by its members.

Introducing New and Improved Above Avalon Reports

In 2018, I unveiled Above Avalon Reports as a way to go deeper into Apple topics for Above Avalon members. Reports were designed to have a long shelf life and be used as reference material that members can periodically turn to. Five reports were published to date, and each received very positive member feedback. The top request has been more reports.

I’m excited to unveil Above Avalon Reports 2.0, which both addresses some improvements to the reports format and introduces a few new concepts. The updates include:

A leveraging of the daily updates back catalog. Since 2015, more than 1,200 daily updates have been published. That amounts to approximately 35 books worth of analysis and perspective. It’s an incredible back catalog that has proven to have a long shelf life. However, the back catalog can be overwhelming to navigate. Reports are going to tackle this problem by purposely covering core topics that we have talked about in prior updates over the course of months and maybe even years. A few sample topics that fall under this bucket will include AAPL valuation trends, Apple’s TV strategy, gauging Apple Watch competition, Project Titan 101, and Mixed Reality 101.

More approachable (i.e. shorter) and frequent reports. With the initial round of reports, word count and publication date became arbitrary targets. Going forward, reports will be as long as they need to be in order to properly cover a topic. This will result in more frequent reports as well.

The tackling of new topics. In addition to covering topics that we have previously discussed in the updates, reports will also include topics that wouldn’t make as much sense for the daily updates format. These reports will likely be narrower in focus and shorter in length.

Easier-to-find reports. Daily updates have their own dedicated Slack channel. Reports will now get the same. Reports will also be featured more prominently on AboveAvalon.com. This will make it easier for members to access reports while potential members are made aware of what members have access to.

Accessible to All Members

It was important to me to keep Above Avalon Reports accessible to all members. Accordingly, reports will remain free for Above Avalon members.

The daily updates are a great way to discuss current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Reports will be a great way to showcase my analysis and research on all things Apple that may not necessarily have a connection to the current news cycle. While I think the daily updates will remain the cornerstone of Above Avalon membership, my expectation is that some members will look at Reports as the gem found with an Above Avalon membership.

Become a member by using the following signup forms ($20 per month or $200 per year).

Payment is hosted and secured by MoonClerk and Stripe. Apple Pay is accepted. You will receive a confirmation email that includes a link allowing you to update your payment information and membership status at any time.

New Private Podcast for Reports

Something new that I am introducing is the option to receive Above Avalon Reports in audio form via a new private podcast. Once a written report has been sent out to all members via email, I will also be releasing an audio version of the report. This audio version will involve me reading through the report as well as explaining and talking through charts, exhibits, and tables. Each report will represent an episode of a new podcast that I am appropriately calling “Above Avalon Reports”. My expectation is that I will also record behind-the-scenes episodes that go over my research and perspective that didn’t make the final cut for publication.

This new private podcast will be made available to Above Avalon members who have attached the podcast add-on to their membership. This means the podcast add-on will now provide members access to two private podcasts:

Above Avalon Reports (for the reports)

The podcast add-on (just $10 per month or $100 per year) offers approachability and accessibility for members looking to customize their membership to their liking. Listen to daily updates and reports around the house, on a walk, or in the car. Receive more than 40 hours of audio per year while gaining access to a back catalog of 60 additional hours of analysis.

Transistor is handling the behind-the-scenes mechanics for distributing the private podcasts so that they can be listened to in various podcast players including Apple Podcasts and Overcast. The set-up process is very simple:

Upon purchasing the podcast add-on, you will receive an email (from “Neil Cybart via Transistor”) that directs you to a signup page listing various podcast players that can be used to listen to the podcast. Open the page on an iPhone, and you will see various iOS podcast players. Open the page on a Mac, and you will see options for listening to the podcast on a Mac.

After you select your preferred podcast player, new Above Avalon Reports episodes will automatically appear in your podcast feed as they are published.

That’s it. There is no need to create a separate login, password, or Transistor profile. In the vast majority of cases, there is no need to even copy or paste a link or RSS feed.

To become a member and have the podcast add-on attached to your membership, use the following signup forms:

Payment is hosted and secured by MoonClerk and Stripe. Apple Pay is accepted. You will receive a confirmation email that includes a link allowing you to update your payment information and membership status at any time.

If you are already an Above Avalon member, fill out this form to get the podcast add-on.

Big Picture

A growing number of sites that rely on paid subscription or membership business models are making their best material free and then treating membership features like exclusive posts and newsletters as “extras.” I’ve been building Above Avalon to be something different. Over the past few years, nearly all of my time and effort has been dedicated to exclusive analysis for members. In the coming weeks, I make a more deliberate effort to show non-members the value and content found with Above Avalon membership. A surprising number of people who read and listen to Above Avalon are still not aware I publish daily updates.

A big thank you to those of you who have supported Above Avalon membership and recommended it to others. Word of mouth has remained a vital growth driver for membership over the years. Above Avalon membership was launched seven years ago last month - May 13th, 2015!

- Neil

Apple Is in a League of Its Own

During Apple’s “Peek Performance” event held last month, the company announced not only a brand new Mac category with the Mac Studio, but also iPhone SE and iPad Air updates that will be well-received in the marketplace. Management fit so much into its 57-minute event, Apple’s entry into live sports was given just 65 seconds.

The primary takeaway from Apple’s event wasn’t found with any particular product. Instead, it was the sheer breadth of product unveilings that caught my attention. Over the past 18 months, Apple has held seven jam-packed product unveilings that have included a collection of new hardware, software, and services. Apple’s peers would be thrilled to hold just one of these presentations every year or two. There is no other company in the same league as Apple when it comes to maintaining and updating such a wide and comprehensive ecosystem of devices and services. The pace of Apple’s new product unveilings has played a role in the company pulling away from the competition.

Ecosystem Strength

It's easy to look at Apple’s quarterly earnings and reach conclusions about the company’s ecosystem strength. Apple’s financials, although strong, don’t tell the full story. With nearly 80% of Apple’s revenue attributable to hardware, the company’s financials remain heavily influenced by upgrading trends. Revenue, operating income, and cash flow metrics undersell how Apple is performing in the marketplace from a new user perspective.

The following new user estimates are obtained by combining Apple management commentary with my own product unit sales assumptions:

To get to the heart of what Apple is doing and how the company is executing so well, we have to go back to 2017 and 2018. Apple began to follow a new strategy that amounted to pushing all of its product category forward at the same time. Previously, Apple had been following a product strategy that can be thought of as a pull system. The company was most aggressive with the products capable of making technology more relevant and personal.

One way of conceptualizing this strategy is to think of Apple product categories being attached to a rope in order of which makes technology more personal via new workflows and processes for getting work done. As Apple management pulled on the rope, the Apple Watch and iPhone received much of the attention while the Mac increasingly resembled dead weight. Similarly, the iPad had hit a rough patch.

Apple is now utilizing a push system in which every major product category is being pushed forward simultaneously. As a result, the iPad, and in particular the Mac, has received more priority. We have also since seen Apple become more aggressive with expanding the number of SKUs available and giving consumers more price and feature options.

At the core of Apple’s product strategy shift was a doubling down on autonomy within its product development process. The Apple machine is operating at such speed and scale, it’s not realistic to think one person can control or run the machine. Apple wouldn’t be able to push its entire product line forward simultaneously if every decision had to go through one gatekeeper. Instead, the Apple machine was designed to take on a certain level of autonomy in order to instill Apple’s values in all employees. Designers of various disciplines have been given greater say over the user experience.

Floundering Competition

As product strategy changes were underway within Apple, the competition began to flounder. A growing number of bad product bets were placed, peaking with the ultimate misdirection in tech of the past decade: voice computing and the stationary smart speaker mirage. The subsequent embrace of stationary screens positioned on kitchen countertops has seen limited adoption. Foldable smartphone sales have not been impressive. Apple competitors are now struggling to capture consumers’ attention and money with routine annual smartphone updates.

We are at the point when tough questions have to be asked about Apple’s competition, or lack thereof. What company can realistically give Apple a run for its money? The number of paid subscriptions across Apple’s platform is increasing by 170 million per year. Google wants to compete in some hardware verticals that Apple plays in, but it’s fair to question Google management’s commitment. At times, their heart just doesn’t seem in it. Amazon and Microsoft have stronger motivations to do well in hardware, but their lack of design thinking is hard to miss. Meta would win the award for strongest public commitment to hardware, but the company’s culture and heritage don’t seem to mesh well with what it takes to do well in hardware. Snap, Spotify, Sonos, and the long list of smaller companies dabbling in hardware all lack the ecosystems to truly go up against Apple toe to toe.

When thinking of competition outside the U.S., a growing number of consumers are looking for entry points into comprehensive (and premium) ecosystems. Apple is selling both the all-around best smartphone in the market and tools and services designed to live both below and above the smartphone. Android switching rates are increasing while Apple entices hundreds of millions of iPhone-only users to move deeper into the ecosystem.

A risk that any company in Apple’s position will face is complacency. With most of its product categories, Apple’s largest competitor ends up being itself. The fact that Apple’s ecosystem updates are accelerating rather than declining as the competition breaks apart is a potential sign of Apple decoupling itself from the “competition drives us” mantra that is found in Silicon Valley. There is a deeper drive within Apple – a feeling that if Apple doesn’t create it, no one else will - that is driving teams forward.

Check out the daily update from April 5th for additional discussion on this topic.

Receive Neil’s analysis and perspective on Apple throughout the week via exclusive daily updates. The updates, which have become widely read and influential in the world of Apple, provide timely analysis of news impacting Apple and its competitors. Neil also publishes exclusive reports on Apple business, product, and financial strategy. The daily updates and reports are available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Above Avalon Year in Review (2021)

Heading into 2021, Apple had just gone through one of the more tumultuous years in its existence. As discussed in last year’s Year in Review, the pandemic turned 2020 into a steady stream of unexpected challenges for Apple. Expectations that 2021 would be much smoother turned out to be optimistic. While society did largely open up halfway through the year, which allowed Apple’s retail apparatus to return to normal operations, Apple continued to face once-in-a-few-decades challenges when it came to the supply chain, product manufacturing, and navigating its 154,000 employees through a pandemic.

According to my estimate, Apple experienced $10 billion of unmet demand in 2021 as a result of supply chain issues. This total is on top of lingering demand issues associated with wearables that arose from the pandemic.

Despite the challenges, 2021 was a record year for Apple on a number of business fronts:

Apple sold 260M+ iPhones - a record high for a 12-month period.

Apple sold 25M Macs - a record high for a 12-month period.

The Apple Watch installed base surpassed 100 million people.

Articles

In 2021, I published 10 Above Avalon articles. In looking through the articles, which are accessible to all, there was one overarching theme: Apple’s ecosystem continues to gain strength and is ready for the next major product category launch (a mixed reality headset).

Here are a few of my favorite articles published in 2021 (in no particular order):

Apple Has a Decade-Long Lead in Wearables. AssistiveTouch allows one to control an Apple Watch without actually touching the device. A series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The technology is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years, but more like a decade.

Apple Won the Share Buyback Debate. I receive many questions about Apple from Above Avalon readers, listeners, and members. In previous years, one topic has been far ahead of any other as a source of questions. Everyone wanted to know about Apple’s share buyback program. Something interesting happened in 2020. I received far fewer questions about Apple’s share buyback program. To be precise, I didn’t receive an incoming question about buyback in nine months - from when the stock market put in a bottom in April 2020 to the start of 2021. What explains such a dramatic change? The Apple share buyback debate ended, and Apple was declared the winner.

Apple’s Extremely Quiet Year for M&A. While going through Apple’s 10-K for FY2021, one number jumped out at me. It wasn’t the record iPhone sales, strong margins, or phenomenal free cash flow. Instead, it was the lack of cash spent on M&A. In 2021, Apple spent just $33 million on business acquisitions (M&A). That’s a record low for Apple with Tim Cook as CEO. It’s a number that deserves further investigation as Apple’s M&A strategy and philosophy play a big role in how Apple was able to get to where it is today.

The five most popular Above Avalon articles in 2021, as measured by page views, were:

Podcast Episodes

There were 11 episodes of the Above Avalon podcast recorded and published in 2021, totaling 4.5 hours. The podcast episodes that correspond to my favorite articles are found below:

Charts and Exhibits

The following charts and exhibits found in Above Avalon articles published in 2021 were among my favorites.

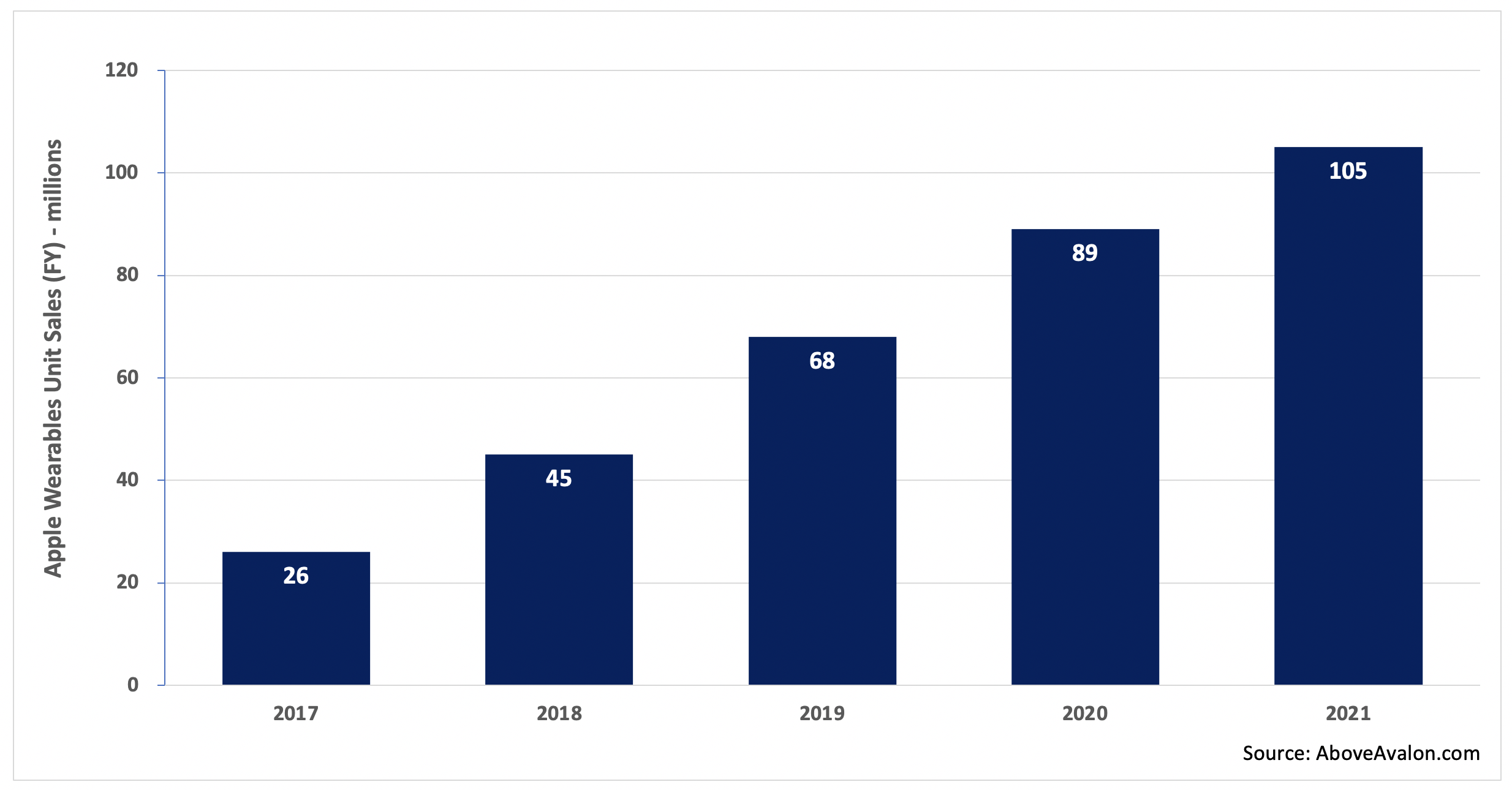

Apple Wearables Unit Sales (2017 to 2021) - from Apple Has a Decade-Long Lead in Wearables

According to my estimate, Apple is on track to sell 105 million wearable devices in 2021. That total represents 40% of the number of iPhones sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Percentage of Apple Revenue Through Direct Distribution Channel - from The Future of Apple Retail

The percentage of sales going through Apple’s direct distribution has gradually increased in recent years. The increase in sales percentage has likely been boosted by services revenue, more sales going through Apple’s website, and more iPhone upgrading taking place through Apple.

Note: Direct distribution channel includes Apple’s website, Apple stores, and direct sales force.

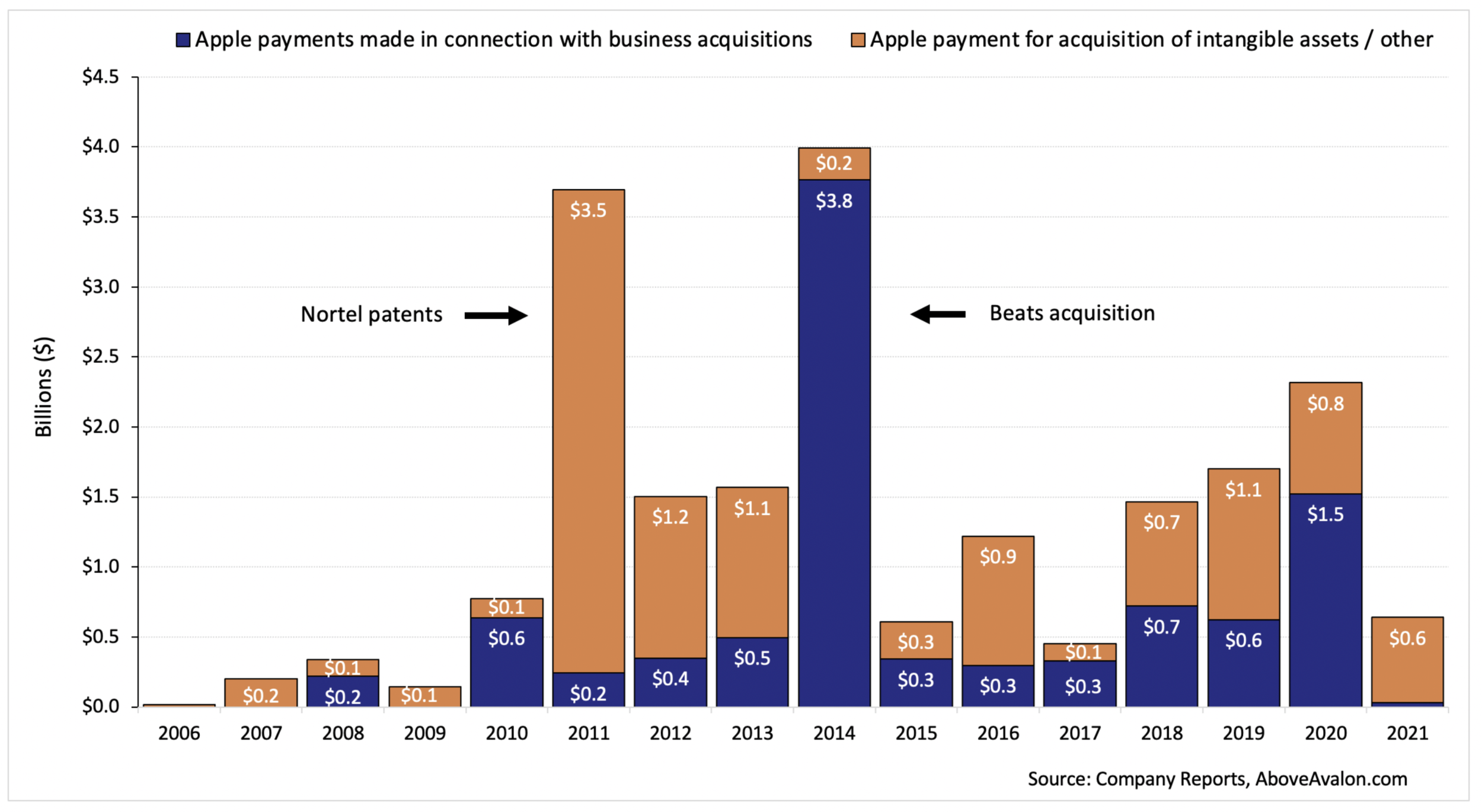

Apple M&A (Cash Payments) - from Apple’s Extremely Quiet Year for M&A

Since 2006, Apple has spent $20.6 billion on M&A with about half of the total tied to “business acquisitions.” The median is $1 billion per year. However, in 2021, Apple spent just $33 million on business acquisitions. That is the lowest amount since 2009 when Steve Jobs was still Apple CEO.

Daily Updates

In 2021, I published 182 Above Avalon Daily Updates that were available exclusively to Above Avalon members. With each update coming in at approximately 2,000 words, 182 updates are equivalent to five books. This continues to be an industry-leading number when it comes to the amount of Apple business and strategy analysis published.

When looking over the topics discussed in this year’s daily updates, a few sub themes become apparent:

Project Titan Moving Forward

Along with mixed reality and AR, transportation is one of the largest areas of opportunity when thinking of future Apple products and services. The year turned out to be the busiest one yet when it came to Project Titan news as Apple began to seek supply chain and manufacturing partners.

Hyundai Confirms Talks With Apple, Apple Considering Car Factory in Georgia, Making Sense of Apple and Hyundai News (Jan 12, 2021)

Apple Car and the Last Mile, Revisiting an Apple Campus Shuttle Service, Thursday Q&A (Feb 4, 2021)

Apple’s Kevin Lynch Joins Project Titan, Apple Car Implications, Apple Watch Implications (Jul 19, 2021)

Doug Field Leaves Apple for Ford, Project Titan’s Trajectory and Leadership, Silicon Valley vs. Detroit (Sep 8, 2021)

Kevin Lynch Tapped to Lead Project Titan, Disillusionment in the Auto Space Is Setting In, Ted Lasso Wins Big at the Emmys (Sep 20, 2021)

Changes in Paid Video Streaming Land

Given the rush of new players into the paid video streaming space in 2020, there was quite a bit of movement in 2021. AT&T’s decision to spin off WarnerMedia was an industry-shaking event. As the months went on, it became clear that many content distribution services were experiencing something equivalent to a pandemic air pocket as subscriber trends became noisy. Netflix and Roku ran into friction while the true new kid on the block (Apple TV+) regained momentum with new shows and movies coming online in the back half of the year.

AT&T to Spin Off WarnerMedia, HBO Max’s Future, Apple Implications May 17, 2021

WarnerDiscovery and Apple M&A, Ranking Paid Video Streaming Leaders, Netflix Contemplating Move into Gaming May 26, 2021

The App Store’s Day in U.S. Court

The well-publicized Epic Games vs. Apple trial resulted in a resounding legal victory for Apple. It ended up being difficult to grasp just how poor of a job Epic Games did in trying to paint Apple as a monopoly. While the court did order Apple to change its anti-steering provision in the U.S., Apple won a stay by a court of appeals. The outcome with the highest probability is for the anti-steering provision to remain as is which would signal Apple’s very strong legal footing as it pertains to the App Store.

Epic Games vs. Apple, Epic's Arguments Against Apple, Epic’s Motivation Apr 27, 2021

Thoughts on the Epic Games vs. Apple Ruling Sep 13, 2021

When looking at my daily updates published in 2021, selecting a few favorites out of 196 updates was not easy. The following updates stood out to me (in no particular order):

Warren Buffett’s Annual Letter, Apple Isn’t Buffett’s Token “Tech” Stock, Apple, Buffett, and Buyback. We kick off today’s update with my thoughts on Warren Buffett’s 2020 letter to Berkshire Hathaway shareholders. Berkshire is Apple’s largest individual shareholder. The discussion then turns to why I don’t agree with those claiming Apple is Buffett’s token tech stock. We conclude by looking at share buyback and how the capital return mechanism leads to a wealth transfer event. (Mar 2, 2021)

Peloton Recalls All of Its Treadmills, The At-Home Fitness Revolution Needs a Reset, Apple, Fitness Machines, and Gyms. Today’s update will be focused on the at-home fitness industry. It’s a market that Apple moved deeper into a few months ago with Apple Fitness+. A good argument can be made that at-home fitness impacts other Apple devices as well especially Apple Watch and Apple TV. We kick things off with my thoughts on Peloton recalling all of its treadmills. The discussion then turns to why I think the at-home fitness industry needs a reset. The update concludes with how fitness equipment safety, or the lack thereof, impacts Apple and why I continue to think there will be a role for gyms to play in the future. (May 6, 2021)

Tesla Buys Bitcoin, Apple and Bitcoin, Apple and Crypto Exchanges. Today’s update will be focused on bitcoin. We begin with news of Tesla buying $1.5B of bitcoin. We then turn to my thoughts on whether or not Apple should follow Tesla into bitcoin. The update concludes with a closer look at RBC Capital Market’s suggestion that Apple should move into cryptocurrency exchanges. We go over why I don’t think the firm’s analysis passes the small test. (Feb 10, 2021)

Apple’s Services Journey, A Different Way of Thinking of Apple One, Apple Services Evolution. For the first time in what feels like a long time, the Apple news cycle is taking a breather. This provides us with an opportunity to pursue some original topics. We kick off today’s update with my thoughts on the narrative surrounding Apple’s Services business. Things are starting to change. The discussion then turns to how I think about Apple’s Apple One bundle and how reframing Apple One leads to some interesting questions and ideas as it pertains to the competition. The update concludes with my thoughts on the future factors determining where Apple Services are headed. (Jul 13, 2021)

Niantic CEO Pours Cold Water on the Metaverse, Meta Buys Within, The Mistake People Are Making With the Metaverse. We kick things off with my thoughts on Niantic CEO John Hanke’s interview with The Verge’s Nilay Patel on his Decoder podcast. Hanke discussed some of the more intriguing topics and concepts found in the AR/VR/metaverse space. The discussion then turns to Meta (Facebook) buying Within. We go over two items that jumped out at me about the acquisition. The update concludes with the mistake that I see consensus making when it comes to metaverse analysis. (Dec 16, 2021)

The Amazon Event, Amazon’s Play for Neighborhoods, Amazon Astro. Today’s update will be focused on Amazon’s product event. We kick things off with my thoughts regarding Amazon’s product strategy involving ambient intelligence. The discussion then turns to Ring’s outsized presence throughout Amazon’s presentation. We go over Amazon’s play for neighborhoods and what is at stake. The update concludes with a closer look at the Amazon Astro. (Sep 29, 2021)

Here are the five most popular daily updates published in 2021 based on page views to AboveAvalon.com. There is naturally a tendency for updates published earlier in the year to outrank more recent updates.

Apple Designer Eugene Whang Left Apple, Apple Industrial Design Turnover, Spotify’s WSJ Op-Ed Against Apple (May 19, 2021)

Peloton Acquires Wearables Company, Peloton vs. Apple Watch, Facebook Talks Up Smartwatch as AR Controller (Mar 23, 2021)

Tesla’s Bitcoin Problem, Apple and Bitcoin Mining, Introducing My FY2022 Estimates for Apple (Feb 11, 2021)

Target to Open Mini Apple Stores, Apple’s Retail Store Growth Strategy, Thursday Q&A (Feb 25, 2021)

Apple Contemplating Apple Watch Explorer Model, Thinking About the Apple Watch Line, Apple Watch Partnerships (Mar 29, 2021)

Just 13% of the daily updates published in 2021 are highlighted in this article. The full archive consisting of all 182 daily updates is available here. Above Avalon membership is required to access the updates.

Daily Podcast

This was the first full year for the Above Avalon Daily podcast, the private podcast available to members who attached the podcast add-on to their membership. A total of 182 episodes were published, totaling nearly 40 hours of audio. The podcast allows members to consume the daily updates in new and different ways while around the house, on a walk, or in the car. Since launch, reception of the daily podcast has exceeded my expectations with very positive listener feedback. More information on the daily podcast, including a few sample episodes, is found here. Once an Above Avalon member signs up for the daily podcast, all prior episodes become available for listening in podcast players that support private podcasts.

Inside Orchard (Launched in 2021)

In March, I launched InsideOrchard.com as a home to my unique perspective on technology and its impact on society. Over the past nine months, 40 essays and corresponding podcast episodes were published. Although distinct from the analysis and discussion found with Above Avalon, the two sites can be thought of as siblings. A bundle consisting of both an Above Avalon membership and Inside Orchard subscription, with an accompanying price discount, was purchased by a good percentage of the Above Avalon member base.

Here’s to 2022

A big thank you goes out to readers, listeners, and members for making 2021 another successful year for Above Avalon. Have a safe and relaxing Christmas, holiday season, and New Year. See you in 2022. - Neil

Above Avalon Podcast Episode 188: Apple Closed Its M&A Wallet

(Episode 188 was published on November 20th.)

While going through Apple’s recently-filed 10-K for FY2021, one number jumped out at me. It wasn’t the record iPhone sales, strong margins, or phenomenal free cash flow. Instead, it was the lack of cash spent on M&A. In episode 188, we discuss the key takeaway found with Apple spending just $33 million on business acquisitions (M&A) in FY2021. The discussion includes Neil’s thinking as to what may be behind the multi-year low for M&A and an overview of Apple’s M&A strategy.

To listen to episode 188, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Apple’s Extremely Quiet Year for M&A

While going through Apple’s recently-filed 10-K for FY2021, one number jumped out at me. It wasn’t the record iPhone sales, strong margins, or phenomenal free cash flow. Instead, it was the lack of cash spent on M&A. In 2021, Apple spent just $33 million on business acquisitions (M&A). That’s a record low for Apple with Tim Cook as CEO. It’s a number that deserves further investigation as Apple’s M&A strategy and philosophy play a big role in how Apple was able to get to where it is today.

Every quarter, Apple reports the amount of cash spent on M&A in the cash flow statement via “Payments made in connection with business acquisitions” within investing activities. The company also reports the amount of cash spent on acquiring intangible assets like patent portfolios via “Other” or “Payment for acquisition of intangible assets.” It is important to note these totals do not reflect payments tied with capital expenditures (property, plant, and equipment). For a company as secretive as Apple, these lines items are among the first things to check out when 10-Qs and 10-Ks are published. Only a fraction of Apple’s acquisitions are ever announced or known via press release or blog post. However, as the saying goes, cash flow doesn’t lie - whatever Apple spends on acquisitions will appear for all to see.

Exhibit 1 shows the amount of cash Apple spent on both business acquisitions (what most people commonly refer to as M&A) and acquiring intangible assets/other going back to 2006.

Exhibit 1: Apple M&A (Cash Payments)

Since 2006, Apple has spent $20.6 billion on M&A with about half of the total tied to “business acquisitions.” The median is $1 billion per year. However, in 2021, Apple spent just $33 million on business acquisitions. That is the lowest amount since 2009 when Steve Jobs was still Apple CEO.

I also examined Apple’s M&A history to count the number of deals by year. There is a major caveat found with such an exercise - I am limited to the number of known acquisitions. Given Apple’s secrecy, a number of acquisitions are never disclosed. To be fair, these unknown acquisitions tend to be small and usually involve teams of talent.

Exhibit 2: Apple M&A (Number of Deals)

Why was 2021 such a quiet year for Apple M&A activity? For many, the pandemic will probably be positioned as a logical explanation. With most teams working from home for a good portion of the year (Apple’s fiscal year starts in October), the environment may not have been right for M&A.

Diving deeper into that explanation, a number of logic holes appear. During the pandemic, there has been no overall decline in M&A activity in tech land. In fact, industry numbers point to a 50%+ increase in M&A activity as measured by deal count. A number of major acquisitions were also announced in FY2021 including Square/Afterpay, Microsoft/Nunance, and Salesforce/Slack. One could make the case that work from home actually contributed to an M&A bonanza as mid- and senior-level executives see and experience shortcomings in product portfolios.

My suspicion is that 2021 was a quiet M&A year for Apple given where the company finds itself from a product pipeline perspective. For the better part of the past five years, Apple’s mixed reality/AR plans have been the catalyst behind approximately 20% of Apple’s M&A deals. Apple’s foray into face wearables is now right around the corner - so close that the company likely has the main ingredients to get a V1 and V2 out the door without the need for additional M&A. Meanwhile, long-term R&D projects like Project Titan are still too far away to lead to a sudden M&A rush. Over the past five years, only three Apple acquisitions can be tied to its automotive ambitions.

We can’t underestimate another factor behind Apple’s quiet M&A year - Apple is doubling down on its long-held M&A philosophy. Apple does not use M&A to acquire revenue, users, or even products. Instead, Apple uses M&A as a tool to acquire talent and technology. There is a very simple thought process behind this philosophy. Apple feels that the product development processes already in place within the company lead to the best products capable of delivering premium experiences. Management is not interested in circumventing these proven processes by acquiring established products that have already gone through another company’s development process phase. Instead, Apple is looking to fill talent and technology holes that may become apparent during the product development process.

Apple’s Beats acquisition in 2014 wasn’t about Apple getting its hands on a wired headphones business. Rather, it was about music streaming assets (and the people behind such assets).

The Shazam acquisition in 2018 wasn’t about acquiring a network of users but rather about content recognition technology that could come in handy for AR and mixed reality.

Dark Sky wasn’t about acquiring App Store revenue via a paid weather app but rather about building the Dark Sky API (hyperlocal weather) into its wearables platform.

Beddit wasn’t about acquiring a sleep tracking accessory but rather about the complicated algorithms related to ballistocardiography - the method of detecting heartbeats and breathing rhythm from small movements like cardiac contraction force.

The reason Apple’s M&A strategy works so well for the company is that it keeps management focused on developing great products and not trying to quickly grow the user base or revenue. Such items (users and revenue) are byproducts of a successful product development process. Said another way, the way for Apple to succeed from a product and financial perspective is to bet on itself and the processes that it has developed over the past two decades.

This thinking plays a role in Apple’s share buyback strategy as well. For years, Apple has been criticized by outsiders for using excess cash to buy back shares instead of buying other companies. The suggestion that Apple should have bought Instagram, Disney, Spotify, Fitbit, Tesla, Peloton, and Netflix all miss a crucial point - they never consider how Apple thinks about the world. The way forward for Apple isn’t to use M&A to expand its product line with established products designed to stand on their own. Instead, it’s to use M&A to reinforce its product development processes by filling asset holes that will inevitably show up as Apple looks to enter new industries.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

The Above Avalon Daily Update Recap (3Q21 Edition)

I publish exclusive daily updates all about Apple throughout the week. The updates contain my perspective and analysis on Apple’s business, product and financial strategy, and competitive relationships with a range of companies. The updates have become widely read and influential in the world of Apple and tech and are ideally suited to executives, investors, project managers, and hobbyists. When combined with the periodic articles and podcast episodes, which are accessible to everyone, the updates provide the full Above Avalon experience throughout the week.

During the third quarter of 2021 (July to September), 48 Above Avalon daily updates were published, chronicling both noteworthy industry and Apple-specific stories as well as my Apple research. The major themes discussed during the quarter included:

Developments in the App Store regulatory space (South Korea, Japan, Epic Games Vs. Apple trial).

Apple TV / paid video streaming industry developments.

Apple unveiling its Child Sexual Abuse Material (CSAM) detection plan and the resulting fallout.

Project Titan leadership changes and developments in the EV space.

The Above Avalon Daily Update Recap (3Q21 Edition) goes over these major themes and the corresponding daily updates.

(To access the following updates, become a member and then request access to the daily updates archive found in Slack.)

Developments in the App Store Regulatory Space (South Korea, Japan, Epic Games Vs. Apple trial)

After years of discussion and debate regarding Apple’s handling of the App Store, there was notable movement on the App Store legal and regulatory fronts. During 3Q, Apple notched two App Store victories in U.S. courts, South Korea rushed an anti-App Store bill through, and Apple began to loosen its grip on some of the more controversial App Store guidelines.

Apple Settles Class-Action Suit from U.S. Developers, Why Settle Now?, The iOS Developer Divide (Aug 30, 2021)

Thoughts on the Epic Games vs. Apple Ruling (Sep 13, 2021)

Peloton Earnings, South Korea Passes App Store Payments Bill, Apple Acquires Primephonic (Aug 31, 2021)

Sonos 3Q21 Earnings, Anti-App Store Legislation Introduced in Senate, The Bill’s Privacy and Security Exemption (Aug 12, 2021)

Apple TV / Paid Video Streaming Industry Developments

The paid video streaming industry continues to intrigue as it expands and evolves. There were a number of noteworthy events and developments during 3Q including Netflix’s move into gaming, a “Ted Lasso” bonanza, and the Netflix vs. Disney dynamic. I also went over my estimate for the number of Apple TV+ subscribers.

Netflix Moving Forward with Gaming, Entertainment Bundles Will Win, This Time Is Different for Games (Jul 15, 2021)

Netflix 2Q21 Earnings, Netflix Is Feeling Competitive Pressure, Netflix’s Video Gaming Strategy (Jul 21, 2021)

Apple’s Return to the Office Brouhaha, Apple Searching for Hollywood Hub, The Ted Lasso Effect (Jul 20, 2021)

Disney Earnings, Disney Will Surpass Netflix, Roku Earnings (Aug 23, 2021)

EU’s Vestager Threatens Apple, Video Streaming Box Market Shares, Peacock Signs Universal Deal (Jul 7, 2021)

Apple and the NFL, Disney’s Black Widow Opening Weekend, A Laptop Revival (Jul 12, 2021)

The Apple TV Debate Rages On, Apple’s Home Strategy, Smart Homes and Ecosystems (Aug 11, 2021)

Apple Unveiling Its Child Sexual Abuse Material (CSAM) Detection Plan and the Resulting Fallout

In August, Apple lit a firestorm of a debate by announcing a plan to combat child sexual abuse. The plan ended up drawing into question a number of philosophical questions as to Apple’s role in society and the company’s reason for being.

Apple Announces Expanded Protections for Children, Thoughts on Apple’s CSAM Detection, Apple CSAM and the Slippery Slope (Aug 9, 2021)

Apple Head of Privacy Talks CSAM Detection, CSAM Detection FUD, Apple and the Privacy High Ground (Aug 10, 2021)

Apple Releases Security Threat Model Review of CSAM Detection, Apple Doing Damage Control, Genuine Pushback to Apple’s CSAM Detection (Aug 16, 2021)

Project Titan leadership changes

Apple’e electric car project continued to move forward with a major leadership change as Apple Watch software chief Kevin Lynch replaced Doug Field as Titan head.

Doug Field Leaves Apple for Ford, Project Titan’s Trajectory and Leadership, Silicon Valley vs. Detroit (Sep 8, 2021)

Apple’s Kevin Lynch Joins Project Titan, Apple Car Implications, Apple Watch Implications (Jul 19, 2021)

Tesla Earnings, Elon Musk Goes After Apple Again, Musk Steps Away from Earnings Calls (Jul 27, 2021)

Follow the Tech Capex, Apple’s Reliance on Chinese Suppliers Increases, Foxconn Moving Forward With Car Factories in U.S. (Aug 18, 2021)

A few additional updates published between July to September stood out to me.

The Amazon Event, Amazon’s Play for Neighborhoods, Amazon Astro (Sep 29, 2021)

Square Acquires Afterpay, Square vs. Apple, The Future of Credit (Aug 3, 2021)

Apple’s Services Journey, A Different Way of Thinking of Apple One, Apple Services Evolution (Jul 13, 2021)

Above Avalon membership is required to read the preceding daily updates. There are two membership options available: $20/month or $200/year. The annual option amounts to a $40 discount. Payment is hosted and secured by MoonClerk and Stripe. Apple Pay is accepted. You can update your payment information and membership status at any time on this page.

Above Avalon Podcast Episode 187: Thoughts on Apple Watch Series 7

In episode 187, Neil discusses his initial observations wearing an Apple Watch Series 7. The episode also goes over Apple Watch strategy, puts the Series 7 into perspective, and discusses why Apple continues to sell Apple Watch Series 3.

To listen to episode 187, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

The Apple Watch Series 7 Is Great

Shortly after Apple’s virtual event last month concluded, some people wondered out loud if the Apple Watch Series 7 was a placeholder. The rumor hill was confident that Apple was going to extend the design language found with the iPhone and iPad by announcing an Apple Watch with flat edges. Instead, Apple unveiled an Apple Watch Series 7 display with curved edges. The apparent lack of other noteworthy features was then used by some as evidence of Apple rushing the Series 7 to unveil something in front of the holidays.

Nothing could be further from the truth.

For the past few days, I’ve been using an Apple Watch Series 7 (45mm - Aluminum Green). The best descriptive words regarding the Series 7 that come to mind are fun, fulfilling, and endearing. The Series 7’s targeted updates help to advance computing on the wrist while addressing some known friction points that had accompanied daily usage. There is nothing like the Apple Watch in the market, and Apple continues to run forward with a device ushering in a paradigm shift in computing.

The following are my initial impressions from using an Apple Watch Series 7.

Larger Screen. Apple Watch Series 7 marketing is anchored around the larger screen - and for good reason. Much to my surprise, reducing the display borders by 40% gives the Series 7 a completely different kind of Apple Watch experience. Instead of using the Series 7’s larger screen (20% larger than the Series 6) to include more text and information, Apple leveraged the additional screen real estate to make buttons and text larger. This was a smart decision. Instead of having Series 7 owners spend more time looking at their wrists, the larger screen makes it easier to quickly gather information and not get lost in the watch.

One way of describing the Apple Watch’s screen size changes over the years is that the Series 4 went after the low-hanging fruit. There was value found in simply fitting more stuff on a bigger screen. The Series 7 screen (50%+ larger than the Series 3) feels like the refinement step, focusing more on the finer things like larger font and click areas that end up having a larger impact on daily usage.

Larger Footprint. Apple Watch Series 7 has a slightly larger form factor than the Series 6 (45mm and 41mm vs 44mm and 40mm). The larger size on the wrist was not noticeable. The Series 7 Aluminum doesn’t feel heavier than the Series 6 either despite weighing 7% more. Weight becomes a bigger issue when moving to the Stainless Steel from Aluminum. As someone who has worn the Aluminum regularly for years, the Stainless Steel is too heavy for my taste. There will come a point at which the larger Apple Watch option starts to become unwieldy, but I don’t think we are at that point yet.

Apple Watch Series 6 (left) vs. Apple Watch Series 7 (right)

Setup. It took about 20 minutes to set up the Series 7 with an iPhone 13 Pro using Restore from Backup. Similar to how the iPhone setup process has become streamlined over the years, the days of needing to wait until the weekend to set up your new Apple Watch for fear of running into issues are over.

Brighter Screen. Similar to how the Series 7’s larger screen jumped out at me, the 70% brighter always-on screen was also noticeable. To the user’s eye, it pretty much seems like the Apple Watch screen has the same brightness regardless of one’s wrist position. With the Series 6, I found myself needing to tap the screen when in the “always-on” state and not in a direct line of sight because it wasn’t bright enough.

Color. Apple unveiled five new aluminum colors - Green, Blue, Product Red, Starlight, and Midnight. The green is very attractive, reminding me more of a greenish black. In certain light conditions, the Watch comes across as having a black case.

Battery Life. Apple has been following an “all day” battery life strategy for Apple Watch. Instead of removing Watch features to extend battery life to two to three days, Apple has strived to have Apple Watch battery life last as close to a full day as possible without the wearer needing a quick boost in the middle of the day. For the most part, Apple has been successful with that objective. Obviously, Apple Watch battery life is dependent on usage. Someone that goes heavy on workouts, podcast listening, and GPS will struggle getting through the whole day on a single charge. However, on average, the Apple Watch should last from a morning charge to getting ready for bed approximately 18 hours later.

In recent years, sleep tracking has complicated Apple’s battery goal for Apple Watch. It’s no longer enough for Apple Watch to last a full day. It also needs to last the subsequent night. Quick charge is Apple’s solution. In the amount of time someone takes to get ready for bed, an Apple Watch can get enough charge (~20%) to do six to eight hours of sleep tracking and then be ready for a longer (~45 minutes) charge in the morning.

Based on my rudimentary testing, the strategy holds true. Thanks to an updated charging architecture and fast-charging USB-C cable, I was able to charge the Apple Watch Series 7 from 0% to 82% in 45 minutes. That is favorable to Apple’s 80% battery charge in 45 minutes claim. As for Series 7 and Series 6 charging, I achieved 25% to 30% faster charging for the Series 7 using the same 20W USB-C power adapter for both the Series 7 and 6. Apple claims the Series 7 has “up to 33% faster charging” than the Series 6 when using a 20W USB-C power adapter with the Series 7 and a 5W USB power adapter with the Series 6.

In practice, does all of this battery life strategizing work for the average Apple Watch wearer? The short answer is “yes.” Most Apple Watch wearers will likely end up getting through the day and night on a single charge. A roughly 30 minute charge in the morning will then be enough to get through the following day. Of course, there is room for Apple to improve Apple Watch battery life. There will likely always be room for battery life improvement.

Full-Size Keyboard. Two words: scary good. I was impressed with Apple’s slide-to-text technology that relies on machine learning to predict what I’m typing. Heading into the Series 7, my view was that tapping or sliding on an Apple Watch screen to write messages or emails didn’t make much sense. Instead, dictation was the way forward. That idea hasn’t completely gone away for me. It’s still faster to dictate messages on the wrist instead of typing. However, using voice for dictation has its limitations, especially when it comes to privacy. It’s just not practical or useful to use voice to dictate messages when in meetings or public settings. By including a built-in full-size keyboard for the first time (third-party options were previously available), Apple has essentially given the Apple Watch a new user input.

In a related note, as discussed above, the larger touch areas made possible by the 20% larger screen really do make a difference. For example, it’s easier and more enjoyable using the calculator app.

Putting the Series 7 Into Perspective. As someone who has worn an Apple Watch daily for the past six years, the Series 7 is up there with the Series 4 as being the most noteworthy upgrade to date. It’s that good. That may come off as surprising given the lack of new features found with the Series 7. However, quality always trumps quantity when it comes to new features. The primary reason for the Series 7 receiving such a high honor is that a larger screen plays a very big role in my day-to-day Apple Watch experience. The wrist is among some of the most valuable real estate for computing, and a larger Apple Watch screen takes advantage of that premium real estate.

At the same time, Apple’s ongoing dedication to Apple Watch’s rectangular design heritage is appreciated. Apple could certainly go in different directions with Apple Watch case design, but the company’s continued commitment to positioning Apple Watch as a general computing device ends up being met with a screen designed to display text and information. Apple’s focus on maintaining all-day battery life despite larger power requirements, like a brighter and larger screen, is also something that can’t be ignored.

One Final Thing About the Series 3. Apple continues to sell the Apple Watch Series 3 alongside the flagship Series 7. Apple is relying on a different strategy here than with the iPhone and iPad. By not keeping last year’s Apple Watch series around, Apple ended up creating a larger gap in feature set between models. The end result is more people opting for the latest and greatest. When comparing the Series 7 to the Series 3, it’s no surprise that the Series 7 will grab the majority of sales. Interestingly, the Apple Watch SE (basically a rebranded Series 4) wasn’t updated last month either. This will only serve to funnel additional sales to the Series 7.

There are a few reasons for Apple to keep the Series 3 in the lineup. Price is a big one. For some users, budget is the most important purchasing consideration. The Series 3 is just $199 in comparison to $399 for Series 7 GPS. The Series 3 also prevents a price umbrella from forming under the flagship model. With the Series 3 still available for sale, it’s difficult for an Apple Watch competitor to gain traction in the $150 to $200 range. Despite being four years old, the Series 3 can still hold its own relative to the competition. That just goes to show how far Apple is with its wearables strategy.

As someone who has used both the Series 3 and now Series 7, the difference between the two models is like day and night. It’s hard to imagine going from a Series 7 back to a Series 3. The $200 price gap comes across as small. The thing is, the Apple Watch is a new user story. Unlike the iPhone, Apple Watch sales are driven by customers buying their first Apple Watch. A Series 3 still beats a bare wrist.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from October 14th.

Above Avalon Podcast Episode 186: The iPhone 13 Has Arrived

Last week, Apple hosted a virtual event where it unveiled annual updates to the iPhone and Apple Watch. Updates to the iPad line and Fitness+ were also announced. Shortly after the event, Neil received an iPhone 13 Pro to try out. In episode 186, Neil discusses the iPhone 13 Pro in a way to add context to the broader iPhone business. The episode includes Neil’s initial impressions from using the iPhone 13 Pro.

To listen to episode 186, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Hands-on with the iPhone 13 Pro

For the past few days, I’ve been using an iPhone 13 Pro (Gold - 1TB). In order to give the device a crash course in handling real world experiences, I took the device with me to the Big E, the third-largest state fair in the U.S.

Before we get to the iPhone 13 Pro’s day at the fair, there is value found in setting the stage a bit. In 2021, there are a handful of iPhone features and attributes that I truly care about and need:

Reliability. This item is designed to be a catch-basin feature that includes everything from performance-related items that allow me to get through my workflows with ease to good enough durability so that a drop or fall doesn’t lead to a cracked screen.

Consistent and carefree cameras. It’s been years since cameras evolved to be just as much about communication as memory capture. I want to be able to quickly take an iPhone out of my pocket and take fuss-free good photos. This includes everything from taking photos of static scenery to trying to capture my 5-year-old and 3-year-old boys (one of the hardest tests for cameras).

Good battery life. There is no worse friction point than having an iPhone turn off in the middle of the day because I forgot to charge it that morning.

I can base my iPhone 13 Pro impressions and reviews on how the device compares in those three categories to the iPhone 12 Pro. A list of objective items can be created to determine if the iPhone 13 Pro is “better” than its predecessor. For me, such an activity is incomplete since it doesn’t reflect what really matters - user experiences. We are very good at identifying good and bad experiences. Accordingly, a more realistic test is to simply use the iPhone 13 Pro for a few days and then ask myself if I would be OK with going back to my previous iPhone. If the answer to the preceding question is “yes,” Apple has a problem on its hands since the newest flagship is in essence leading to a worse user experience. If the answer is “no,” then the various multi-disciplinary teams responsible for developing iPhones succeeded this year and can continue putting the finishing touches on next year’s flagship.

After a few days with the iPhone 13 Pro, I’m perfectly OK with letting the iPhone 11 Pro Max and iPhone 12 Pro be ignored and collect dust. That is one of the best tests for determining that Apple has succeeded with the iPhone 13 Pro.

Here are my initial Impressions:

Setup. The days of needing to set aside a good hour or two for setting up a new iPhone and pairing it with an Apple Watch are over. Setting up the iPhone 13 Pro was a breeze. The number of onboarding screens has been cut significantly. The overall setup process (from iCloud) took about 15 minutes while pairing an Apple Watch Series 6 to the device took a few additional minutes. The biggest hassle was found with signing back into a handful of iOS apps (which isn’t a big deal).

The Front Notch. The iPhone 13 and 13 Pro have a 20% smaller TrueDepth Camera System with much of the volume reduction in the horizontal dimension. Since I never noticed the front-facing notch in the past, the 20% smaller notch was similarly hard to notice. (I watch my videos in landscape mode with black bars on either side.). The notch remains a total nonfactor for me, although I appreciate Apple’s efforts in making it smaller over time.

iPhone 13 Pro (left) vs. iPhone 12 Pro (right)

The Back Cameras Trifecta. While the front notch got smaller, the three cameras located on the back of the iPhone 13 Pro, a setup I’m referring to as the back cameras trifecta, got bigger. Noticeably bigger.

iPhone 13 Pro (left) vs. iPhone 12 Pro (right)

Camera physics adds credibility to the need for physically larger cameras. Apple is right in not trying to hide the camera budges by making the overall iPhone thicker. The thing is, depending on how you hold the iPhone 13 Pro in your hand, the back camera trifecta gets in the way. Based on the way I naturally hold iPhones, my index finger rests very close to the lowest camera. Using an iPhone 13 Pro case (a first-party leather one) actually helps A LOT given that it includes a small lip that my index finger rests on. One can’t help but wonder if Apple’s recent push with first-party cases is partially driven by this fact.

As for the actual cameras found on the iPhone 13 Pro, they are scary good. The era of computational photography involves having the iPhone itself do all the heavy lifting while I just point and tap.

Photograph taken on iPhone 13 Pro.

However, the iPhone 12 Pro and 11 Pro cameras were scary good too. Here is a comparison between the iPhone 13 Pro and 12 Pro. If you can tell the difference, let me know.

Cinematic Mode. By bringing depth of field to video, Cinematic Model is Apple’s latest effort to democratize photography and videography. Based on my tests using the performer Hilby The Skinny German Juggle Boy at the Big E, Apple’s ML and computational photography chops live up to expectations. Results were impressive. (Hilby appears at 8:48 in the video below.)

It is important to point out that the preceding video is a result of simply swiping to Cinematic Mode and pointing a camera at a moving subject. There was no additional work, effort, or knowledge required on my part. Hilby is a good 20 to 25 feet away for me, 3x optical zoom was utilized, and there is unknown in terms of what is going to happen both in terms of what will be filmed and how.

Cinematic Mode is not perfect. When objects, like knives and fire sticks, were added to the scene, I found that Cinematic Mode struggled to determine what to keep in focus. Not surprisingly, when it comes to capturing a scene that is more like 50 to 75 feet away, Cinematic Mode, while still available as a choice, did not produce any discernible focus / bokeh effect.

Another useful feature found with Cinematic Mode is being able to adjust the video after recording. Based on my testing, the edit functionality worked fine.

There is a minor learning curve involved in figuring out what exactly is going on and what to edit but aftera few minutes of playing around, and the average consumer should pick it up. Cinematic Mode feels very much like Portrait Mode in terms of usefulness and utility. My expectation is that I will use it just as much as Portrait Mode, which is pretty often.

ProMotion. For the first time, Apple brought ProMotion (120Hz adaptative refresh display technology) to the iPhone. Comparing an iPhone 13 Pro with ProMotion to an iPhone 12 Pro without ProMotion, I was not able to make out any discernable difference between the two. Even though I may not have noticed a difference visually, an added benefit found with ProMotion is power savings, which impacts all users in one way or another.

Battery Life. According to Apple, the iPhone 13 Pro has 1.5 more hours of battery life in real world usage. This means you will be able to get about 90 minutes more usage before needing a recharge. That exact claim was difficult for me to test based on the limited amount of time with the device. I was able to get about eight hours of battery life at the fair on Saturday, which included going to and from it, before clunking out. Nearly half of my battery usage consisted of use by the Photos app. I spent nearly an hour in this app. Since that is far from normal usage for me, I was not able to compare this performance to that of other iPhones.

Screen Size. When it comes to one of the most subjective debates found with the iPhone, screen size, I remain torn on the topic. I’ve been switching between a 6.5-inch and 6.1-inch screen for the past year. The additional screen real estate found with the iPhone Pro Max is great for video. However, the overall larger form factor needed to support that additional screen real estate is a negative for mobility. I totally understand why the iPhone Pro Max form factor is too large for most people.

Pricing. The iPhone 13 Pro starts at $45.79 per month (before trade-in). That’s $8 more per month than the iPhone 13 (or the price of two Starbucks coffees). For some users, the LiDAR Scanner (for Night mode portraits) or better battery life (22 hours video playback with the 13 Pro vs. 19 hours playback with the 13) are worth that difference.

The iPhone business is all about continuous refinement and advancement with new features aimed at improving the user experience. The iPhone business in 2021 is not dependent on year-over-over upgrades and changes that are so shocking and momentous that a billion iPhone users run out and upgrade. Apple would not be able to handle that kind of demand. In addition, it’s not reflective of the iPhone installed base’s heterogenous nature. What may be important to me may not matter as much to you. Trying to satisfy both of us in the same exact way is a fool’s errand.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Apple’s Big Bet on Memoji

One takeaway from this year’s WWDC had nothing to do with what was announced on the virtual stage. Instead, it was found in the (virtual) audience.

Apple kicked off this year's WWDC keynote with a surprising twist: Tim Cook walked out on stage inside Steve Jobs Theater to an auditorium filled with 600 Memoji. (Yes, I tried to count every Memoji.)

While the decision to include that opening scene may come off as just a way to add some fun to the keynote, my suspicion is it was part of a much larger, multi-year bet Apple is placing that amounts to using Memoji to prepare us for the upcoming mixed reality era.

What Is a Memoji?

The straightforward answer is that a Memoji is a digital representation of how we see ourselves. This explains why Apple launched Memoji with significant customization options and has continued to add seemingly every minor facial and head accessory tweak possible. Apple doesn’t want anyone to feel left out or unrepresented.

Born in the pre-AR era, Memoji were introduced in 2018 alongside iOS 12. One year prior, Apple had introduced Animoji (animated emoji) as a way of utilizing the iPhone X’s TrueDepth camera system.

The process used to create a Memoji provides clues as to how Apple sees them being used. It’s all about communication. One can navigate to the Messages app to create a Memoji. At the end of the Memoji creation process, sticker packs are offered to add more personality and touch to messages. Last year, Apple unveiled a Memoji app for Apple Watch allowing Memoji to be created on the wrist. Creating a Memoji is surprisingly fun, easy, and even relaxing. After just five minutes of customization, here is my Memoji:

One thing that caught my attention with Memoji is how they have a distinct look. It’s easy to pick out a Memoji from various other digital representations of oneself available via a growing number of third-party apps. In an interesting way, Memoji ends up being a form of Apple branding next to the Apple Watch’s distinctive rectangular watch face, the front-facing camera and sensor module on iPhone, and the iMac front-facing chin.

WWDC 2021

Apple continues to lay the groundwork for a move into mixed reality. The clues of this transition were found throughout this year’s WWDC keynote.

FaceTime SharePlay will have a big role to play in mixed reality as we consume content while simultaneously interacting with friends and family.

Live Text in Photos is an obvious feature destined to be used while wearing Apple face wearables.

Apple Maps received additional AR features that are perfectly suited for smart glasses.

Spatial audio is all about rethinking the way we consume (audio) content depending on our relationship between the physical and digital worlds.

There is plenty to talk about with each of the preceding items. Some of that discussion was found in my WWDC keynote review available here. However, there was one clue supportive of Apple’s transition to mixed reality that was not included in the preceding list or in anyone else’s “WWDC clues pointing to mixed reality” list: a heavy emphasis on Memoji.

Apple went all out with Memoji at this year’s virtual WWDC. We got an early hint of this with the WWDC keynote invites. As shown below, the invites included three Memoji looking at MacBooks. Last year’s WWDC keynote invite, also shown below, was similar.

Some may look at the invites as merely reflections of Apple hosting virtual WWDCs. However, that explanation is unsatisfying. The MacBooks being looked at are the references to WWDC going virtual due to the pandemic, not the Memoji themselves.

In addition, Apple updated its leadership page, shown below, to include everyone’s Memoji.

While revising the leadership page wasn’t unprecedented as Apple did something similar to mark world emoji day in 2018, comparing the two pages shows how Apple has been serious in improving Memoji. Apple SVPs also had their Twitter profile pictures converted to Memoji.