Above Avalon Podcast Episode 181: Let's Talk Apple Retail

When asked to identify Apple’s crown jewel, most will point to the iPhone or iPad. Apple’s retail operations probably wouldn’t be too high on many people’s lists. This is a mistake. In episode 181, Neil discusses Apple’s retail operations with a focus on where Apple Retail is headed and what changes are needed. Discussion topics include the three distinct phases that Apple Retail has experienced, the roles that Apple stores need to play going forward, and the three big bets that Apple is placing with its stores.

To listen to episode 181, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

The Future of Apple Retail

In recent weeks, there have been a number of intriguing developments in the retail space. Apple and Target announced a partnership that will bring mini Apple stores to 17 Targets. Last week, Disney announced it will close 20% of its stores. As a sign of just how much the pandemic impacted Apple’s brick and mortar retail, all U.S. stores are fully open for the first time in a year. While the Apple store celebrates its 20th anniversary this May, the pandemic causes many to question retail’s future amid changing consumer behavior. A close examination of Apple’s ecosystem shows both where the company’s retail operations are headed and what changes are needed.

A Crown Jewel

When asked to identify Apple’s crown jewel, most will point to the iPhone or iPad. Apple’s retail operations probably wouldn’t be too high on many people’s lists. This is a mistake. Along with Apple’s design-led culture and vertical integration strategy, the company’s direct retail operations have played a vital role in its expanding ecosystem.

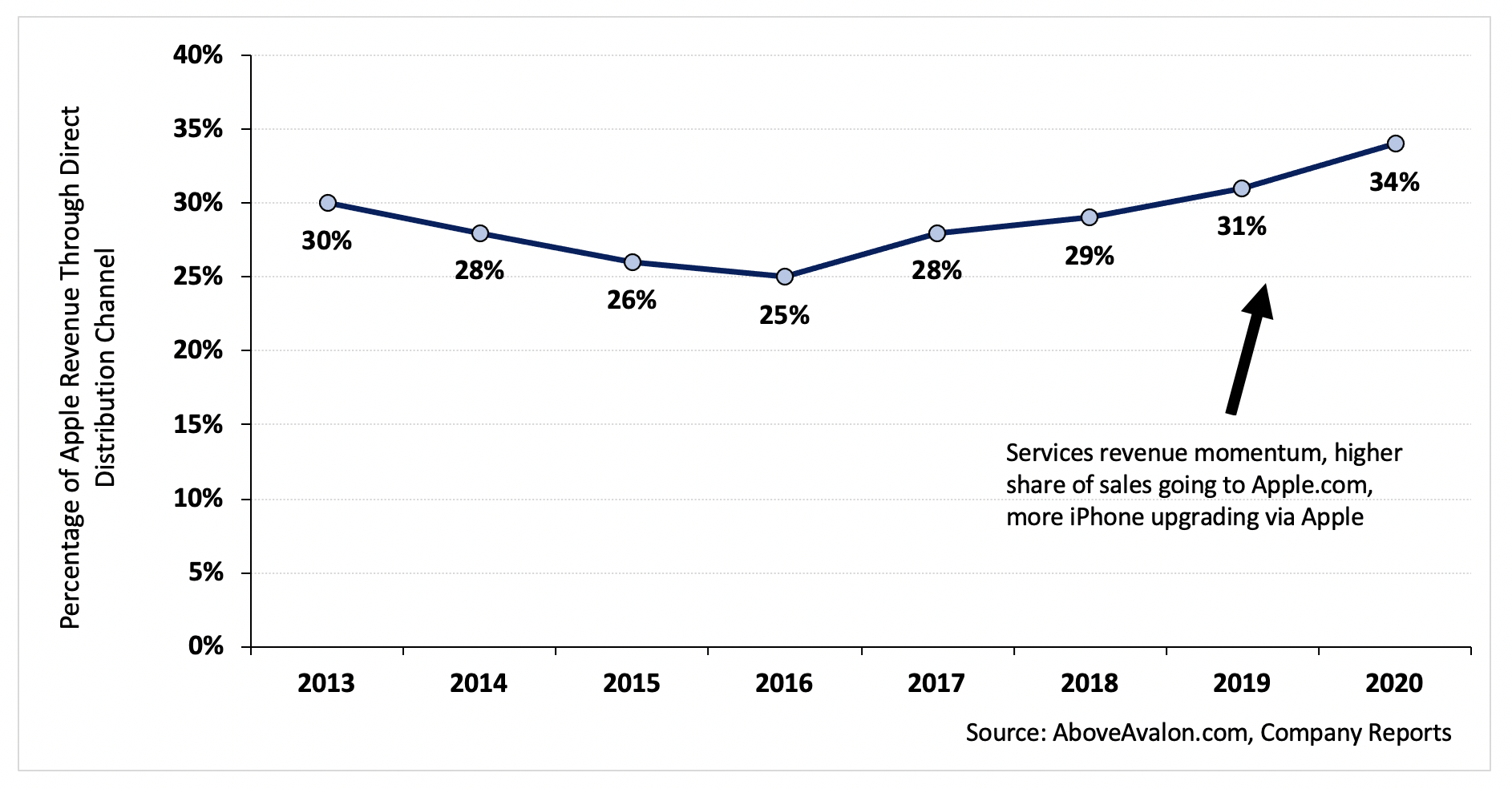

Apple discloses the percentage of sales going through its direct distribution, which includes its website, retail stores, and direct sales force. As shown in Exhibit 1, the percentage of sales going through Apple’s direct distribution has gradually increased in recent years. The increase in sales percentage has likely been boosted by services revenue, more sales going through Apple’s website, and more iPhone upgrading taking place through Apple.

Exhibit 1: Percentage of Apple Revenue Through Direct Distribution Channel

Note: Direct distribution channel includes Apple’s website, Apple stores, and direct sales force.

It’s difficult to gauge Apple retail’s importance by just looking at revenue. The figures do not show the significant role Apple stores play in allowing people to try and test the latest products, get questions answered, and seek product support. Nowhere is this seen more than with Apple’s wearables business. Store closures related to the pandemic have had a negative impact on Apple Watch and AirPods sales. While the product categories are still seeing revenue growth, the numbers would have been stronger with opened stores. Here’s Tim Cook explaining the situation on Apple’s 3Q20 earnings call:

“I think the [Apple] Watch in particular, like the iPhone, is more affected by store closures, because some people want to try on the Watch and see what it looks like, look at different band choices and those sorts of things. And so I think as stores closed, it puts more pressure on that.”

Apple Retail Store Phases

Apple opened its first retail store (shown in the video below) in Virginia on May 19th, 2001. Twenty years later, Apple now has 510 stores across 25 countries and territories.

When assessing how the Apple store has changed over the years, there have been three distinct phases:

Lifestyle Experience. In the beginning, Apple stores were locations to touch and see the Apple lifestyle experience. Since Apple only sold a few Mac models, the stores were designed around five core tenets: "Home" and "Pro" (containing Apple's products), solutions (music, movies, photos, and kids), accessories, software, and the Genius Bar. Another way of thinking about Apple stores was that they let people see what can be done with a Mac.

New Product Experience. As Apple's product line gradually expanded, the Apple Store turned into the best way for consumers to play with new products. Between 2010 and 2015, Apple’s installed base grew by 530 million people.

Customer Service / Product Support / Education. Starting around the mid-2010s, Apple stores embraced more of a customer service / product support feel as the number of users and devices continued to shoot higher. Between 2015 and 2020, Apple’s installed base grew by another 400 million people.

Head of Retail Succession

As head of Apple Retail from 2014 to 2019, Angela Ahrendts took over an operation that wasn’t too far away from collapse. The division had been leaderless for two years, and stores were feeling major strain under Apple’s ecosystem growth. Complaints of stores being too chaotic grew louder by the month. Average store traffic was declining. Things got so bad, many began to suggest Apple drop its unique retail thinking and embrace traditional ideas like cash registers and queues in an attempt to reduce the store craziness. After quickly admitting it had made a mistake hiring John Browett to lead retail, Apple went back to the drawing board and eventually landed on Ahrendts, a rising executive in the retail space that had transformed Burberry, to lead its retail stores.

Judging from reaction to her surprise Apple departure announced in early 2019, Ahrendts’ five-year tenure at Apple was massively misunderstood. One of her not-so-publicized achievements was modernizing Apple’s retail backend so that Apple’s website, online store, and in-store experience weren’t disconnected.

A more public objective for Ahrendts was managing a massive Apple store remodeling plan overseen by Jony Ive and Apple’s design team in addition to Foster + Partners. The store redesign included Apple moving away from its smaller store footprints, embracing more open spaces centered around “forums and “video walls,” and expanding the Genius Bar concept to handle more customers. Another goal for Ahrendts was defining Apple’s retail culture.

By choosing Deirdre O’Brien to be Ahrendts’ successor, Apple gave a pretty clear signal that it wanted to keep employee culture and morale at the center of its near-term retail strategy. Instead of new objectives in terms of the backend or store expansion plans, forward changes to retail operations would be more focused. Of course, the pandemic changed those plans in a very big way.

Store of the Future

It’s easy to say that brick-and-mortar retailers need to rethink the store concept and embrace experiences to compete with e-commerce. In practice, such a strategy is incredibly difficult, and few retailers will be able to pull it off. Microsoft thought adding Xbox consoles would turn its stores into experience centers. It didn’t work. The company made the right decision to get out of retail – it just took a pandemic for the company to reach that decision.

Disney’s recent announcement that it will close 20% of its stores is the latest sign that turning stores into experience centers may make for a good presentation but be extremely difficult to pull off. Disney stores aren’t turned into experience centers by just having some TVs play Disney+ while Mickey and Minnie stroll around the store. The company is likely coming to the realization that its customers prefer consuming Disney stories in the comfort of their own home rather than inside a store at the mall. For those who want Disney stories outside the home, vacations to Disney theme parks are in order. Similarly, Nike knows its experiences are going to be found not in mall stores, but with people using their products at home, at gyms, and outdoors.

Where does this leave Apple and its long-term strategy for brick-and-mortar stores? When assessing Apple’s current ecosystem and where the company needs to go in the future, Apple stores need to play three vital roles:

Brand Embassies. With the Apple installed base now exceeding 1 billion users, 87% of the world’s population doesn’t use any Apple products. Apple stores need to serve as the initial point of contact with the Apple brand for these 87% of people. Having control over someone’s first impression with the Apple brand plays a key role in that person’s likelihood of entering the ecosystem. There are two ways for Apple to reach the 87% of people who don’t own any Apple products – go to them by opening stores in India, China, Brazil, Africa, etc., or have them come to Apple as they visit the world’s largest cities for business and pleasure. As we will discuss shortly, the latter will likely be the option Apple chooses. Upward social mobility will be a defining social-economic trend for decades to come.

Ecosystem Support. Given how everyone is at a different stage when it comes to involvement with the Apple ecosystem, there is a strong need for Apple stores to represent different things to different people. After leaving Apple, Ahrendts commented that roughly a third of Apple store visitors were there to buy products, a third were there to get service for their Apple products, and a third were there to learn about the latest gadgets and attend Today at Apple sessions. Focusing Apple stores on just one of those tasks won’t work.

Distribution Hubs. It is essential that Apple remain a realist with the way shopping habits are evolving. Convenience determines where retail is headed. Using Apple stores as distribution hubs for same day or 2-hour delivery will prove valuable. Ordering a product online from Apple’s website and using an app to track the product being brought to you from the local Apple store via courier is up there with using Uber or Lyft for the first time. The experience makes you look at retail stores differently.

Retail Store Count

As shown in the following exhibit, Apple’s retail store count has plateaued at 510 stores despite continued growth in the installed base. Instead of creating large-scale store expansion plans involving dozens of new stores, Apple has been opening a few stores in a handful of the world’s top cities. The strategy was driven by Ahrendts’ bet on cities not countries, which came from her roots in high-end fashion.

Exhibit 2: Apple Retail Store Count

Source Link (2015 to 2019): 9to5Mac

There are a few key risks found with Apple changing course and pursuing a major expansion in its store count.

Store Size. It’s not practical for Apple to become like a mobile carrier and open thousands of smaller stores in shopping plazas throughout the U.S. or other countries. Such a store expansion strategy would amount to Apple stores being nothing more than sales kiosks which would go against the two first roles (discussed above) that Apple stores will need to play.

Locations. Apple has consistently gone after the most prized (and expensive) real estate in up-and-coming cities. The amount of cash that Apple spends on its retail stores would make any retailer blush. The strategy isn’t for the faint of heart, and nearly all retailers would stay away from the strategy as it can quickly lead to financial ruin. A major store expansion phase that involves locating stores in less optimal locations can raise the endeavor’s financial risk.

Employees. Apple has approximately 70,000 retail employees. Expanding its store footprint to fit the size of its ecosystem would require multiple times the number of employees. Such an expansion in employee count would present a completely different beast for Apple executives to oversee.

Logistics. With 510 stores, Apple is able to keep its retail footprint nimble while quickly responding to product launches and new initiatives. Trying to accomplish such feats with a store footprint that is multiple times the size would present its own unique set of challenges.

While it may not make sense for Apple to grow its store count in a big way from current levels, there are many Apple customers that can benefit from having physical stores in which to try products and get service. For Apple, an alternative to expanding its own store count is to continue partnering with third-party retailers to sell products, service devices, and accomplish other traditional retail tasks like offering different delivery options. By relying on third-party retail partnerships, Apple can establish more points of contact with customers and not worry about the long list of risks and problems found with operating its own stores.

Two weeks ago, Apple announced a partnership with Target to open mini Apple Stores in 17 locations. Some may worry that Apple is going down the wrong path with these partnerships. Apple’s initial move into retail 20 years ago was driven by shortcomings found with needing to go through others to reach customers. Wouldn’t similar shortcomings develop by going through third-party retailers to reach customers?

There is one big difference between the retail landscape of the 1990s and that of today: Apple now has the most powerful device ecosystem in the world. Apple no longer needs to fear having their products get lost in a sea of beige at an electronics store. Retail store employees are no longer incentivized to convince people to buy competing products. Instead, some of the world’s largest retailers are now placing big bets on Apple, hoping some of the company’s brand power will rub off on their own operations and financials.

Retail Bets

The bets Apple ended up placing with its retail stores didn’t end up having to do with selling iPhones and wearables or hosting educational classes. Instead, Apple stores are bets on three big themes:

Cities. Apple is betting that we will want to visit and live in the world’s top cities. This explains the store growth strategy being focused on cities, not countries.

People. Apple is betting that Apple store employees will remain the best ambassadors of the brand, introducing Apple to billions of new people. Having O’Brien, who also oversees Apple’s “People” team, be in charge of retail is an outward recognition of the key role given to Apple retail employees.

Experiences. Apple is betting that humans will continue to seek out premium experiences.

Apple Marina Bay Sands - Singapore. Source: Apple.

The Apple store of the future doesn’t have a specific layout or look. Instead, it ends up being an idea: evolution. We know retail isn’t going to remain static going forward. The way we buy products will continue to change as technology becomes closely intertwined with commerce. Apple’s retail apparatus, both online and brick and mortar, will only remain relevant in the future if it is built and designed to embrace change.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from March 11th.

Above Avalon Podcast Episode 180: 100 Million Wrists

According to Neil’s estimate, 100 million people now wear an Apple Watch. This means that approximately 10% of iPhone users wear an Apple Watch. In episode 180, Neil discusses these installed base and adoption figures as part of a larger discussion regarding Apple Watch’s sales momentum, growth potential, and roles in Apple’s ecosystem

To listen to episode 180, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Apple Watch Is Now Worn on 100 Million Wrists

More than 100 million people wear an Apple Watch. Based on my estimates, Apple surpassed the important adoption milestone this past December. The Apple Watch has already helped usher in a new paradigm shift in computing, and Apple is still only getting started with what is possible on the wrist. New services designed specifically for Apple Watch (such as Fitness+) are being released. The wrist’s utility continues to be unveiled thanks to new hardware and software features revolving around health monitoring.

The Numbers

It took five-and-a-half years for the Apple Watch installed base to surpass 100 million people. As shown in Exhibit 1, the installed base’s growth trajectory has not been constant or steady over the years. Instead, the number of people entering the Apple Watch installed base continues to accelerate. The 30 million new people that began wearing an Apple Watch in 2020 nearly exceeded the number of new Apple Watch wearers in 2015, 2016, and 2017 combined.

Exhibit 1: Apple Watch Installed Base

The next exhibit takes a look at Apple Watch adoption as a percentage of the iPhone installed base. Since an iPhone is required to set up an Apple Watch, the iPhone installed base is a good proxy for the size of Apple Watch’s addressable market. There are a few exceptions to this such as Family Setup, which allows family members who don’t have iPhones to get set up with their own Apple ID and cellular Apple Watch.

Exhibit 2: Apple Watch Adoption Percentage (Global)

As of the end of 2020, approximately 10% of iPhone users were wearing an Apple Watch. This is a high percentage given the diverse technological wants and needs of those in the iPhone installed base.

Since the U.S. has been an Apple Watch stronghold for years, adoption in the country has trended materially high in comparison to global figures. At the end of 2020, approximately 35% of iPhone users in the U.S. were wearing an Apple Watch. This is a shockingly strong adoption rate that should serve as a wake-up call to Apple competitors interested in the wearables space. Apple Watch turned Fitbit from a household name as the wearables industry leader into a company that will eventually be viewed as an asterisk when the wearables story is retold to future generations.

(The calculations and methodology used to reach my Apple Watch installed base estimates is available here for Above Avalon members.)

Installed Base Comparisons

At 100 million users, the Apple Watch is Apple’s fourth-largest product installed base behind the iPhone, iPad, and Mac. At the current sales trajectory, the Apple Watch installed base will surpass the Mac installed base in 2022. Surpassing the iPad installed base will take longer and likely be measured in a number of years based on the current sales trajectory.

Growth Potential

While Apple Watch adoption figures point to a product gaining acceptance and appeal around the world, the same numbers also speak to the product’s sales growth potential. There is nothing stopping Apple Watch from grabbing much higher adoption over time. Stronger adoption will serve as an Apple Watch sales growth engine for years.

Running with a few simple calculations, if 35% of iPhone users around the world one day wear an Apple Watch, the same adoption percentage found in the U.S., the Apple Watch installed base would exceed 350 million people. That’s 2.5x larger than the current installed base.

Of course, a 35% adoption figure when looking at the iPhone installed base may end up selling the Apple Watch far short. There is nothing preventing Apple Watch from being worn by an even higher percentage of iPhone users. More importantly, the Apple Watch’s future is one of true independency from the iPhone. Opening the Apple Watch up to non-iPhone users would expand Apple Watch’s addressable market by 2.5x overnight. A 10% adoption figure among all smartphone users around the world would amount to 350 million people wearing an Apple Watch.

What’s Driving Adoption?

As for the factors behind Apple Watch’s steady growth in adoption, there are four primary ones:

Wearables Fundamentals. Leveraging new form factors and design (how we use the products), wearables are able to make technology more personal. People are attracted to Apple Watch’s ability to handle some tasks currently given to more powerful devices like iPhones and iPads as well as entirely new tasks. Given its design, there is nothing inherently found in wearables that limits its addressable market to the point of making it smaller than that of mobile devices. Instead, wearables are one of the rare product categories that can have an even larger addressable market than smartphones - a difficult feat given such high smartphone adoption figures.

Wrist’s Appeal. Everything from a great line of sight for displaying snippets of text and data, to an opportunity to successfully monitor activity and vital signs makes the wrist a valuable space for bringing utility to the body. By selling intangibles like prestige and wealth on the wrist, the Swiss watch industry ended up missing the wrist’s true value. Wrist real estate was being underpriced, and Apple capitalized on the mispricing with Apple Watch.

The Cool Factor. People want to be seen wearing an Apple Watch. The Apple Watch brand has evolved to become cool yet approachable. The device has wide appeal across gender, age, occupation, and social status. Apple Watch wearers are able to add customization to the wrist through various Watch band, case, and face / complications combinations. Thanks to Apple Watch’s comfortable bands, it’s easy to wear the device all day, every day.

Apple Ecosystem. One of the Apple Watch’s secrets to success is how it ends up being just one part of a much larger Apple ecosystem - an ecosystem that is unmatched in the industry. The ability to work seamlessly with other Apple wearables like AirPods as well as other devices ranging from iPhones to HomePods gives Apple Watch additional appeal and staying power in our lives. The ability to consume Apple Watch Services like Fitness+ on other Apple products helps to solidify Apple Watch’s positioning within the ecosystem.

Future Roles

When assessing Apple Watch’s future roles within Apple’s product line, three in particular jump out:

Identity Checker. Wrist detection allows the Apple Watch to maintain one’s identification chain as long as it remains in contact with the wearer’s skin. This is something that is difficult and cumbersome for other Apple devices to handle since they aren’t likely to be physically in contact with our bodies throughout the day. We already see Apple embrace this functionality by allowing Apple Watch to unlock Macs and most recently, iPhones. Going forward, the Apple Watch’s ability to serve as an identity checker can end up being used throughout our day as we interact with different devices, rooms, and objects.

Digital Health Purveyor. The Apple Watch is able to seamlessly monitor our health and alert us to things that we should know without overwhelming us with lots of data and information. This gives the Apple Watch a key role in our lives that would be difficult for other devices to handle.

Support Device for Face Wearables. While the face is home to some of the most valuable real estate on our bodies, it’s not an ideal place for storing a lot of technology. In order for face wearables to go mainstream, devices as light, thin, and comfortable as a regular pair of glasses are needed. Not surprisingly, this is proving to be a difficult engineering problem to solve. The Apple Watch allows technology required for computing on the face to be placed in a far more convenient location on the body.

A Successful Bridge

Back in early 2018, I called the Apple Watch a bridge to the future - a device that was still very much based on our current user interface repertoire but beginning to lay the groundwork for the future when it comes to greater reliance on voice, audio, and digital identity. At the time, in the Above Avalon article, “Apple Watch Is a Bridge to the Future,” I wrote the following:

“Apple has a vision for how we will use the combination of voice and screens in the future. Unlike Amazon and Google, who are desperately trying to position voice as a way to leapfrog over the current smartphone/tablet and app paradigm, Apple is approaching things from a different angle. Instead of betting on a voice interface that may push some information to a stationary screen, Apple is betting on mobile screens that are home to a digital assistant. Apple is placing a bet that consumers will want the familiarity of a touch screen to transition to a future of greater AI and digital assistants. In addition, Apple thinks user manipulation via screen (fingers, hands, and eyes) will remain a crucial part of the computing experience for the foreseeable future.”

Three years later, I wouldn’t change a word in that paragraph. This scenario has materialized. In addition, the fact that Apple Watch is not a futuristic device struggling to handle tasks that we currently have has given the device a good portion of its appeal and momentum over the past five years. With Apple Watch now worn on more than 100 million wrists, Apple can turn to the next Apple Watch adoption goal: 200 million wrists.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from January 16th.

The Above Avalon Daily Update Recap (January 2021)

Along with publishing periodic articles that are accessible to everyone, I publish daily updates all about Apple. These updates are 2,000-word emails that revolve around Apple business and strategy analysis, my perspective and observations on current news and Apple competitors, and comprehensive coverage of Apple earnings, product events, and keynotes. These daily updates have become widely read and influential in the tech sector and Apple universe. The updates are now also available in podcast form called Above Avalon Daily.

Since 90% to 95% of my time is dedicated to researching and writing the daily updates and recording the corresponding daily podcast, I am introducing a new Above Avalon product called The Above Avalon Daily Update Recap to make it easy for everyone to keep abreast of where my focus has been. Each curated recap of the prior month’s updates includes access to one story from a daily update that I particularly enjoyed writing in the previous month.

The daily updates are available exclusive to Above Avalon members. To sign up and for more information on membership, visit the membership page.

The following story was featured in the Above Avalon Daily Update published on January 14th, 2021 (prior to Apple reporting 1Q21 earnings).

Projections for Apple’s Buyback Pace

Apple has $79B of net cash on the balance sheet. By funding share repurchases and cash dividends, Apple has been gradually chipping away at that total (was $153B in FY17).

Based on my projections, Apple will be able to sustain the current pace of share buyback (approximately $70B per year) for an additional 11 to 13 quarters before net cash gets close to zero.

Where does my 11 to 13 quarters estimate come from?

There is a $25B delta between the amount of cash Apple is returning to shareholders each year ($90B) and annual free cash flow ($65B) - the amount of cash generation leftover after management has paid all of the bills and maintained / funded capital investments. Free cash flow is used to manage debt in addition to fund cash dividends and share repurchases. Meanwhile, Apple has $79B of net cash on the balance sheet. ($79B / $25B = 3.2 years or 13 quarters).

It is important to note that these are rough calculations. Apple’s cash needs will fluctuate year to year. This will have an impact on Apple's free cash flow. In addition, it would not be essential to know the exact moment net cash neutral is obtained, if Apple ever technically gets to that level, but rather when net cash is in the vicinity of $0.

Once Apple reaches a net cash neutral position, my estimate is Apple’s buyback pace will slow to something closer to $50B per year. This total is primarily derived from my Apple free cash flow projection ($70B per year) minus cash dividend expense ($15B per year). Over time, Apple's buyback pace can certainly increase to remain in line with free cash flow growth. The reverse is true as well - a slowdown in free cash flow may result in less buyback.

These estimates assume that Apple management continues to view share buyback as attractive at the current share price. That decision will ultimately be based on management's estimate of Apple's intrinsic value. Based on Apple's most recent buyback activity, management thinks Apple's intrinsic value is higher than $115 per share.

In January, a total of 15 daily updates containing 45 stories were published. Those 45 stories have been rearranged into the following categories:

Earnings / Financials

My Apple 1Q21 Estimates, Wall Street’s Expectations, The Apple Number to Watch (My Apple 1Q21 earnings preview)

Apple Earnings, The Most Important Apple Number, Apple Remains Misunderstood (My Apple 1Q21 earnings review)

Product Strategy

Business Strategy

Management / Leadership

Apple Peers and Competitors

Industry Analysis

Thursday Q&A (The following questions were submitted by Above Avalon members.)

Doesn’t Peloton make more sense as a health acquisition target for Google than Fitbit?

Are you still expecting double-digit iPhone unit sales growth in 2021?

What do you make of the rumors that Apple will remove the Touch Bar from new MacBook Pros?

What do you make of IDC and Gartner projecting huge growth numbers for Mac over the holidays?

All of the following stories are accessible to members via the Daily Updates archive. Access to the archive is a benefit attached to membership. For new members, information about accessing the archive will be sent to you after going through the signup process.

The daily updates are also available via a private podcast called Above Avalon Daily. In January, 14 podcast episodes were recorded for a total of 200 minutes of audio. The daily podcast is available as an add-on that can be attached to an Above Avalon membership. More information on the podcast is available here. All prior episodes will appear in your podcast player after you sign up for the Above Avalon Daily podcast.

Above Avalon Podcast Episode 179: Winning the Buyback Debate

After years of criticism, doubt, and questions surrounding Apple’s share buyback program, we are at a point where we can say with confidence that the buyback debate has ended and Apple was declared the winner. In episode 179, Neil goes over how the buyback debate began and why so many people underestimated Apple’s ability to both buy back shares and invest in its future at the same time.

To listen to episode 179, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Above Avalon Podcast Episode 178: Welcome to 2021

Episode 178 is dedicated to discussing Apple’s 2020 and where the company finds itself as we enter 2021. The episode goes over the first Above Avalon year in review that was published for 2020. Neil discusses his five favorite Above Avalon weekly articles from 2020 and the sub themes that were found in the 196 daily updates published in 2020.

To listen to episode 178, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Apple Won the Share Buyback Debate

I receive many questions about Apple from Above Avalon readers, listeners, and members. In previous years, one topic has been far ahead of any other as a source of questions. Everyone wanted to know about Apple’s share buyback program.

Why is Apple buying back its shares?

Is Tim Cook trying to take Apple private?

Does buying back shares signal anything about Apple’s future product plans?

Why doesn’t Apple use cash to buy larger companies instead of buying back its shares?

Something interesting happened in 2020. I received far fewer questions about Apple’s share buyback program. To be precise, I didn’t receive an incoming question about buyback in nine months - from when the stock market put in a bottom in April 2020 to the start of 2021. What explains such a dramatic change? The Apple share buyback debate ended, and Apple was declared the winner.

How It Started

In the early 2010s, many on Wall Street viewed Apple as the iPhone company, and the iPhone was said to be “dead in the water.” A few activist hedge funds began circling around Apple shares due to their low valuation metrics relative to peers and the overall market. Apple was trading at a single digit forward price-to-earnings multiple – a valuation typically afforded to companies with little to no growth potential. On a free cash flow yield basis, Apple was priced like a junk bond.

In March 2012, after consultation with top shareholders, Apple announced it would begin paying a quarterly cash dividend and buying back shares. While Wall Street mostly applauded the move, Silicon Valley was convinced Apple had made a big mistake. Some thought Tim Cook was pressured into buying back Apple shares. Those who followed the “what would Steve Jobs do” doctrine were convinced that Cook had placed Apple on a path to ruin since Steve Jobs had famously viewed dividends and buyback as nothing more than distractions. At the time, none of Apple’s high-growth peers were buying back shares, which made Apple look even more like an outlier.

The primary concern held by those skeptical of Apple buying back shares was that by using cash to repurchase shares, Apple would have less cash to spend on capital expenditures (capex), research & development (R&D), and mergers & acquisitions (M&A). Said another way, some thought Apple was sacrificing its growth potential just to buy back shares.

Repurchase Pace

When looking back at Apple’s share buyback activity, one event stands out: passage of the Tax Cuts and Jobs Act of 2017. Prior to U.S. tax reform, Apple was constrained in terms of the amount of cash that could be spent on buyback. The company was penalized for bringing foreign cash back to the U.S. to fund share buyback. As shown in the exhibit below, Apple kept share buyback to a $30 billion to $45 billion per year pace despite having more than $150 billion of net cash on the balance sheet. Following U.S. tax reform, Apple was able to repatriate its foreign cash at more attractive tax rates. Apple’s share buyback pace shot higher and has been trending at $70 billion per year.

Exhibit 1: Apple Share Buyback Pace (Annual - FY)

Judging Apple’s Buyback Program

Since beginning to repurchase shares in 2013, Apple has spent $380 billion to buy back 10.6 billion shares at an average price of $35.80 per share. It’s tempting to think that Apple’s share buyback has been a success because Apple shares are trading 265% higher than the average price management paid to repurchase shares. However, one cannot judge buyback’s effectiveness or success by merely looking at the current stock price. Apple retires repurchased shares so there aren’t unrealized gains on the balance sheet from previously repurchased shares.

Share repurchases aren’t meant to boost stock prices even though some management teams may strive for such an outcome. Instead, share buyback is a tool for removing excess cash from balance sheets. In the process, a wealth transfer event is possible as ownership is shifted from shareholders willing to sell shares back to the company to those shareholders not selling shares. This is one reason why share buybacks are not created equally. Some companies incorrectly think buyback is a way to solve a problematic business model or lack of future growth while other companies see share buyback as a tool for balance sheet optimization.

The Above Avalon Report, “Share Buyback 101: An Examination of Apple’s Share Repurchase Strategy” contains much more detail on the wealth transfer dynamic found with share buyback. The report is available exclusively to Above Avalon members.

By repurchasing shares, a company doesn’t face brighter future prospects or even a higher stock price. The list of companies with stock prices that declined precipitously once share buyback concluded is long. Accordingly, a share buyback program’s effectiveness cannot and should not be judged by a company’s stock price.

End of Debate

Consensus agreed that Apple was holding on to too much cash on the balance sheet. However, there were differing opinions as to what Apple should do to remove the excess cash. Some thought that Apple should go on an M&A shopping spree. Twitter? Apple should buy it. Tesla? Apple should buy it. Netflix? Apple should buy it. Others thought Apple should ramp R&D so that as a percent of revenue, its R&D spending would be in line with that of its peers.

Instead of pursuing questionable expenditures such as large-scale M&A, paying special dividends, or simply saying “yes” to every R&D project imaginable, Apple instead saw an opportunity to both manage its balance sheet to a net cash neutral position (the amount of cash equals the amount of debt) and simultaneously invest in its future.

Apple’s share buyback debate didn’t end because Apple shares traded above a certain level, Apple repurchased shares below intrinsic value, or the company’s cash levels declined below a certain threshold. Instead, the buyback debate ended because Apple was able to successfully demonstrate that it can pile cash into buyback at record levels while also investing in its future at the same time. With Apple’s share buyback pace remaining at record levels, the company has been able to ramp up R&D to record levels while continuing to fund capex and pursue intelligent M&A.

What Did People Get Wrong?

Why did so many people underestimate Apple’s ability to both buy back shares and invest in its future at the same time?

People overestimated the amount of cash Apple actually needed to run the business and invest in the future.

People underestimated Apple’s ability to generate free cash flow.

As a percent of revenue, Apple’s R&D has historically been lower than that of its peers. Instead of this reflecting Apple underinvesting in R&D, the lower percentage reflects Apple’s unique culture and approach to product development. A better approach to take when judging Apple’s R&D spending is to compare current expenditures to historical totals. Apple spent more on R&D in FY2020 than the total it spent on R&D cumulatively from FY2010 to FY2014.

Apple’s capex needs are less than those of its peers. Apple has a capex-light business model because the company doesn’t offer free services to billions of people with a monetization strategy revolving around ads. This results in less property, plant, and equipment requirements.

Turning to M&A, Apple isn’t interested in buying products and users – a strategy that would likely be met with failure given the difficulty found with assimilating a target’s culture. Instead, Apple uses M&A to fill asset holes in the form of accessing technology and talent. This lends itself to Apple pursuing smaller deals involving companies with less in the way of thriving business models (and premium price tags).

Based on my estimates, Apple requires $10 billion to $15 billion per year to maintain and invest in property, plant, and equipment, and pursue intelligent M&A. Meanwhile, Apple’s business model predisposes the company to superior free cash flow generation. In FY2020, Apple generated a whopping $71 billion of free cash flow. The lack of significant capex requirements means that a high percentage of its operating cash flow ends up being free cash flow. As shown in Exhibit 2, Apple’s free cash flow has been increasing over time.

Exhibit 2: Apple Free Cash Flow (Annual - FY)

Apple’s superior free cash flow generation, combined with its investment run rate, allows the company to return tens of billions of dollars of excess cash to shareholders each year. This isn’t cash that would have been better suited for more R&D, capex, or M&A. Instead, the cash spent on buyback ends up keeping Apple management more disciplined and focused on proper and intelligent spending.

Big Picture

Apple has become a leader in corporate finance strategy. Following Apple, Google, Facebook, and Amazon have each subsequently announced their own share buyback program. Not surprisingly, none of them faced the kind of pushback that Apple faced during the last decade with its own buyback. Instead, Apple peers were applauded.

Consensus was convinced that Apple was buying back shares at the expense of its future growth potential. In reality, Apple’s growth potential has improved as its well-funded product strategy has allowed the company to pull away with the competition. In just the past five years, Apple has grown the iPhone installed base from 570 million to a billion users, and Apple’s ecosystem growth momentum is building. Apple’s wearables business has grown to the size of a Fortune 130 firm. Apple’s Services business went from a $20 billion to a $54 billion annual revenue run rate. In FY2020, Apple’s non-iPhone revenue growth, one of the best measures of ecosystem expansion, was 16%. Once consumers enter the Apple ecosystem via the iPhone, they proceed to buy additional Apple products and services.

There are still some questions worth asking regarding Apple’s share buyback. For example, with Apple shares trading at premium valuation multiples to the market, what is management’s approach to the buyback pace? However, when it’s a question of whether or not Apple management can buy back shares while also investing in its future, the debate has ended and Apple was declared the winner.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from January 14th.

Above Avalon Year in Review (2020)

Heading into 2020, the big question facing Apple was found with growth. Apple had reached a billion users. Would Apple be able to reach two billion users in the 2020s by continuing to do what it had been doing or would more in the way of strategy shifts be needed?

As it did with every company, the pandemic turned 2020 into a steady stream of unexpected challenges for Apple. The company needed to figure out a way to continue product development on a global scale with little to no employee travel. Apple retail needed to be completely rethought as social distancing initiatives ruled out the usual crowded Apple stores. Apple events (both WWDC and product unveilings) needed to go virtual.

According to my estimate, Apple saw approximately $20 billion of delayed demand in FY2020 as a result of the pandemic. Approximately 15 million iPhone upgrades were delayed while wearables sales faced pressure due to retail stores being closed. Partially offsetting those headwinds, iPad and Mac results have been stellar as consumers upgrade older machines and look for larger displays to support working at home and distance learning.

Articles

In 2020, I published 15 Above Avalon articles. In looking through the articles, which are accessible to all, there was one overarching theme: Apple’s improving competitiveness in comparison to that of its peers and the steps the company is taking to position itself for continued ecosystem growth in the 2020s.

Here are some of my favorite articles published in 2020 (in no particular order):

Apple Is Pulling Away from the Competition. Relying on an obsession with the user experience, Apple is removing oxygen from every market that it plays in. At the same time, the tech landscape is riddled with increasingly bad bets, indifference, and a lack of vision. Apple is pulling away from the competition to a degree that we haven’t ever seen before.

The Secret to Apple's Ecosystem. Apple’s ecosystem remains misunderstood. There is still much unknown as to what makes the ecosystem tick. From what does Apple’s ecosystem derive its power? Why do loyalty and satisfaction rates increase as customers move deeper into the ecosystem? Apple’s ecosystem ends up being about more than just a collection of devices or services. Apple has been quietly building something much larger, and it’s still flying under the radar.

A Billion iPhone Users. A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

Apple’s $460 Billion Stock Buyback. Share buybacks came under fire earlier this year. Some companies that were recent buyers of their shares found themselves in financial distress and seeking bailouts due to economic fallout from the pandemic. A very good argument can be made that Apple has become the poster child of responsible share repurchases. The company has relied on its stellar free cash flow to fund share repurchases over the years.

Apple Watch and a Paradigm Shift in Computing. Despite being only four years old, the Apple Watch has fundamentally changed the way we use technology. Many tech analysts and pundits continue to look at the Apple Watch as nothing more than an iPhone accessory - an extension of the smartphone that will never have the means or capability of being revolutionary. Such a view is misplaced as it ignores how the Apple Watch has already ushered in a paradigm shift in computing.

The five most popular Above Avalon articles in 2020, as measured by page views, were identical to my favorites list.

Podcast Episodes

There were 16 episodes of the Above Avalon podcast recorded and published in 2020, totaling seven hours. The podcast episodes that correspond to my favorite articles are found below:

Charts

The following charts found in Above Avalon articles were among my favorite published in 2020.

Number of Users

While Apple new user growth rates have slowed, the company is still bringing tens of millions of users into the fold. Due to Apple’s views regarding innovation and its focus on the user experience, once someone enters the Apple ecosystem, odds are good that customer will remain in the ecosystem.

Apple Installed Base (Number of Users)

Apple Non-iPhone Revenue Growth

Apple finds itself in an ecosystem expansion phase. Hundreds of millions of people with only one Apple device, an iPhone, are embarking on a search for more Apple experiences. We see this with non-iPhone revenue growing by double digits in the back half of 2020 on a TTM basis, which is higher than growth rates seen in the mid-2010s.

Apple Non-iPhone Revenue Growth Projection

The Apple Innovation Feedback Loop

With Apple Silicon, Apple took lessons learned from personal devices such as Apple Watches, iPhones, and iPads to help push less personal devices, like the Mac, forward.

Daily Updates

In 2020, I published 196 Above Avalon Daily Updates that were available exclusively to Above Avalon members. With each update coming in at approximately 2,000 words, 196 updates are equivalent to seven books. This continues to be an industry-leading number when it comes to the amount of Apple business and strategy analysis published.

When looking over the topics discussed in this year’s daily updates, a few sub themes become apparent:

Apple and the Pandemic

When the pandemic began during the first half of the year, there was much unknown as to how a company like Apple would be impacted. It eventually became clear that Apple and its peers were positioned to do OK during the pandemic although new ways of thinking would be needed to navigate working from home and travel restrictions.

Big Tech Gaining Power in the Pandemic, Apple's Source of Power, Former Apple Industrial Designer Starts Speaker Company (May 28, 2020)

New iPhone Production Starting Soon, iPhone Production Estimates, Apple’s HW Solution for Pandemic Travel Restrictions (Sep 8, 2020)

Apple’s Place in a Stay-at-Home Economy, E-Commerce Acceleration, Some iPad and Mac Production Moving to Vietnam (Nov 30, 2020)

The Paid Video Streaming Battle

With Disney+ and Apple TV+ launching in late 2019 and HBO Max and Peacock launching this past May and July, respectively, 2020 turned out to be the legitimate start of the paid video streaming battle. As the true new kid on the block, Apple learned quite a bit about being more than just a distributor of other people’s content.

Apple Wins Ireland Tax Battle, Apple Hints at Apple TV+ Subscriber Total, Apple’s In-House Content Studio (Jul 15, 2020)

Thoughts on Early iPhone Sales, Disney Reorganizes, Disney Is Streaming’s New Poster Child (Oct 19, 2020)

A Video Content Distribution War, Roku and Amazon vs. Peacock and HBO Max, Microsoft Attacks the App Store (Jul 21, 2020)

Apple Sales Mix by Display Size, WarnerMedia’s Huge Movie Announcement, Apple and Movies (Dec 7, 2020)

Pushback Against the App Store

Apple is pulling away from the competition, and the App Store is considered the best (and last) chance for competitors to reshape the mobile industry to their liking. A series of legal and PR battles were waged against the App Store by a handful of smaller app developers and larger Apple competitors.

Tech CEOs Testify in Front of Congress, Congress’s Concern Regarding Apple, Apple’s Trouble Area (Jul 30, 2020)

Epic Games Breaks App Store Guidelines, Epic Games’ Epic Hypocrisy, The App Store’s Future (Aug 17, 2020)

The Coalition for App Fairness, A New Guerrilla Warfare Tactic, The Coalition’s Questionable Website (Sep 29, 2020)

The House Antitrust Report on Big Tech, Massive Holes in the Antitrust Report, Apple’s Response (Oct 8, 2020)

When looking at my daily updates published in 2020, selecting a handful of favorites out of 196 updates was not an easy task. The following updates stood out to me (in no particular order):

Apple’s Organizational Structure, Apple’s Leadership Structure, An Autonomous Apple. We first go over my thoughts on Apple’s functional organizational structure and the difference between a functional and multidivisional structure. The discussion then turns to Apple leadership and the ideas of “discretionary leadership” and “experts leading experts.” The update concludes with a revisiting of my Above Avalon article, “Jony Ive, Jeff Williams, and a Larger Apple” and a discussion of how Apple has been able to become a larger design company. (Oct 26, 2020)

Nike Earnings, The Similarity Between Nike and Apple, A Stronger Apple and Nike Partnership. We kick off this update with my thoughts on Nike’s earnings. After going over three structural tailwinds facing Nike, we discuss why I think Nike is pulling away from the competition. The discussion then turns to how Nike is the company most like Apple. The update concludes with a look at how Apple and Nike are both interested in health. We go over the competitive dynamic between the two companies and why it’s premature to conclude that Apple and Nike will become fierce competitors in the future. (Sept 24, 2020)

iPhone Momentum Building in Europe, Apple's Good Timing with iPhone SE, Selling Utility on the Wrist. We begin this update with my thoughts on the iPhone gaining momentum in Europe. The discussion includes new iPhone sales share data and what looks to be some kind of inflection point in the region. We also discuss the possible factors behind the inflection point. The update then turns to how Apple ended up launching the updated iPhone SE at just the right time. We then take a closer look at wearables competition on the wrist. In particular, we go over Fitbit’s latest earnings and compare fitness tracker and smartwatch demand. The discussion concludes with why Amazon Halo faces an uphill battle for wrist real estate. (Sep 3, 2020)

Valuing Big Tech on Free Cash Flow, AAPL vs. Free Cash Flow, AAPL vs. Low Interest Rates. This update begins with my thoughts on the idea that Wall Street has changed the way it is valuing Apple - one away from focusing on P/E ratios (price-to-earnings) and more towards free cash flow valuation. After going over the free cash flow yields for the tech giants, we look specifically at Apple’s declining free cash flow yield and what it tells us about how the market is approaching the company. The update concludes with a discussion of interest rates, inflation, and the U.S. Fed looking to embrace elevated inflation before seeing the need for higher rates. There are various AAPL-related implications associated with that development. (Aug 25, 2020)

Apple Acquires NextVR, Apple Glasses in 2022?, A Wearables Platform for the Face. We begin this update with my thoughts on Apple acquiring NextVR. The discussion includes the reasons why I think Apple acquired NextVR and how the company can play a role in Apple’s product strategy. The update then turns to new rumors about Apple Glasses launch dates. Simply put, the Apple AR / VR rumor mill is getting out of hand. We go over two factors that I think are driving the varied rumors regarding Apple Glasses. The discussion concludes with a different way of thinking about AR / VR and Apple. (May 18, 2020)

Warren Buffett’s Annual Letter, The Power of Apple Retained Earnings, Imploding Demand for Fitbit. We kick off this update by examining Warren Buffett’s annual letter to Berkshire Hathaway shareholders. Berkshire Hathaway is Apple’s largest individual shareholder. Accordingly, there is value in keeping on top of Berkshire and Warren Buffett (Berkshire’s CEO and Chairman of the Board). The discussion then turns to retained earnings and why Apple’s retained earnings are such a powerful tool. We conclude with a look at Fitbit’s awful 4Q19 earnings and why the company represents such a problem for Google. (Feb 24, 2020)

Here are the five most popular daily updates published in 2020 based on page views:

iPhone Sales Share Rises During Pandemic, It’s All About Smartphone Upgrading, A $5,000 Swiss Smartwatch (Jun 3, 2020)

Google Pixel Shakeup, Consumer Spending During the Pandemic, Surface Sales vs. iPad and Mac Sales (May 14, 2020)

Apple vs. Hey (Jun 17, 2020)

The App Store’s Impact on Apple Financials, Facebook Launches Paid Online Events, 4Q20 Microsoft Surface Results (Aug 18, 2020)

Just 11% of the daily updates published in 2020 are highlighted above. The full archive consisting of all 196 daily updates is available here. Membership is required to access the updates.

Daily Podcast (Launched in 2020)

In 2020, Above Avalon Daily Updates became available in audio for the first time via a private podcast called Above Avalon Daily. Reception to the daily podcast continues to exceed my expectations with very positive listener feedback. The podcast has allowed members to consume the daily updates in new and different ways while around the house, on a walk, or in the car. More information on the daily podcast, including a few sample episodes, is found here. Above Avalon Daily was launched in August, and 66 episodes were published in 2020, totaling nearly 17 hours of audio. Once a member signs up for the daily podcast, all prior episodes become available for listening in podcast players that support private podcasts.

Here’s to 2021

Without question, 2020 ended up being the busiest year for Apple since Above Avalon was launched in 2014. There was no shortage of newsworthy stories, and all indicators point to the fast pace continuing into 2021. A big thank you goes out to Above Avalon readers, listeners, and members for making 2020 another successful year for Above Avalon.

Above Avalon Podcast Episode 177: The Rise of the Small Display

While the pandemic is pushing people to embrace larger displays like iPads and Macs, the momentum found with smaller displays is still flying under the radar. In episode 177, Neil discusses how analysis of Apple device display size popularity can be used to gain insight into Apple’s ecosystem and quest to make technology more personal.

To listen to episode 177, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

The Rise of Smaller Displays

Apple is a design company selling tools capable of improving people’s lives. Approximately 80% of those tools include a display. Apple is shipping about 300 million displays per year, from iPhones and iPads to Macs and Apple Watches. With Apple running as fast it can towards AR glasses, the number of displays that the company ships will only increase over the next five to ten years. While the pandemic is pushing people to embrace larger displays like iPads and Macs, the momentum found with smaller displays is still flying under the radar.

Display Spectrum

Back in 2017, I published the following chart that tracks Apple device unit sales by display size. The exercise involved breaking out iPhone, iPad, and Mac unit sales by model - something that Apple has never done itself but which the company provided enough clues for me to do on my own and have confidence in the estimates.

Exhibit 1: Apple Device Sales Mix by Display Size (2016 data)

Since Apple offers a finite number of display choices, Exhibit 2 turns the sales data from Exhibit 1 into a broader statement about preferred display size.

Exhibit 2: Apple Device Sales Mix by Display Size (2016 data - Smoothed Line)

The motivation in pursuing such an exercise was to place context around the number of large displays Apple was selling in the form of MacBooks and iMacs. Fast forward three years, and it’s time to revisit the topic. With the significant amount of change occurring in Apple’s product line since 2016, there is value in going through a similar exercise regarding display size preference with 2020 unit sales in mind. While Apple’s financial disclosures haven’t gotten better over the past four years - if anything, the disclosures have gotten worse - I am still confident in my ability to derive unit sales estimates for all of Apple’s products.

Exhibit 3: Apple Device Sales Mix by Display Size (2020 data)

Exhibit 4: Apple Device Sales Mix by Display Size (2016 data - Smoothed Line)

(All of my granular estimates and modeling that went into Exhibits 3 and 4 is available to Above Avalon members in the daily update published on December 7th found here.)

As seen in Exhibits 3 and 4, there is bifurcation in Apple display size popularity. The most in-demand displays fall into two (broad) categories:

Displays large enough for consuming lots of video and other forms of content that can still be comfortably held in a hand or stored in a pocket.

Displays small enough to be worn on the body (Apple Watch) and products lacking a display altogether (AirPods).

It hasn’t been difficult to miss Apple’s gradual move to larger iPhone displays over the years. The 6.7-inch iPhone 12 Pro Max is getting close to the maximum size for an iPhone display, at least when thinking about the current form factor. Such a reality has undoubtedly played a role in some smartphone manufacturers betting heavily on foldable displays for smartphones. Such a bet boils down to believing consumers will want larger smartphone screens to the point of being OK with tradeoffs in terms of device thickness and weight. Move beyond the iPhone and display popularity plummets as the iPad and Mac sell at a fraction of the pace. There are small sales peaks found at 10.2 inches, the size of the lowest-cost iPad, and 13.3 inches, the size of the MacBook Air and entry-level MacBook Pro.

With hundreds of millions of people embracing 4.7-inch to 6.7-inch displays via iPhone, the claim that consumers are embracing larger screens over time contains some validity. Many are now wondering if similar moves to larger displays will take over the iPad and Mac lines. However, focusing too much on large displays will make it easy to miss what is happening at the other end of the spectrum. The rise of wearables has given an incredible amount of momentum to small displays and devices lacking a display altogether.

Implications

There are four key implications arising from this display bifurcation observation.

Apple’s ecosystem naturally supports the idea of multi-device ownership.

As devices are given more roles and workflows to handle, there is a natural tendency for screen sizes to increase without changing the overall form factor much.

Power and value are flowing to smaller displays that are capable of making technology more personal.

Devices relying on voice as an input make more sense when paired seamlessly with devices with displays.

It is worth going over each in greater detail.

1) Apple’s ecosystem is characterized by hundreds of millions of iPhone-only users buying additional Apple products and services. This is a result of industry-leading customer satisfaction rates and subsequently very strong brand loyalty. However, there are more fundamental themes underpinning this trend. By controlling hardware, software, and services, Apple is able to sell a range of products that seamlessly work together. These tools don’t serve as replacements for one another but rather as alternatives. This leads to consumers being able to use multiple Apple devices aimed at handling different workflows in their unique way. Such a dynamic supports the idea of multi-device ownership over time with those additional Apple devices likely containing smaller displays or no displays at all.

2) Apple has given the iPad, iPhone, and Apple Watch larger displays over time. For the iPad, the 12.9-inch / 11-inch iPad Pro and 10.9-inch iPad Air are larger than the initial 9.7-inch iPad and subsequent 7.9-inch iPad mini. The 3.5-inch display found with the first few iPhone models looks downright tiny next to iPhone 12 flagships. Even the Apple Watch was given a larger display after being sold for three years. These moves may seem to be unnoteworthy reactionary outcomes to competitors and market forces. However, the move to larger displays over time ends up being connected to the product category handling more workflows over time. iPhones have become “TVs” for hundreds of millions of people. Today’s iPad Pro flagships are geared toward content creation. Apple Watch faces are being given more complications in order to provide additional new-age app interactions to wearers.

3) The two product categories seeing the strongest unit sales momentum have either the smallest displays Apple has shipped (Apple Watch) or no displays at all (AirPods). As wearables usher in a paradigm shift in computing by altering the way we use technology, new form factors designed to be worn on or in the body for extended periods of time are playing a role in helping to make technology more personal. This leads to an observation that may not be so obvious: Smaller displays require new user inputs and interfaces that force new ways of handling existing workflows while supporting entirely new workflows. Said another way, smaller displays end up playing a vital role in lowering the barriers between technology and humans.

4) The reason stationary smart speakers were one of the biggest tech head fakes of the 2010s is that consensus incorrectly assumed the future was voice and just voice. The idea of voice as a user input being enhanced by the presence of a display was skipped over. Jump ahead a few years and the HomePod is arguably made better by having nearby displays either simply around us (iPhones) or on us (Apple Watch). Some of the magic found with AirPods involves the seamless integration with various displays, especially the Apple Watch display. Voice just isn’t an efficient medium for transferring a lot of data and context. Relying on displays for such context makes it possible for devices without displays to shine by being allowed to do what they do best - either provide superior sound (HomePod) or convenient sound (AirPods).

Bet on Smaller Displays

One takeaway from the pandemic has been that social distancing in the form of distance learning and working from home has fueled momentum for some of the largest displays in Apple’s product line. The iPad is setting multi-year highs for unit sales and revenue. The Mac registered an all-time revenue record last quarter. There are a few reasons behind this momentum that include families needing newer (and faster) machines and employers funding work-from-home upgrades.

Instead of looking at this development as the start of a new era for large displays, the momentum found with larger displays shifts focus away from the actual revolution taking place with smaller displays.

Apple is on track to sell approximately 150M devices in FY2021 that either lack a display or contain a display that is less than two inches (5 cm). We are still in the early innings of this revolution. Looking ahead at AR glasses, Apple will eventually sell devices containing two small displays for the first time. Relying on conservative adoption estimates, Apple will sell hundreds of millions of devices per year that contain either small displays or no displays at all. We are seeing the rise of smaller displays, and the secret to witnessing it is knowing where to look.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Above Avalon Podcast Episode 176: The Mac Earned a Diploma

The Mac is seeing momentum by being true to itself instead of trying to be something that it’s not. With a transition to Apple Silicon, the product category is now benefiting from lessons Apple learned from more popular devices aimed at the mass market. As the Above Avalon podcast enters its seventh season, episode 176 is dedicated to discussing the Mac’s Apple Silicon and what may come next for the Mac. Additional topics include the Apple Silicon transition being akin to a graduation for the Mac, the Apple Innovation Feedback Loop, and overlap between the iPad Pro and Mac portables.

To listen to episode 176, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

The Mac's Graduation

The iPad is seeing more than twice the number of new users as the Mac. Within two years, the number of people wearing an Apple Watch will equal the number of people owning a Mac. Approximately 90% of Apple users don’t use, and probably never will use, a Mac.

It’s tempting to look at the preceding statements and think that the Mac has lost its luster. However, 2020 was a record fiscal year for the Mac in terms of revenue and the number of new users was near a record high. How does one reconcile such different worlds? The Mac is seeing momentum by being true to itself instead of trying to be something that it’s not. With a transition to Apple Silicon, the product category is now benefiting from lessons Apple learned from more popular devices aimed at the mass market.

Apple Silicon Transition

This past June at WWDC, Apple unveiled the Mac’s multi-year transition to Apple Silicon. Last week, Apple’s “One More Thing” product event focused on the first wave of Mac hardware to take advantage of Apple Silicon. Three models saw updates:

13-inch MacBook Air

13-inch MacBook Pro

Mac mini

One of the more interesting takeaways from WWDC and last week’s event ended up being subtle. While Apple technically announced a Mac transition, the Mac ended up taking a back-row seat to the sheer power and capability found with Apple Silicon and Apple’s decade-long bet on designing its own chips.

A Graduation

The MacBook Air, Apple’s best-selling Mac, was included in the first wave of hardware transitioning to Apple Silicon. The well-known model had one of the more memorable unveilings in Apple history when it was pulled out of a manila envelope by Steve Jobs onstage at Macworld 2008.

The MacBook Air’s design was industry leading. Jony Ive and Apple’s industrial design group had utilized a new unibody architecture that was eventually brought to the entire Mac portable line. Twelve years later, the MacBook Air still feels refreshing.

While the MacBook Air’s thinness was the top feature in 2008, a MacBook Air powered by Apple Silicon is all about performance, longer battery life, and quietness. (The 12-inch MacBook that Apple unveiled in 2015 and discontinued four years later was ahead of its time.)

It is telling that Apple didn’t see the need to change the MacBook Air’s design despite the fact that it is being powered by Apple Silicon. This is evidence of the Apple Silicon transition being akin to the Mac graduating and entering a new phase in life.

A graduation is an acknowledgment of someone acquiring a certain amount of knowledge and experience. Such knowledge can then be used to solve future problems. A similar dynamic is found with Macs powered by Apple Silicon. The Mac now has a new toolset that it can rely on to tackle future problems.

Grand Unified Theory

Prior to this year’s WWDC, reaction in some tech circles was cool towards the idea of Apple transitioning the Mac to its own Silicon. Many were skeptical that Apple would want to face any risks and trouble that could be found with such a transition. Others figured the Mac wasn’t important enough to receive that kind of attention from Apple.

In reality, the Apple Silicon transition was always a question of when, not if. The transition would not only give Apple the kind of control over the Mac that it yearned for, but more importantly, Apple Silicon would open new doors to push the Mac forward in ways that simply weren’t possible with Intel.

With Apple Silicon, Apple took lessons learned from personal devices such as Apple Watches, iPhones, and iPads to help push less personal devices, like the Mac, forward. This is a core tenet of The Grand Unified Theory of Apple Products. We saw early iterations of this with Mac features such as the Touch Bar, Touch ID, and T1 / T2 chips. These additions were the clues that an eventual transition to Apple Silicon would take place.

What’s Next?

The Mac, having graduated thanks to Apple Silicon, is now in a much stronger position to navigate a world being overrun with iPhones, iPads, and an expanding line of wearable devices designed for different parts of the body (wrists, ears, and eventually eyes).

Based on my installed base estimates for various Apple product categories, as of the end of FY2020, it’s clear that the Mac hasn’t been for everyone:

There are 7x more people using iPhones than Macs. There are 2x more people using iPads than Macs. Some think that Apple Silicon will dramatically change these ratios by increasing the Mac’s addressable market. Caution is needed in running too far with such thinking.

The value found with Apple Silicon isn’t that it will turn the Mac into a fundamentally different product. We should not assume Macs will become touch-first devices. Apple already sells touch-first or touch-based computers; they are called iPhones and iPads.

For Apple, the goal isn’t to take fundamentally different product categories and form factors and converge them for no other reason than that they can. A far more challenging endeavor is to resist such calls from users, often the most loyal ones, and instead stay true to a form factor’s design.

When thinking about workflows, Apple’s iOS / iPadOS / macOS product lines are designed in such a way that some products do a better job of handling personal workflows than more demanding workflows. As shown in the following exhibit, macOS devices are designed to handle some of the most demanding workflows while iOS and iPadOS is geared toward handling more personal workflows. However, there is overlap between iPads running iPadOS and Mac portables running macOS when thinking about some workflows.

Since a MacBook Air and iPad Pro can handle some of the same workflows, some people think both devices will eventually merge into one another. The iPad Pro’s Magic Keyboard is positioned as a sign of this upcoming merge while touch-based Macs are said to be inevitable.

There are a few holes found in the logic of such thinking.

Even though Mac portables and iPads may handle many similar workflows, that doesn’t mean that both devices should lose their core identity. The iPad doesn’t move away from being a touch-based computer simply because a keyboard can be attached to it or an Apple Pencil can be used to take notes and sketch a drawing. A MacBook Pro doesn't embrace a touch-first interface just because Big Sur has similar elements to iOS and iPadOS.

Instead, we should expect Apple to take what makes the Mac special for 130 million people and accentuate those items, namely, a screen that tilts while always being attached to a dedicated keyboard. While both the screen and keyboard will likely see their fair share of changes in the future, including possibly sharing a foldable display, the dynamic found with using a keyboard permanently connected to a screen would remain.

While iPads would remain touch-first computers with a range of productivity accessories like dedicated keyboards, Macs powered by Apple Silicon could embrace multi-touch and foldable displays but in a dedicated area of the machine where one’s fingers are likely to always be found (think the area between the Touch Bar and the lower fifth of the screen). A good argument can be made that Apple should pursue flexible displays for Mac portables so that the entire area between the Touch Bar and vertical screen can be usable.

Such a product may seem underwhelming to some. The word “legacy” probably will come to mind for others. There is nothing inherently wrong with a product being classified as legacy as long as the product doesn’t jeopardize Apple’s ambition and efforts with new platforms and paradigm shifts. This risk was described in detail in the Above Avalon article titled “The Mac is Turning into Apple’s Achilles’ Heel.”

Apple management has spent the past few years trying to convince Mac users that the Mac’s future has never been brighter. Some pro users may end up disappointed with where Apple will, and won’t, take the Mac. However, it is a positive sign that Apple remains focused on pushing forward with new platforms aimed at lowering the barrier between technology and people while allowing the Mac to be true to itself.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

Above Avalon Podcast Episode 175: iPhone at a Billion

According to Neil’s estimate, Apple surpassed the billion iPhone users milestone last month. With the iPhone upgrade cycle approaching a plateau of four to five years, Apple is well-positioned to report record iPhone unit sales. In episode 175, Neil discusses the current state of the iPhone business as it surpasses a billion users. Topic include: iPhone unit sales, iPhone sales mix broken out by iPhone upgrades and new users, the iPhone installed base, Apple’s top priorities for iPhone, peak iPhone, and more.

To listen to episode 175, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

A Billion iPhone Users

A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Thirteen years after going on sale, the iPhone remains the perennial most popular and best-selling smartphone. Competitors continue to either shamelessly copy iPhone or, at a minimum, be heavily influenced by the iPhone. Looking ahead, Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

iPhone Sales

Over the past two years, iPhone sales have experienced notable gyrations. In early 2019, Apple saw material weakness in iPhone sales due to deteriorating economic conditions in China related to U.S. trade tensions. Although Tim Cook faced some skepticism when making such a claim, the observation was later proven to be legitimate as a number of other companies went on to describe a similar slowdown in demand.

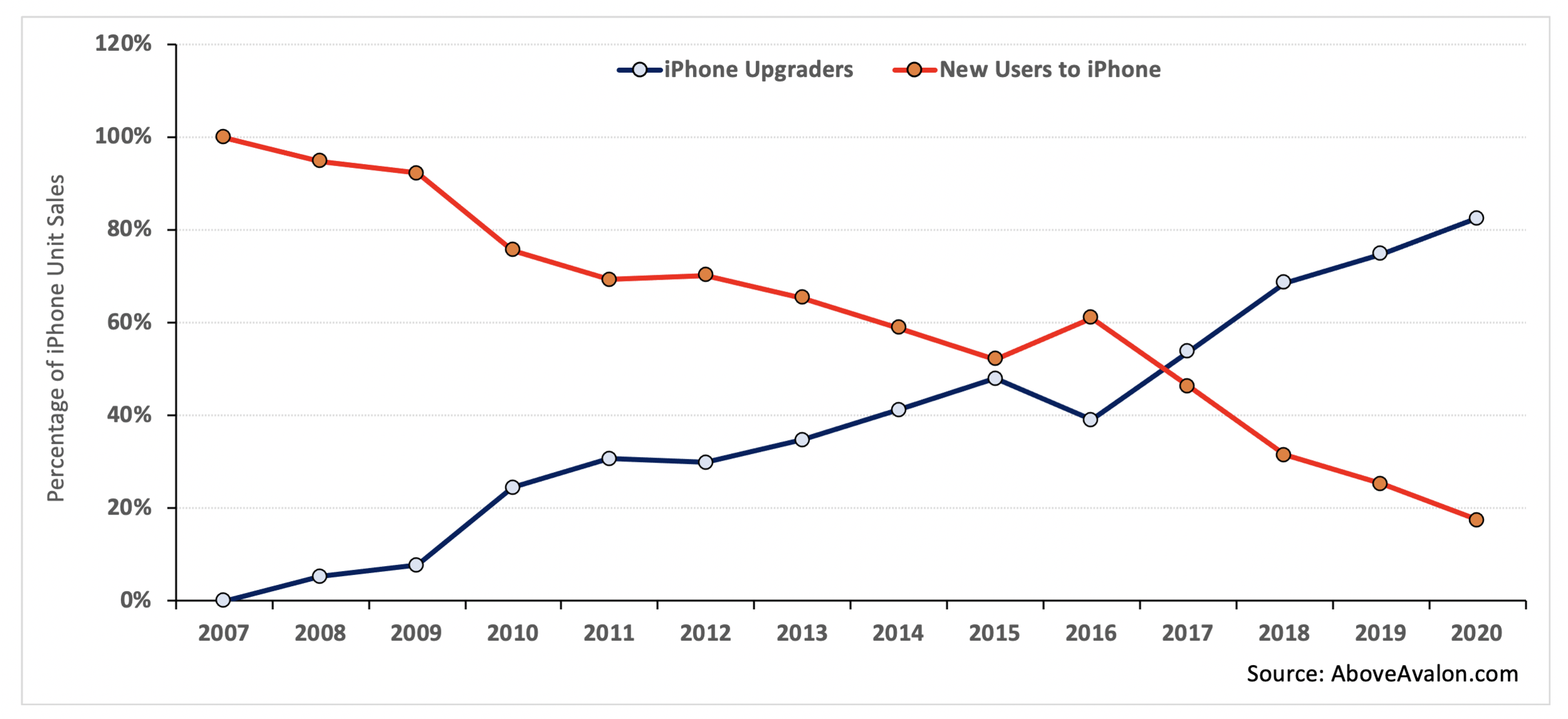

As shown in Exhibit 1, iPhone unit sales on a trailing twelve months basis dropped by about 12% in early 2019 from a 218 million annual pace to a 191 million pace. The iPhone business went on to experience a gradual improvement in sell-through (i.e. customer) demand during the second half of 2019 and the beginning of 2020 before the pandemic hit. iPhone unit sales are back above a 200 million annual pace and are currently 13% below the unit sales high experienced in 2015.

Exhibit 1: iPhone Unit Sales (TTM Basis)

At a glance, Exhibit 1 would suggest that the iPhone business has lost some of the shine it had in the mid-2010s. However, this would be a misreading of the situation. On its own, unit sales don’t tell us the full story about the iPhone business. This is the primary reason behind Apple’s decision in late 2018 to stop providing unit sales data on a quarterly basis. Wall Street was incorrectly using unit sales as a crutch for shoddy analysis.