Above Avalon Podcast Episode 134: Let's Talk Netflix

The Netflix machine seems unstoppable. Strong paid subscriber growth and rising content budgets have given Netflix a commanding lead in the paid video streaming market. However, change is in the air. Episode 134 is dedicated to discussing Netflix’s business model and why calls suggesting Netflix has won the paid video streaming war are grossly premature. Additional topics include Netflix’s keys to success, upcoming paid video streaming competitors, lessons from the music streaming industry, and things to watch out for in paid video streaming over the coming years.

To listen to episode 134, go here.

The complete Above Avalon podcast episode archive is available here.

Netflix Isn't Invincible

Netflix has been on a roll. The company is adding approximately two million paying subscribers per month while its original content portfolio grows by leaps and bounds. However, calls suggesting Netflix has won the paid video streaming war are grossly premature. In fact, the battle hasn’t even begun. We are still in the early stages of what will likely become a brutal stretch for many players as competition for paying subscribers and our time intensifies. New players, including Disney and Apple, are about to enter the scene as different direct-to-consumer business models are put to the test. Many prevailing assumptions about the paid video streaming industry will end up being proven wrong.

Netflix Growth

It’s easy to see why Netflix has been a Wall Street darling. The company has seen years of sustained paid subscriber growth in an intriguing new market. While a few disappointing earnings reports, including 2Q18 results, have led to sporadic bouts of investor jitters, Wall Street has rewarded Netflix’s paid subscriber growth with a market cap roughly equal to that of Disney. Instead of judging Netflix on profitability or sales, Wall Street has only cared about one metric: the number of paid subscribers.

Exhibit 1 highlights both Netflix’s steady increase in the total number of paid subscribers and robust growth in the international segment offsetting slowing U.S. subscriber growth.

Exhibit 1: Netflix Paid Subscribers

As depicted in Exhibit 2, year-over-year growth in the number of paid Netflix subscribers on an absolute basis stands at an all-time high. In 2Q18, Netflix saw a 25M year-over-year increase in paid subscribers. This is roughly equal to the number of Hulu subscribers. Netflix now has close to 125 million paying subscribers, and the company’s momentum seems unbeatable.

Exhibit 2: Netflix Paid Subscriber Growth

Netflix Keys to Success

A few factors explain Netflix’s strong momentum over the years:

Original video content. Netflix’s decision to bet on original content has been a game changer, helping to maintain paid subscriber momentum from the early 2010s. Shows like House of Cards and Stranger Things have single-handily helped boost Netflix’s paid subscriber tally.

Low pricing. Compared to the price of a large cable bundle, Netflix’s low monthly subscription pricing is viewed as attractive by consumers. Netflix is also running with low pricing options in international markets.

Superior user experience. Consumers want to decide when to watch their favorite shows instead of being told when to tune in.

Netflix’s business model is ultimately dependent on the number of hours subscribers spend watching Netflix content. As long as subscribers are watching an increasing amount of content, the Netflix model works marvelously. Strong paid subscriber and engagement trends give management the green light to spend an increasing amount on original content, which then contributes to additional user and engagement momentum. This produces a positive feedback loop, as shown in Exhibit 3.

Exhibit 3: Netflix Feedback Loop

Netflix Competition

Competition has been a recurring theme on Netflix’s quarterly earnings calls. Management’s response has included a carefully-crafted, cautious tone, although the takeaway has been consistent: Instead of spending time worrying about the competition, Netflix remains focused on coming up with a better user experience. The aim isn’t to deny that Netflix faces competition, but rather to claim that Netflix doesn't look at the competition to figure out what to do next.

Up to now, Netflix has faced two primary competitors: legacy cable and our time. Netflix is a media company selling a video bundle to consumers. The company has seen much success in going up against the traditional cable bundle given innovation surrounding distribution. The way we consume video is undergoing a sea change, and Netflix has been able to ride the wave while legacy video struggles to stay afloat.

As shown in Exhibit 4, ESPN’s subscriber count, which serves as a proxy for the health of the large cable bundle, has declined by about 11% from the peak. Given how a growing number of slimmed-down cable bundles include ESPN, the large cable bundle has likely experienced even steeper subscriber declines.

Exhibit 4: ESPN Subscribers

Netflix’s fight against our time has been the more intriguing competitive battle. Netflix’s success is directly related to the amount of time users spend on the platform. Accordingly, the more Netflix video is consumed, the brighter Netflix’s prospects look. Given the finite amount of time available each day, Netflix ends up competing against everyday tasks for our time and attention. This battle has placed Netflix up against work, chores, errands, and even sleep. The battle for our time, not Amazon or even YouTube, has proven to be Netflix’s most formidable competitor to date.

New Battles

While it may seem like Netflix already has quite the nuanced battle on its hands going up against the clock, competition will only intensify. Up to now, Netflix has been running away with the ball with little to no competitive response from other paid video streaming players. When it comes to paid services other than Netflix, the list isn’t long with Amazon, HBO, and Hulu possessing the most mindshare. Things are about to change in a big way. In fact, we haven’t even seen a genuine battle yet in the paid video streaming space.

Three notable competitors are about to enter the paid video streaming scene:

Disney. The company’s existing intellectual property portfolio, combined with assets acquired from 21st Century Fox, position Disney as a formidable force in the direct-to-consumer paid video streaming space. The company plans to have three video bundles: a Disney-branded bundle with family-friendly content, a Hulu bundle with content that isn’t as family friendly, and ESPN+. It is not a question of if Disney will succeed over the long run, but rather how aggressive Disney will be out of the gate in terms of grabbing paying subscribers.

Apple. The new kid on the block. We are seeing what it looks like for Apple to go all-in on developing its own video streaming service. There are still questions surrounding Apple’s video strategy. However, the stream of reports regarding new shows and movies points to Apple building a decent-sized (at least a dozen shows) portfolio out of the gate.

AT&T / Time Warner (HBO). After buying Time Warner for $85 billion, AT&T has a strong incentive to leverage its crown jewel, HBO, to gain a stronger footing in the direct-to-consumer paid video streaming landscape. AT&T seems interested in tinkering with HBO’s strategy of valuing quality over quantity. Such a content strategy is being questioned when compared to Netflix chasing both quality and quantity at the same time.

The three preceding companies will likely unleash a brutal paid video streaming war over the next five years. There will be intense bidding wars for the best ideas and shows. Talent will become even more scarce. Consumers will have more in the way of choice when it comes to watching high-quality shows. This battle will be so intense, free video streaming players, like YouTube, will likely be pulled into the mix. The significant momentum found with the paid video space is a direct threat to ad-based video models. Google may feel pressure to wade even further into the paid video streaming space.

Netflix’s Problems

Netflix’s grip on the paid video streaming market is not as strong as it may appear. The company’s competitive advantages in the marketplace are being oversold.

Netflix’s video catalog is underwhelming. Aside from its one to two dozen original hit shows, Netflix’s broader content portfolio isn’t compelling. Much of the legacy content is stale while a surprising number of original movies feel off - as if they are low-budget despite having household stars. While Netflix’s growing efforts with original shows may be enough to keep viewers as monthly subscribers, more is needed on the content front if Netflix wants to grow viewer engagement.

Switching between video subscription services is easy. The idea that consumers will stick with one video streaming platform has not been fully thought out. While companies like Netflix are incentivized to keep viewers on their own platforms, attention is easily transferrable to other video streaming services. Apple’s TV app breaks down the barriers between video streaming services to the point of there not being any barriers at all. It is not surprising that companies like Netflix have little desire to fully participate in such a service.

Netflix’s technology advantage is misrepresented. As Ted Sarandos, Netflix’s chief content officer, discussed in a recent interview, gut represents around 70 percent of the equation when it comes to Netflix determining what makes great content. The narrative that Netflix is actually a technology company masquerading as a media company ends up being a stretch. Instead, Netflix is a media company that must continue to come up with popular hit shows.

Subsidized subscription pricing helps the competition. Netflix continues to subsidize paid memberships in order to grab as many users as possible. An unintended consequence of this practice is that Netflix ends up leveling the playing field for competitors by devaluing paid video content. By keeping pricing artificially low, Netflix makes it that much easier for new competitors to enter the market with pricing that isn’t too far off from that of Netflix. Disney has telegraphed that it will likely price its family-oriented video bundle at around $5 per month, which isn’t too much lower than Netflix’s pricing, despite Disney having a content portfolio that will be a fraction of the size of Netflix’s.

Business Models

Paid video streaming does not have the characteristics of a winner-take-all industry. No one company will have a monopoly on good, compelling video content. Netflix is not going to become “the new cable bundle.” Instead, it’s very likely that consumers will subscribe to multiple paid video streaming services. We may very well see a handful of video streaming services have more than 100M paying subscribers around the world. This reality is made that much more likely given the significant financial resources found with industry players including Disney, Apple, Amazon, AT&T, and Google.

There have been two primary business models in the paid video streaming space:

Direct subscription fees (Netflix, Hulu)

Larger entertainment bundle fees (Amazon)

The two business models haven’t been put to the test. Direct subscription fees continue to be subsidized in order for companies to grab users. It is very obvious that Netflix will have to raise its subscription pricing in a big way, especially if engagement hours plateau.

Meanwhile, companies that position video as merely one of a handful of services for subscribers don’t need to turn a profit with video streaming. By bundling video into Prime, Amazon doesn’t have to worry about video streaming pricing. Ultimately, this dynamic will pressure companies dependent on direct subscription fees. We haven’t seen what the video streaming industry looks like with another major player bundling video as part of a larger entertainment package. Apple is expected to offer a comprehensive entertainment package containing music, video, news, and even cloud storage.

Mindshare

Paid music streaming provides a sneak peak of what may unfold in the paid video streaming industry. In some ways, the music streaming industry is a few years ahead of the video streaming when it comes to having genuine competition.

There are key differences between the music and video streaming industries. With music, the same content is available on multiple paid streaming platforms. This has resulted in streaming companies positioning music discovery and the listening experience as the primary forms of differentiation. In what is a new development, hardware is also now being positioned as a differentiator with stand-alone stationary speakers, in addition to wearables, increasingly paying a role in how consumers pick between music streaming services.

Meanwhile, differentiation for video streaming comes in the form of original content. For example, Stranger Things is available only on Netflix and will likely remain so for the foreseeable future. Based on Netflix subscriber trends, original programming plays a major role in driving subscriber growth. This has led to a type of arms race when it comes to content budgets. Netflix is reportedly spending close to $10 billion per year on original content. Amazon is spending near $5 billion per year.

There are similarities between the two industries as well. Both music and video streaming began with a clear first-mover. Spotify was the undisputed leader in paid music streaming, similar to how Netflix now holds the same title in the paid video streaming space. This title gave each company significant mindshare, which corresponded to strong early momentum in terms of grabbing new users.

However, with a genuine competitor in the music streaming market, Spotify’s mindshare has suffered. Exhibit 5 compares the growth in paid subscribers for Apple Music and Spotify. While each company continues to benefit from the music streaming pie getting larger, Spotify now has to share the stage with Apple for mindshare.

Based on company disclosures, Apple Music’s new user growth is indeed accelerating as time goes on. In what is likely a worrying development for Spotify, Apple Music is now said to have more paid users than Spotify in the U.S. Similar trends are unfolding in other developed markets.

Exhibit 5: Apple Music vs. Spotify

Meanwhile, Spotify’s stronghold appears to be in Brazil and emerging markets, locations in which Apple’s market penetration is low. This dynamic doesn’t give one confidence in Spotify’s long-term opportunity. Instead, Apple will continue to chip away at Spotify’s mindshare.

While Netflix is able to use original content as a way to set itself apart from the competition, the company hasn’t needed to share the paid video streaming stage with such household names as Disney and Apple.

The Key Variable

The number of paid subscribers is not the key variable to monitor with Netflix. Since the paid video streaming market faces a number of tailwinds, it is certainly possible that Netflix will continue to grow its subscriber count over time. The overall streaming pie will continue to grow. Instead, the Netflix item to watch is subscriber engagement.

Netflix’s business model is ultimately dependent on the number of hours subscribers spend watching Netflix content. As discussed up above with Netflix’s feedback loop, as long as subscribers consume an increasing amount of content, the Netflix model works marvelously.

Based on Netflix’s 2Q18 earnings commentary, viewing/engagement hours are still up year-over-year. What will happen to Netflix engagement once Disney and Apple launch their own video bundles? Questions surrounding future competition are legitimate for Netflix. While consumers may very well end up subscribing to multiple video bundles, there is only so much time that can be split among each bundle. Time spent watching Disney or Apple content will be time not spent watching Netflix content.

As shown in Exhibit 6, the hole in Netflix’s armor will likely be found with the item circled in red: engagement. Any sign of plateauing engagement could lead to a domino effect as Netflix loses pricing power and the ability to run with higher content budgets. Any slowdown in new original content could then begin to impact new user trends, especially in international markets. Less content could then lead to even lower engagement.

Exhibit 6: Netflix Feedback Loop (Potential Problem Circled in Red)

The Big Picture

Given how Netflix is viewed by many as unstoppable, it probably shouldn’t come as a surprise that consensus expectations remain muted for Disney and Apple in the paid video streaming space. This will likely end up being a mistake. Various publications have been solely focused on casting doubt on Apple’s video efforts instead of highlighting how the paid video streaming market remains attractive for a company like Apple. The cynicism surrounding Apple Video brings back memories of the doubt facing Apple Music in the early years.

Tim Cook and Eddy Cue are reportedly taking a very hands-on approach with Apple’s video initiative, highlighting the service’s importance to Apple. Video will end up being a key ingredient of an Apple entertainment bundle containing various services. The company ends up building not just a video streaming service, but a Hollywood arm. Meanwhile, Disney has the strongest intellectual property out of any video player. The company’s problem up to now has been found with distribution. Those problems are now being addressed.

As for Netflix’s future, management appears to be well-aware of the risks found with being just a paid video streaming company. Netflix management will likely focus on two items in particular:

Acquire or build a strong portfolio of intellectual property. It would not be surprising to see Netflix embrace M&A (the company has only acquired one company - Millarworld) in an effort to beef up its intellectual property.

Expand beyond video content. Netflix reportedly considered buying a chain of movie theaters. Recent reports have Netflix moving into radio as well. These efforts are designed to move Netflix beyond being just a paid video streaming company.

Disney and Apple don’t have to go toe-to-toe with Netflix to do well in the video streaming space. Instead, each company is ultimately focused on grabbing viewer attention with compelling content. The ingredients are in place for both Disney and Apple to do very well.

Receive Neil’s analysis and perspective on Apple throughout the week via exclusive daily updates. The updates, which have become widely read and influential in the world of Apple, provide timely analysis of news impacting Apple and its competitors. Neil also publishes exclusive reports on Apple business, product, and financial strategy. The daily updates and reports are available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Above Avalon Podcast Episode 133: The Big Picture from Steve Jobs Theater

Earlier this month, Apple Watch was the star of Apple’s second major product event at Steve Jobs Theater. Episode 133 is focused on looking at the big picture following Apple’s event. The discussion begins by going over Tim Cook’s comments regarding Apple’s mission statement and then quickly puts the iPhone and Apple Watch updates into context. We then turn to my Grand Unified Theory of Apple Products. Additional topics include my user base estimates for Apple’s various product categories, my rationale for why Apple Watch and Apple Glasses will one day have a larger user base than iPhone will, and the power associated with new form factors that are capable of handling new tasks.

To listen to episode 133, go here.

The complete Above Avalon podcast episode archive is available here.

Connecting the Apple Dots

Apple is following a clear and defined product strategy. Last week, Apple provided the latest look at this strategy by unveiling new iPhones and a redesigned Apple Watch. These products represent clues that help paint a picture of where Apple is headed.

Mission Statement

Tim Cook kicked off Apple’s most recent product event at Steve Jobs Theater with an overview of the company’s mission statement. Here’s Cook:

“Apple was founded to make the computer more personal. Of course first with the Apple II, and then later with the Mac. Over the years, we’ve taken this mission further than anyone could have imagined. We’ve created several categories of technology that have had a profound impact on people’s lives - from the iPod to the iPhone to the iPad to the Apple Watch…

Of course we aim to put the customer at the center of everything that we do. That’s why iOS is not just the world’s most advanced mobile operating system. It’s the most personal. We’re about to hit a major milestone. We are about to ship our two billionth iOS device. This is astonishing. iOS has changed the way we live - from the way we learn, to the way we work. To how we’re entertained, to how we shop, order our food, get our transportation, and stay in touch with one another. And of course, how we capture the moments of our lives and share them with those we love. It’s amazing how our mission started with personalizing technology for the desktop to now seeing the many ways that we’ve made it more personal in so many aspects of our lives.

So it’s only fitting that today, we’re going to tell you about two of our most personal products - the ones that are with you everywhere that you go - and how we are going to take them even further.”

Along with announcing three iPhone X successors, Apple unveiled the most significant year-over-year change to Apple Watch since its unveiling in 2014.

My full review of Apple’s event is available for members here (major themes and takeaways) and here (full notes).

iPhone XS / XR

In order to push the iPhone X experience forward, Apple focused on three items:

Larger screens (A 6.5-inch screen with the iPhone XS Max and s 6.1-inch screen with the XR.)

Smarter brains (The A12 Bionic gives Apple an even larger lead over the competition.)

Better eyes (The dual-camera system is giving iPhone the ability to see the surrounding world with a more intelligent perspective.)

The following image does the best job at describing the current state of the iPhone business:

There is a reason Apple spent nearly 10% of the presentation talking about the A12 Bionic chip. Apple has spent the past decade working to control the core technologies powering its devices. The end result is an Apple chip that is providing the company a significant competitive advantage in the marketplace. With each new iPhone release, Apple’s custom silicon is responsible for an increasing portion of the iPhone experience. Apple didn’t just announce three new iPhones last week. Instead, thanks to the A12 Bionic and increasingly capable cameras, Apple announced three AR navigators serving as laptop and desktop alternatives.

Apple Watch Series 4

While the new iPhones were impressive, Apple Watch Series 4 stole the show. Two slides from the Apple Watch portion of the presentation stood out. The first of these covers improved optical heart sensor on the back of Apple Watch. The second shows Jeff Williams demonstrating some findings from Apple's multi-year research into falls.

Both slides depict Apple Watch as a proactive digital assistant. The device is capable of monitoring everything from our heart rhythm to whether we have fallen and need help. By being worn on the body, Apple Watch is able to handle tasks that will never be given to iPhone. When combined with the independence found with cellular, Apple Watch contains an incredibly powerful value proposition.

Apple Product Theory

The iPhone and Apple Watch represent the two most personal devices in Apple’s product line. While it may seem like these products lack any obvious connection with their larger siblings, there is a single philosophy connecting each of Apple’s major product categories. Introduced in 2015, my Grand Unified Theory of Apple Products is worth revisiting given the significant changes that have taken place within Apple’s product line.

Apple’s major product categories are interconnected by the roles they play in making technology more personal. Each product is given a goal that ends up describing its design attributes.

Mac desktops. Designed to be powerful and capable enough to push the boundaries of a computer.

Mac portables. Designed to handle tasks that may have traditionally went to a desktop.

iPad. Designed to serve as an alternative to laptops and desktops.

iPhone. Designed to be powerful enough to reduce the need for iPad and Mac.

Apple Watch. Designed to handle an increasing number of tasks so that less time has to be given to iPhone and iPad.

Apple’s product strategy is based not on coming up with replacements for existing products, but on using personal technology to come up with alternatives to more powerful computers. By relying on new form factors in addition to new user inputs and outputs, Apple has seen much success in coming up with products that contain less in the way of barriers between the user and technology. Intuitiveness is used to harness technology’s potential. Apple’s goal with iPhone has been to give the product enough functionality to serve as a Mac and iPad alternative. Meanwhile, Apple’s goal with Apple Watch is to give the product enough functionality to reduce the need for an iPhone.

The Grand Theory also does a good job of explaining why Apple uses a hands-off approach when it comes to telling consumers which product(s) fit best in their lives. While some think this has been a strategic error on Apple’s part, ultimately management wants customers to determine the degree of personal technology that makes sense for their needs. For some customers, a Mac may be required. For others, an iPhone is the only computer needed. Based on the most recent Mac and iPad Pro ad campaigns, Apple management has become comfortable in allowing each product category to stand on its own and not necessarily lift up one category at the expense of the other.

Connecting the Dots

Based on the most recent iPhone and Apple Watch updates, Apple’s longer-term ambition has become crystal clear. This is a company that believes Apple Watch will serve as a viable alternative to iPhone. As a result, the environment will become more hospitable for new form factors capable of making technology even more personal than is possible with Watch. As shown below, the Grand Unified Theory will likely expand to include a new product category beneath Apple Watch: Apple Glasses.

Apple Glasses fit perfectly within the theory as a product category given the job of handling tasks currently given to Apple Watch and iPhone. This would be accomplished by new user inputs (such as glances and voice) and outputs. The work Apple is doing with its custom silicon, along with miniaturization techniques it is using on Apple Watch will come together to make a pair of lightweight smart glasses possible. With the iPhone continuing to gain new capabilities as an AR navigator and the Watch becoming a new kind of proactive digital assistant, there will be room for a simpler device. This device will be designed to break down technology even further to provide an enhanced view of the world around us. There won’t be too many things as intuitive as a pair of smart glasses.

Consequences

One of the major consequences of the Grand Theory is shown below. Apple’s various product categories have dramatically different user base sizes based on the amount of personal technology found with each product. While the Mac has a combined user base of around 100M users, the iPad has almost three times as large of a user base. Meanwhile, the iPhone will soon exceed a user base that is nine times as large as that of Mac.

For more information on the methodology and calculations used to derive these estimates, visit here (iPhone), here (iPad), and here (Apple Watch).

Apple Watch’s user base has grown to 40M in just three years. For context, the iPhone user base stood at 55M after three years. Considering that an Apple Watch still requires an iPhone, the 40M user base figure is that much more remarkable.

As shown below, my expectation is that Apple Watch and Apple Glasses will one day be used by more people than will the iPhone. Such a radical idea may seem like fantasy, especially given how pivotal of a role the iPhone is playing in our lives. However, the appeal found with intuitive devices capable of making technology more personal will prove too powerful.

As new form factors allow Apple to harness technology’s potential, the scope to which those products are able to connect with humans intensifies. Multi-touch was a leading factor in iPhone having a user base that is nine times larger than that of Mac. A proactive digital assistant on the wrist will give Apple Watch a user base that eventually exceeds that of iPhone. The key to my projection is the eventual decoupling of Apple Watch from iPhone. This is an inevitable development. The only question is found with timing.

When it comes to glasses, a product that will be tasked with making technology more personal than iPhone or Watch, providing enhanced vision will be one of the more attractive value propositions in existence. While a user base of 900M people may seem impossible for Apple Watch or Apple Glasses to surpass, there are 7.5B people on Earth. Everyone can benefit from a device that delivers an enhanced view of the world around us.

The Current Era

With smarter brains and better eyes, the iPhone XS and XR will continue the trend of iPhones gaining functionality. It is not a surprise that we see iPhone pricing begin to move higher as a result. However, despite these advancements, the Apple Watch Series 4 was the star of the show at Apple’s recent product event. While this may have come as a surprise to some observers, there have been signs that this day would come. The Watch’s ability to proactively monitor our life is game changing.

When we look back at the late 2010s for Apple, we will likely refer to this as the early stages of the Apple Watch and Apple Glasses era. Apple’s multi-decade quest to make technology more personal is based on using intuitiveness to knock down the barriers that exist between humans and technology. One way of accomplishing this is push the boundaries found with today’s most personal products. The faster Apple runs with iPhone and Apple Watch, the closer the company will get to announcing its most personal product yet: glasses.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on memberships, visit the membership page.

Above Avalon Podcast Episode 132: Titan vs. Tesla

In episode 132, we take a closer look at Apple's Project Titan. The discussion begins by going over the signs pointing to Apple expanding Titan initiatives in recent months. We then turn to Apple's goal with Titan and the automobile's changing value proposition. Tesla enters the discussion as we look at why the company isn't a realistic acquisition target for Apple. Additional topics include Tesla's struggles, poaching, Doug Field's move from Tesla to Titan, and the most interesting things to watch for in the auto space.

To listen to episode 132, go here.

The complete Above Avalon podcast episode archive is available here.

Poaching Tesla

Apple and Tesla share some similarities. Both companies possess remarkably strong brands, loyal customer bases, and products capable of maintaining that loyalty. Each also has a visionary product leader. Apple has Jony Ive while Tesla has Elon Musk. Accordingly, some have concluded that Apple should acquire Tesla as a way of quickly jumping into the transportation industry.

A Tesla acquisition doesn't make sense for Apple. However, Tesla does have something that Apple has a use for: talent.

Project Titan

Apple's ambition with Project Titan, a catch basin for the company's transportation R&D endeavors, continues to be underestimated. The number of signs pointing to Apple expanding Project Titan initiatives in recent months is on the rise.

Apple currently has the third-largest test fleet of autonomous vehicles on the road in California. In just a few months, the number of test vehicles has expanded from 27 to 66.

Apple reportedly is expanding its vehicle testing presence in Arizona, another hotbed of autonomous driving research.

Apple is reportedly working with Volkswagen on developing autonomous shuttles for Apple employees. The partnership includes Apple developing both hardware and software for the autonomous shuttles.

Apple recently hired two high-level auto industry executives (Jamie Waydo and Doug Field). Waydo played a key role in the safety program Waymo uses to test and develop its self-driving technology while Field was one of Tesla's most important engineers overseeing vehicle engineering and Model 3 production.

One word to describe Apple's Project Titan strategy is "methodical." Apple appears to be gradually doing everything one would expect of a company establishing a large test fleet of autonomous vehicles on public roads. All the while, Apple's hardware ambitions remain intact. The company appears to still own a web of buildings across the Sunnyvale / Santa Clara / San Jose area that are dedicated to heavy manufacturing and have open space for future growth. (A map of the various locations is available for Above Avalon members here.) This is a company that wants to come up with new transportation solutions consisting of hardware, software, and services.

When news of Project Titan's existence broke in early 2015, many people were skeptical because Apple had no expertise in the auto industry. Apple would be starting from scratch.

In what was a departure from the iPhone development playbook, Apple looked outwardly for Titan talent. Specifically, Apple turned to the auto industry for hardware expertise. As shown below, a list of select Titan members (as of mid-2015) served as a wakeup call to skeptics. Apple was indeed working on a vehicle.

In late 2015, Project Titan began to hit speed bumps as friction between designers and engineers intensified. In order to come up with a truly new user experience, Apple designers wanted to skip human-driven vehicles and instead go straight to an autonomous vehicle. Others argued the better strategy was to begin with an electric car and then position autonomy as a future feature. Not surprisingly, the designers won.

Bob Mansfield, a hardware engineering guru who is arguably one of Apple's most successful liaisons between the design and engineering teams, was brought in to right the Titan ship. The initiative was refocused on developing the core technologies that would power a variety of transportation hardware options. The refocus on autonomous driving led to a culling of hardware talent.

At least 40% of the outside hires listed in the table above are no longer at Apple (based on LinkedIn updates). Most of the departures took place between August 2016 and early 2017, which fits with the reported timeline of Mansfield overseeing Titan changes. In addition to turning to outside auto hires, Apple ended up poaching itself by taking veteran Apple product design managers off of other teams. There doesn't appear to be much turnover with those Titan additions. Recent reports peg the number of people working on some aspect of Project Titan to be between 2,000 and 2,500.

Apple's Goal

The best way to understand Apple's goal with Project Titan is to think about the company's design-led culture. Apple's strength lies in taking existing product categories and using design to rethink our assumptions about that category. By rethinking how we use products, Apple is able to come up with products that can change the world.

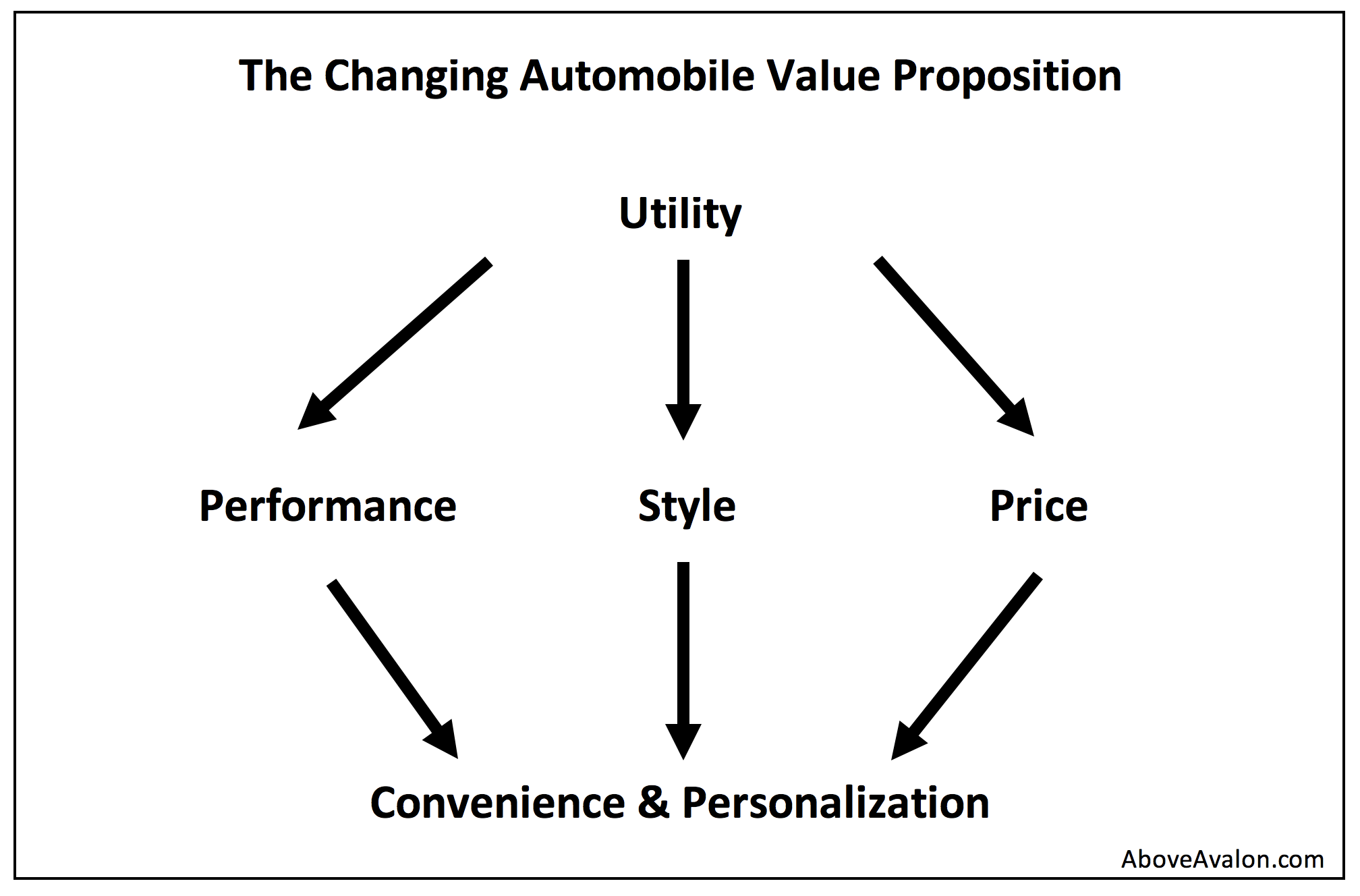

Apple wants to rethink the automobile. While electric powertrains, autonomy, and ridesharing will help in Apple's efforts, something more is needed. Our fundamental assumption of what a car is (and isn't) is still in need of being reimagined. Without fresh thinking when it comes to design, we are still left with most of our prevailing assumptions about cars.

This lack of fresh perspective in automobile design is one factor likely fueling the growing interest in bikes and scooters in high density areas. However, the problem with automobile design goes beyond city centers. People are increasingly tired, frustrated, and bored with cars. The dramatic shift to SUVs in the U.S. is driven by consumers caring less about traditional car value metrics such as performance. Instead, consumers are craving personalization in any form possible. Unfortunately, personalization options, especially when it comes to driver and passenger compartments, remain limited in the auto industry.

Tesla did something extremely well: It developed electric cars that people actually wanted to drive. Talk of other luxury car makers competing with Tesla is likely more fantasy than reality. However, it's not clear if Tesla is actually on the right path given the car's changing value proposition.

One way Tesla has been able to do so well in the luxury segment is by competing on old-school value metrics like performance and style. The problem for Tesla is that these values won't matter in the future. Instead, the focus will shift to convenience and personalization. While iPhone relies on software to become a personalized computer for 900 million people, we will demand a similar personalized experience from automobiles. As it stands now, personalization when it comes to the automobile amounts to CarPlay, moving the driver seat back and forth a few inches, and folding down a row of back seats.

Why Not Acquire Tesla?

Given Apple's interest in transportation and Tesla having the most popular, highest-rated car on the road, many have positioned Tesla as an Apple acquisition target. Apple's strong balance sheet adds fuel to the fire. With $129B of net cash, Apple could pay $70B+ to acquire Tesla and instantly become a player in the auto space.

However, Tesla isn't a realistic acquisition target for Apple. More importantly, Apple doesn't need to acquire Tesla in order to meet its goals. The best way to understand why is to look at the key components of Apple's M&A philosophy:

A strong brand and product aren't enough for an Apple acquisition. There has to be more to an Apple acquisition target besides strong branding and a popular product in the marketplace.

Apple doesn't use M&A to acquire revenue. Apple doesn't use M&A as a tool to grow revenue.

Apple doesn't use M&A to acquire users. Apple doesn't acquire companies simply to grow its user base. This tenet has become that much stronger in recent years as Apple's user base has grown. Apple currently has one billion users. When considering how the vast majority of those users comprise the premium segments of the smartphone and tablet markets, Apple has no need to acquire what ends up being its own users.

In essence, Apple isn't interested in buying its way into new product categories. Instead, Apple positions M&A as a tool to either enhance its existing product line or plug holes in the product development process. M&A is used to a tool to supplement, not replace, Apple's design-led product development process. Accordingly, there are two things Apple looks for when acquiring companies:

Apple uses M&A to acquire technology. Apple looks at M&A as a tool for plugging holes in its asset base. Given how Apple is constantly working on new products, one hole is often the need for new technology.

Apple uses M&A to acquire talent. One area in which Apple is resource constrained is talent. As Apple moves from one industry to another, the company is always on the lookout for teams of talent that help boost knowledge and expertise.

A look at Apple's acquisition history demonstrates these core M&A tenets. Acquisitions such as P.A. Semi, AuthenTec, LinX, and Metaio were about technology and talent. Even acquisitions that included consumer-facing products like Beats, Beddit, and Shazam (pending approval) were ultimately about the technology behind the products.

Netflix

Netflix represents a great example of how Apple doesn't use M&A. In a Netflix acquisition, the two primary things Apple would have bought are a strong brand and lots of users, neither of which is enough to justify an acquisition. In addition, Apple users already had full access to Netflix. It's unclear how Apple owning Netflix would lead to an improvement in Apple products. Positioning Netflix's technology as justification for an acquisition is quite the stretch. Netflix is a media company, and the company's content library is grossly overrated when moving beyond the 15 to 20 marquee series.

Instead of spending $100 billion to acquire Netflix, Apple opted to poach talent from the entertainment industry and build something on its own. The result is a new "Apple Studios" division overseen by former Sony Pictures Television executives. Apple is reportedly planning to launch its new Apple Video streaming subscription service sometime next year.

Arguing that Apple should acquire Tesla because it has a great brand and popular product in the marketplace is faulty thinking. Instead, Tesla would need to provide resources that can either strengthen Apple's existing product line or plug holes in Apple's design-led product development process. Some will say that Tesla's fleet of human-driven cars ends up being the company's secret weapon when thinking about the race to autonomy. I'm not so sure about that claim. Others think Tesla's charging network or factories represent the company's crown jewels. Both claims are questionable. Instead, those items could end up being viewed as liabilities, which is one reason Apple embraced contract manufacturing nearly two decades ago.

Poaching

A Tesla asset that Apple may have an interest in is talent. Given Apple's ambition, Project Titan can benefit from having employees with experience developing cars that people love. However, instead of acquiring Tesla to bring on tens of thousands of employees, which would raise many red flags, a better strategy would include Apple selectively seeking out talent that would be the best fit for Titan.

When selling prospective hires on the Titan message, Apple is ultimately selling two things: vision and process.

Vision. Explaining Apple's mission to come up with products that can change the world. Even though new hires aren't likely given the full lay of the land when joining Titan, the Apple mission can still be telegraphed.

Process. Explaining the process in place for turning vision into reality.

It's not that Apple has necessarily struggled appealing to new hires for Titan. Instead, Tesla likely had the stronger message up to now. In the early 2010s, Tesla was successful at picking off members of the Mac, iPod, iPhone, and iPad teams looking for the next big challenge. At the time, Apple's focus was on Apple Watch, a product that ultimately had a relatively small development team. Project Titan was still a few years away. Doug Field was one of these employees who always had an interest in the transportation space and jumped at the Tesla opportunity.

Around the time Apple began ramping up Project Titan hiring in 2014 and 2015, the Apple versus Tesla talent wars began in earnest. Tesla was much farther along than Titan, with cars already on the road.

However, the environment has changed. The past few months have been a tough stretch for Tesla. The company's long-term goal is to usher in the era of sustainable transport. To reach such a goal, Tesla needed to take a luxury detour and sell cars to those most willing to pay top dollar for a high-performance electric sports car (which happens to have more than two seats). The problem is that Tesla finds itself having trouble getting back on track. A truly mass-market Model 3 remains missing in action. Tesla has become a case study of a company led by a product visionary struggling to turn vision into reality.

Elon Musk has consolidated power, and it's not clear that this is for the better. It's one thing for a product visionary to focus on details. It's a completely different story when a product visionary is being stretched too thin. Recent comments Musk gave to The New York Times regarding him being the only person that can solve Tesla's manufacturing problems is worrying.

These challenges may give Apple a potential opening for poaching Tesla for talent. Meanwhile, after leadership changes and some shaky times, Project Titan is now in a much more orderly state. Apple would make the case that it has a better process in place than Tesla. It's relatively easy to design a great car. The challenge is to build tens of millions of that car and to then be able to develop new versions over time.

Tesla's problem is ultimately its desire to do everything on its own. While such a decision was made given the lack of alternatives, Tesla faces less flexibility and financial capacity as a result. This has opened the door for Apple in terms of appealing to Tesla employees. Other factors may include being attracted by Apple ideals such as protecting data privacy and security, which will become a crucial topic in the auto space.

Doug Field

Tesla critics have been quick to point out the growing list of executive departures as a sign of major issues within Tesla. While the turnover does raise an eyebrow, Doug Field's departure stands out.

Field was Tesla's second-highest ranked engineer, behind CTO JB Straubel. Field was responsible for vehicle engineering and Model 3 production. Back in 2013, his hire from Apple was positioned as a huge win for Tesla. With experience that included Segway's CTO and Mac product design, Field had experience in both personal transport and shipping consumer products at scale.

Field's job at Tesla was to turn Musk's vision into reality. As recently as this past April, Musk viewed Field as one of the most talented engineering executives in the industry. Accordingly, it's telling that Field ended up quitting Tesla to join Titan. It will be interesting to see if any of Field's deputies at Tesla make the same move. Such a defection would end up being a major coup for Titan.

Elon vs. Jony

There will be a role for cars in the new transportation paradigm. Two visionaries to keep an eye on are Elon Musk and Jony Ive. Each is taking lessons learned from other industries with the goal of rethinking transportation. It is no surprise that Musk has thrown a few snide comments and jokes Jony's way in recent years.

Two of the more interesting things to watch in the auto space remain design and manufacturing. Instead of asking questions about legacy auto's software expertise, the more valuable question to ask is, Who is that company's Jony Ive? While auto manufacturers have teams of talented designers, such talent ends up being wasted as upper management and boards mitigate design risk out of fear of losing sales.

Over at Tesla, a company more geared towards engineering than design, Musk and company are learning the harsh realities of auto manufacturing. Many of Tesla's decisions won't be repeated by others.

Meanwhile, Apple's Project Titan is becoming a testbed of new technology that can be used to power new vehicle concepts from Apple's industrial design group.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Above Avalon Podcast Episode 131: Growth Drivers

Apple's latest growth story is driven by three drivers: iPhone, Services, and Wearables. In episode 131, we discuss these three growth drivers to see how they are not created equal. After going over the factors fueling Apple's growth drivers, we spend time discussing how Apple's growth story may change in the near term. The episode concludes with a big picture overview of why Apple's long-term growth story won't just be about Services.

To listen to episode 131, go here.

The complete Above Avalon podcast episode archive is available here.

Apple's Growth Story

Apple is on a roll. The company is seeing record high iPhone ASPs, strong momentum with Services, and a wearables platform connecting with the mass market. Revenue growth has accelerated for the past seven quarters. Apple's growth story has returned with a vengeance. Upon closer examination, it becomes evident that Apple's three primary growth levers are not created equal. While some growth levers are at risk of slowing, others are still just getting started.

Growth Has Returned

In early 2016, Apple hit a rough patch. The company reported its first year-over-year decline in iPhone unit sales as the iPhone 6s and 6s Plus sales cycle proved quite different from that of iPhone 6 and 6 Plus. Overall revenue trends also turned negative with Apple reporting a double-digit revenue decline in 2Q16 and 3Q16.

Just as consensus began to throw in the towel on Apple as a growth story, iPhone unit sales stabilized. As shown in Exhibit 1, revenue bottomed in early 2017 and then once again began to increase. The most recent quarter marked a record high for Apple revenue on a trailing-twelve-month (TTM) basis and the seventh consecutive quarter of sequential growth in revenue.

Exhibit 1: Apple Revenue (TTM)

There are three drivers behind Apple's return to revenue growth:

- iPhone. The average selling price (ASP) of iPhone is up $100 year-over-year.

- Services. Apple is seeing strong revenue growth from the App Store, licensing, and AppleCare.

- Wearables. Apple's wearables platform is gaining sales momentum as Apple Watch and AirPods go mainstream.

Measuring Growth

The interesting thing about Apple's latest growth story is that few people were forecasting that Apple would grow revenue via hardware sales. Instead, many said that Services would be Apple's growth engine going forward. As it turns out, things are developing differently than consensus assumed.

For the twelve months ending this past June, iPhone was responsible for 57% of Apple's year-over-year revenue growth. Services was the second-largest revenue driver, responsible for 23% of Apple's year-over-year revenue growth. Wearables was responsible for 11% of Apple's growth. As seen in Exhibit 2, iPhone has been responsible for an increasing portion of Apple's revenue growth.

Exhibit 2: Measuring Apple's Revenue Growth Drivers

Details

It is helpful to take a closer look at the factors underpinning Apple's three revenue growth drivers.

iPhone. In 3Q18, iPhone revenue was up 20% year-over-year. The vast majority of this growth was due to Apple selling higher-priced iPhones. The iPhone 8 and 8 Plus are the highest-priced 4.7-inch and 5.5-inch iPhones, respectively, to date. Furthermore, the iPhone X is Apple's highest-priced iPhone yet. As seen in Exhibit 3, iPhone ASP experienced a step increase beginning in 1Q18, which marked the first full quarter of iPhone 8 and 8 Plus sales in addition to the iPhone X launch. Given strong flagship iPhone sales momentum, Apple has continued to report strong ASP trends. Apple reported a record high $119 year-over-year increase in iPhone ASP in 3Q18.

Exhibit 3: iPhone ASP

According to my estimates, Apple has sold approximately 120M higher-priced, flagship iPhones (8, 8 Plus, and X) since September 2017. Some of these devices were bought by former Android users switching to iPhone. However, there are only so many premium Android users out there. The majority of sales have likely gone to existing iPhone users upgrading their devices. With an iPhone installed base of approximately 750M users, less than 15% of the iPhone installed base bought a new flagship iPhone over the last nine months.

A small percentage of the iPhone installed base is responsible for driving much of the year-over-year increase in iPhone ASP. While this doesn't necessarily mean that iPhone ASPs are more fragile than they appear, it does add clarity to the current state of the iPhone business. The iPhone upgrade cycle continues to get longer while growth in customer demand for iPhone remains mediocre. Despite these challenges, the sheer size of the iPhone installed base makes it possible for Apple to sell close to 150M higher-priced, flagship iPhones in any given year.

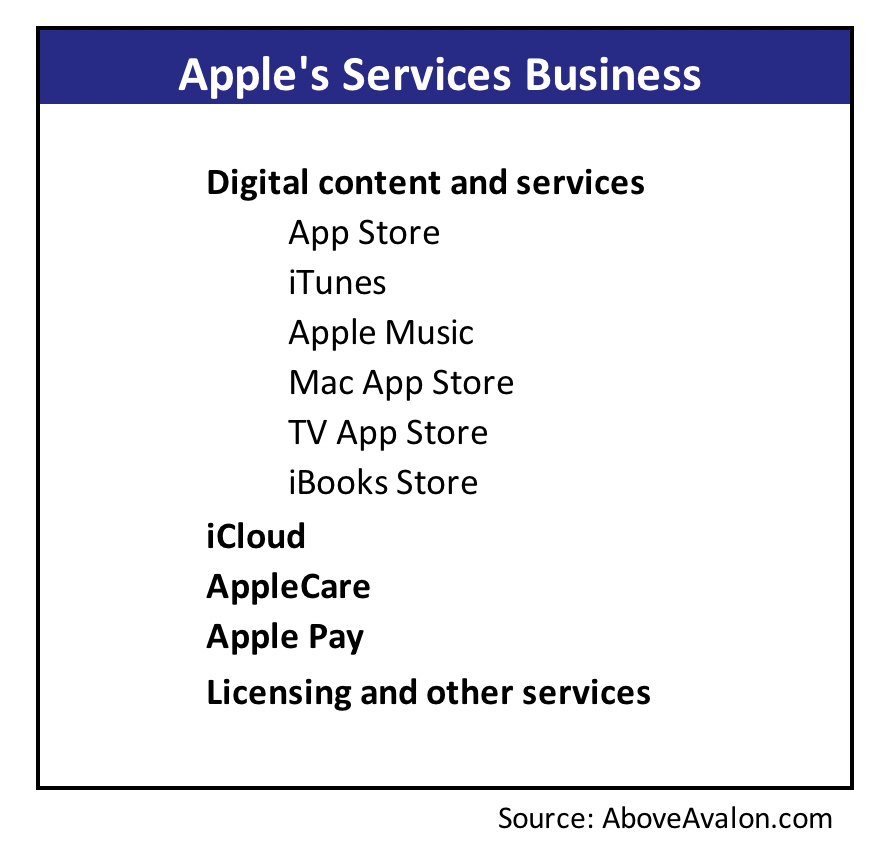

Services. Apple's second-largest revenue driver, Services, is comprised of five items:

- Digital content (App Store, iTunes, Apple Music, etc.)

- Licensing

- AppleCare

- iCloud storage

- Apple Pay

A majority of Apple's Services revenue is associated with Apple distributing digital content to hundreds of millions of people via the App Store and iTunes. Accordingly, the increase in the number of people accessing Apple's content stores, combined with existing users spending more as time goes on, is a leading driver behind Apple's strong Services revenue growth.

Licensing revenue is another major contributor to Services revenue growth as third parties are paying Apple more to get their services in front of Apple's users. It helps that Apple's grip on premium users has gotten stronger over time. AppleCare revenue is also on the rise as the number of Apple devices in the wild increases and Apple expands its AppleCare distribution efforts.

Wearables. Apple is seeing strong unit sales growth for both Apple Watch and AirPods. In just three years, Apple Watch sales have exceeded 20M units per year with a user base nearing 40M. Despite extended supply issues, Apple likely sold more than 10M AirPods during the first year on the market, and coming close to 20M unit sales is a distinct possibility in CY2018. Apple Watch and AirPods sales are benefiting from aggressive pricing, strong mindshare, growing word of mouth, and increased distribution, especially with the cellular Apple Watch Series 3. As shown in Exhibit 4, wearables unit sales (the orange portion of bar) are no longer a footnote on a Apple gadget sales chart.

Exhibit 4: Apple Gadget Unit Sales

Future Growth

When it comes to thinking about how Apple's revenue growth drivers will perform in the coming quarters, it is important to assess the broader environment facing each driver. At the same time, a look at Apple's product strategy is required to the weigh the impact from new products and pricing decisions.

iPhone. Among Apple's three revenue growth drivers, the iPhone faces the most headwinds. While Apple can still grow iPhone revenue with modest unit sales growth, the company will likely see less of a revenue boost from huge iPhone ASP gains. It will be difficult for Apple to increase iPhone ASP by another $100 in 2019. Instead, iPhone ASP increases will likely decline.

Apple is expected to unveil three new flagship iPhones (6.5-inch OLED, 5.8-inch OLED, and 6.1-inch LCD) next month. Even if we assume the 6.5-inch OLED is priced higher than iPhone X, the model likely won't have as large of an impact on iPhone ASP as iPhone X, given a smaller share of overall iPhone sales. Instead, the majority of iPhone sales will be found with the 6.1-inch LCD and 5.8-inch OLED iPhones. These models will likely be priced similar to this year's flagship iPhones, making it that much harder for Apple to see another step increase in iPhone ASP.

Services. There are a number of factors supporting continued robust Apple Services revenue trends into 2019. Apple Services will benefit from continued growth in the iPhone installed base. At the same time, larger industry themes such as video subscription services gaining popularity stand to benefit Apple Services revenue in a few ways. In addition to earning a share of revenue via third-party video subscriptions, Apple is widely expected to launch its own paid video streaming service in 2019. Additional Services growth levers are found with higher licensing fees from third parties, more AppleCare revenue, and a larger number of iCloud storage subscriptions. In a scenario in which iPhone revenue growth slows, it is reasonable to expect Services will represent a larger portion of Apple's revenue growth in 2019.

Wearables. Apple's wearables segment will likely serve as an Apple revenue growth engine for years. The days of Apple wearables being considered a revenue footnote are over. Over the past 12 months, Apple sold over $10 billion of wearables (Apple Watch, AirPods, and Beats headphones). Assuming Apple is able to maintain at least 30% to 40% unit sales growth over the next few years, Apple's wearables platform will reach $20 billon of annual revenue within three years. Given the still relatively low adoption rates for Apple Watch and AirPods within the Apple user base, there are plenty of potential users left to fuel unit sales growth. Over the long run, Apple will likely expand the wearables platform to include new form factors and product categories. These developments will add even more growth potential to the segment.

Big Picture

On the last two quarterly earnings conference calls, Tim Cook has talked about the smartphone market being one of the best for a company like Apple in the history of the world. There aren't too many markets capable of supporting 215M+ annual unit sales at an average selling price exceeding $750. Read between the lines, and Cook's confidence signaled Apple's belief that nothing will displace smartphones as the most valuable computer in our lives in the near term. For example, Cook's answer to an analyst's question about tech in the home didn't make it seem like Apple management was worried about stationary smart speakers.

Much of Cook's optimism around smartphones is supported by recent Apple financial trends as revenue growth has been driven primarily by iPhone, with Services and wearables serving in more supporting roles.

However, this doesn't mean that Apple is betting on iPhone over the long run. In fact, over the next few quarters, it is reasonable to expect that iPhone will become less of a growth driver for Apple, with the growth spotlight turning to digital content distribution and wearables as Apple's primary growth engines.

Apple continues to place bets on new products that have the potential to gradually serve as iPhone alternatives (not replacements). In essence, Apple wants to be the one to disrupt the iPhone. These iPhone alternatives, having to be powered or supported by iPhone out of the gate, will initially be viewed as rudimentary or even as toys. However, these products will be placed on the path to independency from iPhone. The Apple Watch is a great example of such a product. Apple Glasses have the potential to be an even bigger catalyst for growth.

At the same time, we are seeing Apple gain confidence in delivering services focused on distributing digital content and adding value to hardware used by a billion users. As the average number of Apple products per user increases, thanks to wearables, these services will prove essential in delivering personalized and proactive solutions to the Apple community. This strategy will provide Apple years of revenue growth opportunity and pave the way for Apple's eventual entrance into the transportation industry.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on memberships, visit the membership page.

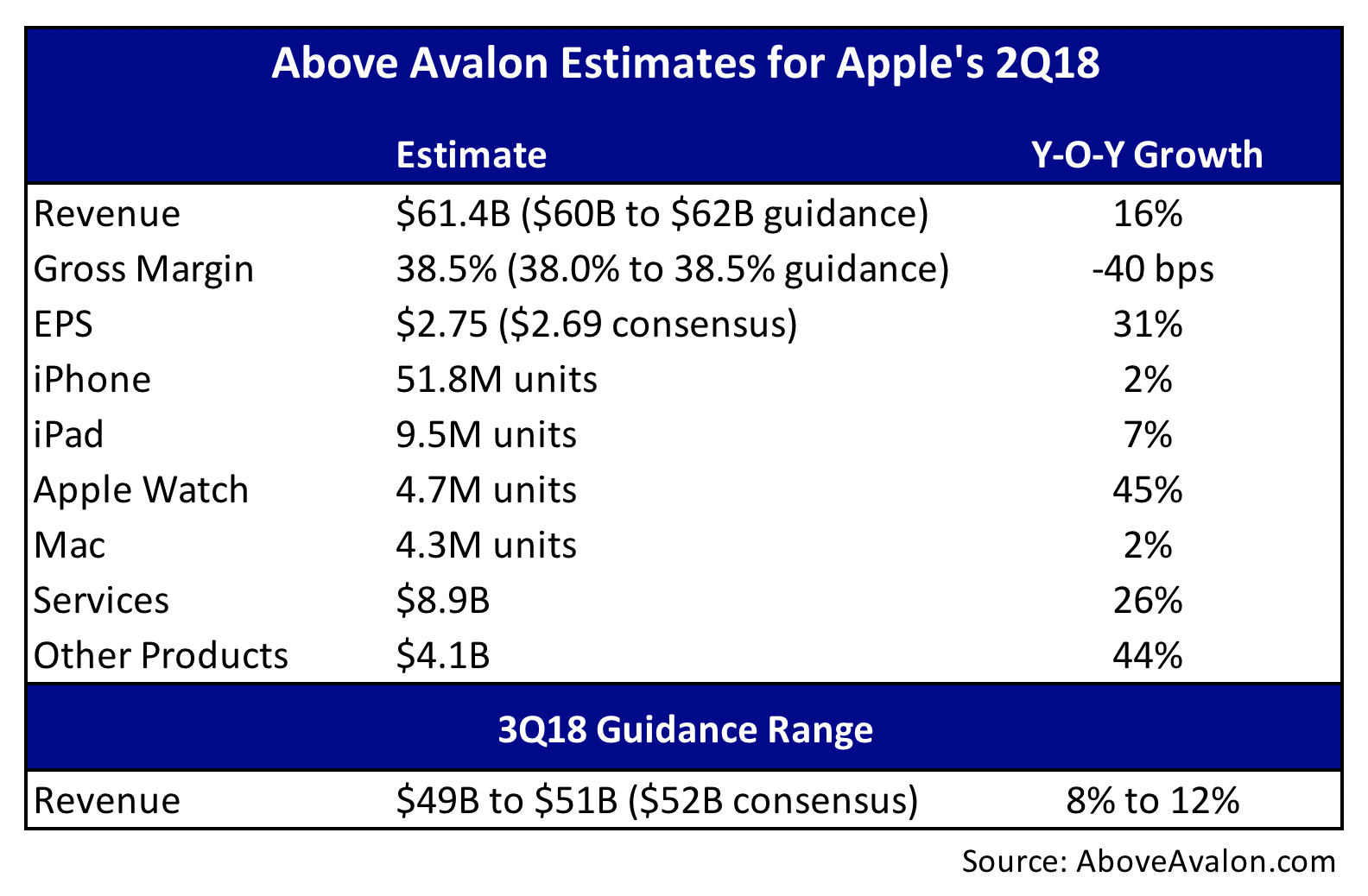

Apple 3Q18 Earnings Expectation Meters

The ingredients are in place for Apple to report an all-around solid 3Q18. If Apple reports more than $52.5B of revenue, 3Q18 would mark the company’s seventh consecutive quarter of accelerating revenue growth. A higher iPhone average selling price (ASP) driven by iPhone 8, 8 Plus, and X will likely represent the largest driver behind Apple's year-over-year revenue growth. Services and wearables are positioned to represent Apple's second and third largest revenue growth drivers, respectively.

The following table contains my Apple 3Q18 estimates.

The methodology and data behind my estimates are available to Above Avalon members. (Become a member to access my full 5,400-word Apple 3Q18 earnings preview that is available here. To sign up, visit the membership page.)

Each quarter, I publish expectation meters ahead of Apple's earnings release. Expectation meters turn single-point financial estimates into more useful ranges that aid in judging Apple's quarterly performance.

In each expectation meter, the gray shaded area represents my expectation range. A result that falls within this range signifies that the product or variable being measured is performing as expected. A result in the green shaded area denotes strong performance and the possibility of me needing to increase my estimates going forward. Vice-versa, a result in the red shaded area has the opposite effect, potentially leading me to reduce my assumptions going forward.

I am publishing three expectations meters for Apple's 3Q18:

- iPhone unit sales

- "Other Products" revenue

- 4Q18 revenue guidance

My 3Q18 iPhone sales expectation range is for Apple to report between 41M and 45M units. A result within this range would be viewed as expected. If Apple reports iPhone sales greater than 45M units, results would be described as strong. A sub-41M iPhone unit sales result would be considered weak and likely lead to a reassessment of my iPhone unit sales expectations going forward.

Apple's "Other Products" is a catch basin for a number of Apple products. "Other Products" include revenue from Apple Watch, AirPods, HomePod, Apple TV, Beats headphones, iPod touch, and Apple-branded and third-party accessories. If Apple reports close to $4 billion of "Other Products" revenue, the implication is that Apple Watch and AirPods were strong sellers in 3Q18. In addition, Apple would have likely sold a respectable number of HomePods. A result closer to $3 billion of revenue would reflect somewhat weak wearables sales.

Apple's 4Q18 revenue guidance will include the initial weeks of Apple's largest product launch of the year. In terms of new iPhones, Apple is expected to unveil three flagship iPhones. Even if Apple ends up needing to push the launch for one flagship iPhone into 1Q19, sales associated with the other two flagship iPhones will likely be strong enough for Apple to provide solid 4Q18 revenue guidance. Revenue guidance that exceeds $60 billion would be viewed favorably while revenue guidance closer to $56B to $57B would likely lead to analysts wanting additional clarification from management on the earnings call.

Above Avalon members have access to my full 5,400-word Apple 3Q18 earnings preview, which includes the methodology and data behind all of my financial estimates (four parts):

- Setting the Stage

- iPhone Estimates

- iPad, Mac, Apple Watch, Other Products, and Services Estimates

- Revenue, EPS, Share Buyback, 4Q18 Guidance

Members will also receive my exclusive Apple 3Q18 earnings review (two parts: major themes and my full notes) once Apple reports earnings.

To read my full Apple 3Q18 earnings preview and receive my earnings review, sign up at the membership page.

Above Avalon Podcast Episode 130: What's a Computer?

Episode 130 is dedicated to discussing how Apple has become comfortable in accepting, and even embracing, the awkwardness that exists between the iPad and Mac. The discussion begins with a closer look at the fascinating juxtaposition between Apple's recent Mac campaign and its iPad ads from earlier this year. We go over what the ads tell us about Apple's thought process regarding the iPad and Mac. Things then turn to how the iPad vs. Mac juxtaposition hasn't been static over the years. After briefly recapping the post-PC era debate, the episode concludes with my thoughts on where Apple will bring the iPad and Mac platforms and why the company faces a large screen paradox.

To listen to episode 130, go here.

The complete Above Avalon podcast episode archive is available here.

The iPad vs. Mac Juxtaposition

Apple has always publicly supported the iPad and Mac. However, that hasn't prevented questions regarding Apple's commitment to the two product categories from popping up. In recent months, Apple has shown a new level of openness when it comes to embracing both the iPad and Mac as unique and differentiated platforms for creative endeavors. The change is noteworthy when thinking about each category's future.

Ad Campaigns

A few weeks ago, Apple unveiled a new Mac ad campaign, "Behind the Mac." The ads were meant to elicit fond memories professionals have of using Macs to get their work done.

The main ad stood out because, aside from one shot showing the Touch Bar, it could have easily passed for something released by Apple a decade ago. Even the plastic white MacBook made a cameo appearance. After watching the ad, words like "familiar," comfort," and "nostalgia" came to mind. Apple was targeting long-time Mac users.

The song used for the ad, "The Story of An Artist," reinforced this point. Here are the beginning lyrics:

Listen up and I'll tell a story

About an artist growing old

Some would try for fame and glory

Others aren't so bold

The ads also gave a subtle nod to people using their Macs for a long time, which possibly served as a response to the recent uproar surrounding Mac keyboard reliability.

The Mac ads stood out that much more by being released a few months after Apple's "What's a computer" ad campaign for iPad Pro. That ad featured a young girl using her iPad (and Apple Pencil and Smart Keyboard accessories) around her neighborhood in various activities and adventures.

After watching the iPad ad, words like "new," "different," and "controversial" were the first to come to mind. Here was a young person using an iPad in different, and in some cases, fascinating ways, while drawing into question the traditional definition of a computer. The ad upset quite a few Mac users.

Apple relied on a similar message with the iPad ad shown at the end of its education event in Chicago back in March. A group of students use iPads (and Apple Pencil) to complete a group homework assignment about gravity. In each case, an iPad is being used for tasks that a Mac or PC wouldn't be able to handle.

With the Mac ad, Apple was selling comfort to a small percentage of its user base. Meanwhile, the iPad ads were selling newness to a different customer. The juxtaposition of the Mac and iPad ads symbolize the awkward relationship the iPad and Mac have within Apple's product line.

History: It's Complicated

This iPad vs. Mac juxtaposition hasn't been static. At launch, the iPad was like a rocket, fueled by apps and intrigue found with larger a touch screen powered by iOS. After just a few months, iPad sales surpassed Mac sales. The iPad went on to double and even triple Mac sales. In an iPad vs. Mac battle, the iPad seemed to be the clear winner.

While Apple management never publicly showed disdain for Mac, the level of attention given to the iPad in the early 2010s likely corresponded with a declining amount of time and focus dedicated to Mac. Some of the Mac decisions made around this time, like the Mac Pro's design, later came back to haunt Apple.

The iPad vs. Mac relationship started to change after iPad sales peaked at the end of 2013. Management's efforts to entice iPad users to upgrade proved futile as iPad sales declined from a 75M units per year run rate to a 40M units per year sales pace. While iPad sales were in free fall, the Mac remained a steady ship, not moving far from its 20M unit sales per year pace. The Mac demonstrated a level of sales consistency that management may not have expected given iPad's popularity.

Apple now finds itself with an iPad business that is twice the size of Mac in terms of unit sales, but smaller than the Mac when it comes to revenue. The iPad user base is nearly three time as large as the Mac user base and is growing by 20 million new users per year while the Mac user base is seeing more like 10 million new users per year. In a nutshell, both the iPad and Mac businesses have found stability and continue to connect with their respective user bases.

Different Tools for Different People

The fact that Apple gave such dramatically different Mac and iPad ad campaigns the green light provides clarity regarding management's approach to the two product categories. Apple has become comfortable in accepting, and even embracing, the awkwardness that exists between the iPad and Mac. Apple isn't trying to hide the differences that exist between the Mac and iPad as creation platforms. Instead, Apple is embracing the unique attributes found with each platform.

Instead of trying to come up with scenarios in which the average consumer will have a use case for both iPad and Mac in their lives, Apple is embracing its heterogeneous user base. For iPad owners, the Mac ads probably didn't connect on an emotional level. Meanwhile, the iPad Pro ad's hostility towards "computers" likely infuriated some Mac users. Apple is OK with such a situation. Their aim isn't to sell consumers on both the iPad and Mac as computing platforms, but rather to ship different kinds of tools that can improve people's lives.

Apple is betting that the Mac will appeal to some users, potentially those users with legacy workflows, while the iPad will appeal to a different set of users - a younger generation of creatives. Of course, the iPad is appealing to two to three times more people than the Mac, but the overall point still stands.

Post-PC Era?

For every Mac that Apple sells, the company sells approximately 15 non-Mac devices. This ratio is near an all-time high and is very likely to increase over time considering the growing momentum found with Apple wearables. If that doesn't describe a post-PC environment, it's difficult envisioning what would.

However, for many people, it doesn't feel like we are in a post-PC environment. There are at least 100 million people still using a Mac. More importantly, there are tens of millions of people with workflows that aren't handled by iOS. This group is unable to move beyond the Mac. The continued importance of Mac and PC have led some to conclude that the post-PC era has been a farce. However, this doesn't feel right either given how hundreds of millions of people have positioned their smartphones as the most valuable, and in some cases only, computers in their lives.

The reason the post-PC era has been so controversial is that smartphones and iPads have become Mac and PC alternatives, not replacements. This subtle, but important, distinction means tens of millions of people still need a Mac to get work done. However, for a much larger number of people, smartphones and iPads have been able to handle certain workflows formerly given to laptops and desktops. We are experiencing the post-PC era. It's just a bit more nuanced than initially imagined.

Looking Ahead

There's always been a grey area between the iPad and Mac within Apple's product line. Questions have swirled as to how Apple can best bridge the gap between iOS and multi-touch computing with macOS and the accompanying mouse and cursor. Some pundits have been vocal that Apple should follow Microsoft and ship hybrid devices that utilize elements from both paradigms. Others think a more practical solution is for Apple to ramp up its bet on the Mac as the iPad sees its use cases eaten by larger iPhones.

One way to address this grey area is to think about inspiration.

It's easy to think that Apple is getting inspiration for the iPad from the Mac. New multi-tasking features, an updated dock, and apps like Files would seem to bring up memories more reminiscent of Mac than iPhone. However, I think the opposite is true. Apple is using the iPhone as ultimate inspiration for where to bring its larger iOS sibling. Moreover, even the Mac is getting inspiration from the iPhone.

Apple is bringing things like its custom silicon and Touch ID to the Mac platform. It's not a stretch to envision Face ID eventually making its way to the Mac (after first being brought to the iPad). There is then Apple's focus on making it easier to port iOS apps to macOS. All of these efforts demonstrate Apple utilizing the iPhone (and the iOS developer community) as a catalyst to push both the iPad and Mac platforms forward. This makes sense given the iPhone's ability to connect with the mass market as seen with a user base of approximately 900M users.

In terms of where Apple will bring the iPad and Mac platforms, a few things stand out:

- Larger, more powerful, iPads that share many features with their iPhone siblings.

- Macs powered by Apple chips (likely starting at the low end of the Mac line) and gaining features made popular by iOS.

- Powerful Macs that push the boundaries of a Mac.

In essence, Apple will continue to dedicate resources to pushing both the iPad and Mac categories forward, even if it means the products target increasingly different types of users.

Where things aren't headed:

- Apple coming up with hybrid devices that amount to combining multi-touch tablets with laptops and desktops.

- An overall move away from iPad or Mac.

There is no evidence that Apple is growing frustrated or tired of the differences found between iPad and Mac. Instead, Apple's strategy for iPad and Mac is to position each as its own creative platform. The iPad ends up being a creative arm for iOS, while the Mac harnesses the potential with macOS to power the needs of a wide variety of creators. While this strategy doesn't prevent Apple from trying to share features between the platforms, Apple seems set on recognizing the key differences found with iPad and Mac - iPad's multi-touch user interface and Mac's cursor and mouse paradigm.

Large Screen Paradox

Three major computing themes have grabbed Apple's attention in recent years:

- Wearables

- Smaller, more intelligent screens

- More powerful and intelligent cameras

Apple is excelling in each of the preceding themes with clear vision and strategy. However, what about the largest screens in our lives? Is it a coincidence that these devices lack the compelling vision found with the smallest screens in our lives? If AR glasses were to become a mainstream Apple product one day, where would that leave the long-term trajectories for large screens like televisions, iPads and Macs? It's not entirely clear.

For now, Apple's strategy for iPad and Mac appears to be to position each as a tool for creators. While a growing number of people will be able to do more with smaller screens worn on the body, the iPad and Mac are allowed to handle workflows that require additional screen real estate and power. This doesn't mean Apple is free of challenges and risks.

The company's approach to Mac continues to be a controversial one as legacy users feel uncomfortable with the direction in which Apple wants to take the platform. At the same time, there are some who think Apple isn't moving fast enough with iPad as a tool capable of handling legacy workflows still given to the Mac. Many of these challenges will likely remain for Apple in the near term. However, by embracing the somewhat awkward iPad vs. Mac juxtaposition, Apple is revealing to the world that it will remain true to each platform and focus on the attributes that make the iPad and Mac stand out as creator platforms.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on memberships, visit the membership page.

Above Avalon Podcast Episode 129: Giants on Wall Street

A select group of corporate giants have been gaining influence and investor dollars on Wall Street. Episode 129 is dedicated to discussing today's corporate giants (Apple, Amazon, Alphabet, Microsoft, and Facebook) including the key differences and similarities between the five. The second half of the episode goes over why I think odds are good that today's giants won't be tomorrow's giants. The episode concludes with a closer look at Apple's quest to do the seemingly impossible - remain relevant.

To listen to episode 129, go here.

The complete Above Avalon podcast episode archive is available here.

The Race to a Trillion

An arbitrary race that many have been following on Wall Street is, which company will be the first to reach a trillion dollar market capitalization? Currently, there are four legitimate contenders: Apple, Amazon, Alphabet, and Microsoft. However, the race to a trillion dollars ends up hiding a much more interesting development that has been unfolding on Wall Street.

A select group of corporate giants continue to gain influence and investor dollars. Their rise is drawing into question whether or not this time is different. Have these companies found a way to remain at the top indefinitely? Are we seeing the rise of a new breed of corporate giant?

Today's Giants

There are currently five giants on Wall Street:

- Apple: $924B

- Amazon: $848B

- Alphabet: $814B

- Microsoft: $782B

- Facebook: $587B

Combined, the five preceding companies total $4.0 trillion of market cap, representing 16.5% of the entire S&P 500. This development has raised concerns that we may be in some kind of tech bubble or, worse, that today's giants are gaining too much power over the broader market.

History offers a different viewpoint. Wall Street has been no stranger to corporate giants. In fact, power was much more centralized at the top in the 1960s and 1970s when the top five companies made up more than 20% of the S&P 500.

Exhibit 1: Market Capitalization of Top Five Companies in S&P 500 (% of Total S&P 500)