Poaching Tesla

Apple and Tesla share some similarities. Both companies possess remarkably strong brands, loyal customer bases, and products capable of maintaining that loyalty. Each also has a visionary product leader. Apple has Jony Ive while Tesla has Elon Musk. Accordingly, some have concluded that Apple should acquire Tesla as a way of quickly jumping into the transportation industry.

A Tesla acquisition doesn't make sense for Apple. However, Tesla does have something that Apple has a use for: talent.

Project Titan

Apple's ambition with Project Titan, a catch basin for the company's transportation R&D endeavors, continues to be underestimated. The number of signs pointing to Apple expanding Project Titan initiatives in recent months is on the rise.

Apple currently has the third-largest test fleet of autonomous vehicles on the road in California. In just a few months, the number of test vehicles has expanded from 27 to 66.

Apple reportedly is expanding its vehicle testing presence in Arizona, another hotbed of autonomous driving research.

Apple is reportedly working with Volkswagen on developing autonomous shuttles for Apple employees. The partnership includes Apple developing both hardware and software for the autonomous shuttles.

Apple recently hired two high-level auto industry executives (Jamie Waydo and Doug Field). Waydo played a key role in the safety program Waymo uses to test and develop its self-driving technology while Field was one of Tesla's most important engineers overseeing vehicle engineering and Model 3 production.

One word to describe Apple's Project Titan strategy is "methodical." Apple appears to be gradually doing everything one would expect of a company establishing a large test fleet of autonomous vehicles on public roads. All the while, Apple's hardware ambitions remain intact. The company appears to still own a web of buildings across the Sunnyvale / Santa Clara / San Jose area that are dedicated to heavy manufacturing and have open space for future growth. (A map of the various locations is available for Above Avalon members here.) This is a company that wants to come up with new transportation solutions consisting of hardware, software, and services.

When news of Project Titan's existence broke in early 2015, many people were skeptical because Apple had no expertise in the auto industry. Apple would be starting from scratch.

In what was a departure from the iPhone development playbook, Apple looked outwardly for Titan talent. Specifically, Apple turned to the auto industry for hardware expertise. As shown below, a list of select Titan members (as of mid-2015) served as a wakeup call to skeptics. Apple was indeed working on a vehicle.

In late 2015, Project Titan began to hit speed bumps as friction between designers and engineers intensified. In order to come up with a truly new user experience, Apple designers wanted to skip human-driven vehicles and instead go straight to an autonomous vehicle. Others argued the better strategy was to begin with an electric car and then position autonomy as a future feature. Not surprisingly, the designers won.

Bob Mansfield, a hardware engineering guru who is arguably one of Apple's most successful liaisons between the design and engineering teams, was brought in to right the Titan ship. The initiative was refocused on developing the core technologies that would power a variety of transportation hardware options. The refocus on autonomous driving led to a culling of hardware talent.

At least 40% of the outside hires listed in the table above are no longer at Apple (based on LinkedIn updates). Most of the departures took place between August 2016 and early 2017, which fits with the reported timeline of Mansfield overseeing Titan changes. In addition to turning to outside auto hires, Apple ended up poaching itself by taking veteran Apple product design managers off of other teams. There doesn't appear to be much turnover with those Titan additions. Recent reports peg the number of people working on some aspect of Project Titan to be between 2,000 and 2,500.

Apple's Goal

The best way to understand Apple's goal with Project Titan is to think about the company's design-led culture. Apple's strength lies in taking existing product categories and using design to rethink our assumptions about that category. By rethinking how we use products, Apple is able to come up with products that can change the world.

Apple wants to rethink the automobile. While electric powertrains, autonomy, and ridesharing will help in Apple's efforts, something more is needed. Our fundamental assumption of what a car is (and isn't) is still in need of being reimagined. Without fresh thinking when it comes to design, we are still left with most of our prevailing assumptions about cars.

This lack of fresh perspective in automobile design is one factor likely fueling the growing interest in bikes and scooters in high density areas. However, the problem with automobile design goes beyond city centers. People are increasingly tired, frustrated, and bored with cars. The dramatic shift to SUVs in the U.S. is driven by consumers caring less about traditional car value metrics such as performance. Instead, consumers are craving personalization in any form possible. Unfortunately, personalization options, especially when it comes to driver and passenger compartments, remain limited in the auto industry.

Tesla did something extremely well: It developed electric cars that people actually wanted to drive. Talk of other luxury car makers competing with Tesla is likely more fantasy than reality. However, it's not clear if Tesla is actually on the right path given the car's changing value proposition.

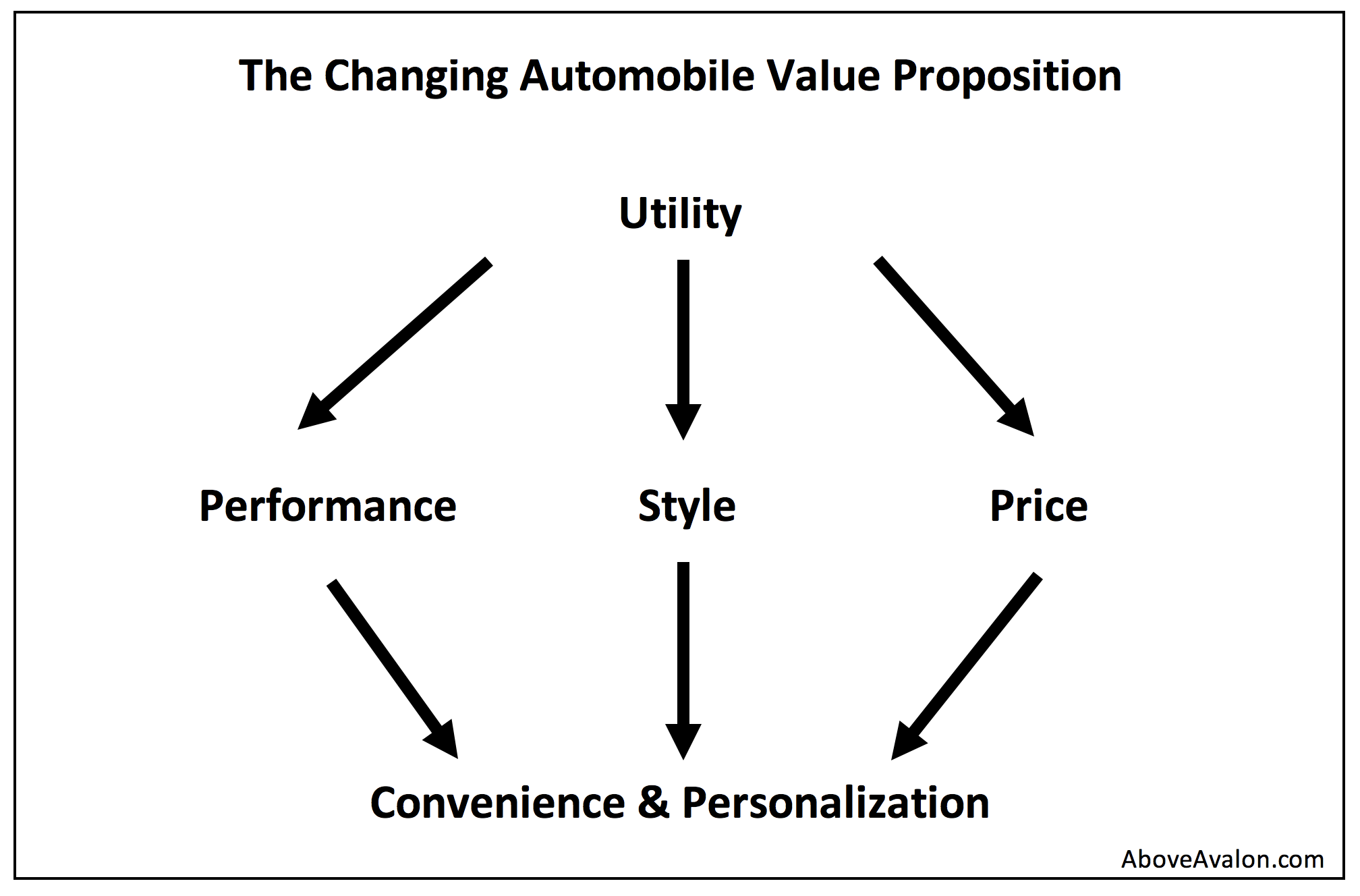

One way Tesla has been able to do so well in the luxury segment is by competing on old-school value metrics like performance and style. The problem for Tesla is that these values won't matter in the future. Instead, the focus will shift to convenience and personalization. While iPhone relies on software to become a personalized computer for 900 million people, we will demand a similar personalized experience from automobiles. As it stands now, personalization when it comes to the automobile amounts to CarPlay, moving the driver seat back and forth a few inches, and folding down a row of back seats.

Why Not Acquire Tesla?

Given Apple's interest in transportation and Tesla having the most popular, highest-rated car on the road, many have positioned Tesla as an Apple acquisition target. Apple's strong balance sheet adds fuel to the fire. With $129B of net cash, Apple could pay $70B+ to acquire Tesla and instantly become a player in the auto space.

However, Tesla isn't a realistic acquisition target for Apple. More importantly, Apple doesn't need to acquire Tesla in order to meet its goals. The best way to understand why is to look at the key components of Apple's M&A philosophy:

A strong brand and product aren't enough for an Apple acquisition. There has to be more to an Apple acquisition target besides strong branding and a popular product in the marketplace.

Apple doesn't use M&A to acquire revenue. Apple doesn't use M&A as a tool to grow revenue.

Apple doesn't use M&A to acquire users. Apple doesn't acquire companies simply to grow its user base. This tenet has become that much stronger in recent years as Apple's user base has grown. Apple currently has one billion users. When considering how the vast majority of those users comprise the premium segments of the smartphone and tablet markets, Apple has no need to acquire what ends up being its own users.

In essence, Apple isn't interested in buying its way into new product categories. Instead, Apple positions M&A as a tool to either enhance its existing product line or plug holes in the product development process. M&A is used to a tool to supplement, not replace, Apple's design-led product development process. Accordingly, there are two things Apple looks for when acquiring companies:

Apple uses M&A to acquire technology. Apple looks at M&A as a tool for plugging holes in its asset base. Given how Apple is constantly working on new products, one hole is often the need for new technology.

Apple uses M&A to acquire talent. One area in which Apple is resource constrained is talent. As Apple moves from one industry to another, the company is always on the lookout for teams of talent that help boost knowledge and expertise.

A look at Apple's acquisition history demonstrates these core M&A tenets. Acquisitions such as P.A. Semi, AuthenTec, LinX, and Metaio were about technology and talent. Even acquisitions that included consumer-facing products like Beats, Beddit, and Shazam (pending approval) were ultimately about the technology behind the products.

Netflix

Netflix represents a great example of how Apple doesn't use M&A. In a Netflix acquisition, the two primary things Apple would have bought are a strong brand and lots of users, neither of which is enough to justify an acquisition. In addition, Apple users already had full access to Netflix. It's unclear how Apple owning Netflix would lead to an improvement in Apple products. Positioning Netflix's technology as justification for an acquisition is quite the stretch. Netflix is a media company, and the company's content library is grossly overrated when moving beyond the 15 to 20 marquee series.

Instead of spending $100 billion to acquire Netflix, Apple opted to poach talent from the entertainment industry and build something on its own. The result is a new "Apple Studios" division overseen by former Sony Pictures Television executives. Apple is reportedly planning to launch its new Apple Video streaming subscription service sometime next year.

Arguing that Apple should acquire Tesla because it has a great brand and popular product in the marketplace is faulty thinking. Instead, Tesla would need to provide resources that can either strengthen Apple's existing product line or plug holes in Apple's design-led product development process. Some will say that Tesla's fleet of human-driven cars ends up being the company's secret weapon when thinking about the race to autonomy. I'm not so sure about that claim. Others think Tesla's charging network or factories represent the company's crown jewels. Both claims are questionable. Instead, those items could end up being viewed as liabilities, which is one reason Apple embraced contract manufacturing nearly two decades ago.

Poaching

A Tesla asset that Apple may have an interest in is talent. Given Apple's ambition, Project Titan can benefit from having employees with experience developing cars that people love. However, instead of acquiring Tesla to bring on tens of thousands of employees, which would raise many red flags, a better strategy would include Apple selectively seeking out talent that would be the best fit for Titan.

When selling prospective hires on the Titan message, Apple is ultimately selling two things: vision and process.

Vision. Explaining Apple's mission to come up with products that can change the world. Even though new hires aren't likely given the full lay of the land when joining Titan, the Apple mission can still be telegraphed.

Process. Explaining the process in place for turning vision into reality.

It's not that Apple has necessarily struggled appealing to new hires for Titan. Instead, Tesla likely had the stronger message up to now. In the early 2010s, Tesla was successful at picking off members of the Mac, iPod, iPhone, and iPad teams looking for the next big challenge. At the time, Apple's focus was on Apple Watch, a product that ultimately had a relatively small development team. Project Titan was still a few years away. Doug Field was one of these employees who always had an interest in the transportation space and jumped at the Tesla opportunity.

Around the time Apple began ramping up Project Titan hiring in 2014 and 2015, the Apple versus Tesla talent wars began in earnest. Tesla was much farther along than Titan, with cars already on the road.

However, the environment has changed. The past few months have been a tough stretch for Tesla. The company's long-term goal is to usher in the era of sustainable transport. To reach such a goal, Tesla needed to take a luxury detour and sell cars to those most willing to pay top dollar for a high-performance electric sports car (which happens to have more than two seats). The problem is that Tesla finds itself having trouble getting back on track. A truly mass-market Model 3 remains missing in action. Tesla has become a case study of a company led by a product visionary struggling to turn vision into reality.

Elon Musk has consolidated power, and it's not clear that this is for the better. It's one thing for a product visionary to focus on details. It's a completely different story when a product visionary is being stretched too thin. Recent comments Musk gave to The New York Times regarding him being the only person that can solve Tesla's manufacturing problems is worrying.

These challenges may give Apple a potential opening for poaching Tesla for talent. Meanwhile, after leadership changes and some shaky times, Project Titan is now in a much more orderly state. Apple would make the case that it has a better process in place than Tesla. It's relatively easy to design a great car. The challenge is to build tens of millions of that car and to then be able to develop new versions over time.

Tesla's problem is ultimately its desire to do everything on its own. While such a decision was made given the lack of alternatives, Tesla faces less flexibility and financial capacity as a result. This has opened the door for Apple in terms of appealing to Tesla employees. Other factors may include being attracted by Apple ideals such as protecting data privacy and security, which will become a crucial topic in the auto space.

Doug Field

Tesla critics have been quick to point out the growing list of executive departures as a sign of major issues within Tesla. While the turnover does raise an eyebrow, Doug Field's departure stands out.

Field was Tesla's second-highest ranked engineer, behind CTO JB Straubel. Field was responsible for vehicle engineering and Model 3 production. Back in 2013, his hire from Apple was positioned as a huge win for Tesla. With experience that included Segway's CTO and Mac product design, Field had experience in both personal transport and shipping consumer products at scale.

Field's job at Tesla was to turn Musk's vision into reality. As recently as this past April, Musk viewed Field as one of the most talented engineering executives in the industry. Accordingly, it's telling that Field ended up quitting Tesla to join Titan. It will be interesting to see if any of Field's deputies at Tesla make the same move. Such a defection would end up being a major coup for Titan.

Elon vs. Jony

There will be a role for cars in the new transportation paradigm. Two visionaries to keep an eye on are Elon Musk and Jony Ive. Each is taking lessons learned from other industries with the goal of rethinking transportation. It is no surprise that Musk has thrown a few snide comments and jokes Jony's way in recent years.

Two of the more interesting things to watch in the auto space remain design and manufacturing. Instead of asking questions about legacy auto's software expertise, the more valuable question to ask is, Who is that company's Jony Ive? While auto manufacturers have teams of talented designers, such talent ends up being wasted as upper management and boards mitigate design risk out of fear of losing sales.

Over at Tesla, a company more geared towards engineering than design, Musk and company are learning the harsh realities of auto manufacturing. Many of Tesla's decisions won't be repeated by others.

Meanwhile, Apple's Project Titan is becoming a testbed of new technology that can be used to power new vehicle concepts from Apple's industrial design group.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.