Apple Watch: What Did Apple Just Roll out Here?

Reviewing an Apple Watch three days after launch in any traditional sense has as much long-term value as publishing an iPhone review on July 2, 2007 would have had. Instead, I am going to try a better approach. This post will be the start of what will become an ongoing series about my Apple Watch thoughts and observations with a focus on how the product will impact the world.

What is important?

What isn't important?

Financial implications.

Longer-term ideas and viewpoints.

I've already written a few words about Apple Watch, and I continue to think they provide a good foundation for beginning to analyze the device and wrist wearable product category.

The Apple Watch Journey Begins

42mm Apple Watch Sport with Solar watch face.

I am convinced Apple Watch is not a watch. Positioned as my personal assistant who just began on-the-job training, the Watch has potential. While it isn't quite able to monitor and guide me through the world, the product has a coolness level that makes me want to wear it all day and begin incorporating it into my lifestyle. From Apple's point of view, I suspect that is a best case scenario for a new product category.

I ordered a 42mm Apple Watch Sport with the white sports band. I knew almost instantly when the Apple Watch was introduced, back in September 2014, that I wanted that particular model. I am a long-distance runner so I knew a Watch collection named "Sport" would be up my alley. In addition, I've owned and worn a regular watch for years, so I wanted something that did not remind me of a regular watch.

UPS Delivery and Extensive Packaging

My Apple Watch experience started off with a memorable exchange this past Friday:

UPS delivery man [holding a "heavy" Apple Watch box at my door]: "What did Apple just roll out here?"

Me: "Apple Watch. You have a lot of these boxes?"

UPS delivery man: "Oh yeah. Couldn't figure out what it was."

I vividly recall the first time I first held iPhone and iPad. For iPhone, it was at an Apple store following a nightmarish visit to an AT&T store the day prior. For iPad, it was after picking up the device at the local shipping depot because I missed the delivery earlier in the day. I've always felt that the first time one sees and holds a product is quite telling as it can be used to judge not just the connection to a product, but also brand and company. There are companies besides Apple that have a similar ability to create such emotional connections, but it's rare for a company to mean so much to so many people.

Extensive packaging for Apple Watch Sport.

As part of that introduction, the packaging that a product comes in plays a crucial role as the experience begins at delivery or purchase. I've always been intrigued by Apple packaging because of the time and effort put into something that will never look as perfect as when it is first opened. The Apple Watch Sport packaging is no different. Weighing in at a pound, the box had a noticeable and substantial weight to it. I would go so far as to say Apple Watch packaging was the most extensive, and thought-provoking, I have seen out of any Apple product in a very long time. No wonder the UPS delivery man mentioned how heavy the Watch box felt. Most of the weight is due to the white elongated case that Apple Watch comes in. I'm still not quite sure what to make of it; is it a carrying case or a cradle for my Watch while charging? The one I have is a less fancy version of the Watch collection case and a very distant cousin of the Edition case. However, even this case represented a faint connection or similarity that Apple relied on between Watch and traditional watches. Only watch wearers would be able to discern the familiarity.

The Apple Watch came with a number of instructions, such as how to put the watch band on one's wrist, which I thought symbolized how people have tuned out modern-day watches to the point of not even knowing how to put one on.

The overall Apple Watch setup and pairing process with my iPhone will be fine for anyone comfortable using an iPhone. I did not encounter any issues. For those with a bit more hesitation, I think Apple holding special Apple Watch introduction sessions at Apple Retail locations is a smart move as it may be a bit overwhelming.

The Watch Band

One trend that has taken place over the past few weeks is the Watch bands getting the most attention out of the entire Watch discussion. The interesting aspect of that is the band has very little to do with technology. I don't think that is by mistake. Of course, the bands are indeed a byproduct of manufacturing technology and innovation, but for the average consumer, the Watch bands are about fashion and personalization.

Apple hit a home run with this initial sports band. It looks and feels great. Even putting the Watch on extra tight to see if there was any impact to my wrist's circulation, I was unable to have it leave any marks. I suspect the way the band connects to the Watch case, leaving a small amount of space between the case and skin on each side, is the primary reason I have a hard time having the band leave any marks. The slight protrusion at the bottom of the Watch where the heart rate monitor is allows me to enjoy the feeling of a nice tight band on my wrist without most of the negatives, such as perspiration, usually associated with such a thing. I can wave my arms and the watch will not move, which produces a certain kind of calm and relaxation. Even during a run, the Watch band performed well with no discernible markings while my previous running watch band would indeed leave marks because I had to wear it tightly in order to have it remain in place. I suspect the rubber band will change shape somewhat as time goes on, but with a small/medium band piece also included in the box, I am not concerned about the band becoming more loose as time goes on.

One interesting thing is that when I look at myself in a mirror with the Watch, the aluminum case melts away, and it looks like I have a white band with a black piece in the front of my wrist. It is hard to see that I have a watch case connected to a band. They just look like one piece. I suspect this is the primary reason why the Apple Watch doesn't look quite like a smartwatch even though it is a rectangular piece of glass attached to a watch strap. I have definitely become more doubtful in recent days that circular smartwatch faces are anything but a calculated bet to grab sales from traditional watch owners that are familiar with a watch's circular look.

Watch Faces and Notifications

I have long thought that the wrist is an interesting place for technology, breaking down some of the more complex tasks found in an iPhone to easier to digest bits of information. That doesn't mean that we take iPhone apps and shrink them down, keeping the same thought and design process, but applying it to a watch. Everything needs to be rethought. I've downloaded a few third-party Watch apps (or should I say extensions of iPhone apps?) and there really isn't much to write about. While some are adequate, I just couldn't find any that really got my imagination running. However, after only 12 hours of use, a few value-add uses for the Watch became apparent.

One thing I am discovering is I really don't want to look at my watch screen too much. I could very well go a full evening at home with barely looking at Apple Watch. I don't look at that as a negative. While things can (and certainly will) change, I have no desire to sit on the couch and play with my watch while my iPhone is somewhere else in the house. Instead, I am finding myself wanting to feel notifications, or at the very least just turn my wrist periodically and look at the watch screen and see what I need to know quickly. The information can be as trivial as time or temperature.

The Watch has two very valuable ways of displaying or giving information.

Watch faces

Notifications

Turning my wrist and being able to see my selected Watch face automatically means that the ability to customize Watch faces to put specific information on that initial screen would be an incredible value proposition. It is no surprise that third-party app developers (as well as Apple) sense the untapped opportunity. The iPhone home screen displays nothing until the home button is pressed, and even then initially just time, data, and the slide to unlock button are displayed. In contrast, the Watch face provides much more valuable information without the need to do anything besides look at the Watch. I could also open an app on Watch and it will remain displayed on the watch screen (like a running app), however the hierarchy is still built around Watch faces.

Modular, Solar, and Utility Apple Watch faces.

In addition, the tapping and sounds from notifications, followed by a prominent position on the Watch as someone goes to check the notification by looking at their watch, represent additional valuable attention and location for information. While Glances are indeed easy to reach with just one swipe up from the Watch Face, the sheer number of them may limit their value a bit. I consider the Glances to be equivalent to apps on an iPhone home screen: easy to reach, but still one among a few.

Apple Watch Use Cases

Apple is aware of this type of attention hierarchy and will act accordingly by, I suspect, retaining much of the power around Watch faces for the foreseeable future because it impacts the user's experience to such a degree. But the implications of this hierarchy are indeed interesting for what the Watch can be used for.

The Apple Watch will excel at:

Recording aspects of my behavior/movement and then providing feedback. Track miles run, sending me taps after each mile, or monitoring health vitals and then creating recommendations.

Real-world notifications. Notify via tap or sound that a shower or thunderstorm will be at my current location in ten minutes.

Identification. Use Apple Watch to enter my office and home, unlock a car, as well as contain information that is inaccessible when Watch is removed from the wrist.

While there are other devices, including the iPhone, that can do most of these tasks, it is the ability to have it on the wrist in a more ergonomic fashion, void of additional distraction, that makes things interesting. In addition, the aspects of maintaining identity once the Watch is attached to my body is, in a weird way, incredibly refreshing and reassuring.

A few hours after my Apple Watch arrived via UPS, I took it out on a seven-mile run. I don't take my iPhone on runs or any physical exercise that involves motion, so I was going to just use the Watch as a timer, knowing it didn't have its own GPS. Around eight minutes into my run, I received a slight tap on the wrist, I lifted my wrist up, and it said I had ran one mile. Having run this same route for years, I knew it was spot-on. Throughout my run I was getting accurate mile readings. How is this possible when the watch doesn't have GPS? Apple had previously asked me a few questions during the Fitness app set-up including my height, weight, and age. In addition, since I have been running for years, I have a pretty consistent stride. I suspect that consistency is what gave the Watch the ability to measure my stride to produce mileage and be so accurate without any iPhone calibration.

The ability for the watch to give me information (mile readings) without needing to look at it (taps) was incredibly valuable to me and my needs as a runner, especially with not having to carry a bulky iPhone. I actually found myself every so often lifting my wrist up to see other metrics such as my mileage pace. The Watch is essentially taking elements that I used to rely on a few devices for and combining them into a device where fitness and health is just one feature. This is why there is something more behind Apple Watch.

Early Signs of Behavioral Pattern Change

While it is early to reach any conclusions about long-term behavioral change, I have noticed that I have an urge to see why my Watch is tapping me or making a noise. I had very few vibration and sound alerts for my iPhone, so it may just be a realization that allowing some kind of notification through the filters could prove to be valuable. In addition, I have this weird urge to keep the watch on regardless of what I am doing once I put it on each morning. If I am washing my hands or am wrist deep in food preparation, I don't think twice about keeping my Watch on. It's not so much an annoyance to take it off that is the primary culprit, but I am starting to sense a little bit of connectivity as I am wanting to not miss something. Having it be so comfortable helps in this regard.

Apple Watch Is Definitely Not a Watch

There is no question in my mind that the Apple Watch is not a watch. The way I use the device is nothing like the way I would use a watch. While Apple is undoubtedly taking certain elements of the watch world to sell Apple Watch, much of that is merely due to providing some level of comfort and recognition to avoid consumer backlash and risk aversion. It is much easier to position the Watch as a better watch than an ancillary iPhone screen. The Watch is something different.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Apple 2Q15 Earnings Preview: Another Strong Quarter Driven by iPhone in China

Apple will likely report a 2Q15 beat to consensus EPS of $2.14 this coming Monday on strong revenue growth (up 24% from last year) and margin trends (41.0% vs. 39.3% last year). The iPhone will be the primary focus as investors look for any indication of continued above average sales trends compared to previous iPhone cycles. While recent iPhone sales share in the U.S. and Europe appear slightly ahead of previous years, strong sales in China will be the primary driver behind 35% growth in iPhone unit sales. In addition to earnings, Apple is expected to announce an updated capital return program. The Mac and iPad are becoming less of a factor for earnings as those two product categories now represent a smaller percentage of Apple's overall business. It will be difficult to get Apple Watch sales expectations from guidance, but management may give commentary on how the Watch launch is proceeding. Similar to last quarter, the impact from a strong dollar will be reflected in management's revenue and margin guidance for 3Q15.

iPhone: The Big Story for the Foreseeable Future

Representing close to 70% of Apple's quarterly revenue and 80% of gross profit, the iPhone will likely remain the primary focus for Apple investors until new Apple products gain enough momentum to account for a bigger piece of the financial pie. While there is nothing inherently wrong with this situation, it does serve as a reminder that the iPad and Mac are becoming less of a factor on earnings day. The following exhibits highlight the changing revenue and gross profit mix over the past two years as the iPhone's share has grown, while iPad and Mac share have declined.

Exhibit 1: Apple's Shifting Revenue Mix (2Q13 vs. 2Q15)

Exhibit 2: Apple's Shifting Gross Profit Mix (2Q13 vs. 2Q15)

I estimate Apple sold 60 million iPhones last quarter, which would represent 37% growth from last year. On last quarter's earnings call, management noted that global iPhone supply/demand remained out of balance for most of January. Accordingly, I am assuming Apple sold as many units as it was able to produce for one-third of the quarter (24 million units in January). Once supply/demand was in equilibrium in February, I am running with a 20-25% reduction in shipments (19 million units in February and 17 million in March). Apple will need to ship millions of iPhones just to get channel inventory into an acceptable range, but management noted this will be done over time. As shown in Exhibit 3, I would consider iPhone sales between 57 million and 63 million to be relatively in-line with my estimate and not causing much change to my forward iPhone estimates.

Exhibit 3: iPhone Unit Sales Expectation Meter (2Q15)

Capital Return Program Revision Expectations

The board is expected to announce an increase to the quarterly cash dividend and additional authorization for the share buyback program. Last month, I went into detail on prospects for both the quarterly cash dividend increase and share repurchase program. I expect the quarterly cash dividend to be increased approximately 8% to $0.50/share to $0.51/share. The share buyback authorization will likely be increased $35 to $45 billion, bringing total authorization to $125 to $135 billion. It will be important to watch for any change in commentary and tone regarding the capital return program, especially as Apple is currently near the maximum buyback pace that it can sustain given its U.S. free cash flow and debt issuances. Consensus already expects a pretty significant change to the buyback ($30-$40 billion increase), so it may take an increase of more than $40 billion to move the stock specifically related to the buyback news.

Guidance

I currently have $47 billion of revenue estimated for 3Q15. A revenue guidance range of $43-$46 billion would suggest that my estimates are on track. Apple's guidance will include Apple Watch revenue, although the data will be lumped in with the "Other Products" category. I still think it will be possible to arrive at some conclusions as to how many watches Apple sold since the Watch will make up a good portion of "Other Products". While it remains very difficult to judge Watch supply over the next two months (3Q15), I would expect the Watch to contribute around $2 billion of revenue from April 24th to the end of the quarter in June.

iPad and Mac: No Significant Changes

As discussed by management, there won't be much change to continued weak iPad sales momentum. The entire tablet category is facing increased competition from larger smartphones. The iPhone 6 and 6 Plus, in addition to a strong MacBook line-up, continues to pressure iPad sales. I expect iPad unit sales to decline 22% to 12.8 million, which would track close to the decline seen last quarter (18%). iPad channel inventory was already at sufficient levels coming into 2Q15. The iPad is still in the process of finding its normal sales run-rate, but that level may still be quite a bit lower than current sales levels. For perspective, the iPad is outselling the Mac by nearly three-to-one.

Exhibit 4: iPad Unit Sales Expectation Meter (2Q15)

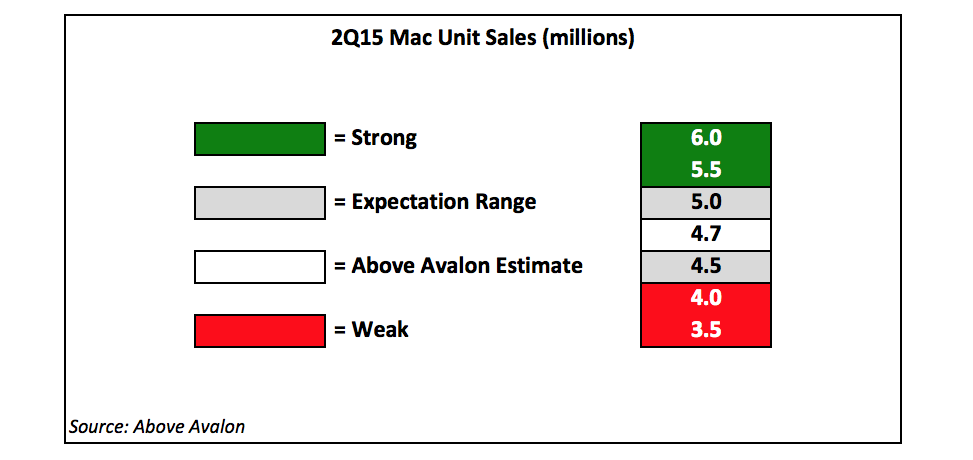

Mac sales will likely continue to follow the 10-20% growth experienced over the past five quarters as the current product mix resonates with consumers that want a more powerful machine compared to the iPad Air or iPhone 6/6 Plus.

Exhibit 5: Mac Unit Sales Expectation Meter (2Q15)

Other Thoughts

Given the current point in the iPhone cycle, it's fair to assume the average selling price will decline a bit (to around $650 from $687), but some of this decline should be offset by an increase in profit margins. Apple's guidance will reflect the impact from the stronger dollar, but with trends stabilizing in recent weeks, management may be able to get a better handle on foreign currency trends.

Similar to last quarter, all eyes will be on iPhone on Monday. For every one million iPhones sold, Apple EPS is impacted by $0.04/share. The difference between 55M and 60M iPhone unit sales explains most of the Street's EPS estimate variation. It looks increasingly likely that China will once again prove to be the quarter's primary revenue driver.

This report was produced by Neil Cybart on April 22, 2015 and is not meant to be used as investment advice.

Want to read more posts like this? I write an exclusive daily email about Apple (10-12 stories a week). For more information and to subscribe, visit the membership page.

Betting Big on the Camera

The camera's primary role has changed from capturing memories to becoming a full-fledged communication tool. Apple's recent $20 million acquisition of LinX serves as a reminder that the camera is positioned to be not only one of the most important smartphone components, but also a tool that will play a major role in how technology impacts society. Instead of betting on mobile platforms, a bet on the camera will likely pay more consistent dividends.

The Camera's Expanding Job Title

The camera's original use case was straightforward: capture memories. Moments in time ranging from a birthday party, graduation, or wedding were chronicled in order to tell a story in the future. Discretion was taken as to what subject or event should be captured as both film and the process of getting film developed were expensive. A week-long trip abroad would likely result in a splurge of maybe eight or nine rolls of film and a total of 200-300 pictures, of which a handful ended up being worth including in a photo album.

Everything changed in 2010 when Instagram was able to successfully position the photograph as a communication medium in the mobile era. Up to that point, phone cameras had been underwhelming with many people needing to carry both a phone and camera. In 2010, the world had just been introduced to the iPhone 4 and Android smartphones were starting to take off. In other words, it was the right time for something like Instagram to start pushing the camera beyond just memory capture.

Instagram's popularity was based on taking photographs with mediocre image quality and turning them into something cool by often making them look even older and grainier by applying fun filters. Users were then able to share their creations with others. In a world dominated by text-based Facebook and Twitter, Instagram represented a refreshing alternative.

Instead of using our smartphone camera just to capture momentous occasions in life, we began to use them to capture everything from the breakfasts we ate, to the magazines and books that we read. The camera was turning into another pair of eyes, and an internet connection allowed others to see the world through those eyes.

The camera's changing role wasn't confined to just software companies. With an initial mission to take photographs while surfing, GoPro was started as a way of have point-and-shoot cameras handle extreme environments. GoPro eventually experienced the same advancements in camera technology and social trends benefitting Instagram, where the camera was turning into a way of sharing unique vantage points and not just memory capture. The camera's expanded job title turned GoPro from a niche camera company into a $6 billion hardware and content company with even bigger plans of becoming a media powerhouse.

Apple and the iPhone Camera

We now find ourselves in a world where cameras are becoming ever more capable in a smaller footprint. Apple's LinX acquisition is all about multi-aperture cameras, suggesting the desire to fit more power in a smaller form factor using sensors and software to capture multiple images simultaneously. The result is better quality, and more importantly, depth and three-dimensional capabilities.

We have reached the point where the camera found in one's smartphone is likely to be the best camera they have ever owned. As Apple continues to push the boundaries on iPhone innovation, the camera will be positioned as one of the likely components that will not only drive iPhone upgrades, but expand the iPhone's use case. While the camera has been used by third-party developers to accomplish various tasks such as scanning barcodes in stores or using augmented reality to display travel directions or public transit, Apple's primary near-term goal will be to improve the camera's ability to take photos and video in various settings to foster an even greater reliance on non-text communication.

Cameras in the Future

Three primary use cases demonstrate how the camera will continue to change the world.

Memory Organization. While we will still use cameras to capture important moments in our lives, much of the focus will be on the software required to navigate the thousands of pictures found on our smartphones, likely taking up precious phone storage if we haven't signed up for a photo cloud service. New capabilities to catalog photographs as they are taken and then search through old digital photographs will serve as features deserving of a keynote slide or two. I suspect Apple and other software companies would be able to contribute much in this area in the coming years, assuming they give the topic enough attention and resources. One issue is that memory capture is simply unable to grab the hearts and minds like it once did. This area will not entice the high valuations from venture capitalists as memory capture has more of a connection to yesterday than the future. While we will still have start-ups trying to fill the niche, the camera's bright future isn't built around simply capturing memories.

Communication. The camera's new functionality as a communication tool is impacting billions of lives, drawing a great deal of attention from investors and users. It is all too obvious by Snapchat's success and the modern-day mobile video boom including Periscope, Meerkat, Facebook, YouTube, Twitter, and various messaging platforms, that the world has moved beyond text to tell stories. Photographs and video are occupying a larger role in our daily lives which by its very nature reduces the desire to hold on to so many reminders of relative mundane aspects of our day, summing up Snapchat's appeal.

Interpretation. While there is still plenty of innovation left with how we use cameras to communicate with others, the camera's most exciting role will be utilizing software to help us interact with and navigate the world. The camera will become an input device for software to interpret clues in various settings at home, the office, or school. The camera essentially becomes a pair of intelligent eyes that goes beyond simple image capture.

The camera's changing role has brought up important discussions concerning how technology impacts humanity. With some companies selling the idea to film one's entire day by wearing cameras on the face or body, questions around privacy and morality will need to be addressed. At what point does obtrusive technology do more harm than good?

The camera discussion has usually been about Kodak, and other camera companies from yesterday, missing the mobile bandwagon. We have now moved to a point where such a story is no longer relevant. The software that turned cameras into critical pieces of communication would have never have been created by traditional camera makers. The camera's potential was unleashed by mobile as smartphones were primarily cameras with a mobile connection. The camera's ability to not only capture the world around us, but begin interpreting that world, suggests the camera's impact on society is still being underestimated. There's still time to place a big bet that the camera will play a much bigger role in our lives in the future.

Want to read more posts like this? I write an exclusive daily email about Apple (10-12 stories a week). For more information and to subscribe, visit the membership page.

Apple's Watch Strategy Embraces the 80-20 Rule

We are starting to get early reads on how Apple Watch pre-order mix is trending and there are a number of surprises. It is obvious why Apple will not disclose Apple Watch revenue data. By knowing which Watch collections are selling and at what price, it would be easier for competitors to reach conclusions on customer preferences. Using early pre-orders reports and a few long-standing theories, the Apple Watch will likely be loosely guided by the premise behind the 80-20 rule, where approximately 80% of Apple Watch profits will come from 20% of Apple Watch customers. In essence, the Apple Watch and Edition collections will likely account for a small portion of sales, yet play a much bigger role in terms of Apple Watch profit. The implications are significant when contemplating how management will treat the Apple Watch line in subsequent years.

Sport is the Most Popular Collection by a Wide Margin

The two most popular Watch models have been space gray aluminum with black sport band and silver aluminum with white sport band. Using U.S. pre-order data from Slice, and extrapolating across the world, these two models could represent close to 70% of Apple Watch pre-orders. There will be millions of wrists with a black or white sports band in the coming months. The sheer popularity of these two models suggest there may be something more at play, possibly related to customers not wanting to spend more than $400 and these particular options representing the most popular color choices.

Majority of People Are Not Valuing Stainless Steel and Sapphire Screen for $200

Most consumers are not valuing the stainless steel case and sapphire crystal screen at an additional $200. The easiest way to see this is compare the black and white sport band models in the Sport and Watch collections, with the only difference being the watch face (sapphire vs. Ion-X glass) and watch case (stainless steel vs. aluminum). When given the choice between a $399 Apple Watch Sport - black band and $599 Apple Watch - black band, pre-order data would suggest customers are overwhelmingly choosing the Sport by a magnitude of 5-10x.

This isn't to suggest that sapphire and stainless steel aren't worth the extra $200, but rather consumers are not reaching that conclusion. Apple Watch try-on appointments may give consumers the best opportunity to make a more informed decision between the two collections, resulting in a slight shift in sales trends.

One theory is that many consumers pre-ordered the Sport for the first version and plan on upgrading to a better watch in 2016 or 2017. This may be true, but the impact may be overshadowed by new Apple Watch buyers deciding to go with the Sport. In essence, the sales mix will likely remain the same, regardless of first-generation owners upgrading their watches over time.

Demand for Expensive Watch Bands is Niche

Even though much attention has been given to the higher-quality watch bands, it would appear that the majority of people are opting for the sports bands. At least judging by pre-order data from Slice, there is tepid demand for higher-end watch bands made of metal and leather. The Milanese Loop would appear to be the best selling watch band out of the non-Sport options, which may give Apple confidence that consumers will value band innovation that moves away from traditional watch bands. The leather band options will likely remain quite niche. My Apple Watch observations would back these claims as I actually thought the sport bands were more comfortable and bold than some of the leather bands.

Financial Impact from Watch Bands

The conventional wisdom is that Watch bands will play a crucial role in Watch financials. I think it will be a bit more complicated.

- One can make a strong case that customers will update their Apple Watches every 2-3 years. In this scenario, the Apple Watch will experience an update cycle that mirrors the iPhone more than iPad. Since each purchase will come with a new band, consumers may not see the need to spend money buying another watch band. Watch average selling price (ASP) and revenue will be driven more by case upgrades ($399+), not additional bands.

- With most people opting for the Sport over Watch, I have difficulty envisioning the majority of customers buying expensive additional watch bands. Instead, there may be demand for cheap, but fun, third-party bands ($29-$49). While such bands may have attractive margins, from a dollar perspective, Watch cases will still account for a majority of the Watch category's profit.

- I suspect 10-20% of Apple Watch owners may be willing to buy an additional high-quality watch band. This is the part of the market where watch bands may become an attractive revenue and margin proposition. Apple will likely want to compete in this lucrative segment of the market, which may include traditional luxury brands.

The 80/20 Rule

The Apple Watch is being sold as the most personal device with 25 distinct styles, yet four options (all with black or white sports bands) comprised a clear majority of pre-orders in the U.S. on the first day according to Slice. On the surface, that would suggest the other models aren't important and Apple should just concentrate on the sports bands. However, in reality, the exact opposite is true. When looking at profits, I suspect the 20% of customers opting for the Watch and Edition collections will likely represent 70-80% of Apple Watch profits. A few equations will help demonstrate what is happening:

- Revenue: One $17,000 Apple Watch Edition = 42 $400 Apple Watch Sport

- Profit: One $17,000 Apple Watch Edition = 75 $400 Apple Watch Sports

Karl Lagerfeld's custom Apple Watch with gold link bracelet. Source: Instagram

The implications from this are far-reaching. Apple will likely dedicate significant attention and resources to updating higher-end Apple Watch models and bands. Rumors had indicated a platinum option priced higher than the current gold Edition models. Karl Lagerfeld's custom Apple Watch with gold link bracelet will likely be available one day for more than $50,000. Marc Newson's schooling and experience with jewelry design will likely play a major role in this effort. In essence, Apple would be catering to the 20% of the iOS customer base that values exclusive personalization, which will boost revenues and margin.

Longer-Term Watch Implications

As long as the Watch is considered an iPhone accessory, I'm not convinced the majority of people are willing to spend more than $500 for one, which will position the Sport collection as the most popular option by a good margin. Meanwhile, the Watch and Edition collections will continue to represent approximately 20-25% of sales, but account for a clear majority of profits, and this ratio may even become more pronounced as Apple introduces additional high-quality bands with higher margins.

Apple is now a premium mass market luxury brand. The Apple Watch Sport is positioned for mass market consumption, reflected by the lowest entry-level price of any new Apple product category. Meanwhile, the Watch, and especially the Edition, are produced with luxury in mind, catering to the 20% of Apple consumers that have been craving personalization. Apple's Watch strategy will cater to both types of consumers, balancing well-crafted, yet practical mass-market items where price matters, and extravagant opulence where price doesn't factor into the purchasing decision. Welcome to the wearable market.

Want to read more posts like this? I write an exclusive daily email about Apple (10-12 stories a week). For more information and to subscribe, visit the membership page.

Apple Watch is Cool, Just like iPhone

After spending time with Apple Watch, it became abundantly clear why people will like the device: it's new and cool. A device that can fit into one's life, but still seemingly blend away when not in use, shares many similarities to the iPhone. While coolness may not be enough to use as the conclusion of a 5,000-word product review, and it certainly won't cause the general public to run out to an Apple store and spend $400+ on a watch, it will lead to imagination. Apple Watch's long-term success will depend on the people pre-ordering the device today; the trailblazers who view the Watch's potential with the same eye that saw iPhone's potential in its early years.

Apple Watch's coolness transcends the much more complex and important topic of technology. The Apple Watch needs to become a better device. While this may sound like a stern warning, it is a necessity that simply describes the path of technology, exemplified by the iPhone over the past eight years. Not only did the iPhone become thinner and lighter over the years, but the fundamental way we used the device changed, thanks in part to more powerful components and third-party developers. From a device used to access the internet when we were away from our computer, the iPhone is now our computer.

The same process will occur with Apple Watch. Today, the Apple Watch is a cool device that can show the time when we look at our wrist, track how many steps we walk each day, and send tap messages to friends. As the device gains additional sensors, better battery technology, and revolutionary materials and components, the use cases will expand as developers utilize the device's potential.

Apple Watch will use coolness to sell itself until people find that utility. As developers understand what the Watch is, and more importantly isn't, apps will improve, taking information once destined for the iPhone and repackaging it for the wrist. In many ways this is what early adopters do, buy things that they think are cool and interesting and then spend time tinkering and thinking. Saying a product is for early adopters isn't an insult, even though many have equated the two in recent years.

Watching people of all ages try on and interact with the Apple Watch, the impression I got was that most saw it as an interesting watch. That is to be expected considering the wrist was ruled by the watch for decades and anything destined for the same spot on our bodies will likely be initially compared to a watch. This is one reason why I heard a few complaints about the screen turning off when not pointed at the wearer, or having to charge it each night. Regular watches don't have those "tradeoffs". The same was said about iPhone "drawbacks" such as not having a keyboard and needing to charge it more frequently compared to feature phones. Even though the iPhone was introduced as the best smartphone in the market, in many ways it made for a suboptimal phone. Over time, our demands for a phone changed. The same will occur with what we consider to be Apple Watch negatives, and ultimately, what we want out of a watch.

The bet that Apple is making with Apple Watch is that in an environment of smart glasses, virtual and augmented reality goggles, and other wearable devices, it is the wrist that has a long runway with an immense level of untapped innovation, and more importantly, void of many roadblocks to reach that innovation. Apple knew that consumers wanted to wear and play with something that looked cool, while every other smartwatch maker was too concerned about first answering the utility question. Why else are Apple Watch bands, which have little functionality besides being a fashion accessory, the most talked about Apple Watch feature?

The Apple Watch represents potential. I suspect that is one reason why Apple executives can't hold back a smile whenever Apple Watch comes up in conversation. With an iPhone, although there is still plenty of innovation left, exemplified by Apple's recent $20 million acquisition of LinX, people now understand the iPhone is a computer. The level of excitement or surprise will never be the way it used to be. We now demand our iPhone to take over the world. The Apple Watch possesses similar traits to when we first saw the iPhone. There isn't just a level of excitement around the device, but also intrigue and mystery. We don't know what will happen to Apple Watch in a few years. We are told Apple Watch will never work on its own. We are told it will always be an iPhone accessory and companion. People are buying it today because subconsciously they want to see if those statements are true. We want to know if the Apple Watch is the future. Just like the iPhone, a very good case can be made that the answer is yes and it starts with being cool.

Receive my exclusive analysis and perspective about Apple throughout the week (2-3 stories a day, 10-12 stories a week). For more information and to sign up, visit the membership page.

My Apple Watch Try-On Experience

For the past seven months we have been told how the Apple Watch is the most personal device Apple has ever created. This past Friday, the general public had its first chance to find out what Apple meant as Apple Watch try-on appointments were rolled out. I selected one of the first time slots at my local Apple store as in many ways I was more interested in the way Apple had set up these try-on appointments than actually trying out the device. Needless to say, I ended up learning quite a bit.

While I have some constructive criticism and suggestions, I found the entire try-on process enjoyable. Despite following the Apple Watch beat for the past seven months, I still found there to be surprises. I can only imagine how someone not familiar with Apple Watch would likely feel overwhelmed by this new gadget for the wrist.

Going into the try-on I thought the Apple Watch Sport will be the most popular model, possibly by a pretty wide margin, and the black and white sports bands will be the most popular bands by a significant number. That view was only reinforced after trying on all of the different options.

No Lines and Limited Try-On Models

Despite Apple encouraging customers to make an appointment to try on the Apple Watch, I ended up simply walking in and getting taken care of as there were open try-on slots available. The store had been open for an hour, but things still seemed pretty quiet. While my specialist was friendly, helpful, and approachable, there was little in the way of agenda or questioning. "Which would you like to see?" was the first, and basically the only question asked of me during my appointment. Fortunately, I was already well aware of each band choice. Unfortunately, the store only had one size of each available watch band, often with the smaller 38mm case, which I found odd. I asked one of the workers why so many models were missing, and he said that was all they had received. Strange, but honest answer.

Tough Choice Between 38mm and 42mm Watch Case

A 38mm Apple Watch on the left compared to a 42mm Apple Watch on the right. It was a close call between which one looked more appropriate on my 140mm wrist.

I came into Friday with the assumption that the 38mm Watch case was being sold just to push the 42mm version, with few people actually opting for the 38mm. After Friday, I actually think the 38mm is indeed the right size for a certain percentage of the buying population. Recent data from Slice would seem to support that view, with their analysis pointing to approximately 30% of pre-orders in the U.S. going with the 38mm. The Apple specialist even said the 38mm looked better on my 140mm wrist, although I responded I wanted the extra screen real estate that came with the 42mm. It honestly was a close call between the two, as seen in the attached image.

The Watch collection stainless steel cases certainly had the finish of a higher quality product compared to the Sport collection, but I actually didn't look at the aluminum Sport as cheap or a toy compared to its more expensive counterpart. Instead, I think Apple was successful in having the Sport give off a more active vibe. I'm not sure I would feel as comfortable running with a stainless steel Watch.

Sports and Leather Watch Bands Were Most Comfortable

In what I just label as first-time jitters, I had quite a bit of trouble putting on nearly every watch band, especially the Sport. I didn't come away with any lasting concerns from this, but rather just thought it was interesting.

The bands are truly all about personal preference. I enjoyed the fluoroelastomer (sports band) followed by the stone leather loop. I found both to be the most comfortable on the wrist and the easiest to forget I was wearing a watch. The Milanese loop and link bracelet definitely had a more solid feel to them, reminding me of a regular men's watch, something I actually was trying to avoid with Apple Watch. The modern buckle didn't stand out to me as something I would be interested in wearing. With fitness and exercise in mind, I would have little interest in wearing anything other than the sports band. I wouldn't label any of the bands as inferior, so I think Apple succeeded with this first round of watch bands. I would be interested to see where things go from here concerning the bands.

Random Trying-On Musings

Apple Watch try-on station, showing Apple Watch supply issues and the official Apple Watch rag.

Not following any agenda, I continued trying on every watch model that they had in stock, often wearing two at a time for comparsion. All the while, the specialist was super careful to not have any of the watches fall on the ground. I had to keep my wrist above the counter, especially when I was taking a watch on and off. My only thought was that Apple must be very nervous about tight supply as the store was probably told to make these first demo units last. The other noticeable activity was the near-constant wiping down of both Apple Watch try-on units and the Apple Watch display table that had a large piece of glass covering all of the Apple Watch models. There is something off-putting with seeing someone clean something you just had on your wrist right in front of you.

The Apple Watch security guard was also hard to ignore, making sure that no one ran off with a non-functional $399 Apple Watch Sport.

Apple Watch Demo Unit

After I ended my try-on session by declaring "I guess I tried every watch you have here," I preceded to use one of the Apple Watch demo units on the other side of the store. I was able to quickly observe what some had said was a interface that took some getting used to, but over the span of 15-20 minutes that awkwardness went away. To be completely honest, I am a bit disappointed that so many early reviewers from the Watch keynote demo made such a big deal out of this issue. I think it was blown way out of proportion.

The only thing that I needed help with was changing the utility watch face to solar. After being shown that a Force Touch was the answer, I then spent the next 15 minutes engulfed in the various watch face options. I actually found this feature to be the most interesting. There really is something mesmerizing about the various watch faces including the motion options.

As a sign of how ingrained my iPhone and iPad usage is, I gravitated towards using my finger on the Watch screen instead of the Digital Crown. While some of that may be due to the fact that the watch wasn't on my wrist, I was thinking that the Digital Crown was more of a required feature in order to use the watch, instead it would appear to just be one way of gaining more precision.

I found all of the demo apps worked flawlessly with no noticeable lag or hiccups. After 45 minutes of trying the demo Apple Watch, I noticed the store was getting more crowded and the available demo units were dwindling, so I moved over to play with the new MacBook.

Remaining Nimble

The thing that struck me the most during my try-on was that Apple was doing something completely new (selling a wearable product) with the same retail strategy that Apple Store has come to be known for. Instead of renovating each store or creating a special Apple Watch area with a new layout, Apple stuck with the well-known large rectangular wooden table scheme. This process even extended to Apple's store-in-a-stores in Tokyo, London, and Paris.

Apple Watch display table on left with try-on and demo table on the right. Additional try-on and demo spots were located alongside each wall.

The Apple Watch area in the store I visited comprised a demo/try-on station table, an adjacent Watch display table, and then additional try-on stations on one wall and demos on the opposite wall. In total there were eight try-on stations and eight demo stations. Considering this was one of the smaller stores in Apple's retail footprint, I would imagine bigger stores had multiple times the number of demo stations.

Ultimately, I view the effort to remain nimble as the guiding principle behind the Apple Watch try-on process. Apple had given us clues not to expect anything too dramatic with the way the stores would look with Apple Watch as Apple's recent financial filings indicated there wouldn't be many store renovations and we got a look at Jony's new Watch display table at Colette in Paris this past September, looking very similar to the now iconic wooden tables but with a cut out in the middle covered by glass.

I noticed that most of the Apple store employees were still somewhat in awe of the Watch display table, so I asked when it arrived. Just a little while ago was the answer. It is important to keep in mind that all of this Apple Watch try-on sales process was installed in nearly 400 Apple stores overnight, or in some cases that morning. I wonder if this gives us clues as to how Apple will sell new products in the future, relying on the same wooden table theme.

Would I Change Anything?

Having gone through the try-on process, I asked myself if there was anything I would have changed. Surely, each step was created by Apple's retail and marketing teams (not to mention Jony and his team), so I spent some time figuring out the pros and cons of the major decisions that went into the process.

The Apple Watch demo unit.

Apple is accomplishing two goals with these Apple Watch try-ons: having people test the various watch models and then being able to interact with a working Apple Watch. Apple chose to split these two goals, which I suspect is more related to practicality and timing. It would be hard to have people not only try various watch bands on, but also play with the device on their wrist. For example, I spent 15 minutes trying on various watch bands, but then 45 minutes playing with the demo unit. With the current layout, customers can also play with a demo unit while waiting for a try-on appointment, which is an added benefit of splitting the two. I really didn't have a problem with interacting with the watch on a table versus on my wrist. Having demo units on a table also made it easier for an Apple Store employee to help with any questions that I had about the Watch interface or an app, in addition to having more than one person look at the same watch demo unit.

As for the actual trying-on process, there are two fundamental preference tests: watch case sizes and watch bands.

- I would have liked to see a more formal process with answering which watch case (38 mm or 42mm) was a better fit for me. A few people on Twitter told me there is indeed a way to tell what is right or wrong for watch sizing. The specialist did comment on what he thought looked better on me after I showed a bit of confusion, but I was still left a bit unsure. While this comes down to personal preference, I would have liked a bit more help.

- As for the bands, I would have preferred a set up where I know more about the watch bands. Simply going up to a demo unit and being asked which band I wanted to see isn't going to work for most people. I was well aware of the watch going into the process, having memorized all of the models. I would suspect most consumers wouldn't know the first thing about the band options. While much of this process could be discussed by the specialist instead of having printed material or a display, I think there was room to explain the bands a bit more.

I suspect the whole concept of having the specialist stand next to me instead of across from me over a watch case like in every other retailer was a byproduct of Apple trying to make the try-on fit in with the current store layout. For the Edition, a conference room was used for demos in some cases while other stores simply relied on a quiet back corner, which doesn't exactly sound as an ideal option for a "luxury" experience. While having a "watch bar" with chairs and a team of Apple Store employees behind the bar sounds interesting, I think it all goes back to Apple simply being unable to incorporate such change into the current footprint without a lot of additional work. I also am not sure if a "watch bar" would make it easier to assist customers with putting on various watch bands.

Ultimately, I think Apple did a great job with my try-on appointment. While going through the process early Friday morning revealed some early jitters on the part of the Apple Store specialists, backed up by others who told me they were repeatedly given incorrect information about the watch, I thought the overall process worked fine.

Takeaways

Over the next two weeks, Apple will be in a position to give hundreds of thousands of consumers the chance to try Apple Watch. It cannot be overstated how important these try-on appointments are for Apple Watch's success. They give Apple a competitive advantage against others that will undoubtedly enter the wearable space. I would expect Apple to fine-tune the process over time, but at least on Day One, I had a great time trying on Apple Watch. It is rather amazing how the average Apple retail store employee's job description has changed with Apple Watch. The involvement and personal interaction required when helping people try on various Apple Watches supports the idea that the retail store employees play the most crucial role out of the entire experience.

Looking at the crowd, I actually didn't get an early adopter vibe that we have assumed would be the only ones interested in the device. Obviously, going on a weekday morning resulted in the lack of children and teenagers, but I would say the crowd interested in Apple Watch was generally in-line with any other day at the Apple store. I was able to talk with a few "non-early adopter" people about their first impressions about the device. Interestingly, their first comment was that it was a cool watch, with fun customizable watch faces. I go back to when Apple first introduced the watch and I was explaining the device to people, even then the watch faces were the primary talking point. I really think there is something to be said with how normal people look at Apple Watch as primarily a watch that can do other things. I also received a comment about going to see the device made them want it even more, an obvious goal that Apple had in mind with the try-on appointments.

When I left the Apple Store, I asked myself how would I describe the device in one sentence. Without much thought I said, "It's cool." I've been very adamant that people have been overthinking the watch for the past seven months. When it comes down to it, the watch is simply a cool device and my try-on experience reinforced that view.

Receive my exclusive analysis and perspective about Apple in a daily email containing 2-3 stories (10-12 stories a week). For more information and to sign up, visit the membership page.

I went into more detail on my trip to the Apple Store for Apple Watch on Above Avalon Podcast Episode 20.

Product Reviews are Broken

Apple Watch reviews were published yesterday. The majority of reviewers thought the Apple Watch was a great device and has potential to be a game changer in how they use technology. The problem is that unless you read every review, you wouldn't have known that. Instead, the collective conclusion from the web yesterday was that the Apple Watch flopped with early reviews. There were 21 Apple Watch reviews published, but the 4 reviews that were more critical of the device got the most attention, leaving the 14 glowing reviews behind. Meanwhile, most of the important features of the Watch such as watch bands and durability were either not included or buried within lots of other text. Simply put: product reviews are broken. There needs to be a better way to review products.

Product Reviews Have Lost Their Luster

I couldn't help but think how the product review has changed over the years. Whereas a company's primary benefit from a product review was to win precious space in newspapers and magazines, product reviews are still mostly a marketing ploy, but the review itself has become a commodity, with people pulling the most interesting and juicy quotes (using iPhone screenshots) from various sites, and combining them into a new "Review Round-Up" post. The rest of the narrative, and the actual review, is left far behind. This process has been occurring for a few years, but lately it is getting much worse. This is the primary reason why so many people thought the Apple Watch was panned by reviewers while in reality, most people enjoyed the product. Out of thousands of words written about Apple Watch, most will only remember a small fraction and even a smaller fraction will be included in these problematic "review summary" posts.

We now get our news and information from social networks where the desire to be noticed in a sentence or two has led to much more noise with sporadic bouts of greatness. In the process, the product review has lost its luster. Whereas in the past we may have turned to the WSJ for the definitive Walt Mossberg product review, we now are exposed to 20+ reviews that are all trying to be the one to stand out from the pack. While we still have talented people writing most of these reviews, they are increasingly gearing them toward their core audiences. Apple realized this long ago and expanded the number of review units accordingly, effectively watering down the review and in doing so, diffusing the voice of a few into a dull rumble of many.

In a quest to stand out, we now have some reviews turning into full-fledged productions. The Verge's Apple Watch review involved 31 people. Meanwhile, other reviews have remained largely unchanged from yesterday, basically a few paragraphs of generalized statements.

There is still a Place

I still think the world needs independent product reviews. There is enough prior misbehavior on behalf of companies to suggest such third-party reviews can serve a purpose by giving consumers value. The problem is that many reviewers don't know what kind of value that is. The move into personalized wearables has largely turned the traditional tech gadget review into an artifact from a begone era. The nature of the tech review should have changed, but many tech reviewers haven't adapted their review process to this new wave of technology. While adding video may represent a new dimension to the review, the underlying premise of the review needs to be rethought.

Path to Fixing the Review

There are two ways to start putting the review on the right path.

1) Embrace the Current Environment. Video. Video. Video.

One of the more effective Apple Watch reviews came courtesy of Mashable. It wasn't their couple thousand word review intertwined with various high-quality photos but their six-second Vine clip that didn't include any words. I found the clip to be amusing and interesting because it: 1) showed Apple Watch packaging 2) briefly revealed watch bracelets being resized 3) revealed the mechanism of how the watch bracelet worked. I wasn't able to get that information from any other Apple Watch review. Of course Apple could have had the same video on their website, but this is where the independent product review's value shines: legitimacy. There is value in seeing someone not connected to Apple show off its technology in a real-world setting.

Video is an effective medium for much of this to take place because it's 1) easily shareable 2) able to retain its message. One of the biggest's problems facing text reviews is the ease in simply taking a few words out of context. But a six-second Vine? It would be pretty hard to shrink that down any further.

Pharrell Williams published his seven-second Apple Watch "review" Tuesday on Instagram. Similar to Mashable, it showed one aspect of the watch that most people would actually find interesting: how the watch face turns on when one's wrist is turned.

I think one of the better Apple Watch reviews would have been comprised of 10 Vine or Instagram clips that highlight features of Apple Watch that would likely show how we would use the device. Johanna Stern at WSJ did a four-minute video for her Apple Watch review which was entertaining but ultimately too long and missing the larger point of Apple Watch: it means something different to each user. The answer to that isn't simply to do every single thing possible with the watch and then complain at the end that the watch does too many things.

2) Redefine a Review. As technology products become more personal, it is becoming more critical to redefine what a product review should be. Instead of videotaping oneself doing 20 different things with Apple Watch during a typical day, focus on aspects of the device that are universal: quality, craftsmanship, durability, and the simple tasks everyone will have to do.

- Does the Apple Watch screen scratch easily?

- What happens if you get grease on Apple Watch? What about sweat?

- What if you keep the Apple Watch on for long periods of time? Any rash?

- Is it easy to charge?

- How do you replace bands?

Very few reviews addressed those talking points, with only a few even mentioning watch bands, arguably one of the more important deciding factors when it comes time to purchase the watch. Each one of those questions could be answered with a six-second Vine. The product review essentially becomes a test as to whether a company's claims about a product are true. There is a different time and place to talk about the larger implications of how Apple Watch will or won't change the world. A product review isn't necessary the right place to go into theories about technology or nit-pick on why turning on all notifications results in too many notifications being sent. People are going to buy Apple Watch if it looks cool. The review should try to help answer that question.

Taking into account Apple's changing retail strategy, reviewers will need to understand how Apple.com and the Apple Store iOS app are going to become more crucial information sources for consumers. It is important to embrace the change and not brush it off. Apple will have 10 Guided Tours for various Apple Watch features. How about using Instagram video to compare the most important parts of Apple's multi-minute videos to real-life reenactments?

Apple's New Apple Watch Guided Tours

The product review will be rescued when it is understood that the consumer should make the final decision of whether a product is good or bad. The product review should be one variable in the much bigger buying process that likely will involve family, friends, time, and a bank account. The product review has a bright future for giving valuable information and insight to consumers. It just needs some help getting there.

Want to read more posts like this? I write an exclusive daily email about Apple (10-12 stories a week). For more information and to subscribe, visit the membership page.

It's Time for the Watch

"Apple decided to make a watch and then set out to discover what it might be good for..." - Wired

With one sentence, Wired perfectly described the Apple Watch, Apple's first product designed specifically to have a purpose dependent on the user. Today it is a watch. Tomorrow it will be something else. Next year it may be completely different. After years of development, the next phase of Apple Watch has arrived with preorders beginning on Friday. Just as was the case when the product was introduced in September, many are overthinking the watch, turning Apple's refrain about making great products into a complex business theory that risks missing the obvious keys to success. By overthinking the watch and ignoring the clues we received over the past few years, it is too easy to miss what Apple Watch actually is: freedom to do different things with technology.

iPod Nano

Phil Schiller announcing new clock faces for iPod nano in 2011.

While it is hard for any outsider to pinpoint when the idea for Apple Watch first started to percolate, according to Apple executives, the project had its official beginning in late 2011, soon after Steve Jobs' death. However, it was clear at a much earlier time that Apple was at least thinking about a watch.

Back in 2010, Apple shipped an "instantly wearable" new iPod nano that had a multi-touch user interface. Possibly due to some inclination that people may use it as a time piece, Apple included a few watch faces. Steve Jobs even said one of Apple's board members was going to clip it on an arm band as a watch (which got chuckles from the audience). Soon enough, people began to use the device as a wrist watch. Apple embraced the trend and in 2011 went so far as to create new clock faces. It was fun and cool. There were limiting factors for a more advanced gadget at that time, including a new user interface and better battery, but that didn't matter. Apple was a different company in 2010, having just launched the iPad and iPhone 4. Simply put, Apple had more important things to focus on than a watch, but the idea was there. There was something about the wrist.

Tim Cook Gave Us Clues

One of the key questions after Tim Cook became CEO was if Apple would be able to come up with new product categories. The question took on renewed vigor given a few years of evolutionary iPhone and iPad updates. While product secrecy continues to be a very important intangible asset for Apple, the company has historically given a few clues as to areas of interest, and Cook was no different judging by his public appearances in the years leading up to the Watch launch.

2012: Tim Cook at D10 conference. "I think there's some cool things that can be done [with wearables] and I think it's an interesting area...The book hasn't been written on that yet. If it's just a cool thing to know, it will fade, but if it can really drive someone to act differently, to behave differently, then I think it can be pretty cool, and so I think the verdict is out. It will largely be determined by how much innovation is in that area. I think there are some good companies that are working on this."

2013 : Tim Cook at D11 conference. "I think wearables is incredibly interesting, and I think it could be a profound area for technology...there's lots of things to solve in this space, but it's an area where it's ripe for exploration. It's ripe for for us to get excited about...I see it as something, as another very key branch of the tree...I'm interested in a great product...The wrist is interesting."

The Apple Watch Sales Pitch

Tim Cook introducing the three main marketing tentpole features for Apple Watch: a timepiece, communication device, and health/fitness tracker.

As 2014 began, it was becoming increasingly likely that Apple was indeed up to something with a wearable, if nothing else due to the fact that so many other companies were coming out with subpar smart watches. Each device had severe limitations lacking fashion or personalization cues.

In September 2014, Tim Cook introduced the Apple Watch with the following sales pitch: a personal device that could be used to tell time, communicate with people, and track one's health and fitness.

In the preceding weeks and month, the official Apple Watch marketing campaign took shape with the main refrain remaining largely the same, focused on the three primary use case tentpoles. In addition, it gave more insight as to the overall design process behind the Watch and Apple's product-first culture.

2014: Tim Cook during interview with Charlie Rose. "The Apple Watch is the most personal device we've ever created. I think it takes us into a whole different area. We had an intense team working on this for three years...As the product came to fruition it became not only the timepiece that you would expect, but a device that can do many different things include really a whole new way of communicating and connecting with people and also it has a health and fitness component that we think could be profound."

2014: Jony Ive at Vanity Fair. "One of the advantages of being part of the design team that's been around for a long time is that we haven't the luxury and opportunity to develop out process, and so one of the things we do is we meet religiously as the creative team three or four times a week...I'm still so excited about just the nature of the process. I feel so absurdly lucky to be part of a creative process where you know on one day, on Tuesday, there's no idea. We don't know what we are going to do. There's nothing. And then on Wednesday, there's an idea that was created and invariably the idea is a thought that becomes a conversation, and so that we design to start with is to talk and it's fairly exclusive..involves a few people...and a remarkable thing happens in the process, and it's the point in the process where there is the greatest change and it's when we give form to an abstract idea."

2015: Tim Cook at Goldman Sachs Technology Conference. "We want to change the way you live your life. And just like this iPad has changed the way you work, and hopefully the way you live, and the iPhone has done that. We see the Apple Watch doing that...There's just an enormous number of things that it will do, and I think you're going to find it something that you're going to think, 'Wow, I can't live without this anymore!'"

2015: Jony Ive in The New Yorker: "We always thought that glasses were not a smart move, from a point of view that people would not really want to wear them. They were intrusive, instead of pushing technology to the background, as we've always believed...We always thought it would flop, and, you know, so far it has...[Apple Watch] isn't obnoxious. This isn't building a barrier between you and me..."

2015: Alan Dye in Wired: "There was a sense that technology was going to move onto the body...We felt like the natural place, the place that had historical relevance and significance, was the wrist."

The prevailing message illustrated in the above comments was that Apple looked at the wrist as something special with the primary idea of a watch that could change your life serving as the start of everything. More refined use cases and ideas around watch bands came at a later time.

Apple's New Marketing Strategy

Judging from Apple's Watch marketing strategy over the past seven months, it is clear that Apple is taking a new route. The Katie Cotton era of public relations is over. With most new things, there are risks, and I suspect we are seeing one of those risks play out as some company observers are having trouble with an Apple that gives out so much information. If Steve Jobs represented a firewall for Apple marketing, Apple's primary risk now is not filtering the message enough.

Apple's new marketing strategy has relied heavily on positioning Jony Ive as leader of an industrial design team that uses collaboration to create products. Photo: Vogue

Apple is relying on a new marketing strategy because it no longer has the showman that introduced the iPod, iPhone, and iPad to the world. Instead, Apple is forming the narrative around a range of individuals involved with product development, led by Jony Ive and Tim Cook. Apple likely feels it has reached a point where its size and social awareness make it difficult for just one person to control the entire marketing campaign, and management is right. Apple is different today. The news cycle is ever more busy and filled with noise. While it is critical to make sure that the narrative stays on point and coalesces, Apple's strategy is fundamentally the same: get people to want to use the product. To accomplish that goal, Apple is relying on a shock and awe type of public relations strategy to elevate Apple Watch awareness to extreme levels.

It's All about the Product

One theme that management has taken very seriously with Apple Watch marketing is that Apple strives to make great products, and that is the primary theme Apple has tried to showcase with its marketing by using interviews and various high-profile write-ups. I suspect many technology observers have simply gotten used to Apple executives repeating the refrain, ignoring what that phrase really means. One secret to Apple's success is keeping product development behind closed doors, leaving the final, well-polished product to be seen in a retail store. While much strategy is involved in determining what products to work on or what industries to get involved in, strategy alone will lead to failure. At the end of the day, if the product isn't good, nothing else matters, even if the strategy is on point.

When David Pierce talked about Apple deciding to produce a watch first and then thinking of use cases second in his Wired piece, he correctly described Apple's product-first strategy. One theme that has become apparent in mobile is that a product's use case changes over time. It is much more important to focus on the big picture first, positioning a product that can take advantage of major computing themes, not something that checks off a few use cases on a list.

- Apple wants to make a product that has the potential to change the way we live our lives. Management is interested in owning the core technologies that underlie such a product. Management has commented that much time, and anxiety, is spent on this part of the equation.

- The wearable space had become interesting, not because of smart watches, but due to fitness bands. Meanwhile, phones were becoming more powerful as time went on, to the point of being able to replace laptops and desktops for some. Was there room for a simpler device able to turn the complex into the simple?

- Judging from decades of watch use, and now fitness bands, it was clear the wrist contained some value. However, watches were not able to unlock that value due to their lack of utility. It was reported that Jony started to research the history of the watch, including the reasons the wrist was so valuable. The focus was first on the device itself.

- With the idea in mind (don't forget about lessons learned from the iPod nano), it was then time to develop use cases for a device destined for the wrist. With a workable user interface, there can be attention given to what can be done with the device. Taking a look at the iPhone and iPad, it's clear the initial use cases designed for a device aren't even that important. Instead, the technical capabilities (and the runways of such technologies) are much more important.

In the future, the watch may begin to take on more iPhone functions, or it may not. The much more important goal for Apple is to make sure that each new model is better than the previous one. Looking at the iPad, although sales momentum has stalled, Apple is still concerned with shipping the best iPad each year. Market dynamics may not always work in an Apple's product favor, but management hopes to be the reason such market changes impact its product line.

Too Busy Finding a Story

One problem that is becoming a theme in the ever-increasing news cycle is overthinking things by needing to add a new twist or take. While such overarching theories may make for an interesting weekly column or Medium post, in reality, I suspect the truth is much more simple and rudimentary.

Looking back at the iPad and iPhone, many have developed elaborate stories around those products in order to address the mystery. In reality, they were simply great products that relied on a revolutionary multi-touch user interface. After launching at a too-high price (and different business model based on mobile revenue sharing) and without an app store, it took Apple and the iPhone three years and additional features and changes before hitting mass-market awareness. However, the legend was that Apple foresaw the coming mobile app revolution. Stories are told to provide answers to the unknown. The problem occurs when those answers are fabricated. Apple is launching the watch as a fun, personalized iPhone accessory with different use cases dependent on the user. If one doesn't leave the complicated stories and theories at the door, it will be difficult to see the Apple Watch for what is and, more importantly, isn't.

Judging Success

Apple's goal is to make a great product. With Apple Watch, success will be straightforward. Will people want to use it? A few days ago, I asked on Twitter what will be Watch's likely "-gate" controversy, similar to iPhone 6 and "Bendgate." As expected, I got responses ranging from waterproofing issues to scratching and rashes. One of the more serious public relations problems that could impact the watch is drawer-gate or nightstand-gate. If people forget to wear the Watch, not seeing a point in putting it on for their run, the trip to the grocery store, or to attend parent teacher night, the device won't be able to impact someone's life. One of the reasons the iPhone has done so well, including having a strong upgrade cycle, is that it is literally on us all day, every day. If people enjoy wearing Apple Watch, the product will be a success.

Freedom

The Apple Watch is the first Apple product designed from the beginning to be worn and have a purpose dependent on the user. For some, it is the best way to listen to music on a run. For others, it is a revolutionary way to communicate with the kids or keep track of appointments. This is the primary reason why so many people are struggling to understand the Apple Watch. The Apple Watch doesn't mean the same thing to everyone.

We don't know what the Apple Watch will become as we have never experienced personalized technology worn on the body. Personalization doesn't just mean getting to choose between a white or blue wristband, but having a product mean something different and special to each user.

The Apple Watch is an attempt at giving users freedom to do various things with technology suited to their lifestyles. It has been three years since Apple came up with the idea for a cool device for the wrist. On Friday, the era of personalized technology will enter the next phase as Apple Watch pre-orders signal the start of something new.

Want to read more posts like this? I write an exclusive daily email about Apple (10-12 stories a week). For more information and to subscribe, visit the membership page.

Apple's Music Strategy Looks Increasingly Risky