Apple 2Q15 Earnings Preview: Another Strong Quarter Driven by iPhone in China

Apple will likely report a 2Q15 beat to consensus EPS of $2.14 this coming Monday on strong revenue growth (up 24% from last year) and margin trends (41.0% vs. 39.3% last year). The iPhone will be the primary focus as investors look for any indication of continued above average sales trends compared to previous iPhone cycles. While recent iPhone sales share in the U.S. and Europe appear slightly ahead of previous years, strong sales in China will be the primary driver behind 35% growth in iPhone unit sales. In addition to earnings, Apple is expected to announce an updated capital return program. The Mac and iPad are becoming less of a factor for earnings as those two product categories now represent a smaller percentage of Apple's overall business. It will be difficult to get Apple Watch sales expectations from guidance, but management may give commentary on how the Watch launch is proceeding. Similar to last quarter, the impact from a strong dollar will be reflected in management's revenue and margin guidance for 3Q15.

iPhone: The Big Story for the Foreseeable Future

Representing close to 70% of Apple's quarterly revenue and 80% of gross profit, the iPhone will likely remain the primary focus for Apple investors until new Apple products gain enough momentum to account for a bigger piece of the financial pie. While there is nothing inherently wrong with this situation, it does serve as a reminder that the iPad and Mac are becoming less of a factor on earnings day. The following exhibits highlight the changing revenue and gross profit mix over the past two years as the iPhone's share has grown, while iPad and Mac share have declined.

Exhibit 1: Apple's Shifting Revenue Mix (2Q13 vs. 2Q15)

Exhibit 2: Apple's Shifting Gross Profit Mix (2Q13 vs. 2Q15)

I estimate Apple sold 60 million iPhones last quarter, which would represent 37% growth from last year. On last quarter's earnings call, management noted that global iPhone supply/demand remained out of balance for most of January. Accordingly, I am assuming Apple sold as many units as it was able to produce for one-third of the quarter (24 million units in January). Once supply/demand was in equilibrium in February, I am running with a 20-25% reduction in shipments (19 million units in February and 17 million in March). Apple will need to ship millions of iPhones just to get channel inventory into an acceptable range, but management noted this will be done over time. As shown in Exhibit 3, I would consider iPhone sales between 57 million and 63 million to be relatively in-line with my estimate and not causing much change to my forward iPhone estimates.

Exhibit 3: iPhone Unit Sales Expectation Meter (2Q15)

Capital Return Program Revision Expectations

The board is expected to announce an increase to the quarterly cash dividend and additional authorization for the share buyback program. Last month, I went into detail on prospects for both the quarterly cash dividend increase and share repurchase program. I expect the quarterly cash dividend to be increased approximately 8% to $0.50/share to $0.51/share. The share buyback authorization will likely be increased $35 to $45 billion, bringing total authorization to $125 to $135 billion. It will be important to watch for any change in commentary and tone regarding the capital return program, especially as Apple is currently near the maximum buyback pace that it can sustain given its U.S. free cash flow and debt issuances. Consensus already expects a pretty significant change to the buyback ($30-$40 billion increase), so it may take an increase of more than $40 billion to move the stock specifically related to the buyback news.

Guidance

I currently have $47 billion of revenue estimated for 3Q15. A revenue guidance range of $43-$46 billion would suggest that my estimates are on track. Apple's guidance will include Apple Watch revenue, although the data will be lumped in with the "Other Products" category. I still think it will be possible to arrive at some conclusions as to how many watches Apple sold since the Watch will make up a good portion of "Other Products". While it remains very difficult to judge Watch supply over the next two months (3Q15), I would expect the Watch to contribute around $2 billion of revenue from April 24th to the end of the quarter in June.

iPad and Mac: No Significant Changes

As discussed by management, there won't be much change to continued weak iPad sales momentum. The entire tablet category is facing increased competition from larger smartphones. The iPhone 6 and 6 Plus, in addition to a strong MacBook line-up, continues to pressure iPad sales. I expect iPad unit sales to decline 22% to 12.8 million, which would track close to the decline seen last quarter (18%). iPad channel inventory was already at sufficient levels coming into 2Q15. The iPad is still in the process of finding its normal sales run-rate, but that level may still be quite a bit lower than current sales levels. For perspective, the iPad is outselling the Mac by nearly three-to-one.

Exhibit 4: iPad Unit Sales Expectation Meter (2Q15)

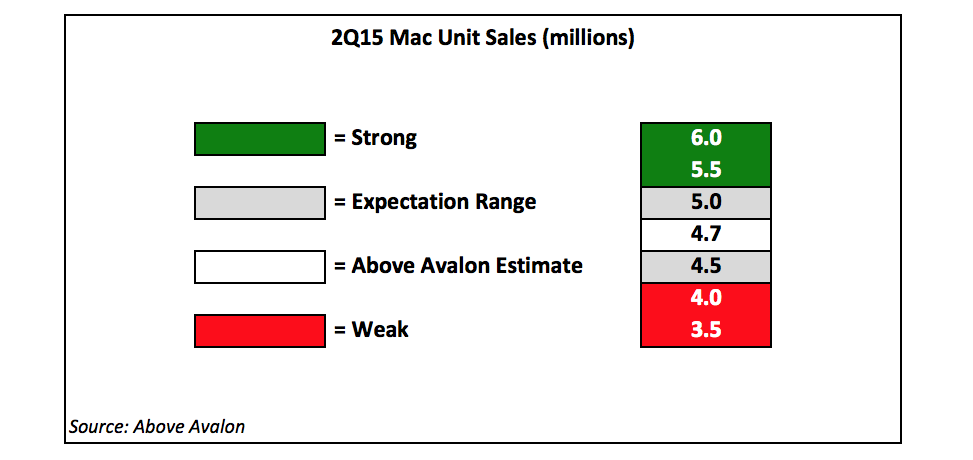

Mac sales will likely continue to follow the 10-20% growth experienced over the past five quarters as the current product mix resonates with consumers that want a more powerful machine compared to the iPad Air or iPhone 6/6 Plus.

Exhibit 5: Mac Unit Sales Expectation Meter (2Q15)

Other Thoughts

Given the current point in the iPhone cycle, it's fair to assume the average selling price will decline a bit (to around $650 from $687), but some of this decline should be offset by an increase in profit margins. Apple's guidance will reflect the impact from the stronger dollar, but with trends stabilizing in recent weeks, management may be able to get a better handle on foreign currency trends.

Similar to last quarter, all eyes will be on iPhone on Monday. For every one million iPhones sold, Apple EPS is impacted by $0.04/share. The difference between 55M and 60M iPhone unit sales explains most of the Street's EPS estimate variation. It looks increasingly likely that China will once again prove to be the quarter's primary revenue driver.

This report was produced by Neil Cybart on April 22, 2015 and is not meant to be used as investment advice.

Want to read more posts like this? I write an exclusive daily email about Apple (10-12 stories a week). For more information and to subscribe, visit the membership page.