Anchoring Bias Impacting Wall Street's View on Apple

Predicting tech trends beyond 6-12 months is somewhat of a futile endeavor, but two groups of analysts attempt the feat: paid and non-paid. Paid analysts largely encompass sell-side analysts - think along the lines of Goldman Sachs and Piper Jaffray. Non-paid analysts include everyone else and seem to have acquired the “independent” nomenclature. There remains another group - buy-side (think hedge funds and mutual funds) - who don’t actually publish Apple forecasts, instead utilizing paid (and independent) analysts forecasts.

Modeling Apple’s business (and earnings) involves two parts:

1) Knowing how to model a company’s financials. This is the easy part. Setting up an excel sheet to model revenues, expenses, and earnings going forward. Financial modeling is essentially Finance 101 (ironically many students have no clue what they are doing when they take intro Finance classes since the field is so disorganized academically in primary and high school).

2) Knowing how to model a company’s performance. This is the hard part. This is the part of modeling that is more art than science. How many iPads will Apple sell next year? How about iPhones? Experience, intelligence, and a clear mind separate the amateurs from the professionals.

I’ve discovered that looking at someone’s forward Apple projections reveals a lot about what they think of Apple and this is where things get interesting. Sell-side consensus for Apple earnings per share currently stands at $32.35 for fiscal year 2012 and $36.94 for fiscal year 2013. From a stock valuation standpoint, these numbers are important, but converting these numbers into growth, Wall Street believes Apple will grow 18% in 2012 and 14% in 2013.

In order to put these numbers in context, I compare Apple’s projected earnings growth to other technology companies:

2012 2013

GOOG: 19% 17%

IBM: 11% 11%

MSFT: 6% 9%

HPQ: -1% 2%

RIMM: -20% 2%

DELL: 26% -2%

Average: 7% 7%

AAPL: 18% 14%

(consensus data from FactSet and current as of 9/10/11)

Now we are getting a better picture of how Wall Street views Apple. Tim Cook and company are expected to outperform the overall technology sector, growing earnings 14% in 2013, versus a peer average of 7%. However, Apple’s 14% projected growth in 2013 pails in comparison to current 70% growth. What is going on here?

Instead of sell-side analysts “not getting it” - as some independent Apple analysts say, I think anchoring bias is the main culprit.

I thought Wikipedia did a good job at trying to define anchoring in a few sentences:

Anchoring and adjustment is a psychological heuristic that influences the way people intuitively assess probabilities. According to this heuristic, people start with an implicitly suggested reference point (the “anchor”) and make adjustments to it to reach their estimate. A person begins with a first approximation (anchor) and then makes incremental adjustments based on additional information.

Sell-side analysts are comparing Apple to its peers too much. Although analysts still believe Apple will outperform, many are modeling Apple with a 5-10% technology industry growth rate in mind. Apple’s growth is then pegged above this range, albeit by only a small margin. Apple is being anchored to its peers and corresponding lower growth rates.

Sell-side analysts may think Apple will sell a ton of iPhone and iPads, but end up with much lower Apple growth rates because Apple’s peers are performing so poorly. To make matters worse, much of this comparing, and anchoring, is occurring on a subconscious level, making it that much harder to acknowledge and correct.

Meanwhile, independent Apple analysts aren’t subjected to anchoring bias since they are only modeling Apple. In a way, they are able to put Apple in a valuation bubble. If independent analysts began to model Apple peers on a regular basis, I would suspect anchoring would become a bigger issue among the group.

As an independent Apple analyst, how fast do I think Apple will grow earnings?

2012: 40%+

2013: 35%+

My 2012 earnings growth estimate is twice the pace of Wall Street’s 18% growth estimate.

RIMM’s troubles, HPQ’s reorganization, MSFT’s status quo, and GOOG’s continuing mystery are causing Wall Street to view Apple with a more conservative eye. What is the solution? Unfortunately, I don’t expect Wall Street’s anchoring bias to end anytime soon. Apple will continue reporting large quarterly earnings beats, while Wall Street continues to gush over Apple’s growth.

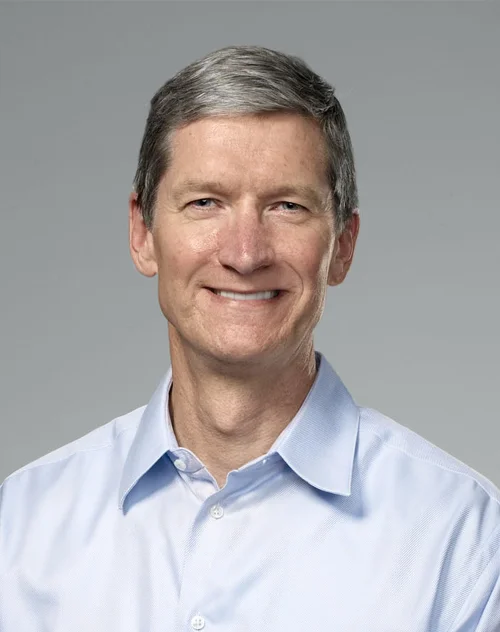

Tim Cook. The Architect.

While some have responded to Steve’s resignation as Apple CEO by recalling personal stories involving Steve or Apple, others have focused on how Apple’s culture will handle a different leader. Let’s take a step back and reassess Apple’s current situation.

Current Products

I have extreme confidence that Apple will successfully update its flagship products in the near-term. As I previously wrote, Apple’s start-up structure assures resources are allocated to a product in the months leading up to a refresh; breaking down the “walls” between executives and workers - the same walls that often destroy other technology companies. Having executives involved in seemingly detailed and mundane aspects of a product is the difference between having a product be “magical” or “good”. Tim Cook will continue to hash out aggressive business contracts with Apple friends and foes. Apple’s expanding supply and distribution channels will continue to be run with the dedication and intelligence that have put competitors to shame. As a prime example of how much confidence I have in Apple’s ability to execute in the near-term, I have no intention in lowering my forecasts for Mac, iPod, iPhone, or iPad sales in my AAPL earnings model following Steve’s resignation.

Future Products

Apple will continue to innovate and brainstorm ideas that will change the world. While it is difficult to pinpoint why the iPod, iPhone, and iPad have been so successful, it is important for Apple to continue to make similar industry-changing strides. I think this is where Apple will face its first significant challenge with Steve no longer at the helm. What makes Apple so great is its willingness to take abnormally large risks and essentially bet the farm on those risks. Apple is able to translate a big idea (big bet) into reality with very little friction and inefficiency. The biggest risk enters the equation on the demand side - whether consumers want the product. Steve made bets. Big ones. Will Tim be able, or willing, to take similar big risks?

At this time, I do think Tim is capable of such responsibility. Tim isn’t some young gun who has been thrown into the game. Observing how the world has changed (and where it will go) is an art not a science, and while Steve mastered that art so successfully, Tim was in a perfect position to watch the master perfect his art, giving him a significant advantage over everyone else in Silicon Valley. Apple will lose on some bets, but will still be able to strive to new heights if more is wagered on winning bets.

Face of Apple

Apple is Steve and Steve is Apple and that will not change. However, there is now a debate as to who will become the new face of Apple or if Apple even needs a singular public representative given Apple’s size and power. I do think the entire Apple executive team will gain more exposure with some SVPs acquiring new affiliations with consumers. Forstall as Mr. iPhone and iPad, Jony as Mr. Apple Design, Schiller as Mr. Apple Brand, while Tim remains the “Big Dad”. Great brands create emotional connections between users and products. People will want to connect with Apple and its leadership in new ways. When Apple is ready to unveil its next big thing, we will most likely have a few members of the Apple team explain why the world needs this new product, whereas up to now, only Steve has had the honor.

AAPL

Concerning financials and other AAPL stock decisions, I would expect no significant changes or speed bumps with Tim as CEO. In addition, an internal CEO promotion often results in minimal changes to prevailing capital philosophies concerning dividends and share buybacks.

The Architect

At the end of the day, Steve built the foundation for a magnificent castle and Tim is a great architect. As I wrote back in December: "As long as most of the risk variables are monitored and marginalized to a certain extent by upper management (and Steve Tim) - the consumer is left as the biggest risks. Apple can then rely on its brand power to turn the odds in its favor.”

Inflection Point: HP webOS

HP’s decision to discontinue webOS devices and look for strategic alternatives, including the outright sale of webOS, marks a significant inflection point for the mobile industry. The barriers of entry are now too high for a new mobile OS. For the next 5-10 years, iOS, Android, (and Windows) will shape the future of mobile.

While there are still questions as to what value is left in webOS and rather patents/IP may still be of interest to potential bidders, the era of being able to grow an integrated ecosystem from scratch is over.

AAPL Orchard's AAPL 4Q11 Estimate

Overall Quarter Metrics

I expect iPad and iPhone to represent nearly 70% of Apple’s quarterly revenue. Remarkable.

Apple’s margin in 2011 has ranged from 38.5% to 41.7%. Management explained the 41.7% margin experienced in 3Q11 included some one-time warranty benefits and guidance of 38% for 4Q11 is primarily driven by the product mix. I don’t buy it. I don’t see many reasons for Apple’s margin to set a new low for 2011 in 4Q due to more iPhones (mostly iPhone 4 and 3GS) and iPads being sold. I expect attractive component pricing trends will offset any modest impact from back-to-school promotions (Macs and certain iPods are discounted). Timing issues surrounding the next iPhone may very well push margin pressure out to 1Q12. I would expect more bullish estimates to have GM closer to 41.5%.

I expect Apple to report 82% yoy earnings growth. While 82% growth is down from 122% yoy growth seen in 3Q11, I would not make much of this decline. Most of the difference is related to the ramp up in iPhone unit sales in 2010.

Product Unit Sales and Commentary

I expect MacBook Air and Mac mini updates to contribute to another solid Mac quarter. Apple will continue to take market share from Windows (early stages of 5-10+ year trend). As the PC market struggles to grow (thanks in part to the proliferation of smartphones and iPad), I view Mac growth greater than a range of 10%-15% as very respectable.

With iPad supply/demand still out of balance in a number of countries, I expect Apple to continue to expand the iPad channel during the quarter. While it remains to be seen if back-to-school purchases will include iPad, I don’t see many hiccups to stellar iPad demand during 4Q. Rumors of a possible iPad Pro have been very sporadic and I don’t expect such rumors to impact mainstream consumer purchasing habits. As seen with 3Q iPad growth of 183%, Apple has expanded iPad production nicely and is capable of greater than 100% year-over-year unit shipment growth.

I expect strong iPod touch sales to be offset by the continued decline in Apple’s other iPod models. Going by historical trends, Apple will refresh the iPod line up near the end of 4Q11, possibly at the same time as the expected iPhone refresh. I would not necessarily expect a large move in iPod shipments one way or another because of this refresh event, unless Apple moves forward with a plan for a low cost iPhone that includes changes to the iPod touch.

I expect Apple to unveil the new iPhone in September. Traditionally, I would include a significant supply drawdown of the old iPhone model, followed by a slow ramp up of the new iPhone model to go along with an iPhone refresh, but last quarter’s amazing iPhone sales lead me to believe Apple will continue to post sequential quarterly iPhone unit growth. I expect Apple will continue to sell iPhone 4 (and possibly iPhone 3GS) into 2012, therefore I am not expecting a significant drawdown in iPhone shipments in the weeks leading up to the iPhone refresh as iPhone 4 roll-out continues to new carriers and countries. Additionally, I would expect pent-up iPhone (4s or 5) demand will continue to grow during the quarter. Similar to the iPad 2 supply debacle, I expect the next iPhone to experience the same craziness and supply shortages in its first few months of sale, which will only help Apple’s 1Q12 iPhone numbers.

Similar to other sell-side analysts, I will most likely be revisiting my estimates following the end of the quarter. At this point, I would attribute any significant differences to my EPS estimate to differences in iPhone unit shipments. Questions can be addressed to me through twitter.

Apple CEO Succession 101

Daring Fireball’s thoughts on Apple’s CEO succession: click here.

My thoughts?

Issues like Apple CEO succession show how little people understand Apple.

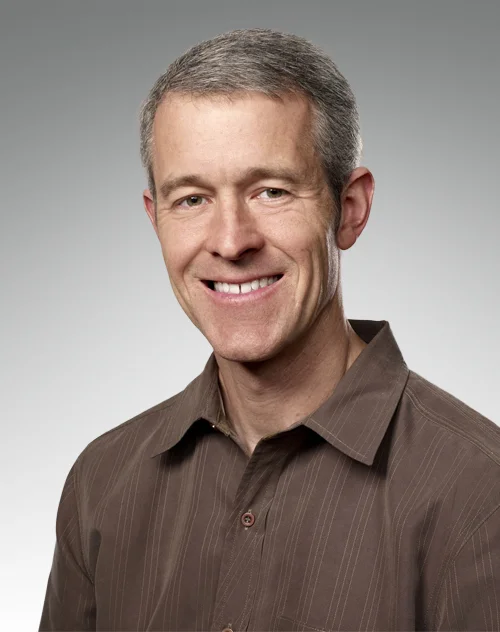

This is Apple’s next CEO: Tim Cook

From Apple:

"Cook is responsible for all of the company’s worldwide sales and operations, including end-to-end management of Apple’s supply chain, sales activities, and service and support in all markets and countries. He also heads Apple’s Macintosh division and plays a key role in the continued development of strategic reseller and supplier relationships, ensuring flexibility in response to an increasingly demanding marketplace."

This is Apple’s backup CEO: Jeff Williams

From Apple:

"Jeff Williams is Apple’s senior vice president of Operations, reporting to COO Tim Cook. Jeff leads a team of people around the world responsible for end-to-end supply chain management and dedicated to ensuring that Apple products meet the highest standards of quality.

Jeff joined Apple in 1998 as head of worldwide procurement and in 2004 he was named vice president of Operations. In 2007, Jeff played a significant role in Apple’s entry into the mobile phone market with the launch of the iPhone, and he has led worldwide operations for iPod and iPhone since that time.”

I have my reasons supporting this Apple CEO succession hypothesis. Stay tuned to AAPL Orchard for more commentary on this issue in the future.

I publish a daily email about Apple called AAPL Orchard. Click here for more information and to subscribe.

Great Use for Apple's Cash

City Urban Core Population # of Apple Stores

Shanghai, China 9,495,701 2

Beijing, China 7,296,962 2

Hong Kong, China 6,780,000 0

Tianjin, China 5,066,129 0

Wuhan, China 4,488,892 0

Guangzhou, China 4,154,808 0

Shenyang, China 3,981,023 0

Chongqing, China 3,934,239 0

Nanjing, China 2,822,117 0

Fuzhou, China 2,710,000 0

Harbin, China 2,672,069 0

Xi’an, China 2,588,987 0

Chengdu, China 2,341,203 0

Changchun, China 2,223,170 0

Dalian, China 2,118,087 0

Hangzhou, China 1,932,612 0

Jinan, China 1,917,204 0

Taiyuan, China 1,905,403 0

Qingdao, China 1,867,365 0

Zhengzhou, China 1,688,681 0

Shijiazhuang, China 1,632,271 0

Kunming, China 1,549,593 0

Lanzhou, China 1,527,383 0

Zibo, China 1,514,070 0

Changsha, China 1,489,259 0

Nanchang, China 1,386,454 0

Urumqi, China 1,358,986 0

Guiyang, China 1,341,243 0

Anshan, China 1,287,136 0

Tangshan, China 1,279,226 0

Wuxi, China 1,245,129 0

Jilin City, China 1,244,725 0

Fushun, China 1,244,144 0

Suzhou, China 1,170,618 0

Baotou, China 1,146,506 0

Qiqihar, China 1,125,948 0

Xuzhou, China 1,120,534 0

Hefei, China 1,107,143 0

Handan, China 1,069,146 0

Shenzhen, China 1,058,531 0

Luoyang, China 1,043,243 0

Nanning, China 1,016,013 0

West Des Moines, Iowa 46,403 1

Newark, Delaware 28,547 1

Leawood, Kansas 27,656 1

Tukwila, Washington 17,392 1

Buford, Georgia 10,668 1

Emeryville, California 9,859 1

Apple expects to utilize $650 million for retail store facilities in 2011, opening 40 new stores worldwide, 70% to be located outside the U.S.

And people wonder what Apple will spend its cash on…

A New AAPL Era

Apple reported its most recent quarterly earnings this evening. Impressive would be an understatement.

Here are some talking points:

1) Emerging Market Growth. Skewed perspective is making it hard to understand how fast Apple is growing. Many tech analysts are situated in developed countries and economies where the Apple brand is well established, and accordingly have a harder time conceptualizing how Apple can maintain dramatic growth rates. The combination of rising standards of living and the increasing availability of lower-priced Apple products is a new trend for emerging markets, and it is reasonable to expect this scenario to drive Apple’s growth in the future.

2) Product Line Diversification. Similar to the iPod, we are seeing the emergence of the iPhone product line: a series of iPhones with a sliding scale of features and capabilities. By the end of 2011, iPhone 3GS, iPhone 4, and iPhone (4S or 5) will most likely round out Apple’s iPhone line. Importantly, each iPhone utilizes iOS apps and has access to the iTunes store. I see the same trend happening with the iPad in due time; multiple versions sold simultaneous at different price points. Apple will rely on this product line diversification to cater to different market segments using price as a key differentiator. Emerging markets will have iPhone 3GS, mainstream will be content with iPhone 4, and early adopters will go crazy over iPhone (4s or 5). In addition, Apple’s overall margin benefits from the continued sale of “older” products as component pricing generally declines over time.

3) Big Losers and Winners. Apple management was very clear on the earnings conference call: iPads are eating away at Windows PC sales and iPhone continues to grow like a wild weed. Companies focused on selling consumer hardware (Dell, HP, RIMM, Motorola, and Samsung) are in a very difficult position as each is starting to understand that having good software is just as important as selling sexy hardware. Big winners (besides Apple) include companies who luckily aren’t competing in the consumer market, and are instead focusing on selling enterprise services or infrastructure needed to foster commerce and further innovation (IBM and Oracle come to mind). It is no coincidence that Dell, HP, RIMM, Motorola, and Samsung have indicated (or will indicate) an interest in entering the enterprise services market.

Random Bytes:

-) Look for Android activation numbers to become less relevant as time goes on. I have this growing feeling that Google is nervous that Android is becoming nothing more than a large void, taking up mobile space, and is relying on activation numbers to impress app developers to dedicate resources to the platform. It’s not working. iOS reached critical mass a few quarters ago and Android will not stop iOS momentum.

-) While I will keep AAPL stock thoughts to myself (at this time), it is important to remember that the large institutional holders control Apple stock and many of these entities are not interested in quick 5-10% stock moves, but instead the attractiveness of AAPL 5-10 years out. Potential AAPL dividend payout ratios, cash flows, and cash holdings will begin to matter just as much as iOS market share, iOS user statistics, or other random Apple product data points. The big boys will continue to support AAPL as long as they feel confident they will receive an annual return that beats other asset classes (fixed income, real estate, etc.) over an extended period of time.

Facebook Gets It

While Facebook’s presentation skills were lacking during today’s new features event, I thought there were some interesting tidbits that came out of Zuckerberg’s ramblings.

1) Facebook gets it. Over the past few years, Facebook has unveiled incremental design changes and new features, which by themselves aren’t earth-shaking, but collectively have served to move the platform forward and give Facebook the freshness users demand. Doesn’t this strategy sound familiar? I was also pleased to hear Facebook’s goal to make the Skype integration and video calling “stupidly easy”. As seen with Apple’s current success, if your business is built around scale, new features and products must be easy enough to use that even people who don’t like dealing with technology will have a blast using your product. Facebook gets it.

2) Facebook wants to redefine how we use the web. Zuckerberg is a believer of apps and while a ton of people at Apple HQ agree with him that apps are the way to go over the next 3-5 years, Zuckerberg wants those apps to run on the Facebook OS, whereas Apple wants to keep the curated app garden on Apple soil. While Facebook’s primary goal has been to increase its user base (and I suspect this will remain a top priority until 1-1.5 billion people are on Facebook), eventually Facebook will shift its attention on third party apps and webpage connectivity (and I am not just talking about Zynga games). Down the road, the Facebook OS can be expanded outward, with the help of mobile devices, so that Facebook serves as a bridge between our daily lives and our always changing social network (re: how your social network may impact the way you perform mundane chores around town, shop for birthday gifts, or even get a new haircut). We will look at the web in a much different light.

3) I doubt Facebook cares about competitive pressures from Google+ (if there are any), Twitter, or any other social networking platform. Facebook’s biggest competitor isn’t another company, but instead user’s quest for privacy. Facebook’s success depends on people sharing information, privacy be damned. Twitter and other social features are helping people get use to the idea of sharing ideas and thoughts. If Google+ catches on in some way or form, Facebook would hope users will become only more willing to loosen their privacy setting because “everyone else is doing it”, or “it’s becoming the norm”. Only a few years ago, it was taboo to have a public Facebook profile due to concerns over employers or family peeking into one’s life. Now its common to share mundane photos or interesting posts from the web with strangers. As time goes on, people will continue to lower their privacy walls and not even realize it.

Facebook is quietly hovering over its targets, not yet ready to attack. Showing little outward aggression and more secrecy and obscurity than clarity and straight forwardness, Facebook is content with expanding its reach and building its army. Eventually, the time will come for Facebook to attack with its foot soldiers being you and me (assuming you are on Facebook). With a current valuation in the neighborhood of $50-$75 billion, investors are betting Facebook has its sights on quite the large battle.

Will Your Mom Love Google+?

Normal consumers are more likely to try out a new product if they hear their children raving about it, or watch Diane Sawyer report on it during the evening news. Normal consumers are more likely to try out a new product when they feel left out by their reluctance to “join the movement”. Grandparents and parents are joining Facebook because all they hear from their children and grandchildren is “it’s on Facebook” or “go on Facebook to see it”.

I suspect Google realizes how popular Facebook has become with the masses and will rely on what it does best to get people to use Google+; force users (Gmail, YouTube, search) into interacting with Google+ in one form or another.

Force is the wrong word. I mean coerce.

RIMM Observations

After the market close, RIMM reported fiscal 1Q12 earnings. A few things stood out to me.

1) RIMM will begin a headcount reduction. As millions of consumers switch to smart phones from feature phones, RIMM is cutting back. While it is understandable for a company to remove redundancies and waste, the writing is on the wall; RIMM had invested for a much bigger company compared to what it now sees itself as going forward. Can things change? Sure. Will things change? Not likely. Fixed costs can sure be a killer when your products sit on store shelves.

2) RIMM shipped 500,000 Playbook tablets. Keyword being shipped. The difference between shipped and sold? When a product leaves the factory (in a boat, plane, car, truck, mule), the product is characterized as “shipped”. No consumer has purchased the unit. RIMM’s 500,000 Playbook number is largely related to RIMM filling the Playbook inventory channel (the location between factory and consumer). It’s one thing when you ship a product that people are buying (iPad), but when you are shipping a product that no one is buying, you have the classic channel stuff.

3) Management wants to buyback RIMM stock. While RIMM’s business is falling apart on all sides, management wants to spend part of its precious cash chest ($2.9 billion) on buying back its tanking stock. While buying back stock can carry a lot of different meanings, largely depending on which industry a company is operating in, stock buyback in the technology industry does not carry a positive connotation. Instead of using money to better your position to innovate, buying back a stock that finds itself on a slippery slope screams desperation and a ploy to show Wall Street that management holds confidence in the future (Wall Street rarely cares - quickly seeing through the action like swiss cheese).

4) Guidance gives perspective. In the matter of a few weeks, RIMM cut its annual guidance by 30%. Given RIMM’s size, cutting guidance by 30% in such short order is not caused by one bad product launch, or by economic concerns impacting your consumer base. A 30% guidance cut is evidence of stuffing the inventory channel with a ton of product and finding out that no one was actually buying your product. A 30% guidance cut is evidence that your fixed cost base is quickly eroding profits as your new product lineup is delayed and your old product line up is stagnant. A 30% guidance cut for a mobile phone company during the age of the mobile revolution should speak volumes for the amount of trouble RIMM is facing.

Going forward, look for liquidity to be a front and center issue for RIMM. For management to have any chance of a comeback, it needs ample cash, and a $2.9 billion war chest contains only limited opportunities.

Snapshots

While surfing the web this morning, I could only laugh at the amount of optimism given to Windows 8. Posts on how Windows 8 will truly revolutionize Microsoft (they said the same thing about Windows 7) were the cherry on top. Commenters rushed in with Microsoft support throwing around such figures as 350 million Windows 7 licenses sold to date or some other funny math that supports their claims. If I wanted to live like it was still 2004, I could go along with these individuals and drink the Microsoft kool-aid, but its time to wake up.

People are making a fundamental error. Rather than looking at tech trends, many are looking at snapshots of the current technology landscape and then extrapolating what they see into the future. Snapshots do nothing but reinforce the dying status quo.

June 2011 technology snapshots would show:

1) Nokia is still selling plenty of phones.

2) Microsoft is crushing it with Windows 7 licenses.

3) Research in Motion is still selling a boatload of blackberries.

All snapshots; singular moments in time that won’t show:

1) Mac sales are gaining market share every quarter and will soon surpass 15% of the consumer computer market.

2) iOS is becoming ever-more vibrant as a growing number of developers are now earning a honest living from iOS app revenue.

3) iPad power.

4) Android is largely becoming the non-Apple destination for anything mobile.

While Windows 8 may have its attractive points, interesting features don’t change consumer technology trends. Instead, years of successful product launches and value-added services help turn a loyal consumer base into an army of brand enthusiasts. The tech industry is still in the early stages of working through the death of a monopoly. Industries take years, if not decades, to work though such an industry-changing event. Certain brands are dying a slow death, while at the same time, being replaced by up and coming brands. Taking snapshots will never give the true picture.

Want to Beat iPad? Hire a Psychologist

When unveiled in 2010, Apple didn’t know why iPad would be a major hit.* After spending most of the keynote explaining some of iPad’s basic features, such as email, reading books, and surfing the web, Apple left the fundamental question of why iPad would become popular to the marketplace to answer.

One year, and 19.5 million iPads, later, the marketplace has spoken. While users have a variety of reasons for liking iPad, I attribute its success primarily to its ability to transfer innovation to the user. Apple’s curated iOS ecosystem allows iPad to bring app innovation, and functionality, into users’ lives, all the while sustaining a satisfaction level that is unmatched in Silicon Valley. When selling technology to consumers, initial satisfaction is good, but being able to deliver continued satisfaction and enjoyment is even better.

When putting iPad in this context, it’s easier to see the uphill battle facing competitors. The competition is having a hard time beating iPad because they don’t understand why people are actually buying iPad. To beat iPad, you can’t look at it as some piece of hardware that runs apps; you can’t look at it as “an iPad”, but instead as “iPad”. You have to understand the emotional connection between iPad and its user, which a psychologist could analyze at a steep price. A cheaper option to see the connection between iPad and its user is to walk into an Apple store and hover around the iPad table. After a minute or two, you will see the connection when looking at people’s faces.

Competitors need to aim for users’ hearts and minds and not assume that consumers are buying iPads just because they have $499 lying around the house. I have little confidence that competitors can successfully appeal to consumers in the same way that Apple does. Instead, competitors have two options for fighting iPad: low price commoditization with little emotional appeal, or reliance on innovation to beat Apple at its own game.

1) From a financial perspective, removing the emotion out of a product does not bode well as competition will lead to hardware commoditization and the ensuing margin collapse. Profits and brand power will quickly evaporate. Nevertheless, competitors need to convince users that some level of satisfaction can be received from a tablet form factor at a much lower cost than iPad. Apple understands this alternative strategy (some say due to its PC war history) and is relying on its massive $66 billion cash position to secure device components at prices that help lower iPad’s cost to a price point that is very difficult for the competition to slide under, while at the same time maintaining attractive margins. If you are curious what the tablet market would look like if iPad competitors choose the route of hardware commoditization and low cost, instead of appealing to consumer’s emotion, look no further than the MP3 player market, where Apple’s iPod and iTunes ecosystem maintains 70% market and emotion share.

2) You can only rely on apps and services to such a extent before poor financials, low product margins, and a lack of cash become too much to bear and competitors exit the market. If low-priced commoditization sounds unappealing, a better strategy for competing against iPad is to innovate and come up with something completely different. Once this new product is developed, control the emotional connection to your consumer and strive for increasing functionality and user satisfaction. Let iPad have its user base, while your product entice others with unique features and attributes. Try to beat Apple at its own game.

One year, and 19.5 million iPads, later, the marketplace has spoken, but competitors have spent more time talking instead of listening and watching.

*I didn’t write “if iPad would be a major hit”, but instead, “why iPad would be a major hit”. Apple has a history of releasing major products only after it knows it is worthy of becoming a hit.

iOS App Innovation and iPad 2 Design Lead to Magic

After my attempt to pick up iPad 2 on opening day failed miserably, I had to settle for ordering one online and waiting four weeks. On Wednesday, my wait ended. My initial iPad 2 thoughts focus on two themes; app innovation and iPad design.

After connecting iPad to iTunes (using the iOS umbilical chord) and running through the obligatory setup process, I was ready to take my iPad 2 for a spin. My first stop; the app store. Instead of searching for a specific app, I found myself scrolling through the Featured and Top Charts lists. After one hour, I had installed 15 apps, 14 of which were free*.

Apps. Apps. Apps. Without apps, iPad 2 would feel empty. I’m intrigued by the ongoing debate as to how to judge an application ecosystem’s health and popularity. Does it mean anything if Android reports more apps than iOS? Should I look at the number of app developers, or the growth rate of application submissions? Can I go by how quick a developers conference sells out as some indication of ecosystem success?

The most critical aspect of an app ecosystem (iOS, Android, HP webOS, Windows Phone 7) is app innovation. Every time I check the Featured app list, I want to see new apps. When I check the Top Charts list, I want to see new apps. I want to see strong app circulation. This type of app innovation stands at odds against those who argue as long as an app platform has the 10-15 apps that I use most often, then the platform is healthy and I should be happy. I strongly believe this type of settling for the bare minimal will lead to stagnant app buyers that become disenfranchised with routinely searching and paying for apps.

With 15 apps downloaded and my iPad 2 in hand, I sat on my couch and it wasn’t long before I lost track of time.

After a few minutes of using iPad 2, I found myself forgetting that I was using iPad 2. My entire thought process was given to the app that I was using. While iPad looks and feels amazing, the iPad dissolves away when in use, exactly how Apple planned it. Remove the intermediary and let users interact directly with innovation. I don’t care what’s inside or isn’t inside iPad 2, as long as iPad 2 has the ability to run the highest quality apps possible. iPad 2 meets this goal. When I see iPad competitors spend precious commercial space discussing product specifications, similar to the laptop wars of the early 2000s, I can only laugh.

Random bytes: Although iPad 2’s Safari is adequate for web surfing, I’m having a much better experience using apps to access website content. I always think back to a Wired article published a few months back, titled “The Web is Dead. Long Live the Internet”. While the author was somewhat off with the concept of “The Web” , I agree with some of his general ideas; primarily that Apps are changing the way we use the Web. I find myself turning to apps instead of surfing the Web through a search engine.

Drawbacks: Overall, I did find it somewhat hard to type on iPad 2. The onscreen keyboard is not wide enough for normal typing, even with iPad 2 turned horizontally on its side. I also found having the onscreen keyboard displayed horizontally was subpar because of the amount of screen real estate that it took up. I’ve been finding myself using one finger to type (similar to the iPhone) and this can make certain tasks difficult.

I also have a number of questions on transporting iPad 2 safely. Should I put iPad 2 in a backpack, briefcase, or carry it in hand? I don’t have a smart cover (yet), but what about the back of the iPad and possible scratches or scuffs? I am leaning towards buying some type of pouch to put it in (which then can go in another bag), but it’s the first time that I actually felt the need to buy some type of protection for an iOS device, which I’m not thrilled about. I would hate to cover something up that was meant to be seen.

Overall, my iPad 2 has exceeded my lofty expectations. Interestingly, I am finding specific and distinct uses for my three primary Apple products (Macbook - typing, iPhone 3GS - continuous communication, iPad 2 - apps and entertainment). I believe the iOS ecosystem has reached an inflection point where app innovation now has enough momentum to self-sustain itself (given continuous product innovation from Cupertino). In the coming weeks, I will lay out my argument for why I think the iOS ecosystem is in a solid position compared to other mobile platforms and how app innovation will ultimately decide the winners and losers in this ongoing technology revolution. Stay tuned.

*I am still hesitant to pay for applications without knowing how often I will utilize the app. As I have said for months, a better app store with the ability to preview and test drive paid apps would be beneficial.

Amazon Cloud

1) While I applaud Amazon’s willingness to adapt its business model to the changing technology environment, I am left wondering if cloud music storage is the answer to Amazon’s quest for mobile content relevancy. While digital music was a hot topic a few years ago, services such as Pandora, last.fm, and Rhapsody have been gaining in popularity and serve as a viable alternative to digital music downloads. I also question Amazon’s seemingly eagerness to compete directly with Apple and its accompanying competitive advantages on more than one front.

2) I worry that Amazon’s relationship with Android and the relative ho-hum introductions of these new features (appstore and now Cloud storage) could backfire and turn into Amazon’s achilles heel. One of Google’s perceived weaknesses (but actually looked at as a strength within Google) is unveiling countless features and services with the goal of seeing what sticks, if anything. Is Amazon playing the leader or the follower with Amazon Cloud Drive? Will Amazon need to kick up its advertising campaign to put these new initiatives in front of potential users? As it stands now, mainstream media, and most of America, are unaware of Amazon Cloud Drive and probably will never use it due to this unawareness. Amazon has a had a healthy success rate in new features, but if new services are deemed unready or incomplete for prime time, Amazon’s reputation could take a hit.

3) How is Amazon’s new music storage initiative intertwined with the music labels? According to several news sources, Apple has been stuck in music label negotiations as to how to adapt iTunes to the changing times. Amazon apparently didn’t seek any licenses or music label agreements and went ahead with its plans for storing purchased music in the Cloud. Does the music label’s support actually mean anything anymore?

4) Similar to Amazon’s recently unveiled appstore, the financial impact from Amazon Cloud Drive is murky and I suspect the long-term goal is once again to reiterate the “Amazon is Web Commerce” mental connection.

5) My gut tells me Apple is looking at these digital music initiatives, but from an industry changing perspective. As the music labels remain extra conservative in negotiations for fear of losing even more power at the hand of Apple, I am a believer that music labels will eventually cave and iTunes will adapt to changing consumer habits. It remains to be seen if Amazon will be at a position capable of competing with the new and improved iTunes. As it stands now, I still see Amazon’s digital music initiatives at a huge disadvantage against the iTunes/iOS ecosystem.

Amazon Appstore

1) Amazon is a Retailer. Retail DNA. Retail Brains. Retail Ambitions.

2) Amazon’s brand is the most powerful thing it owns. Similar to how people now associate “Google” with Search, “Amazon” holds the power to be associated with Retail - at the expense of the current retail brick and mortar giants.

3) Amazon’s strategy for sustaining its brand is buying out (or killing) competing online retailers that have shown success in gaining name recognition and appeal (Zappos is a prime example). Buy or kill the competition before it becomes too big to buy or kill.

4) Amazon cannot buy or kill iTunes/App Store and Amazon sees the writing on the wall. An ecosystem such as Apple’s iTunes/App Store is in a prime position to expand its reach into online commerce - at Amazon’s expense. iTunes/App Store represents danger to Amazon’s long-term sustainability and strategy of becoming the unanimous destination for online retail and commerce.

5) Amazon now has its own mobile application marketplace, using Android apps to fill the shelves. Revenues and profits will largely be a non-factor, similar to the black box surrounding the Kindle/eBooks ecosystem. Amazon’s prime goal in creating a curated appstore is to compete against Apple, remain relevant, and stay on track to becoming the Walmart of the Web - the first and only destination for online retail.

You Want iPad 2?

1) You head to your local Apple store.

2) Although you see a queue line outside, you walk in and ask an Apple store employee if they have any iPad 2s? Answer is no.

3) After walking around aimlessly for 10 minutes, you head outside and get in-line. You are #14.

4) After talking with #4, #8, and #12, you realize that this store hasn’t received any iPad 2 shipments for two days.

5) You start to think that you can be in line for days. You have no chair, little food, and already skipped this morning’s shower. Your Apple dedication begins to wane.

6) Apple store employee walks out and says there will be no iPad 2s sold today, but an iPad shipment might arrive tomorrow morning. Queue line doesn’t seem too upset. Inside, you are torn. You think, it’s just a stupid big iPod touch.

7) Apple store is now closed. It’s dark and somewhat cold outside. Queue line is now 30 long. You wonder if anyone in line has anything else to do. Your question will go unanswered.

8) You fall asleep while laying on some gum and leaves.

9) You wake up with the sun. Two hours later, an Apple store employee comes out and says they received a limited number of iPad 2s. Numbers will be passed out shortly.

10) Line is downright giddy.

11) Apple store employee reaches you and asks which iPad 2 model you want. You say 16GB Black Wi-fi. The response: “Sorry, we didn’t receive any of those.” In a moment of desperation you then say 32GB Black Wi-fi. The response: “Sorry, we didn’t receive any of those either. We do have 64GB White Wi-fi.” You know you don’t want white and you know you don’t need 64GB, but you have waited in line for half a day. You say okay. You now own one 64GB White Wi-fi iPad 2.

12) You head home and log-on to eBay. You realize you can make $40-$50 selling your new white iPad 2.

13) Eight hours later, and after a long nap, you head back to your local Apple store (this time with a sleeping bag).

14) Although you see a line outside the Apple store, you walk in and ask an Apple store employee if they have any available extension cords. Your Macbook Air only gets 10 hours of battery life and the nearest outside power outlet is near queue line #4. You are now queue line #18.

iPad's Actual Market Share

Ever since Steve Jobs unveiled the iPad 2, people have busy trying to compare his statements to the truth, especially this one:

"Many have said (iPad) is the most successful consumer product ever launched. Over 90% market share and our competitors were flummoxed."

Where was Steve getting this 90% market share data point? Strategy Analytics showed iPad’s market share at 75% in 4Q10 and falling fast.

The thing about Steve Jobs is that he rarely outright lies, instead opting to look at data in a way that he thinks makes most sense and which contains some shred of validity. I don’t think Steve was far off from the truth saying iPad had 90% market share. Using conservative figures and assumptions, I calculate iPad’s tablet market share at 90% in 4Q10, and nearly 95% for 2010.

However, in coming quarters, iPad’s market share will fall, but not for the reasons you might think.

The main problem with market share data is that there is no easy way of measuring how many tablets are purchased by consumers. Instead, market research firms rely on company figures (i.e. Apple earnings reports, Samsung press releases) and other estimates to reach unit numbers that are better described as “shipped” rather than “sold”. There is nothing wrong with this procedure as long as it is clearly labeled and, more importantly, the accompanying attention-grabbing headlines indicate this terminology. Instead, bloggers and reporters jump to conclusions that are often misguided and misleading.

So why is it okay that companies report units shipped as units sold? It all comes down to accounting.

Companies need to determine inventory and cost of good sold figures in order to calculate earnings. Sounds simple enough. Diving deeper into purchasing contracts would show the more intricate interactions between a buyer and seller. Without jumping into the accounting bunny hole, let’s look at Apple’s most recent 10-K:

"(Apple) recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, and collection is probable. Product is considered delivered to the customer once it has been shipped and title and risk of loss have been transferred. For most of (Apple)’s product sales, these criteria are met at the time the product is shipped. For online sales to individuals, for some sales to education customers in the U.S., and for certain other sales, (Apple) defers revenue until the customer receives the product because (Apple) legally retains a portion of the risk of loss on these sales during transit.”

An iPad on a freight plane headed to a Walmart warehouse is no longer counted as an iPad in Apple’s inventory, instead it is counted as an iPad in Walmart’s inventory. Apple is able to recognize that iPad as sold and recognize the accompanying revenue (and profit).

So how should one account for market share data with this shipped/sold methodology in mind? I support the idea that proper market share data should make an attempt of calculating how many units have been sold to consumers. There is no exact science to this, and to a certain degree, even Apple and Samsung may not know day to day how much of its product is actually sold (although this process is becoming more efficient thanks to advancements such as Walmart’s lean inventory practices which notifies Apple soon after you buy iPad). Given the tablet market’s young age and small sales figures, we can reach market share according to units sold to consumers with a large degree of confidence.

Let’s start with the most recent market share data by Strategy Analytics published on January 31, 2011:

Global Tablet 4Q10 OS Shipments:

iPad: 7.3 million

Android: 2.1 million

Others: 0.3 million

According to these figures, iPad’s market share fell to 75% in 4Q10. Let us dive deeper into these numbers.

1) Since Strategy Analytics is using shipped units, I want to turn these numbers into units sold. To do this, I need to estimate the number of tablets that are currently in a company’s distribution channel, (the location between Apple’s factories and your living room). Apple’s iPad distribution channel is easy to calculate, since Apple’s CFO Peter Oppenheimer gave it to us on Apple’s most recent earnings call. iPad channel inventory was up 525,000 iPads during the quarter with a total of 4-6 weeks of sales in inventory (roughly 2.5-3 million iPads). Apple had already filled its distribution channel two quarters ago and the 525,000 additional iPads were put in the channel to fill additional points of sale. iPad was available in 46 countries with an additional 15 countries selling iPad in the beginning of 2011. To recap, Apple shipped 7.3 million iPads in the quarter, which includes stuffing 525,000 iPads into the already filled channel, leaving 6.7 million iPads actually sold to consumers (iPads shipped - iPads put in channel inventory = iPads sold). To be ultra conservative, I will assume they had to fill their channel more than they said, leaving approximately 6.4 million iPads bought by consumers during the most recent quarter.

2) Let us do the same calculation for Android sales: 2.1 million android tablets were shipped during 4Q10. How big is that distribution channel? Taking a look around the marketplace, there really wasn’t much in the way of Android tablets besides Samsung’s Galaxy Tab and we know from reports that the Galaxy Tab was available in 94 countries and 200 different wireless carriers. We also know that the Galaxy Tab was introduced close to the end of 3Q10, and market share data shows only 0.1 million android tablets were shipped during 3Q10. Ladies and gentlemen, this is called a channel stuff. Android’s 2.1 million shipped figure for 4Q10 was primarily Samsung filling its extensive channel (which I estimate to be at least 1.5 million Galaxy Tabs). Available in twice as many countries as Apple, I assume that the channel is nearly 50% the size of iPad’s channel (for the sake of being conservative). Samsung’s Galaxy Tab channel has been relatively small in the U.S., but in Asia and Europe, the Galaxy Tab’s retail reach has been much more extensive. Backing out the channel inventory, leaves me with around 0.6 million Android tablets sold during 4Q10.

3) Tablets marked as “Other” I will largely ignore since that is a non-factor considering a typical freight plane will hold a few thousand tablets at a time. I consider the 0.3 million tablets as largely channel fill and random promotions, so I will include 0.1 million “other” tablets sold during 4Q10.

Revised market share for tablets that were actually sold during 4Q10:

iPad: 6.4 million

Android: 0.6 million

Others: 0.1 million

Revised iPad market share in 4Q10: 90%. For 2010, using the same procedure, I calculate that Apple sold approximately 12 million iPads, with Android selling 0.7 million tablets and 0.1 million “other” tablets sold to consumers, giving iPad approximately 95% market share for 2010. Steve Jobs wasn’t far off with his 90% iPad market share statement.

With all of this shipped vs. sold terminology in mind, it is important to think about how this will impact iPad’s market share going forward. With tablets from RIMM and HP shipping sometime in the near future, and additional Android tablets like the Motorola Xoom, it is obvious that there will be more tablets shipped in 2011 than in 2010. Running back of the envelope numbers: if Apple can ship 20 million iPads (conservative) in 2011, RIMM ships 3 million, HP ships 2 million, and Motorola ships 2 million, iPad’s market share is now down to 74% and falling fast.

However, if we take a look at units sold, I am confident that iPad will be doing much better.

It will be interesting to keep an eye on how actual sell-through turns out for non-iPads. The tricky part in this whole market share discussion is what happens to tablets that don’t sell? Will price reductions beef up sales? What if non-iPads are literally given away? Does every non-iPad that gets manufactured eventually finds its way into the hands of a consumer? Why does all of this matter? One word. Developers.

A tablet stuck in a distribution channel or sitting on the shelve at Walmart will not lead to many sales of a developer’s application. A stack of tablets given out for free because no one wanted to pay for it doesn’t exactly sound like prime ground to stake app development dollars, and we all know that software (and the accompanying third-party app ecosystem) will ultimately decide long-term tablet market share.

Use caution when reading the dozens of upcoming tablet market share reports in 2011 or you will misunderstand what is actually happening in the marketplace.

Do You Really Understand Apple?

Person who doesn’t get Apple:

"Apple is crazy. How can they tell music streaming apps like Rhapsody that 30% of their revenue belongs to Apple? It is insane. Apple is making the biggest mistake in 10 years. All of these apps will leave the iOS ecosystem. If I am on an airplane and I see someone with an Android tablet and they are enjoying Rhapsody and I don’t have it on my iPad, I am going to buy that Android tablet. Apple is doomed if they move forward with these draconian app store rules."

Person who gets Apple:

"Apple is planning on coming out with their own music streaming service so they don’t care one lick about music streaming apps."

(the interaction underlining this post was real and involved two somewhat notorious Apple pundits…I of course paraphrased a few minutes of blabber into these two paragraphs).

HP Needs to Apologize for the webOS Event

The HP webOS event was a complete disaster leaving me questioning HP’s integrity. Am I shocked that product release dates and pricing wasn’t announced? No. However, I thought HP would at least make it look like they were interested in making webOS into something great.

1) The actual unveiling presentation was very difficult to watch demonstrating no clear understanding of who this presentation was intended for. Consumers, the press, developers? There was so much information packed into 2 hours, I don’t even know if there were good things announced. Imagine if Apple introduced the iPod Touch, iPhone, and iPad, along with iOS, in 2 hours. It just doesn’t work. There were definitely neat aspects of webOS, but they simply were overmatched by the negative aspects of the presentation. It’s a shame.

2) The products were not great. Hardware was sighted as a major downfall of the Palm Pre. To my surprise, HP webOS hardware was nothing to write home about. I really thought HP would use some Palm resources to come up with great hardware. (ok, I might have been fooling myself to ever think that). As demonstrated by iPhone and iPad, hardware is important. Why include a slide out keyboard on the Palm Pre 3? Why even make the Veer? There is no good reason the Veer should have been on that stage. It is irresponsible. If HP doesn’t know who should use the Veer, how would consumers figure it out? The TouchPad was essential an iPad clone. I am not sure if that was HP’s intention to maybe confuse consumers, but it was just bad.

3) I am left questioning HP’s overall direction. The webOS event seemed like HP gave this division a few million bucks and told them to go do something. HP’s CEO wasn’t even on stage. I didn’t expect him to demo the units, but at least show the world that top brass was fully behind webOS. In reality, HP is half-assing webOS due to fears that other strategic partners (like Microsoft) would begin to worry about HP’s commitment. HP mentioned they wanted to expand webOS into other things, but for now, it is just a lot of thinking in the clouds.

HP wants to be like Apple. Control hardware and software. HP’s webOS event made it look like they just don’t want to put the same amount of effort and attention to detail that Apple routinely gives their products.

Will HP webOS Get Knocked Out Before Entering the Fight?

HP will unveil its revamped webOS platform on February 9th and in the process reveal what has come from its Palm acquisition. There is also an evening event planned for that same day for developers interested in the webOS platform.

HP faces many challenges as it jumps with both feet, and webOS, into the mobile space. I give the company credit for trying. There is something about attempting the integrated approach of creating the hardware and software that I admire. I think HP is noteworthy as being the second company to give this integrated approach a try in the tablet space (still waiting for RIMM to ship its PlayBook). While iOS and Android are busy eating up mobile phone market share, the tablet market is less than a year old with only a handful of scrawny iPad competitors out there. Yes, I am calling the Samsung Tab scrawny. HP is still somewhat on time for the fight.

HP faces four major challenges that must be addressed before any new webOS products are shipped.

1) Lack of third-party developer interest. HP and its revamped webOS will enter the phone and tablet space with little third-party interest, as measured by developers devoting tangible resources to the platform. It’s clear management is aware of this problem, scheduling an event just for developers on the same day of the webOS announcement. Third-party support is crucial. There is also growing anticipation for webOS designed for a tablet, so one would assume developers would at least be interested in the platform.

But webOS is funny. Judging from tech pundits on the web, webOS is great, fantastic, and amazing. However, developers did not want to create apps for webOS, partially due to the lack of users. The Chicken vs. Egg paradox. When the Palm Pre went on sale in 2009, users were promised that a wide spectrum of great apps were coming and to just hold on. Two years later and Palm Pre users are still holding on. As I never forget to point out, the Palm Pre was labeled as the first iPhone killer partially due to its “potential” and “possibilities”. Those possibilities never came true.

For webOS to gain widespread third-party support, developers need to divert resources from iOS (and Android) and focus on a platform that has little to no installed base, no vibrant app economy, and no solid history of consistent developer support. Good luck with that.

2) Lack of corporate support and direction. HP is a mess right now. With a new CEO and drastic Board of Directors shakeup, I think it is appropriate to question how the change in leadership will impact HP’s mobile plans. How did the HP/Palm integration turn out? Decisive leadership is needed to make sure HP positions itself in the shrinking sweet spot required to get a solid footing and advance the HP webOS platform. The drastic management changes, in addition to the mass exodus of Palm talent, worries me.

3) Weak Branding. The HP brand has taken a beaten in recent years. HP laptops are nothing to write home about. There are no HP products to get excited about. Excitement is needed when selling consumer technology products. Palm may give HP some temporary brand power (and a loyal but small fanboy community), but Palm is not some spotless brand itself. Don’t forget Palm basically was sold in a fire sale due to running out of cash, and two Palm “smartphones” had hardware that was compared to kitchen utensils. I do find it interesting that recent HP webOS tablet renderings have the world Palm right under HP on the tablet’s back. Maybe HP does consider the Palm brand still valuable and is planning on keeping it around, although Palm was removed from the Palm webOS name a few months ago.

4) Difficult Price Points. At the end of the day, price is maybe one of the biggest factors in determining whether HP webOS products will sell. Phone pricing has a ceiling of $200 (after carrier subsidy). No phone will sell for more than $200, regardless of its feature set. Unfortunately, even $200 for a smartphone is becoming a rarity these days. Windows Phone 7 units and Android phones are often sold for under $100 and iPhone 3GS is selling for $49.

Tablet pricing is even scarier for HP. iPad’s $499 base price serves as a ceiling for the tablet market. Most companies are showing they have no means of competing with iPad on price. I can only imagine the number of tablets turned into vapor once iPad’s $499 price was revealed. Apple’s strategic supplier agreements (and technology) appears to result in attractive component pricing that gives Apple a strong competitive advantage that is difficult to match. In addition, carrier subsidies are not that popular for tablets as consumers don’t want to sign another multi-year contract in addition to their phone.

What HP needs to do on February 9th to even have a chance with HP webOS:

1) Have HP webOS phones and tablet available for demo. HP needs to show they have products that are close to being shipped. RIMM and Android are failing in this respect, announcing tablets that are no where near ready to be shipped. More importantly, demo units let users feel how heavy the devices are and test out important aspects of the UI.

2) A HP webOS tablet needs to be priced at $399 or lower. Ouch, I know. A HP webOS tablet can not have a $499 tablet because iPad sells for $499. Even if the HP webOS tablet is better than iPad, it still needs to be priced lower because of Apple’s strong brand and customer awareness. If Apple lowers the price of iPad to $399 once iPad 2 is unveiled, HP webOS tablet will need to be priced $350 or lower (these are unsubsidized prices).

3) HP needs to announce extensive and enhanced webOS third-party support with demonstrations from a number of leading gaming companies and other popular app makers demonstrating their iOS apps now ported to webOS devices. A new app store with some easy form of monetization would help.

4) Don’t give these new products silly, long-winded names. I think HP should stick with one version of a phone and one version of a tablet. HP will have more luck creating the required enthusiasm and emotional connection to webOS if all the attention is put on one product and one name. Why spread out your resources on a bunch of mediocre devices when you can release one good device?

Wild Card: HP can unveil some surprises such as completely new form factors or new technologies that Palm was working on before running out of cash. Things that make one go hmmm.

What I am afraid HP will do on February 9th (I really hope I am wrong, but we will see):

1) Have no demo units (part of me is afraid they might not even show finished units on stage).

2) Pricing will not be released or discussed.

3) The lack of third-party interest will continue to be questioned, in which HP will simply say developers are really interested in the platform and they cant wait until apps start arriving.

4) HP will announce an extensive line-up of phones and tablets with silly names and useless features. People will forget their names and which product is which a few hours later.

5) HP wont announce any of this stuff and will simply talk about webOS 3.0.

HP webOS has potential, but in a mobile phone space where powerhouses like Microsoft are struggling and in a tablet market where Motorola and Samsung are having a hard time matching the right price points, HP will need to have luck in its corner for webOS to have a chance in this hard fight.