"iPhone Impact on Verizon" For Dummies

Verizon with iPhone

Verizon with no iPhone

There will be a pop quiz next Wednesday. So take notes!

Big M&A Not in Apple's DNA

What will Apple do with its $50 billon cash hoard, which is growing nearly $20 billion annually? On January 6, a Bloomberg article-stating that Apple was shopping around for a new CFO-led some to think that Apple is interested in picking up its M&A pace. In recent months, rumored Apple targets have included Disney ($75 billion), Sony ($40 billion), Netflix ($10 billion), and Twitter ($5 billion).

Steve Jobs, Apple’s CEO, stated on Apple’s most recent earnings call:

[Apple] strongly believe[s] that one or more very strategic opportunities may come along that we’re in a unique position to take advantage of because of our strong cash position. And I think we’ve demonstrated a really strong track record of being very disciplined with the use of our cash. We don’t let it burn a hole in our pocket, we don’t allow it to motivate us to do stupid acquisitions. And so I think that we’d like to continue to keep our powder dry because we do feel that there are one or more strategic opportunities in the future. That’s the biggest reason. And there are other reasons as well that we could go into. But that’s the biggest one.

While Steve sure sounded like Apple is looking at a huge M&A deal, I don’t expect Apple to acquire any large companies (which I label as anything with a $3 billion and higher price tag).

Company Culture. It is an understatement to say that Apple’s corporate culture is unique. Apple managers have roles that are not typical in other companies, with more time spent on actual product development and brainstorming. Apple managers rarely just manage. Former IBM executive Mark Papermaster reportedly left Apple only a few months on the job as SVP Devices Hardware Engineering due to cultural incompatibility. On top of that, Apple had spent months trying to fill the SVP Hardware position before settling on Papermaster. It is tough for Apple to fill its top ranks due to its unique culture. If Apple were to acquire a company with a large workforce, it would be tricky to assimilate these new Apple workers to the culture that has led to so much success. Conflicting company culture is one of the biggest reasons for failed M&A and that rings even truer in Silicon Valley.

Company Structure. As I discussed in a previous AAPL Orchard post, Apple’s structure allows decision makers to come in contact with everything that is shipped to the consumer (Macs, iPhones, iPads, etc) and more importantly everyone who is in charge of the product (designers, engineers, marketers, etc.). Ideas are not bounced off of committees. Finished products are not required to get a certain number of approvals. I know of few, if any, large companies with a similar structure. For Apple to acquire and assimilate a company with a management structure reminiscent of a Egyptian pyramid, more than luck and hard work would be needed.

No Prior History for Large M&A[1]. Apple has never acquired a large company. Apple’s largest acquisition was NeXT in 1997 for $404 million ($540 million inflation adjusted). Recent acquisitions P.A. Semi and Quattro Wireless were $278 million and $275 million, respectively.

What is the right kind of M&A for Apple?

Peter Oppenheimer, Apple CFO, on Apple’s F1Q10 earnings conference call was pretty clear:

[Apple] occasionally acquire[s] small companies from time to time for their technology and talent. That is why we do it.

Tim Cook, Apple COO, shed more light on Apple’s M&A strategy at an investor conference in 2010.

[Apple has] always been about making the best product, not having the highest market share or the highest revenue, and so acquiring a company so our revenue gets larger isn’t something that drives us.

I think Tim Cook’s quote is important. Apple is focused on making the best products, not growing it’s earnings. Steve Jobs knows great products drives great earnings and Apple will never follow any other rule, or its continued success will be in jeopardy.

As an example, would Apple acquire Twitter? Would Twitter help make Apple’s current product lineup better? I don’t think so. (I am not even considering Twitter’s financials and possible sale price)

So what will Apple do with it’s cash?

1) Acquire talent to plug any holes in Apple’s current team and resources. I suspect some software team acquisitions may be in the offering as distinguishing software will become even more important for Apple to set itself apart from the competition. Buying smaller teams of outside talent makes company assimilation, from both a culture and company structure viewpoint, easier to accomplish. A small group of acquired software engineers can be quickly lumped within the iTunes or iOS team without much disruption.

2) Long-term agreements (aka “strategic opportunities”) for product components. In 2009, Apple paid an up-front cost of $500 million to enter into a long-term agreement with Toshiba for NAND flash chips. Recent rumors include Apple partnering with Sharp and Toshiba to build LCD factories with a price tag over $1 billion. Apple faces supply constraints whenever a new product is released and I expect Apple to pour billions into its infrastructure, forming new partnerships to guarantee that components are available, and at a good price, when needed. Finally, Apple needs additional investments, such as the $1 billion data center in North Carolina, to support and grow its current product lineup.

3) I don’t expect Apple to buyback its stock or issue stock dividends in the near term.

All of these investments and cash outlays won’t end up costing anywhere near $50 billion, but since when was having a lot of cash that bad of a thing?

[1] Some will say it is for this reason that Apple is interested in a more experienced CFO. I would respond that Apple’s storied history is a result of no large M&A. For Apple to change course now, especially considering how its team is performing, would be shocking to me and serve as a worrying indicator that something is awry in Cupertino. I am not ruling out large partnerships or agreements with certain companies that are not in a position to be acquired (Facebook, AT&T, Comcast etc.), but these are a whole other ball game compared to an acquisition.

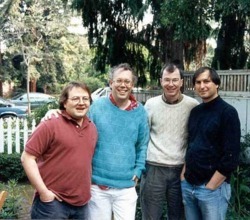

I love these vintage photos (if you can call a photo from the 1990s and the original iPhone introduction as vintage). You should be able to name at least two people from these photos - most likely three. If you can name all four: congrats, you are a true Apple believer. Sometimes we forget what Apple is really about. #TrueApple

Clue: First photo: H A T J Second Photo: J H A

Various Holiday Crowds

Apple

Microsoft

Verizon

Sprint

I couldn’t make it to a Best Buy, but I’m sure that’s where everyone was buying Windows and Android products for the holidays.

My Ping

Apple - this is what I want you to do with Ping:

1) Don’t make Ping into another traditional social network. I already use Facebook. I don’t need another one.

2) Make Ping all about content discovery. I am still having an awful time finding new music. Yes, I know you have genius playlists, but a lot of times it is just so impersonal and cold. I just want to “follow” my favorite music artists and see what projects they are working on, or cool songs that they are recommending. (I don’t care what kind of music my friends are listening to - I use Facebook for this)

3) Have more music artists debut new songs exclusively on Ping for a day or two. I really enjoyed listening to the new Michael Jackson songs. It’s an excellent way to let fans listen and buy new music.

4) Bring Ping to the iOS app store. I want to “follow” my favorite iOS apps and app developers. Ping could be a great way for app developers to brand themselves. Imagine an app developer having a follower list of 25,000 iOS users on Ping. Talk about easy marketing. I can already see myself following Angry Birds or Rovio Mobile and seeing what apps they recommend, if they got inspiration from other apps, or if they will be introducing Angry Birds updates. I can’t get this type of stuff from Twitter or Facebook.

5) Please do all of this in 2011. If you wait any longer, music artists and other content creators are only going to be strengthening their Twitter and Facebook presences. If I was a content creator, I would give iTunes and Ping (and all of those credit cards attached to Ping profiles) some attention.

Thanks

(P.S. Apple - I already know you are doing all of this, but just make believe I am the first one telling you)

iPhone Can Still Beat Android in Smartphone Market Share

On smartphone battlefields where iPhone hasn’t yet arrived, Android is winning the battle.

It is premature to declare Android the eventual winner in the smartphone market share race, even with Google now activating 300,000 Android units/day. Steve Jobs noted on Apple’s recent quarterly earnings call that there is "no solid data" on Android phone shipments. For this argument, let me assume Google is actually selling 300,000 Android units/day (27 million/quarter). Apple sold 14.1 million iPhones in the most recent quarter and is on track to sell 15-16 million iPhones/quarter.

How can iPhone outsell Android if these sales numbers are correct? Here are the reasons why I think iOS can still beat Android in terms of smartphone unit market share:

1) iPhone (4 and 3GS) is outselling Android (dozens of models) in markets where both iPhone and Android are competing face-to-face on the same carrier.

iPhone dominates European mobile ad market

Mobile OS usage; iOS #1 in North America, Europe, and Australia

When a customer has the choice between iPhone and Android, side by side, they are choosing iPhone.

(I recognize that these links rely on data that carries a number of disclaimers and is often based on some sort of survey, to which I say, show me clearer evidence. With Google, mobile carriers, and phone manufactures not releasing actual Android unit sales figures, what other type of evidence can be obtained on a regional basis? The only surveys and evidence that even try to depict OS mobile market share continuously point to iOS leading Android in regions where both are sold on the same carriers)

2) Verizon. Android has received a ton of attention and mind share due to its strong hold on Verizon’s 90 million customers. While a few million Verizon subscribers have jumped ship over the past three years to buy iPhone on AT&T, the majority haven’t due to high carrier switching costs, including termination fees, sticky family plans, and differing coverage areas.

Why are Verizon customers buying Android phones?

A) Coming from a feature phone, any Android phone will appear amazing. The ability to use the internet or check email on a touchscreen is truly amazing for someone coming from a basic phone.

B) Android phones are in front of Verizon customers. Most Verizon subscribers pick a phone from the selection that they see in a Verizon store or kiosk. If the only thing a customer sees is Android, chances are good that they will buy an Android phone.

C) Verizon customers have few options: stay with a feature phone, buy Android, or leave Verizon and buy iPhone on a network that doesn’t support phone calls due to their awful coverage and service. Which option would you choose?

In addition, with Sprint and T-Mobile not selling the iPhone, Android has the perfect incubator to flourish - a market of about 180 million subscribers with no access to iPhone (AT&T has 90 million subscribers).

3) Interesting Android developments in recent weeks have actually supported my thinking that iOS isn’t in as bad shape as some may say. For example, the Samsung Galaxy Tab has sold 1 million units in its first 28 days - nearly as fast as the iPad - pretty remarkable.

Although the Galaxy Tab is a tablet computer and not a smartphone, I think there is an interesting development to be seen from this data. The Galaxy Tab has done well thanks in part to its sales in South Korea, a country where android has 80% market share, a country where Samsung is a source of national pride. Reports indicate that approximately 50,000 - 70,000 Galaxy Tabs were sold in South Korea in the first 28 days (the Galaxy Tab went on sale in a total of 30 countries). What about iPad? In South Korea, the the iPad just went on sale three weeks ago and initial sales are already on par with Galaxy Tab and I imagine iPad sales will soon exceed the Galaxy Tab. The Galaxy Tab entered a market that was void of iPads, with people eagerly wanting to get their hands on iOS.

Google VP of Engineering Andy Rubin recently said, “After the US, (Android) saw Asia go crazy” with sales in South Korea going “berserk” in the past four months. Once again, it’s funny how Android is doing so well in South Korea. How about iPhone? Well, South Korea recently decided to allow iPhone sales in South Korea. So Android was doing great in South Korea, a country where iPhone was banned. A true battle is one where both sides are present.

China is another interesting story. China Unicom, China’s second largest mobile carrier with approximately 175 million customers, is the exclusive provider of iPhone in China. Last year, the iPhone unveiling was a disaster in China due to restrictions imposed on the device by the Chinese Government. In 2010, iPhone 4 is a complete success with over 200,000 pre-orders being taken for the device and curbs having to be put in place to control the buying frenzy in Apple stores. Overall though, Apple still has a small presence in China with only four retail stores and the largest mobile carrier, China Mobile and its 570 million customers, still not carrying the iPhone. A true battle is one where both sides are present.

My thesis will be validated, or disproven, by Verizon iPhone data in 2011 (and possibly by China Mobile carrying iPhone in 2011). If Verizon sells the same number of iPhones as AT&T (somewhere in the neighborhood of 10-15 million in the first year), my thesis will most likely hold true and iOS will be the top selling smartphone platform in the U.S.

Music Wars: Facebook vs. Twitter vs. Myspace vs. Ping

Curious as to how Ping adoption rates were doing, I compared several popular music artists on Facebook, Twitter, Myspace, and Ping as of 10:45 am December 11, 2010. I also looked at the number of original updates posted on Friday (December 10) by each music artist.

Justin Bieber

Facebook: 16,672,233 fans (original updates: 7)

Twitter: 6,295,146 (updates: 17) (38% of FB fans)

Myspace: 1,118,446 (blog updates: 1) (7% of FB)

Ping: 0 (updates: 0) (0% of FB) - No Ping page

Lady Gaga

Facebook: 24,578,788 (updates: 1)

Twitter: 7,325,965 (updates: 1) (30% of FB)

Myspace: 1,420,540 (blog updates: 0) (6% of FB)

Ping: 635,799 (updates: 0) (3% of FB)

Michael Jackson

Facebook: 25,158,445 (updates: 2)

Twitter: 264,761 (updates: 4) (1% of FB)

Myspace: 1,008,716 (blog updates: 0) (4% of FB)

Ping: 76,826 (updates: 0) (<1% of FB)

Coldplay

Facebook: 8,401,093 (updates: 1)

Twitter: 3,287,929 (updates: 2) (39% of FB)

Myspace: 665,719 (blog updates 0) (8% of FB)

Ping: 427,010 (updates: 0) (5% of FB)

Atomic Tom (band playing song using iPhones on NYC subway)

Facebook: 37,799 (updates: 2)

Twitter: 2,674 (updates: 2) (7% of FB)

Myspace: 12,318 (blog updates: 0) (33% of FB)

Ping: 2,447 (updates: 0) (7% of FB)

Quick Observations:

1) Facebook pages are killing the compeititon. Pages are easy to navigate and include gift shops and song previews. Comment threads are packed.

2) Lady Gaga had the option to buy songs on Facebook through iLike (which has deep partnerships with Myspace and Facebook).

2) Twitter had around 30% the number of Facebook followers. Smaller bands have much smaller twitter follower lists. Combined, Myspace and Ping had, on average, less than 10% the number of Facebook followers. Atomic Tom had a much bigger representation on Myspace and Ping compared to Facebook and Twitter. Will lesser-known artists/independent musicians turn to Ping?

3) Music artists have more fans following their Myspace page compared to their Ping page, but Myspace pages seem very cluttered and slow.

4) Maintaining four different fan/music pages seems like a difficult task and very redundant. Original updates were minimal across the board with even twitter updates kept to the occasional promotional tweet (not fun to read).

5) From the music artist’s point of view, which page is most important? Whichever offers the best spot for music fans to interact and buy music.

Facebook is currently the best spot for fans to interact. Besides Lady Gaga having the option to buy music using iLike, every other artist mentioned in this post relied on Facebook fans going elsewhere to buy their digital music, with iTunes remaining the easiest option.

Facebook + iTunes integration - watch out. (Could this be the reason why Apple and Facebook can’t seem to agree on Ping?)

Two articles on the disagreement between Facebook and Apple on Ping:

This post was compiled while streaming Michael Jackson’s new album “Michael” through Facebook.

Making Big Bets and Controlling Risk - How Apple Succeeds

I get to hang out with some of the most talented, committed people around, and together we get to play in this sandbox and build these cool products. Apple is an incredibly collaborative company. You know how many committees we have at Apple? Zero. We’re structured like a start-up. We’re the biggest start-up on the planet. And we all meet once a week to discuss our business. - Steve Jobs D8 Conference June 1, 2010

Success in Silicon Valley results from placing the right bet at the right time. When analyzing the competitive landscape, knowing who is capable of making big bets is crucial.

Apple is among a select group of firms capable of placing bets big enough to change the world. How? Apple’s corporate structure helps to control risk.

Apple’s start-up mentality begins with a small number of shallow groups - all leading back to one central visionary. There is no confusion what Apple’s groups are: Mac, iPod, iPhone, iPad, iTunes. Everything else comes second and can be folded into one of those categories (don’t forget about R&D and Steve’s “special projects” either).

Apple relies on resource prioritization. Upper management may spend most of their time working on iPhone in the weeks leading up to the annual iPhone announcement, only to shift to Mac in the weeks leading to the annual Fall Mac announcement. Meanwhile, support staff designated to each individual product are busy year-round preparing for future product revisions, all the while guided by strict deadlines. It is for this reason that Apple is quick to kill product lines based on old technology and other unsuccessful ventures. All resources are geared to the future.

This structure lets the decision makers (upper management) come in contact with everything that is shipped to the consumer (Macs, iPhones, iPads, etc) and more importantly everyone who is in charge of the product (designers, engineers, marketers, etc). Ideas are not bounced off of committees. Finished products are not required to get a certain number of approvals. Decisions are made at the top quickly and decisively.

How does this corporate structure relate to placing big bets?

Apple is able to translate a big idea (big bet) into reality with very little friction and inefficiency. The biggest risk enters the equation on the demand side - whether consumers want the product. All other variables (risk factors) are controlled by Apple’s corporate structure - the supply chain is ready to go, designers have run their ideas by upper management, engineers have been given their tasks and deadlines, and marketers know the message to send. The machine remains well-oiled and ready to go.

Most importantly, this machine can be turned on by the main operator (Steve Jobs) one day and be turned off the next, with little impact on any other product.

Steve Jobs makes bets. Big ones. The iPod was a huge bet. Back in 2001, people had big money invested in CDs and iTunes was still a few years away. Apple took another huge risk with iPad. Would consumers and third-party developers be interested in a tablet form factor? How would iPad cannibalize MacBooks?

Apple needs to take risks to control where technology is heading. As long as most of the risk variables are monitored and marginalized to a certain extent by upper management (and Steve Jobs) -the consumer is left as the biggest risk. Apple can then rely on its brand power to turn the odds in their favor.

Apple iPod Event - 2001

Always fun to look back at prior technology unveilings - especially those put on by Apple.

How many people thought this was a big deal back in 2001? And to think…the iPod Touch is a direct descendent of the iPod unveiled by Steve in this video.