Apple Device Upgrading Is Improving, Apple’s Underpenetrated Services Business

Today's Above Avalon Daily update includes the following stories:

Apple Device Upgrading Is Improving

Apple’s Underpenetrated Services Business

Happy Monday. This past Friday’s update included my initial thoughts on Apple’s strong earnings and how my numbers compared to Apple’s results.

The following snippet was from Friday’s update:

“Apple’s financials are now showing the impact from management doubling down on its ecosystem via:

More frequent and substantial product updates (thanks in big part to Apple silicon). One way of getting existing users to [up]grade is launch new and exciting product updates that add genuine value to people’s workflows and lives.

Greater awareness on management’s part that Apple’s ecosystem is severely under-penetrated from a Services monetization standpoint. Apple’s AI strategy is flying under the radar with the company well-positioned to leverage its role as distributor of AI-infused apps and services to an ecosystem of 1.5B+ premium users.”

There’s much to unpack from that snippet regarding two of the major takeaways from Apple’s earnings: Improving Apple device upgrading trends and Apple's Services growth potential.

Let's jump right in.

An Above Avalon Daily subscription is required to read this daily update. Subscribers can read the update here.

An audio version of this update is available to members who have the podcast add-on attached to their membership.

Choose either a monthly or annual subscription. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and subscription status at any time.

Subscriber Privileges and Benefits

Exclusive Analysis. Receive the Above Avalon Daily newsletter, widely-recognized as the leading daily newsletter dedicated to Apple. Now in its tenth year.

Archive Access. Access previous updates sent to members in an easy-to-navigate archive built in Ghost.

Full Access to Above Avalon Forum. Access exclusive channels in the Above Avalon forum in Discord.

Email Access to Neil Cybart. Receive timely responses from Neil to email inquiries.

Access Bundle Discounts. Customize a subscription with additional Above Avalon products and save: AVALON, Podcasts Packages, Inside Orchard, and Financial Models.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent voice and resource. Above Avalon is 100% funded by subscribers.

iPhone, Mac, and Apple Watch Unit Sales Data

Hello everyone. We will continue our Apple 3Q25 earnings review. Leveraging the latest Apple financial data, we take a closer look at iPhone, Apple Watch, and Mac unit sales. In some ways, the three product categories are each telling a different story. Let's discuss.

iPhone, Mac, and Apple Watch Unit Sales Data

After spending more time with Apple’s 3Q25 earnings and my Apple earnings model, the most intriguing takeaways from Apple’s quarter were found with something that the company doesn’t actually disclose themselves: HW unit sales. Specifically, iPhone, Mac, and Apple Watch unit sales. Apple stopped disclosing unit sales data in 2018. My earnings model derives unit sales data from Apple HW revenue disclosures, management commentary, and my installed base models that track upgrading behavior.

We will circle back to talk more about the latest Apple margin trends tomorrow when going over Apple's 3Q25 earnings call with analysts. While there are fresh headwinds for margins in terms of tariffs and greater investments in AI, FX has flipped to being neutral to even slightly positive. In addition, Apple’s overall gross profit found with HW is moving higher despite margin percentages coming down a tad.

iPhone Unit Sales

Based on headlines and articles in recent years, one may think iPhone sales peaked a while ago and have been flat or even trending down since. This would be a misread of the situation.

Become a member to continue reading today’s update. Already a member? Read the full update here.

An audio version of this update is available to members who have the podcast add-on attached to their membership.

Member Privileges and Benefits

Become an Above Avalon member and receive the following privileges and benefits:

Exclusive Analysis. Receive the Above Avalon Daily newsletter, widely-recognized as the leading daily newsletter dedicated to Apple. Now in its tenth year.

Archive Access. Access previous newsletters sent to members.

Member Forum Access. Access all channels in the Above Avalon forum in Discord.

Email Access. Receive timely responses from Neil to email inquiries.

Access to Add-ons. Customize a membership with the AVALON, Podcasts, Inside Orchard, and Financial Models add-ons.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent voice and resource.

Deconstructing Apple’s Product Event (iPhone)

Hello everyone. We will conclude our Apple event review, focusing on the iPhone segment of the presentation.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Above Avalon Membership

Choose either a monthly or annual membership. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time. Contact me with any questions.

Contact me directly if you would like to purchase multiple subscriptions (five or more) for your team or company.

An audio version of the newsletter is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-ons.

Apple FY3Q22 Earnings Recap

Two weeks ago, Apple reported a solid FY3Q22 (April to June) given the tough year-over-year compare and considerable FX headwind. In terms of good news, supply chain issues, component shortages, and COVID-related headwinds appear to have bottomed for Apple. When it comes to bad news, some parts of Apple’s business are getting hit by inflation and slowing economic growth more than others.

Here are Apple’s reported 3Q22 results versus my expectations with brief commentary for each item.

Revenue: $83.0 (vs. my $85.9B estimate). Results missed my estimate due to a larger than expected headwind from FX, a larger than expected supply shortage with Mac, and macro issues impacting Wearables, Home, and Accessories.

EPS: $1.20 (vs. my $1.25).

iPhone revenue: $40.7B (vs. my $39.9B). That’s a good iPhone revenue number that doesn’t raise any yellow or red flags to me.

Services revenue: $19.6B (vs. my $20.1B). Results missed primarily on a larger than expected headwind from FX.

Wearables / Home / Accessories revenue: $8.1B (vs. my $9.4B). This was a weak number which Apple attributed to a “cocktail of headwinds.”

Mac revenue: $7.4B (vs. my $8.9B). Apple experienced major issues with supply as the Mac was the product category impacted the most by COVID lockdowns closing factories in China.

iPad revenue: $7.2B (vs. my $7.6B). Apple experienced ongoing issues with iPad supply.

Overall gross margin: 43.3% (vs. my 43.3%)

Services gross margin: 71.5% (vs. my 72.0%)

Products (HW) gross margin: 34.5% (vs. my 34.5%)

Breaking down the $2.9B revenue miss to my estimate, there were two primary drivers:

$1.5B revenue miss due to Mac supply not being as good as thought.

$1.3B revenue miss due to weaker Wearables, Home, and Accessories.

Even though Apple missed my (elevated) expectations, the company reported a 3Q22 beat to consensus as revenue came in about $2B stronger than sell-side analysts were expecting. The beat was due to stronger iPhone revenue as most analysts were expecting something more like $36B to $38B of iPhone revenue (vs. the $40.7B reported figure). EPS came in $0.04 above consensus as Apple’s margins came in slightly better than consensus thought as well.

An Above Avalon membership is required to continue reading this article. Members can read the full article here.

The full article includes the following sections:

Apple’s 3Q22: The Key Numbers

iPhone Sales Resiliency

Apple Ecosystem Growth Slows

Reading Between the Lines of Apple’s 3Q22 Earnings Q&A With Analysts

Notes From Apple’s 3Q22 10-Q

Tracking Apple’s Paid Subscriptions

Apple's Share Buyback Update

My Revised Apple Financial Estimates

An audio version of the article is available to members who have the podcast add-on attached to their membership. More information about the add-on is found here.

Above Avalon Membership

Become a member by using the following signup forms (starting at $20 per month or $200 per year).

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The Rise of Smaller Displays

Apple is a design company selling tools capable of improving people’s lives. Approximately 80% of those tools include a display. Apple is shipping about 300 million displays per year, from iPhones and iPads to Macs and Apple Watches. With Apple running as fast it can towards AR glasses, the number of displays that the company ships will only increase over the next five to ten years. While the pandemic is pushing people to embrace larger displays like iPads and Macs, the momentum found with smaller displays is still flying under the radar.

Display Spectrum

Back in 2017, I published the following chart that tracks Apple device unit sales by display size. The exercise involved breaking out iPhone, iPad, and Mac unit sales by model - something that Apple has never done itself but which the company provided enough clues for me to do on my own and have confidence in the estimates.

Exhibit 1: Apple Device Sales Mix by Display Size (2016 data)

Since Apple offers a finite number of display choices, Exhibit 2 turns the sales data from Exhibit 1 into a broader statement about preferred display size.

Exhibit 2: Apple Device Sales Mix by Display Size (2016 data - Smoothed Line)

The motivation in pursuing such an exercise was to place context around the number of large displays Apple was selling in the form of MacBooks and iMacs. Fast forward three years, and it’s time to revisit the topic. With the significant amount of change occurring in Apple’s product line since 2016, there is value in going through a similar exercise regarding display size preference with 2020 unit sales in mind. While Apple’s financial disclosures haven’t gotten better over the past four years - if anything, the disclosures have gotten worse - I am still confident in my ability to derive unit sales estimates for all of Apple’s products.

Exhibit 3: Apple Device Sales Mix by Display Size (2020 data)

Exhibit 4: Apple Device Sales Mix by Display Size (2016 data - Smoothed Line)

(All of my granular estimates and modeling that went into Exhibits 3 and 4 is available to Above Avalon members in the daily update published on December 7th found here.)

As seen in Exhibits 3 and 4, there is bifurcation in Apple display size popularity. The most in-demand displays fall into two (broad) categories:

Displays large enough for consuming lots of video and other forms of content that can still be comfortably held in a hand or stored in a pocket.

Displays small enough to be worn on the body (Apple Watch) and products lacking a display altogether (AirPods).

It hasn’t been difficult to miss Apple’s gradual move to larger iPhone displays over the years. The 6.7-inch iPhone 12 Pro Max is getting close to the maximum size for an iPhone display, at least when thinking about the current form factor. Such a reality has undoubtedly played a role in some smartphone manufacturers betting heavily on foldable displays for smartphones. Such a bet boils down to believing consumers will want larger smartphone screens to the point of being OK with tradeoffs in terms of device thickness and weight. Move beyond the iPhone and display popularity plummets as the iPad and Mac sell at a fraction of the pace. There are small sales peaks found at 10.2 inches, the size of the lowest-cost iPad, and 13.3 inches, the size of the MacBook Air and entry-level MacBook Pro.

With hundreds of millions of people embracing 4.7-inch to 6.7-inch displays via iPhone, the claim that consumers are embracing larger screens over time contains some validity. Many are now wondering if similar moves to larger displays will take over the iPad and Mac lines. However, focusing too much on large displays will make it easy to miss what is happening at the other end of the spectrum. The rise of wearables has given an incredible amount of momentum to small displays and devices lacking a display altogether.

Implications

There are four key implications arising from this display bifurcation observation.

Apple’s ecosystem naturally supports the idea of multi-device ownership.

As devices are given more roles and workflows to handle, there is a natural tendency for screen sizes to increase without changing the overall form factor much.

Power and value are flowing to smaller displays that are capable of making technology more personal.

Devices relying on voice as an input make more sense when paired seamlessly with devices with displays.

It is worth going over each in greater detail.

1) Apple’s ecosystem is characterized by hundreds of millions of iPhone-only users buying additional Apple products and services. This is a result of industry-leading customer satisfaction rates and subsequently very strong brand loyalty. However, there are more fundamental themes underpinning this trend. By controlling hardware, software, and services, Apple is able to sell a range of products that seamlessly work together. These tools don’t serve as replacements for one another but rather as alternatives. This leads to consumers being able to use multiple Apple devices aimed at handling different workflows in their unique way. Such a dynamic supports the idea of multi-device ownership over time with those additional Apple devices likely containing smaller displays or no displays at all.

2) Apple has given the iPad, iPhone, and Apple Watch larger displays over time. For the iPad, the 12.9-inch / 11-inch iPad Pro and 10.9-inch iPad Air are larger than the initial 9.7-inch iPad and subsequent 7.9-inch iPad mini. The 3.5-inch display found with the first few iPhone models looks downright tiny next to iPhone 12 flagships. Even the Apple Watch was given a larger display after being sold for three years. These moves may seem to be unnoteworthy reactionary outcomes to competitors and market forces. However, the move to larger displays over time ends up being connected to the product category handling more workflows over time. iPhones have become “TVs” for hundreds of millions of people. Today’s iPad Pro flagships are geared toward content creation. Apple Watch faces are being given more complications in order to provide additional new-age app interactions to wearers.

3) The two product categories seeing the strongest unit sales momentum have either the smallest displays Apple has shipped (Apple Watch) or no displays at all (AirPods). As wearables usher in a paradigm shift in computing by altering the way we use technology, new form factors designed to be worn on or in the body for extended periods of time are playing a role in helping to make technology more personal. This leads to an observation that may not be so obvious: Smaller displays require new user inputs and interfaces that force new ways of handling existing workflows while supporting entirely new workflows. Said another way, smaller displays end up playing a vital role in lowering the barriers between technology and humans.

4) The reason stationary smart speakers were one of the biggest tech head fakes of the 2010s is that consensus incorrectly assumed the future was voice and just voice. The idea of voice as a user input being enhanced by the presence of a display was skipped over. Jump ahead a few years and the HomePod is arguably made better by having nearby displays either simply around us (iPhones) or on us (Apple Watch). Some of the magic found with AirPods involves the seamless integration with various displays, especially the Apple Watch display. Voice just isn’t an efficient medium for transferring a lot of data and context. Relying on displays for such context makes it possible for devices without displays to shine by being allowed to do what they do best - either provide superior sound (HomePod) or convenient sound (AirPods).

Bet on Smaller Displays

One takeaway from the pandemic has been that social distancing in the form of distance learning and working from home has fueled momentum for some of the largest displays in Apple’s product line. The iPad is setting multi-year highs for unit sales and revenue. The Mac registered an all-time revenue record last quarter. There are a few reasons behind this momentum that include families needing newer (and faster) machines and employers funding work-from-home upgrades.

Instead of looking at this development as the start of a new era for large displays, the momentum found with larger displays shifts focus away from the actual revolution taking place with smaller displays.

Apple is on track to sell approximately 150M devices in FY2021 that either lack a display or contain a display that is less than two inches (5 cm). We are still in the early innings of this revolution. Looking ahead at AR glasses, Apple will eventually sell devices containing two small displays for the first time. Relying on conservative adoption estimates, Apple will sell hundreds of millions of devices per year that contain either small displays or no displays at all. We are seeing the rise of smaller displays, and the secret to witnessing it is knowing where to look.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

A Billion iPhone Users

A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Thirteen years after going on sale, the iPhone remains the perennial most popular and best-selling smartphone. Competitors continue to either shamelessly copy iPhone or, at a minimum, be heavily influenced by the iPhone. Looking ahead, Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

iPhone Sales

Over the past two years, iPhone sales have experienced notable gyrations. In early 2019, Apple saw material weakness in iPhone sales due to deteriorating economic conditions in China related to U.S. trade tensions. Although Tim Cook faced some skepticism when making such a claim, the observation was later proven to be legitimate as a number of other companies went on to describe a similar slowdown in demand.

As shown in Exhibit 1, iPhone unit sales on a trailing twelve months basis dropped by about 12% in early 2019 from a 218 million annual pace to a 191 million pace. The iPhone business went on to experience a gradual improvement in sell-through (i.e. customer) demand during the second half of 2019 and the beginning of 2020 before the pandemic hit. iPhone unit sales are back above a 200 million annual pace and are currently 13% below the unit sales high experienced in 2015.

Exhibit 1: iPhone Unit Sales (TTM Basis)

At a glance, Exhibit 1 would suggest that the iPhone business has lost some of the shine it had in the mid-2010s. However, this would be a misreading of the situation. On its own, unit sales don’t tell us the full story about the iPhone business. This is the primary reason behind Apple’s decision in late 2018 to stop providing unit sales data on a quarterly basis. Wall Street was incorrectly using unit sales as a crutch for shoddy analysis.

Flat to down iPhone unit sales do not automatically mean iPhone business fundamentals have deteriorated. Instead, a longer upgrade cycle can be a leading factor behind declining unit sales. In addition, unit sales don’t say anything about customer loyalty and satisfaction rates, which are crucial when it comes to a customer’s decision to continue using a product.

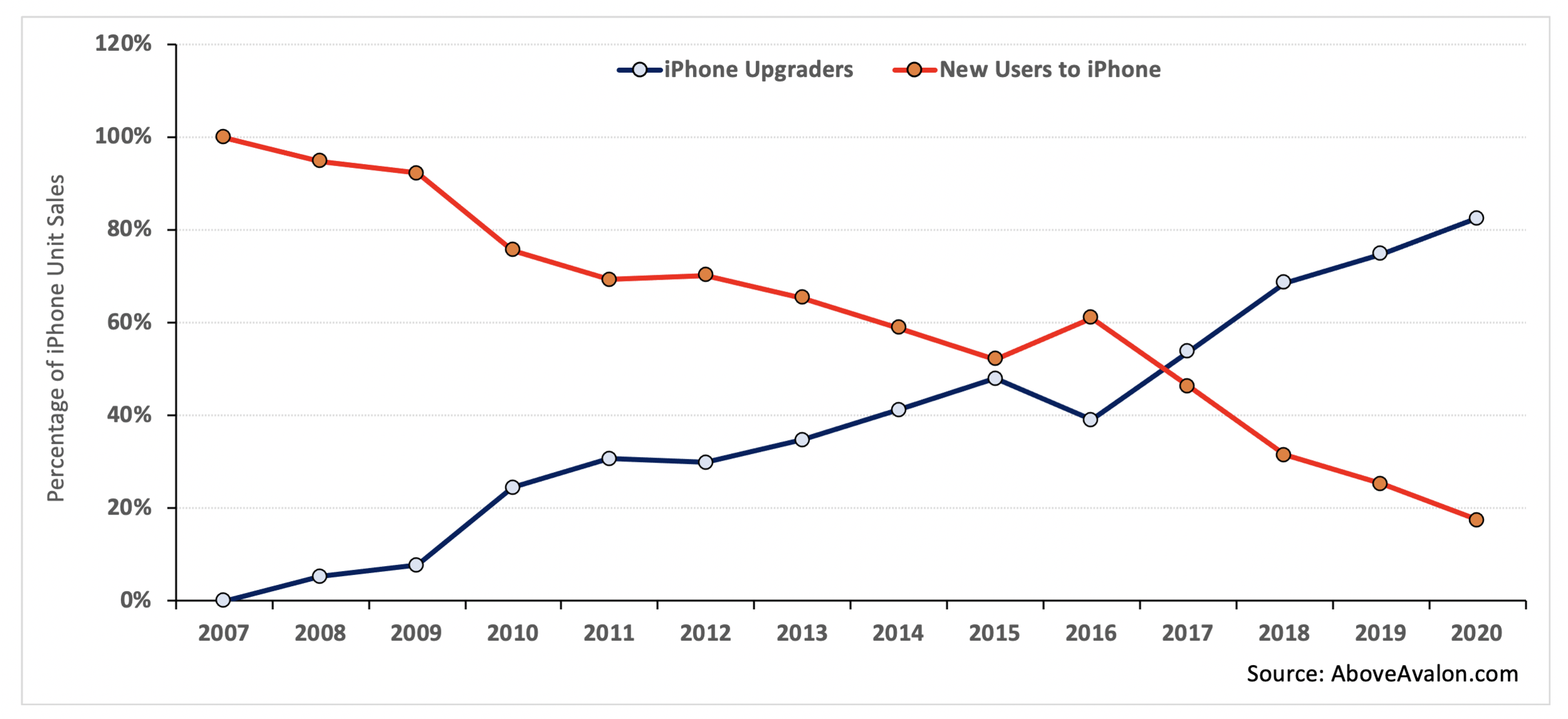

In order to reach more valuable insights regarding the iPhone business, Exhibit 2 takes unit sales data from Exhibit 1 and adds granularity. Instead of looking at sales just in terms of the number of units shipped from a factory, Exhibit 2 takes into account who bought iPhones: customers upgrading to a new iPhone or customers buying their first new iPhone. The data is derived from my iPhone installed base model that tracks when customers entered the installed base and then monitors upgrading patterns.

Exhibit 2: iPhone Unit Sales Mix (iPhone Upgraders vs. New Users to iPhone)

The iPhone business has turned into an upgrading business. While Apple is still bringing in 20M to 30M new iPhone users each year, the percentage of overall iPhone sales going to new users has steadily declined. For FY2020, iPhone sales to new users will likely have accounted for less than 20% of overall iPhone sales - an all-time low.

iPhone Installed Base

While quarterly iPhone unit sales contain an inherent amount of volatility, installed base totals do a better job of monitoring iPhone fundamentals over the long run. The iPhone installed base is defined as the total number of people using an iPhone (both new and used iPhones). A shrinking iPhone installed base would raise a number of warning signs for Apple as it would suggest people have been switching to Android. A growing iPhone installed base would suggest Apple continues to see new users embrace the iPhone for the first time.

Two variables are needed to estimate and track the iPhone installed base:

The number of people who purchase (and continue to use) a new iPhone from Apple or a third-party retailer.

The number of people who are using an iPhone obtained via the gray market. These iPhones have either been passed down through families and friends or resold to new users via a web of retailers and distributors.

By combining the two groups, one is able to derive estimates for the total number of iPhones in the wild. Although Apple does not disclose this installed base figure on a quarterly basis, the company did mention that the iPhone installed base surpassed 900M devices by the end of FY1Q19. As shown in Exhibit 3, which displays my estimates for the Apple installed base over the years, the iPhone installed base has grown each year since launch and recently surpassed a billion people.

(The methodology used to reach my iPhone installed base estimates is available here for Above Avalon members.)

Exhibit 3: iPhone Installed Base (total number of iPhone users in the wild)

In recent years, the pace of growth in the iPhone installed base has slowed. Much of this slower growth is due to high smartphone penetration and Apple having already successfully targeted the premium end of the smartphone market. With that said, Apple is still bringing in approximately 20M to 30M new iPhone users per year. These users are prime candidates for moving deeper into the Apple ecosystem by purchasing other Apple devices and services. Strong growth trends seen with iCloud storage, Apple’s content distribution services, Apple Watch, AirPods, and even iPad / Mac are made possible by hundreds of millions of people moving beyond just an iPhone to own additional Apple services and devices.

iPhone Priorities

Looking ahead, Apple has three primary priorities, or goals, for the iPhone:

Push camera technology boundaries.

Increase the value found with iPhone ownership.

Increase the number of roles handled by the iPhone.

Cameras. When thinking about the iPhone feature that will lead the way over the next five to ten years, more powerful cameras are high on the list. For the past few years, camera improvements and upgrades have been positioned as the top feature found with new flagship iPhones. A similar trend has been found with every major smartphone manufacturer. This has led to a type of camera arms race as each company tries to convince consumers that they have the best camera.

The primary reason Apple and its peers are betting so big on cameras is that they are convinced consumers will find value in smarter “eyes" - cameras that increasingly move into 3D rendering and AR realms. Advances in computational photography are also leveraged to make it easier for people to take really great photos.

While a bet on the camera will turn out to be a good one for Apple, the move doesn’t lack risk. As Apple pushes camera technology forward, many existing iPhone users are content with the iPhone camera they already own. This will manifest itself in no discernible bump in iPhone upgrading simply due to camera upgrades and advancements.

Another factor behind betting big on iPhone camera technology is that the smartphone form factor remains conducive to bringing powerful cameras to the mass market. While a “selfie” camera may make sense on the wrist with Apple Watch, it is difficult to see the wrist as a good place for cameras used to capture memories. There is similar hesitation found with the idea of putting such powerful cameras on the face in the form of AR glasses. Therefore, it makes sense that the device held in our hands and stored in our pockets will likely contain the most powerful camera in our lives.

iPhone Value. A major development regarding the iPhone that continues to fly under the radar is the improving value proposition found with owing and using an iPhone. By improving iPhone durability and longevity, Apple ends up strengthening the iPhone’s value proposition via higher resale values. If a new iPhone can be recirculated to additional users, the gray market will be strengthened and consumers will find more attractive payment terms and options at time of purchase.

An increasing number of iPhone users think about iPhone pricing in terms of monthly payments rather than lump sum. Attractive trade-in offers and payment plans with built-in upgrades only serve to improve the iPhone’s value proposition.

iPhone Roles. Tim Cook kicked off Apple’s “Hi, Speed” product event earlier this month by referring to the iPhone as the product we use the most, every day. He went on to say that the iPhone has never been more indispensable than it is now.

It is in Apple’s best interest to have the iPhone take over an increasing number of roles once given to laptops and desktops in addition to handling entirely new roles. By increasing our dependency on iPhone today, Apple ends up being in a better position to sell various wearable form factors tomorrow. Wearables are designed to not only handle entirely new tasks, but also take over tasks given to the iPhone.

Peak iPhone?

In FY2015, Apple sold 231 million iPhones. There continues to be a debate regarding whether or not Apple experienced “peak iPhone,” never exceeding that 231 million unit sales total in a 12-month stretch.

As a general rule, one needs to approach “peak” sales claims very carefully with Apple products. It may be tempting to look at unit sales data and conclude that a lower sales trend won’t reverse. However, weaker sales may not be the result of a change in market fundamentals such as a permanently reduced addressable market or less capable product. Instead, lower sales may simply reflect a slowdown in upgrading.

Odds are increasing that Apple has not experienced peak iPhone. As shown in Exhibit 4, my FY2021 iPhone unit sales estimate stands at 240M units, 4% higher than Apple’s previous iPhone sales record. My estimate does not assume a mega upgrade cycle kicked off by 5G iPhones. With the iPhone installed base having surpassed a billion users and continuing to expand by 20M to 30M people each year, Apple is in a good position to grow iPhone unit sales as the iPhone upgrade cycle plateaus between four and five years. This is where iPhone’s strong resale value enters the picture with consumers embracing various upgrading plans and options made possible by a well-functioning gray market.

Exhibit 4: iPhone Unit Sales (TTM Basis) - Includes Above Avalon FY2021 Estimates

New User Generation

The iPhone was the largest contributor to Apple growing its overall installed base from 125 million people in 2010 to more than a billion in 2020. Looking ahead, it’s fair to wonder if the iPhone will remain Apple’s primary new user funnel for the next billion users.

A strong case can be made that Apple will continue to rely on the iPhone for new user generation in the near term. While flagship iPhone pricing is aimed at the premium segment of the market, the gray market continues to play its role in expanding the iPhone’s reach to lower price segments.

Apple is also getting that much closer to launching its face wearables strategy. Requiring early versions of face wearables (AR / VR glasses) to work with an iPhone is logical when thinking about the limited amount of space for technology found with a pair of thin and light glasses.

Over time, we can’t ignore the new user growth potential found with Apple wearables. Apple Watch remains on its march to full independency from the iPhone. A truly independent Apple Watch would expand the product’s address market by threefold. AirPods are similarly well-positioned for appealing to Android users around the world. This brings us to India. The country will likely play a crucial role in Apple’s strategy of bringing hundreds of millions of new people into the ecosystem. As wearables make technology more personal, the product category’s addressable market will only expand.

While the iPhone may have been responsible for Apple getting to a billion users, wearables have a decent shot of getting Apple to two billion users.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.