Sonos Closes Door to Video, Time to Start Asking the Sonos Questions, Apple Opportunities

Today's Above Avalon Daily email contains the following stories:

Sonos Closes Door to Video

Time to Start Asking the Sonos Questions

Apple Opportunities

Hello everyone. Today's update will take us into Sonos land. As Sonos continues to navigate turbulent waters, we are getting to the point when questions regarding the company's longer-term prospects need to be asked. There are also some implications to consider as it pertains to Apple.

Let's jump in.

Become a member to continue reading today’s update. Already a member? Read the full update here.

An audio version of this update is available to members who have the podcast add-on attached to their membership.

Member Privileges and Benefits

Become an Above Avalon member and receive the following privileges and benefits:

Exclusive Analysis. Receive the Above Avalon Daily newsletter, widely-recognized as the leading daily newsletter dedicated to Apple. Now in its tenth year.

Archive Access. Access previous newsletters sent to members.

Member Forum Access. Access all channels in the Above Avalon forum in Discord.

Email Access. Receive timely responses from Neil to email inquiries.

Access to Add-ons. Customize a membership with the Podcast, Inside Orchard, and Financial Models add-ons.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent voice and resource.

Sonos CEO Fired, Where Sonos Went Wrong, Smart Speaker Intrigue

Today's Above Avalon Daily email contains the following stories:

Sonos CEO Fired

Where Sonos Went Wrong

Smart Speaker Intrigue

We will shift gears by talking about Sonos. Obviously, we can point to Sonos’ problematic app as a major factor behind the company’s current predicament. We can’t underestimate just how damaging the app fiasco has been on Sonos business results. However, the app saga is a symptom of much larger and deeper issues within Sonos. Today’s discussion also goes over why the premium smart speaker space remains fascinating to me.

Become a member to continue reading today’s update. Already a member? Read the full update here.

An audio version of this update is available to members who have the podcast add-on attached to their membership.

Member Privileges and Benefits

Become an Above Avalon member and receive the following privileges and benefits:

Exclusive Analysis. Receive the Above Avalon Daily newsletter, widely-recognized as the leading daily newsletter dedicated to Apple. Now in its tenth year.

Archive Access. Access previous newsletters sent to members.

Member Forum Access. Access all channels in the Above Avalon forum in Discord.

Email Access. Receive timely responses from Neil to email inquiries.

Access to Add-ons. Customize a membership with the Podcast, Inside Orchard, and Financial Models add-ons.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent voice and resource.

The Sonos App Fiasco, Sonos Earnings, YouTube Premium Is Having A Moment

Hello everyone. We will begin today's update by focusing on the Sonos app fiasco. Our attention will then shift to Sonos earnings. The update concludes with an observation regarding YouTube Premium, YouTube's ad-free subscription offering.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Above Avalon Membership

Choose either a monthly or annual membership. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time. Contact me with any questions.

Contact me directly if you would like to purchase multiple subscriptions (five or more) for your team or company.

An audio version of the newsletter is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-ons.

Sonos FY4Q23 Earnings, Sonos Discloses New Installed Base Data, Sonos’ Product Roadmap for 2024

Happy Tuesday. Today’s update will be dedicated to discussing Sonos. The company reported earnings a few days prior to the Thanksgiving break. Sonos is on a path to being a more direct competitor to Apple.

Let’s jump right in.

Sonos FY4Q23 Earnings

Two weeks ago, Sonos reported FY4Q23 earnings (July through September).

Sonos is feeling the impact of the consumer gadget recession. Revenue was down 3.5% to $305M as the number of products sold were down 8% and speaker registrations were down 13%. The 500 basis point gap between products sold and registrations is due to channel inventory fill. This means quarterly results were boosted by Sonos putting speakers into the channel ahead of the holidays. The stronger revenue total (-3.5%) versus products sold (-8%) was due to higher speaker ASP.

The following exhibit shows Sonos speaker sales on a TTM.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time.

Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Podcast and Financial Models add-ons.

Sonos FY3Q23 Earnings, Sonos Taking Speaker Share, Sonos vs. Apple

Happy Wednesday. For today’s update, we take a closer look at Sonos’ FY3Q23 earnings. The discussion then goes over Sonos taking market share in the speaker categories that the company competes in. We conclude with key differences/similarities between Sonos and Apple.

Let’s jump right in today’s update.

Sonos FY3Q23 Earnings

Sonos has had a very busy 2023. New speakers (Era 100 and 300), services (Sonos Pro), and partnerships (Apple Music spatial audio) have fulfilled the company’s promise of continuing to move the platform forward. However, Sonos is unable to escape the consumer electronics gadget recession. Sales promotions continue to be needed to maintain speaker sales trends.

The following exhibit shows Sonos speaker sales on a TTM (trailing twelve months) basis to remove the seasonality associated with the holidays. The sales decline is becoming more noticeable.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Sonos Earnings, Sonos Unveils Sonos Pro, Peloton Earnings

Hello everyone. Two quick follow-ups to yesterday’s update:

The “ESPN in 100M households at its peak” vs. "Netflix’s 74M paying subscribers in the U.S. and Canada" is not a simple comparison. Not only is password sharing rampant with Netflix - making it likely that Netflix is found in more than 74M U.S. households – but it’s also very simple to signup/cancel a Netflix subscription. ESPN was, and still is, only available as part of a $$ bundle.

A few people reached out to me to say that they have never had a woven/fabric Apple Watch band tear or split despite years of usage. Such wear and tear for a band specifically marketed as rugged seems odd. I agree with that statement. At least based on my experience, Alpine Loop was far too delicate to be part of the Apple Watch Ultra series. That doesn't mean Apple should move away from comfortable materials for Ultra bands. Instead, they should introduce more rugged bands that begin to provide additional utility to the wearer.

In today’s update, we begin to wrap up our CY1Q23 earnings reviews with smaller companies that remain intriguing to keep an eye on from an industry/competition standpoint: Sonos and Peloton. We will cover Spotify tomorrow.

Sonos Earnings

Sonos was not able to escape the consumer gadget recession. CY1Q23 revenue was down 24% to $304M (vs. $400M last year) as fewer people bought premium speakers in the home. The closest equivalent to unit sales was down by about 30% While Sonos fell victim to a tough year-over-year compare, similar to what Apple experienced in a few product verticals, sell-through demand was also weaker.

Here is Sonos speaker sales on a TTM basis to remove the seasonality associated with the holidays:

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Sonos 4Q22 Earnings, Spotify Subscriber Trends (Daily Update)

We kick off today’s update by looking at the latest earnings release from Sonos. The discussion then turns to Spotify’s earnings with a focus on the company’s subscriber trends.

Hello everyone. Welcome to December. This month is going to fly by.

Two quick notes:

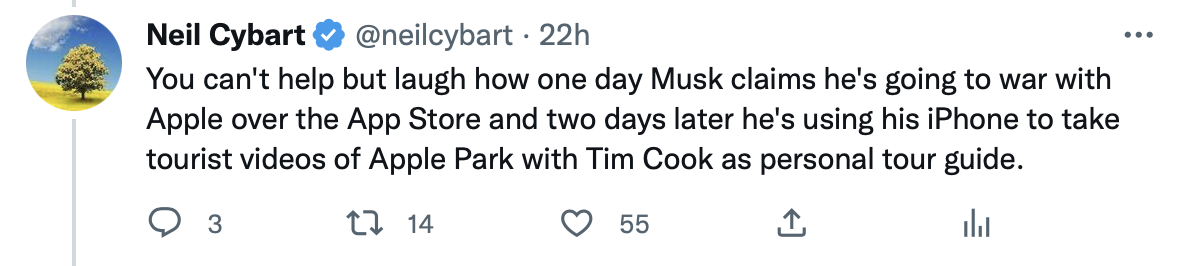

1) The Elon Musk saga took another twist yesterday. Tim Cook invited Musk to Apple Park. This was the first time Musk and Cook have talked with each other. According to Musk, "Tim was clear that Apple never considered [removing Twitter from the App Store]." Musk had just said the opposite - that Apple had "threatened to withhold Twitter from its App Store" without explanation – two days earlier. Musk’s initial tweet never sounded accurate to me. It’s not clear what Cook actually told Musk while walking around Apple Park yesterday. The following tweet that I wrote yesterday sums up the situation:

2) Looking back over the past two months of updates, we have gone over 10 earnings reports from various Apple competitors.

Warner Bros. Discovery (Nov 16)

Roku (Nov 10)

Peloton (11/10)

Disney (11/9)

Amazon (11/8)

Microsoft (11/8)

Meta (11/2)

Apple (10/28, 10/31, 11/1)

Alphabet (10/26)

Netflix (10/19)

Nike (10/3)

In today’s update, we will go over two earnings reports that have been on my list: Sonos and Spotify. Sonos was one of the last companies to report earnings. As for Spotify, it’s been six months since we took a closer look at the company’s subscriber trends.

Sonos 4Q22 Earnings

Sonos reported FY4Q22 earnings two weeks ago. Management had previously warned that things were going to look funky with demand slowing a bit over the summer and the company placing what ended up being poorly-timed bets on inventory.

4Q22 revenue was down 12% to $316M.

Gross margins dropped by 720 basis points (to 39.2%). Management claims the drop is temporary.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

HomePod: The Discontinuation That Still Has Unanswered Questions (Above Avalon Report)

An examination of the run-up, decision, and fallout related to Apple’s most curious product discontinuation.

Written by Neil Cybart

In March 2021, Apple discontinued the original HomePod with the stated reason of focusing on the HomePod mini. The decision was a curious one, not only because Apple rarely discontinues products, but also the HomePod mini is an all-around inferior product in comparison to the HomePod.

More than a year later, all of the questions related to Apple’s decision to discontinue HomePod remain just as valid today. The HomePod was one of the more impressive products Apple had shipped in years. The stellar music listening experience obtained by pairing two HomePods together remains an eye-opening experience. It’s hard to imagine Apple executives have replaced original HomePods in their homes with HomePod minis.

HomePod may be up there as the most questionable product discontinuation in modern Apple. In its quest to say no much more often than yes, the HomePod may have fallen victim to Apple’s focus culture.

The Stationary Smart Speaker Market

In the late 2010s, we experienced a stationary smart speaker mirage. Companies were using smart speakers to take advantage of an awkward phase of technology in which there didn’t seem to be any clear direction as to where things were headed.

An Above Avalon membership is required to continue reading this report. Members can read the full report here. An audio version of this report is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Reports are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Member Privileges and Benefits

Receive Exclusive Daily Updates. The cornerstone of Above Avalon membership is access to Neil’s exclusive daily updates about Apple. Updates are sent via email and go over current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Approximately 200 daily updates are published throughout the year. Sample daily updates can be viewed here, here, and here.

Receive Exclusive Reports. Members have access to Neil’s reports, which are in-depth examinations of Apple's business, product, and financial strategy.

Access Private Podcasts. Members have the option of attaching a podcast add-on to their membership in order to receive the daily updates and reports in audio form.

Access Neil’s Earnings Model. Members have access to Neil’s working Apple earnings model (an Excel file that also works in Numbers). The model is fully functional and adjustable and provides the ability to alter earnings drivers.

Email Priority. Receive priority when it comes to having email questions and inquiries answered. Neil personally answers all inquiries, including customer service matters related to your membership.

Archive Access. Read 1,200+ daily updates and reports that have been previously sent to members. The Above Avalon member archive is unmatched in the marketplace in terms of the sheer amount of Apple analysis found in one location. The daily updates archive can be viewed here while the reports archive is available here.

Member Forum Access. Join other Above Avalon members in an active forum containing in-depth discussion and debate. Neil moderates and participates in the forum. The forum is run through Slack and can be accessed here.

Virtual Meet-ups. Talk with Neil about Apple and other related items in virtual meet-ups held via Slack throughout the year.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent source of Apple analysis. Above Avalon is fully sustained by its members.