Above Avalon Podcast Episode 175: iPhone at a Billion

According to Neil’s estimate, Apple surpassed the billion iPhone users milestone last month. With the iPhone upgrade cycle approaching a plateau of four to five years, Apple is well-positioned to report record iPhone unit sales. In episode 175, Neil discusses the current state of the iPhone business as it surpasses a billion users. Topic include: iPhone unit sales, iPhone sales mix broken out by iPhone upgrades and new users, the iPhone installed base, Apple’s top priorities for iPhone, peak iPhone, and more.

To listen to episode 175, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

A Billion iPhone Users

A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Thirteen years after going on sale, the iPhone remains the perennial most popular and best-selling smartphone. Competitors continue to either shamelessly copy iPhone or, at a minimum, be heavily influenced by the iPhone. Looking ahead, Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

iPhone Sales

Over the past two years, iPhone sales have experienced notable gyrations. In early 2019, Apple saw material weakness in iPhone sales due to deteriorating economic conditions in China related to U.S. trade tensions. Although Tim Cook faced some skepticism when making such a claim, the observation was later proven to be legitimate as a number of other companies went on to describe a similar slowdown in demand.

As shown in Exhibit 1, iPhone unit sales on a trailing twelve months basis dropped by about 12% in early 2019 from a 218 million annual pace to a 191 million pace. The iPhone business went on to experience a gradual improvement in sell-through (i.e. customer) demand during the second half of 2019 and the beginning of 2020 before the pandemic hit. iPhone unit sales are back above a 200 million annual pace and are currently 13% below the unit sales high experienced in 2015.

Exhibit 1: iPhone Unit Sales (TTM Basis)

At a glance, Exhibit 1 would suggest that the iPhone business has lost some of the shine it had in the mid-2010s. However, this would be a misreading of the situation. On its own, unit sales don’t tell us the full story about the iPhone business. This is the primary reason behind Apple’s decision in late 2018 to stop providing unit sales data on a quarterly basis. Wall Street was incorrectly using unit sales as a crutch for shoddy analysis.

Flat to down iPhone unit sales do not automatically mean iPhone business fundamentals have deteriorated. Instead, a longer upgrade cycle can be a leading factor behind declining unit sales. In addition, unit sales don’t say anything about customer loyalty and satisfaction rates, which are crucial when it comes to a customer’s decision to continue using a product.

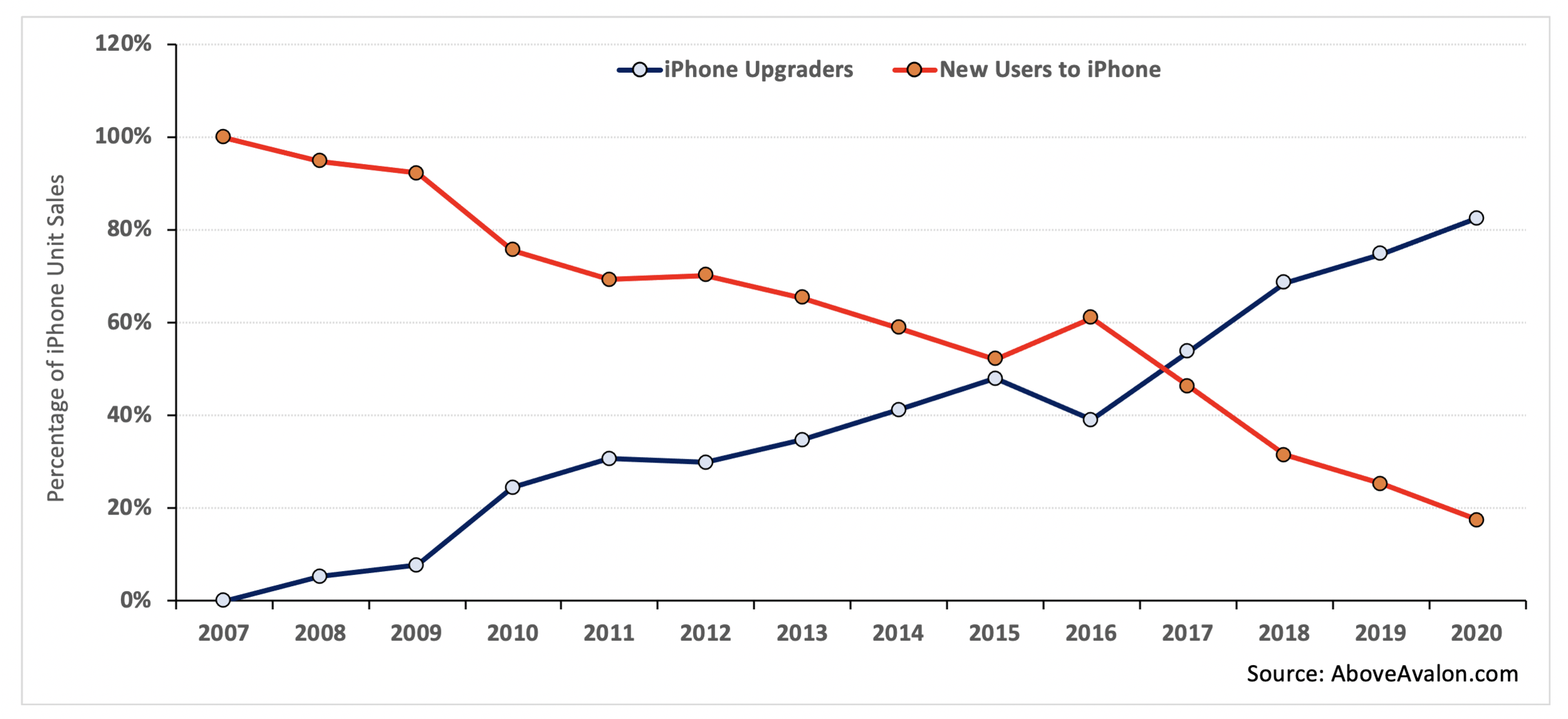

In order to reach more valuable insights regarding the iPhone business, Exhibit 2 takes unit sales data from Exhibit 1 and adds granularity. Instead of looking at sales just in terms of the number of units shipped from a factory, Exhibit 2 takes into account who bought iPhones: customers upgrading to a new iPhone or customers buying their first new iPhone. The data is derived from my iPhone installed base model that tracks when customers entered the installed base and then monitors upgrading patterns.

Exhibit 2: iPhone Unit Sales Mix (iPhone Upgraders vs. New Users to iPhone)

The iPhone business has turned into an upgrading business. While Apple is still bringing in 20M to 30M new iPhone users each year, the percentage of overall iPhone sales going to new users has steadily declined. For FY2020, iPhone sales to new users will likely have accounted for less than 20% of overall iPhone sales - an all-time low.

iPhone Installed Base

While quarterly iPhone unit sales contain an inherent amount of volatility, installed base totals do a better job of monitoring iPhone fundamentals over the long run. The iPhone installed base is defined as the total number of people using an iPhone (both new and used iPhones). A shrinking iPhone installed base would raise a number of warning signs for Apple as it would suggest people have been switching to Android. A growing iPhone installed base would suggest Apple continues to see new users embrace the iPhone for the first time.

Two variables are needed to estimate and track the iPhone installed base:

The number of people who purchase (and continue to use) a new iPhone from Apple or a third-party retailer.

The number of people who are using an iPhone obtained via the gray market. These iPhones have either been passed down through families and friends or resold to new users via a web of retailers and distributors.

By combining the two groups, one is able to derive estimates for the total number of iPhones in the wild. Although Apple does not disclose this installed base figure on a quarterly basis, the company did mention that the iPhone installed base surpassed 900M devices by the end of FY1Q19. As shown in Exhibit 3, which displays my estimates for the Apple installed base over the years, the iPhone installed base has grown each year since launch and recently surpassed a billion people.

(The methodology used to reach my iPhone installed base estimates is available here for Above Avalon members.)

Exhibit 3: iPhone Installed Base (total number of iPhone users in the wild)

In recent years, the pace of growth in the iPhone installed base has slowed. Much of this slower growth is due to high smartphone penetration and Apple having already successfully targeted the premium end of the smartphone market. With that said, Apple is still bringing in approximately 20M to 30M new iPhone users per year. These users are prime candidates for moving deeper into the Apple ecosystem by purchasing other Apple devices and services. Strong growth trends seen with iCloud storage, Apple’s content distribution services, Apple Watch, AirPods, and even iPad / Mac are made possible by hundreds of millions of people moving beyond just an iPhone to own additional Apple services and devices.

iPhone Priorities

Looking ahead, Apple has three primary priorities, or goals, for the iPhone:

Push camera technology boundaries.

Increase the value found with iPhone ownership.

Increase the number of roles handled by the iPhone.

Cameras. When thinking about the iPhone feature that will lead the way over the next five to ten years, more powerful cameras are high on the list. For the past few years, camera improvements and upgrades have been positioned as the top feature found with new flagship iPhones. A similar trend has been found with every major smartphone manufacturer. This has led to a type of camera arms race as each company tries to convince consumers that they have the best camera.

The primary reason Apple and its peers are betting so big on cameras is that they are convinced consumers will find value in smarter “eyes" - cameras that increasingly move into 3D rendering and AR realms. Advances in computational photography are also leveraged to make it easier for people to take really great photos.

While a bet on the camera will turn out to be a good one for Apple, the move doesn’t lack risk. As Apple pushes camera technology forward, many existing iPhone users are content with the iPhone camera they already own. This will manifest itself in no discernible bump in iPhone upgrading simply due to camera upgrades and advancements.

Another factor behind betting big on iPhone camera technology is that the smartphone form factor remains conducive to bringing powerful cameras to the mass market. While a “selfie” camera may make sense on the wrist with Apple Watch, it is difficult to see the wrist as a good place for cameras used to capture memories. There is similar hesitation found with the idea of putting such powerful cameras on the face in the form of AR glasses. Therefore, it makes sense that the device held in our hands and stored in our pockets will likely contain the most powerful camera in our lives.

iPhone Value. A major development regarding the iPhone that continues to fly under the radar is the improving value proposition found with owing and using an iPhone. By improving iPhone durability and longevity, Apple ends up strengthening the iPhone’s value proposition via higher resale values. If a new iPhone can be recirculated to additional users, the gray market will be strengthened and consumers will find more attractive payment terms and options at time of purchase.

An increasing number of iPhone users think about iPhone pricing in terms of monthly payments rather than lump sum. Attractive trade-in offers and payment plans with built-in upgrades only serve to improve the iPhone’s value proposition.

iPhone Roles. Tim Cook kicked off Apple’s “Hi, Speed” product event earlier this month by referring to the iPhone as the product we use the most, every day. He went on to say that the iPhone has never been more indispensable than it is now.

It is in Apple’s best interest to have the iPhone take over an increasing number of roles once given to laptops and desktops in addition to handling entirely new roles. By increasing our dependency on iPhone today, Apple ends up being in a better position to sell various wearable form factors tomorrow. Wearables are designed to not only handle entirely new tasks, but also take over tasks given to the iPhone.

Peak iPhone?

In FY2015, Apple sold 231 million iPhones. There continues to be a debate regarding whether or not Apple experienced “peak iPhone,” never exceeding that 231 million unit sales total in a 12-month stretch.

As a general rule, one needs to approach “peak” sales claims very carefully with Apple products. It may be tempting to look at unit sales data and conclude that a lower sales trend won’t reverse. However, weaker sales may not be the result of a change in market fundamentals such as a permanently reduced addressable market or less capable product. Instead, lower sales may simply reflect a slowdown in upgrading.

Odds are increasing that Apple has not experienced peak iPhone. As shown in Exhibit 4, my FY2021 iPhone unit sales estimate stands at 240M units, 4% higher than Apple’s previous iPhone sales record. My estimate does not assume a mega upgrade cycle kicked off by 5G iPhones. With the iPhone installed base having surpassed a billion users and continuing to expand by 20M to 30M people each year, Apple is in a good position to grow iPhone unit sales as the iPhone upgrade cycle plateaus between four and five years. This is where iPhone’s strong resale value enters the picture with consumers embracing various upgrading plans and options made possible by a well-functioning gray market.

Exhibit 4: iPhone Unit Sales (TTM Basis) - Includes Above Avalon FY2021 Estimates

New User Generation

The iPhone was the largest contributor to Apple growing its overall installed base from 125 million people in 2010 to more than a billion in 2020. Looking ahead, it’s fair to wonder if the iPhone will remain Apple’s primary new user funnel for the next billion users.

A strong case can be made that Apple will continue to rely on the iPhone for new user generation in the near term. While flagship iPhone pricing is aimed at the premium segment of the market, the gray market continues to play its role in expanding the iPhone’s reach to lower price segments.

Apple is also getting that much closer to launching its face wearables strategy. Requiring early versions of face wearables (AR / VR glasses) to work with an iPhone is logical when thinking about the limited amount of space for technology found with a pair of thin and light glasses.

Over time, we can’t ignore the new user growth potential found with Apple wearables. Apple Watch remains on its march to full independency from the iPhone. A truly independent Apple Watch would expand the product’s address market by threefold. AirPods are similarly well-positioned for appealing to Android users around the world. This brings us to India. The country will likely play a crucial role in Apple’s strategy of bringing hundreds of millions of new people into the ecosystem. As wearables make technology more personal, the product category’s addressable market will only expand.

While the iPhone may have been responsible for Apple getting to a billion users, wearables have a decent shot of getting Apple to two billion users.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.