Apple’s Big Bet on Memoji

One takeaway from this year’s WWDC had nothing to do with what was announced on the virtual stage. Instead, it was found in the (virtual) audience.

Apple kicked off this year's WWDC keynote with a surprising twist: Tim Cook walked out on stage inside Steve Jobs Theater to an auditorium filled with 600 Memoji. (Yes, I tried to count every Memoji.)

While the decision to include that opening scene may come off as just a way to add some fun to the keynote, my suspicion is it was part of a much larger, multi-year bet Apple is placing that amounts to using Memoji to prepare us for the upcoming mixed reality era.

What Is a Memoji?

The straightforward answer is that a Memoji is a digital representation of how we see ourselves. This explains why Apple launched Memoji with significant customization options and has continued to add seemingly every minor facial and head accessory tweak possible. Apple doesn’t want anyone to feel left out or unrepresented.

Born in the pre-AR era, Memoji were introduced in 2018 alongside iOS 12. One year prior, Apple had introduced Animoji (animated emoji) as a way of utilizing the iPhone X’s TrueDepth camera system.

The process used to create a Memoji provides clues as to how Apple sees them being used. It’s all about communication. One can navigate to the Messages app to create a Memoji. At the end of the Memoji creation process, sticker packs are offered to add more personality and touch to messages. Last year, Apple unveiled a Memoji app for Apple Watch allowing Memoji to be created on the wrist. Creating a Memoji is surprisingly fun, easy, and even relaxing. After just five minutes of customization, here is my Memoji:

One thing that caught my attention with Memoji is how they have a distinct look. It’s easy to pick out a Memoji from various other digital representations of oneself available via a growing number of third-party apps. In an interesting way, Memoji ends up being a form of Apple branding next to the Apple Watch’s distinctive rectangular watch face, the front-facing camera and sensor module on iPhone, and the iMac front-facing chin.

WWDC 2021

Apple continues to lay the groundwork for a move into mixed reality. The clues of this transition were found throughout this year’s WWDC keynote.

FaceTime SharePlay will have a big role to play in mixed reality as we consume content while simultaneously interacting with friends and family.

Live Text in Photos is an obvious feature destined to be used while wearing Apple face wearables.

Apple Maps received additional AR features that are perfectly suited for smart glasses.

Spatial audio is all about rethinking the way we consume (audio) content depending on our relationship between the physical and digital worlds.

There is plenty to talk about with each of the preceding items. Some of that discussion was found in my WWDC keynote review available here. However, there was one clue supportive of Apple’s transition to mixed reality that was not included in the preceding list or in anyone else’s “WWDC clues pointing to mixed reality” list: a heavy emphasis on Memoji.

Apple went all out with Memoji at this year’s virtual WWDC. We got an early hint of this with the WWDC keynote invites. As shown below, the invites included three Memoji looking at MacBooks. Last year’s WWDC keynote invite, also shown below, was similar.

Some may look at the invites as merely reflections of Apple hosting virtual WWDCs. However, that explanation is unsatisfying. The MacBooks being looked at are the references to WWDC going virtual due to the pandemic, not the Memoji themselves.

In addition, Apple updated its leadership page, shown below, to include everyone’s Memoji.

While revising the leadership page wasn’t unprecedented as Apple did something similar to mark world emoji day in 2018, comparing the two pages shows how Apple has been serious in improving Memoji. Apple SVPs also had their Twitter profile pictures converted to Memoji.

There was then the WWDC keynote’s opening scene, which could have benefited from a bit more commentary. Due to the pandemic, Steve Jobs Theater, Apple’s $100+ million 1,000-seat underground theater, has not hosted a product event since the second half of 2019. While the theater was shown in prior virtual events, there was something about having Tim Cook stand in front of an empty theater that just didn’t feel right. By including Memoji, Apple was able to add some life, albeit animated, to the theater.

Mixed Reality

As for why Apple’s Memoji push stands out to me, Memoji is a tool Apple is relying on to prepare users for mixed realty and completely rethought ways to consume content and communicate with others.

Most people are familiar with the terms augmented reality and virtual reality. However, such terms have become confusing when figuring out what they actually mean or describe. “Mixed reality” is a more encompassing term that simply refers to technology made available via comfortable head-worn visors and goggles. Instead of being worn all day, such devices would be designed to be used while seated.

Mixed reality will introduce the idea of sharing real-world experiences with others via a digital space. Examples include “attending” everything from live sports events and awards shows to theatrical plays from the comfort of one’s home. Given the right camera technology, any real-world event will likely one day be able to be consumed in mixed reality. Instead of these live events occurring in a digital world with a vibe similar to that of a video game like The Sims or Fortnite, the user will feel like they are actually attending the event seated in the front row at Madison Square Garden or the Staples Center.

Given how live events are all about communal experiences with friends and family, mixed reality has to be able to replicate shared experiences. This will require a method of representing oneself to others while “attending” the live event via mixed reality. Instead of using odd-looking avatars or actual portraits of ourselves that have been animated to appear life-like, Memoji is Apple’s answer for that digital representation.

By pushing Memoji now, prior to actually selling mixed reality devices to the public, Apple is looking to remove whatever awkwardness may be found with creating and using a digital representation of ourselves. Higher Memoji adoption will then make it easier for people to embrace mixed reality when it is time. Strong adoption for mixed reality would then help Apple’s efforts to develop a platform developers can use to rethink our communication and social activities.

Apple M&A Clues

Apple recently acquired two companies that were involved in sharing real-world experiences. NextVR played in the realm of using cameras to map the real world, creating a “virtual world that is painted with images of the real world.” The company had also begun work on placing elements of live experiences “into the viewer’s physical world,” to use NextVR’s own description.

These "virtual" experiences can be achieved by mapping indoor sports arenas, concert halls, or practically any room for that matter. The point in building indoor maps isn’t to take the user into some kind of imaginary world similar to Mark Zuckerberg’s Metaverse. Instead, it’s all about delivering enhanced experiences for consuming content. Although it’s difficult to portray this point using traditional video, the following example from the 2017 Wimbledon final (via NextVR) provides some ideas as to the possibilities.

Simply put, there is something compelling found there. Apple could take this technology and interlace it with Memoji to offer a new method of consuming live sporting events digitally with friends and family.

Last year, Apple also acquired Spaces, which was founded and incubated within DreamWorks Animation. The Spaces team has an interesting perspective to share in the entertainment space. The leadership team view themselves as game developers – which explains the company’s stated mission of focusing on experiences. Spaces worked with the National Geographic Society in offering an audience the ability to consume the same VR experience led by a presenter.

About the Metaverse

As for Zuckerberg’s vision involving the Metaverse in which people will spend time in a digital world instead of hopping between digital and the real life, the idea is flawed for one very simple reason. The Metaverse is at odds with a trend that has been unfolding for decades and will continue to unfold for decades to come. As technology has become more personal, the barriers between humans and technology have eroded. It’s hard to think of a larger barrier between technology and humans than what is being described as the Metaverse.

The value and promise found with mixed reality isn’t to remove us from the real world but to bring the real world to us. There will always be a limited number of front row seats available at a sports arena or concert hall. By allowing a sports game or concert to be consumed in mixed reality, everyone will be able to have that front row experience. Instead of merely watching Tim Cook walk out on stage to kick off a product event in Steve Jobs Theater, we will be able to experience what it’s like to sit inside Steve Jobs Theater.

Listen to the corresponding Above Avalon podcast episode (24 minutes) for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from August 24th.

Apple Has a Decade-Long Lead in Wearables

Last week, Apple quietly unveiled one of the more remarkable pieces of technology that has been developed in the past few years. AssistiveTouch allows one to control an Apple Watch without actually touching the device. Instead, a series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The video below showcasing AssistiveTouch is quite impressive:

Just two months prior, Facebook went on a big PR push to show the world how it was in early R&D stages of working on technology that can also use hand and finger movements to control future gadgets. AssistiveTouch is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years but more like a decade.

Apple Wearables by the Numbers

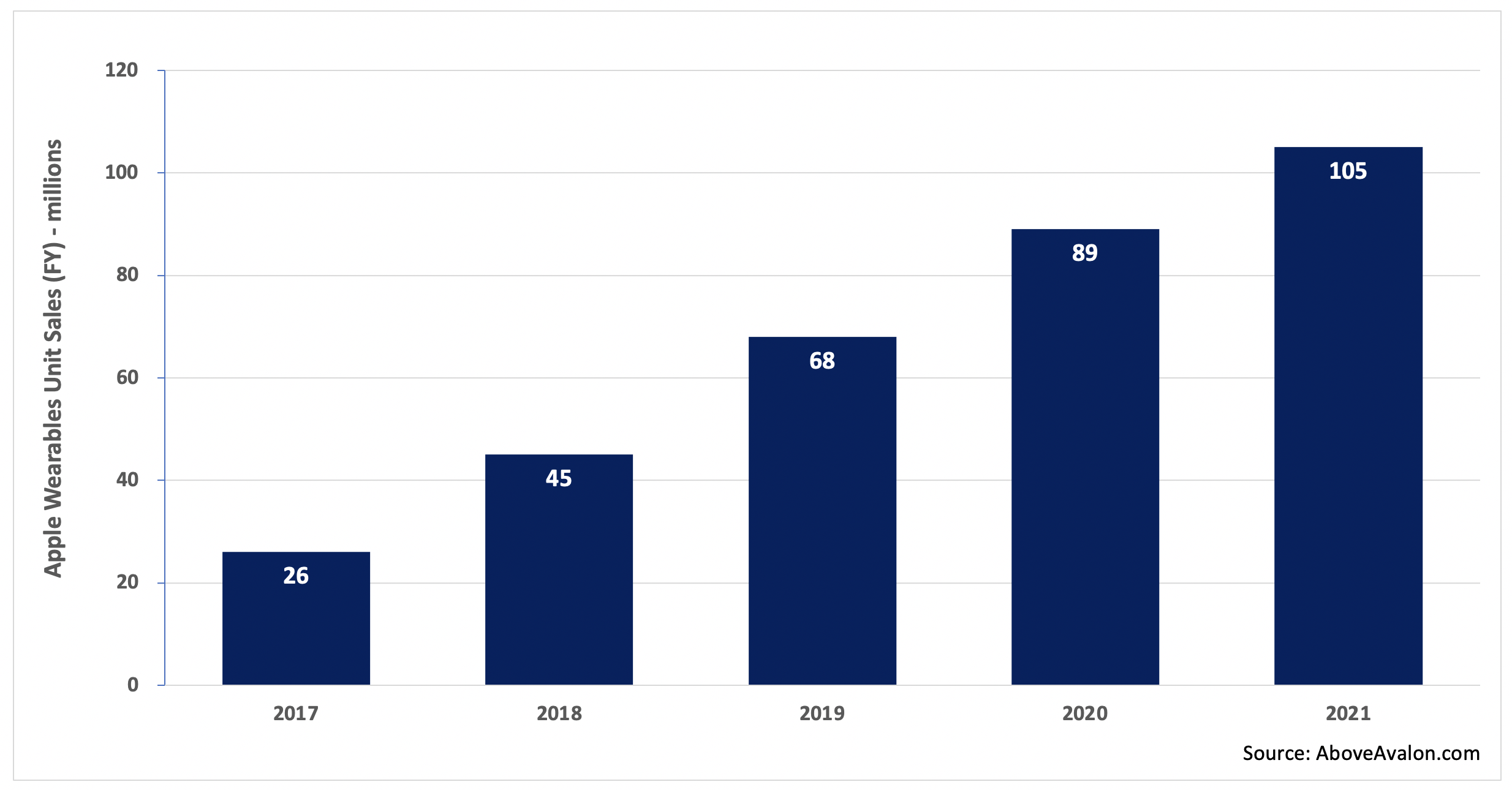

According to my estimate, Apple is on track to sell more than 100 million wearable devices in 2021. That total represents nearly 40% of the number of iPhones that will be sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Exhibit 1: Apple Wearables Unit Sales (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

On a revenue basis, Apple Watch, AirPods, and select Beats headphones are a $30 billion per year business. That would rank Apple wearables on a combined basis just shy of a Fortune 100 company. Assuming continued Apple Watch and AirPods momentum, along with Apple expanding its wearables platform by getting into face wearables (AR/VR headsets and glasses), Apple wearables will likely be able to generate up to $50 billion of revenue annually within a few years.

Exhibit 2: Apple Wearables Revenue (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Measuring Apple’s Lead

When Apple unveiled the iPhone in January 2007, Steve Jobs famously said that the iPhone was “literally five years ahead of any other mobile phone.” He ended up being mostly correct. It took the competition a number of years, and a whole lot of copying, to catch up with what Apple had just unveiled.

With wearables, my suspicion is Apple’s lead is longer than five years. There are three components to Apple’s wearables lead:

Custom silicon / technology / sensors (a four to five-year lead over the competition, and that is being generous to the competition)

Design-led product development processes that emphasizes the user experience (adds three years to Apple’s lead)

A broader ecosystem build-out in terms of a suite of wearables and services (adds two years to Apple’s lead)

Apple has at least a four-to-five year lead over the competition when thinking about just the technology powering its wearables. Everything from custom silicon and health monitoring sensors to audio and AR-focused technologies come together to set Apple apart from the competition. Only a select number of companies will likely be able to even compete with Apple on the technology front. Others will be forced to pursue partnerships.

Apple’s wearables lead extends beyond four to five years when taking into account attributes that set wearables apart from mobile devices. Succeeding on the technology front is not enough. Wearables need to be designed so that people want to be seen wearing them for extended periods of time. A smartwatch or wireless pair of headphones must also be able to work seamlessly with other devices and services. A competitor needs to have not only an answer for effectively competing with Apple Watch on the wearables front, but also answers for various services available on AirPods and Apple’s other devices. Looking ahead, Apple’s entry into face wearables will only make the hill to climb that much steeper for competitors trying to go after Apple Watch and AirPods.

For competitors, the intimidating part is that the pieces needed to compete effectively with Apple wearables are unable to be worked on concurrently (at the same time). A company needs to first spend the required years developing and researching the core technologies before turning its focus on ensuring the right kind of collaboration exists between engineering and design. Product sales will then need to materialize before a company has the means of leaning on an ecosystem to sell additional wearable devices.

Apple M&A

A different way of measuring Apple’s lead in wearables is to look at the company’s M&A activity. Apple has been busy buying tech and talent for its upcoming face wearables play for the past six years. In wearables land, the days of new products taking only two to three years to develop are over. The required technology and R&D required to get such devices off the ground require much more lead time.

Metaio - AR (2015)

SensoMotoric Instruments – AR glasses (2017)

Vrvana – AR / hand & positional tracking technology (2017)

Akonia Holographics – AR glasses (2018)

NextVR – content platform for wearables (2020)

Spaces – content platform for wearables (2020)

Examples of Apple’s Lead

There are a number of real-world examples demonstrating Apple’s significant lead in wearables.

AssistiveTouch vs. Facebook Reality Labs. Two months ago, Facebook gave the press a peek at how it is researching using a smartwatch-like device as an input method for a pair of AR glasses. The research, centered on electromyography, looked to be in the pretty early stages with many years needed before seeing the technology in a consumer-facing product. The video was intriguing as it showed research that was thought to be at the forefront of what is going on in technology R&D today. Apple then shocked everyone by unveiling AssistiveTouch for Apple Watch. Instead of showing a behind-the-scenes look at an R&D project, Apple unveiled a technology ready for users today. The technology, relying on a combination of sensors and technologies to turn the Apple Watch into a hand / finger gesture reader, was designed for those in need of additional accessibility. Of course, the technology can go on to have other use cases over time, such as controlling a pair of smart glasses like the ones Facebook is working on. AssistiveTouch does a good job of showing just how far ahead Apple is on the wearables R&D front.

Google I/O 2021. At its 2021 developers conference, Google showed signs of finally taking wrist wearables seriously by ditching Wear OS and partnering with Samsung on a new OS. While it is fair to be skeptical that the effort will end up being successful, the announcement was a marked change from prior Google I/Os when wearables were all but ignored. Diving a bit deeper into Google’s announcement, it’s easy to see how far behind Google truly is in wearables. The company doesn’t even have an OS capable of powering a smartwatch. This may be excusable if Apple Watch was just unveiled. However, last month marked Apple Watch’s sixth anniversary.

Snap Spectacles 4 / Microsoft HoloLens / Magic Leap. While we see a handful of companies release various kinds of prototype hardware for the face (AR/VR/mixed reality), nothing has stuck with consumers. The feeling in the air is that they all lack something – design thinking. This is an item that is not easy to recreate with most companies simply not structured to emphasis design. Many companies will need to rethink their face wearables strategies once Apple enters the market. None have viable answers for smartwatches or wireless headphones either, which make their face-focused efforts look incomplete.

How Did This Happen?

Apple’s lead in wearables wasn’t driven by any one factor or item. Instead, a series of events came together to give Apple an advantage.

Apple was early. One way to build a big lead against the competition is to get an early start. Wearables represent a paradigm shift in computing, and few companies other than Apple saw it coming. As for how Apple was able to see it so early, wearables are all about making technology more personal - a mission Apple has been on for decades. In a way, Apple was built to excel with wearables. Apple’s lack of fear in coming up with new products that may potentially impact sales of existing products also helped the company run wrist-first into wearables in the early 2010s.

Voice computing distraction. Even after Apple began to unveil its wearables strategy, many competitors balked at following the company. Competitors thought the actual paradigm shift materializing was found with voice computing. Most of these companies didn’t have the hardware expertise to do well with wearables out of the gate, so they pinned their hopes on voice assistants being piped through stationary speakers. Once the stationary smart speaker mirage became apparent, companies found themselves years behind Apple on the wearables front.

Wearables require design expertise. It’s not enough to just throw together some leftover smartphone components and ship wearables. People want to wear devices that they are OK with being seen in. This is one reason why so many companies have looked at Apple Watch for design cues. The lack of design talent and ability remains a major roadblock for many companies.

Ecosystem and technology advantage. Wearables are the ultimate ecosystem play. On the technology front, Apple was able to utilize lessons learned from mobile devices to push wearables forward. Not many companies are able to do the same. Consolidation in the smartphone space has left only a handful of companies even in a position to have a wearables and mobile ecosystem. The probability of there being a wave of smartwatch OEMs utilizing something akin to Android remains low.

No price and feature umbrellas under Apple. One reason Android found oxygen in the smartphone space is that Apple left a pretty wide price umbrella under the iPhone. In addition, Android positioned itself as giving users features that iPhone users may not have had access to. No such umbrellas exist in wearables. Entry-level AirPods sell for $159 and are often available for less at third-party retailers. Apple Watch is available starting at $199. It is very difficult for a hardware manufacturer to sell wearables for less than Apple and turn a profit. Meanwhile, companies that would look to make money in other ways, such as through data collection, are still stuck with the requirement of wearables needing to look good enough to be worn in public.

Six years after releasing the Apple Watch, it’s still not clear who is going to represent genuine competition for Apple in the wearables space. Apple’s success in wearables is finally being noticed by others, as seen by the growing number of companies selling products for the body (Amazon, Microsoft, Facebook, Google, Samsung, Huawei, Xiaomi, Garmin, and the list goes on). However, none are in as strong of a position as Apple was in a few years ago, let alone today. Apple’s wearables lead stands to grow further once the company enters face wearables. The next few years will likely dictate the power structure in wearables for the next 10 to 20 years. When it comes to competitors figuring out a way to slow Apple in wearables, it’s now or never.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Apple Deserves More Credit for Wearables

The wearables era at Apple began years ago. However, Wall Street and Silicon Valley are only now slowly starting to pay attention to what Apple has been building. Apple is the undisputed leader in wearables, and they are pulling away from the competition. Given how Apple’s wearables strength continues to be underestimated, the company deserves more credit for what it has achieved and where it is headed.

The Data

A takeaway from Apple’s recent 3Q19 earnings was that we are witnessing the wearables era continue to unfold at Apple. Segmenting Apple’s quarterly revenue growth into product categories is one way of highlighting wearables momentum. Both an accurate financial model and close following of Apple clues over the past four years are required to accurately estimate Apple Watch and AirPods unit sales and average selling prices (ASPs). Therefore, this exercise has not been practiced by many.

The preceding totals represent the change in revenue from 3Q18 to 3Q19.

Apple Revenue Growth Drivers (3Q19)

Services: $1.5 billion

Wearables: $1.2 billion

Home / Accessories: $0.6 billion

Mac: $0.6 billion

iPad: $0.4 billion

Note: These totals do not represent revenue totals but instead the change in revenue between 3Q18 and 3Q19.

The revelation from the preceding data is riveting. Wearables nearly exceeded Services in 3Q19 as Apple’s top revenue growth generator when looking at absolute dollars. Consensus was not expecting this to occur as Services was positioned as Apple’s growth engine. It is clear that consensus spent too much time on the Services highway and ended up missing the exit for wearables.

In taking a closer look at wearables revenue growth, it becomes evident that Apple is benefiting from both higher ASPs for Apple Watch and AirPods as well as continued strong unit sales growth. For AirPods, unit sales growth is nothing short of spectacular at 80%.

Speaking of unit sales, one out of five gadgets that Apple sells is now a wearables device. Exhibit 1 highlights the growing share that wearables represent when looking at overall Apple device unit sales.

Exhibit 1: Wearables Share of Apple Device Unit Sales

Exhibit 2 depicts wearables’ growing share of gadget sales relative to Apple’s other product categories. Apple is currently selling approximately 70M wearable devices per year. This includes 30 million Apple Watches and more than 30 million AirPods.

Exhibit 2: Apple Gadget Unit Sales

On a revenue basis, Apple’s wearables business is now at a $16 billion annual run rate growing at 55% to 60%. At the current pace, wearables will surpass both the iPad and Mac near the end of 2020 to become the third largest product category behind iPhone and Services when looking at revenue.

The Wearables Train

One way of thinking about Apple’s wearables business is that it’s a train gaining momentum. Competitors face declining odds of being able to stop the train.

The Apple wearables train is boosted by three items that no other company has the luxury of utilizing or leveraging:

A massive installed base of iPhone users (925M globally).

Core competencies and a company culture built on making technology more personal, intuitive, and easy to use.

A thriving platform of multiple wearables products.

Apple is leveraging its ecosystem of users and devices to give its wearables business an ideal launching pad for success. While there are handful of companies with more than a billion users, no other company has an ecosystem of a billion users and nearly 1.5 billion devices (nearly 90% of which are running the latest software). The lack of a self-sustaining ecosystem is one of the primary factors driving Fitbit’s gradual fade into irrelevancy. This limitation manifests itself in new products like the Fitbit Versa smartwatch failing to catch the needed traction.

Design, or the lack thereof, is proving to be another high barrier for many companies to get over in terms of wearables. Silicon Valley continues to focus too much on technology and not enough on design, or how we actually use technology. Google’s ineptitude when it comes to wearables is partially due to the company not having a clue as to how to get people to wear wearable devices. Management thought consumers would want to wear Pixel earbuds because the devices had real-time translation. In reality, consumers don’t want to be seen in public wearing wireless headphones that don’t reflect aspiration and coolness. A keen understanding of how to play in the luxury and fashion realms while simultaneously appealing to the mass market is tricky.

Flying Under the Radar

In assessing why Apple’s wearables business has received so little attention to date, one doesn’t have to look much further than the iPhone. Preoccupation with trying to find a singular product capable of replacing iPhone made it difficult for many to see how a platform of wearable devices is the answer for what can eventually serve as a viable iPhone alternative.

A cellular Apple Watch paired with AirPods is already able to handle a number of tasks currently given to the iPhone. Add a pair of smart glasses to the mix, and mobile devices like the iPhone and iPad stand to lose even more use cases.

It doesn’t help that new Apple products are also graded on a curve next to iPhone. If a new product is unable to move Apple’s financial meter out of the gate, the product is looked at as a flop, toy, or mere iPhone accessory.

Guardrails

For competitors, the bad news is that there is evidence that Apple is still applying some breaks to its wearables train. In some ways, Apple is holding things back. An iPhone is still required to set up an Apple Watch. A truly independent Apple Watch that doesn’t require an iPhone would grow the device’s addressable market by three times overnight.

In addition, Apple currently only offers wearables devices for two pieces of real estate on the body: our wrists and ears. A compelling argument can be made that the most prized piece of wearables real estate, our eyes, remains untapped.

Looking Ahead

We are witnessing wearables usher in a paradigm shift when it comes to how we use and interact with technology. Apple deserves more credit for not only choosing to ride the wearables wave, but also playing a crucial role in getting wearables off the ground.

Apple is well on its way to having Apple Watch and AirPods installed bases of 100M people each. The company is more than half way there with Apple Watch and is quickly approaching the same level with AirPods despite the product being sold for half the time.

Apple also finds itself in the midst of a major investment phase to expand its wearables platform. There is an opportunity to bring more utility, in addition to clearer vision, to the eyes in the form of smart glasses. Such a product would be a precursor to a pair of AR glasses.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.