The Above Avalon 2Q21 Recap

In addition to publishing periodic essays and podcast episodes, which are accessible to everyone, I publish exclusive daily updates all about Apple. These emails contain my perspective and analysis on Apple business, product, and financial strategy, in addition to industry developments. The updates have become widely read and influential in the world of Apple.

During the second quarter of 2021 (April to June), 47 Above Avalon daily updates were published, chronicling the major industry and Apple-specific news stories. Major themes included Apple hosting a virtual WWDC, major developments in the paid video streaming space, bluetooth trackers being put front and center as Apple unveiled AirTags at a spring product event, and tech antitrust legislation / regulation developments.

The Above Avalon 2Q21 Recap begins by going over these major themes and the corresponding daily updates that went over the themes. The focus then shifts to the Above Avalon daily update of the quarter - a daily update that stood out for its Apple analysis.

Major Themes

WWDC 2021

Last month, Apple held its largest event of the year - WWDC. Similar to last year, WWDC 2021 was an impressive one. When considering the breadth of new features announced, no company is in a position to match Apple. By leveraging its ecosystem of products and services to sell premium experiences to a billion people, Apple continues to pull away from the competition.

Video Streaming Industry News

Last year was a big year for paid video streaming as Netflix began to face genuine competition with other paid video bundles. Based on the busy news flow so far in 2021, there continues to be much interest and intrigue found with paid video streaming. The two big industry events that occurred in 2Q21 were AT&T announcing its intention to spin off WarnerMedia with Discovery and Amazon offering $8.5B for MGM. The former is all about AT&T trying to get back to the basics while the latter is about Amazon reducing churn and keeping Prime users as video viewers.

Netflix Earnings, Netflix Is in Denial About Competition, Netflix Announces Share Buyback (May 5)

AT&T to Spin Off WarnerMedia, HBO Max’s Future, Apple Implications (May 17)

Comcast’s Video Streaming Strategy, Ad-Based Streaming Momentum, Revisiting M&A in Video Land (Jun 30)

AirTag / Find My Network / Location Layers

After more than a year of rumor head fakes, Apple finally unveiled its answer for bluetooth trackers at a virtual product event in April. AirTag and the broader idea of finding / locating devices in the physical world is a precursor to Apple building location layers, which will be crucial for the company’s move into AR.

Apple Expands Find My Network, Apple Is Building Location Layers for AR, What About AirTags? (Apr 8)

The Story Behind Apple and VanMoof, Find My Network vs. Tag My Network, Thursday Q&A (Apr 15)

Apple’s Impressive Event (Apr 21)

Amazon Partners With Tile, The Tile Dilemma, Apple Hires New PR Chief (May 10)

Antitrust Legislation / Regulation

Last month, focus was placed on Washington as six anti-tech bills moved from the antitrust subcommittee to the broader judiciary committee. Apple not only held behind closed door discussions with some lawmakers, but also unveiled its public response to the bills by publishing a white paper on iOS side loading and funding more analysis into the App Store ecosystem. As the bills progressed, it became easier to see where opposition to the bills will materialize.

Previewing Apple’s WWDC 2021, A $650B App Store Ecosystem, The App Store Breeds IPOs and M&A (Jun 3)

There were 30 additional updates which covered various Apple topics, tech industry developments, and ideas that were of interest to me. The following updates in particular stood out:

An Above Avalon membership is required to read the preceding updates. To become a member, sign up in seconds using one of the following signup forms:

After becoming a member, you will receive instructions on accessing the daily updates archive. Once you are set up, click on any of the updates above to be bought directly to that update.

More information on membership is available here. This includes customization options such as receiving the updates in podcast form and bundling an Inside Orchard subscription (my new site with tech-related analysis) at a special discounted rate.

Daily Update of the Quarter

In June, Apple unveiled Beats Studio Buds for $150. The move led me to investigate Apple’s broader headphones strategy. For non-members, the following update provides a great feel for the length, detail, and analysis that is found in every daily update.

The following was sent out to members on June 17th.

Hello everyone. Given how Beats Studio Buds continue to be on my mind, today’s update is going to be a bit different as we take a deeper dive into Apple’s headphones strategy. We will examine Apple's headphones line, discuss the strategy found with both AirPods and Beats headphones, and conclude with a look at Apple headphones financials.

Dissecting Apple’s Headphones Line

Apple sells three AirPods-branded products:

AirPods (includes H1 chip) for $159. Notes: The model with wireless charging case is $199.

AirPods Pro (H1 chip) for $249. Notes: Has a shorter stem than AirPods and includes active noise cancellation, transparency mode, spatial audio (with head tracking), and multiple size tips.

AirPods Max (includes two H1 chips) for $549. Notes: Comes in five colors and includes active noise cancellation, transparency mode, and spatial audio (with head tracking)

Looking at just those three headphones, AirPods Pro is likely the most popular and best-selling. Apple is now able to use AirPods Max as a price anchor, which makes the $249 for AirPods Pro look even more reasonable than before. The jump from AirPods to AirPods Pro is substantial not only because there is a visible difference between the two, which should not be underestimated as driving purchasing behavior, but also due to a notable expansion in features.

In addition to AirPods, Apple sells a number of Beats-branded headphones (all of which are available in multiple colors).

Beats Flex (includes W1 chip) for $50

Beats EP for $130. Notes: A wired pair of headphones.

Beats Studio Buds for $150. Notes: Truly wireless headphones that include active noise cancellation, transparency mode, spatial audio.

Powerbeats (H1 chip) for $150

Powerbeats Pro (H1 chip) for $170 promotional rate / $250 regular . Notes: Truly wireless headphones.

Beats Solo3 Wireless (W1 chip) for $200

Solo Pro (H1 chip)for $300. Notes: Includes active noise cancellation, transparency mode.

Beats Studio3 Wireless (W1 chip) for $350. Notes: Includes active noise cancellation.

Apple’s H1 chip is the successor to the W1 chip offering better power management, more talk time, faster connection times when switching between Apple devices, and Hey Siri integration.

The first thing that jumps out to me when comparing AirPods to Beats is how much broader the Beats portfolio is compared to the AirPods line (eight Beats models versus just three AirPods models). The other item that is noteworthy is the degree to which Beats headphones include either a W1 or H1 chip. After years of updates, just two Beats headphones, one of which was just announced, lack Apple silicon. This explains why pretty much all of Apple’s Beats revenue has been included within my “Apple wearables” unit sales and revenue estimates.

The fact that pretty much every Beats headphones model contains Apple silicon also shows why Beats Studio Buds present a challenge for me in terms of whether or not to change my “must include Apple silicon” requirement for a product to be included next to AirPods and Apple Watch as an Apple wearable.

One thing that is worth clarifying from yesterday’s update: Despite not including the H1 chip, Beats Studio Buds include Hey Siri integration. This is one of the main reasons for referring to Beats Studio Buds, along with every W1/H1 pair of Beats headphones, as an Apple wearable.

Apple’s Headphones Strategy

Controlling sound is one way of delivering impactful and memorable user experiences. This is a strategy that Apple has been developing for decades .The iPod changed the way we consumed music on the go, offering a much better experience than existing mobile listening options at the time. Then, the iPhone redefined what it meant to bring sound on the go to the mass market. Now, AirPods have been born out of the belief that there isn't a place for wires in a wearables world.

With each product category, the guiding principles are to deliver superior experiences. Along those lines, consider the following features that Apple has rolled out for AirPods over the past four years since launch:

Active noise cancellation

Transparency mode

Spatial audio (with head tracking)

Conversation boost (announced at WWDC 2021)

These features, some may also call them technologies, end up being experiences for sound on the go. This is a key reason why all Apple headphones with either a W1 or H1chip can be thought of as a platform. We are seeing Apple continue to announce new features for its audio platform.

Going forward, health tracking and monitoring capabilities are certainly worth investigating with wireless headphones in mind. In addition, third-party developer support for AirPods seems inevitable as we move into the AR and mixed reality era.

Beats headphones are also part of Apple’s sound-on-the-go strategy. However, Beats serves a different target market than AirPods, which ends up positioning Beats as a compliment to AirPods.

While there is likely some overlap between Beats and AirPods addressable markets, Apple is using the Beats brand to tap into markets that may want a bit more customization than what is found with AirPods. Even if Beats eats into AirPods sales, Apple is not going to be worried or upset as they would much rather be the one eating into AirPods sales than having competitors grab traction.

Turning to Apple’s headphones pricing strategy, if we take the granular information about Apple’s different headphone models from above and look at the line just in terms of prices, we arrive at the following:

$50

$150

$150

$159

$170

$200

$249

$300

$350

$549

The following graph makes it easier to analyze Apple’s headphone pricing spectrum:

Note: The $159 AirPods is included under $150 while the $170 Powerbeats Pro is marked under $175.

Two big observations from the preceding exhibit:

The sweet spot for Apple wireless headphones is in the $150 to $200 range. If you are competing against Apple (AirPods or Beats), it will be tough to price your product above this range. As for AirPods and Beats forming some kind of price umbrella for competitors to undercut Apple, AirPods are routinely available for less than $150 at third-party retailers. Best Buy currently has AirPods at $130 and AirPods Pro for $200. Weaker headphone brands have offerings in the $25 to $50 range but these products are not serious contenders to AirPods. One reason many people buy AirPods is to be seen wearing AirPods. It’s also not easy for companies selling $25 to $50 pairs of wireless headphones to make much money while also trying to match the overall user experience found with $130 to $160 AirPods.

The $549 AirPods Max sure do seem like an outlier going by price. Much of that dynamic likely reflects Apple running with unit sales assumptions for the number of people interested in over-ear headphones and pricing AirPods Max accordingly with the goal of maximizing overall gross margin dollars.

Sizing Up Apple’s Headphones Business

Here are my estimates for Apple headphones revenue (includes both AirPods and Beats headphones)

2017: $2.1B

2018: $3.8B

2019: $7.3B

2020: $12.0B

2021E: $14.5B

Note: The FY2021 total does not include Beats Studio Buds.

On a year-over-year basis, Apple headphones revenue is growing by 15% to 20%. This growth rate is lower than the ~30% seen last year. AirPods sales have slowed a bit due to a combination of factors including the pandemic impacting commuting and replacement sales, lack of updates, and a slowdown in upgrading.

In order to put the $14.5B of revenue in context, the total represents just 4% of Apple’s overall revenue in FY2021E. Compared to iPad or Mac, Apple headphones revenue is trending at about 40% of the revenue seen with those product categories. As for the Apple Watch versus AirPods revenue race, it looks like Apple Watch revenue still exceeds headphones revenue by about $1B per year.

Of the $14.5B headphones revenue total for FY2021E, $2.4B or 16% is from Beats headphones with a W1 or H1 chip. That may come as a surprise to some people who haven’t paid much attention to Beats. However, the Beats brand has been strong for many years, especially in certain verticals like sports. Customer awareness of the brand is up there, which is one reason why Beats headphones include the Beats logo. Since Apple has an even stronger brand relative to Beats, Apple device industrial design is increasingly becoming a type of logo (24-inch iMac, iPhone notch, Apple Watch, AirPods).

One quick note regarding how my Apple headphones revenue estimates are derived. For the past few quarters, Apple has compared the size of its wearables business to that of Fortune 500 firms. In the past, Apple even provided some clues regarding the year-over-year change in wearables revenue. These clues are very helpful in estimating Apple Watch revenue and unit sales and then backing into estimates for both AirPods and Beats. This is one reason why estimating Apple wearables financials is like putting together a giant puzzle.

Turning to unit sales, here are my estimates for the number of headphones Apple sold:

2017: 12M

2018: 24M

2019: 42M

2020: 60M

2021E: 70M

Note: The FY2021 total does not include Beats Studio Buds.

My ASP (average selling price) assumptions for AirPods has increased from about $150 out of the gate to more than $200 today. My Beats ASP assumption is a little over $200.

Seventy million headphones sold per year represents about 15% of the devices that Apple ships annually.

My estimate is that Apple headphones sales to new users is less than the ~75% seen with Apple Watch. This reflects a decent amount of AirPods owners either upgrading to AirPods Pro or simply getting a second (or third) pair. The heavier reliance on sales to upgraders exposes AirPods to more revenue and unit sales volatility than is seen with Apple Watch.

Apple Has a Decade-Long Lead in Wearables

Last week, Apple quietly unveiled one of the more remarkable pieces of technology that has been developed in the past few years. AssistiveTouch allows one to control an Apple Watch without actually touching the device. Instead, a series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The video below showcasing AssistiveTouch is quite impressive:

Just two months prior, Facebook went on a big PR push to show the world how it was in early R&D stages of working on technology that can also use hand and finger movements to control future gadgets. AssistiveTouch is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years but more like a decade.

Apple Wearables by the Numbers

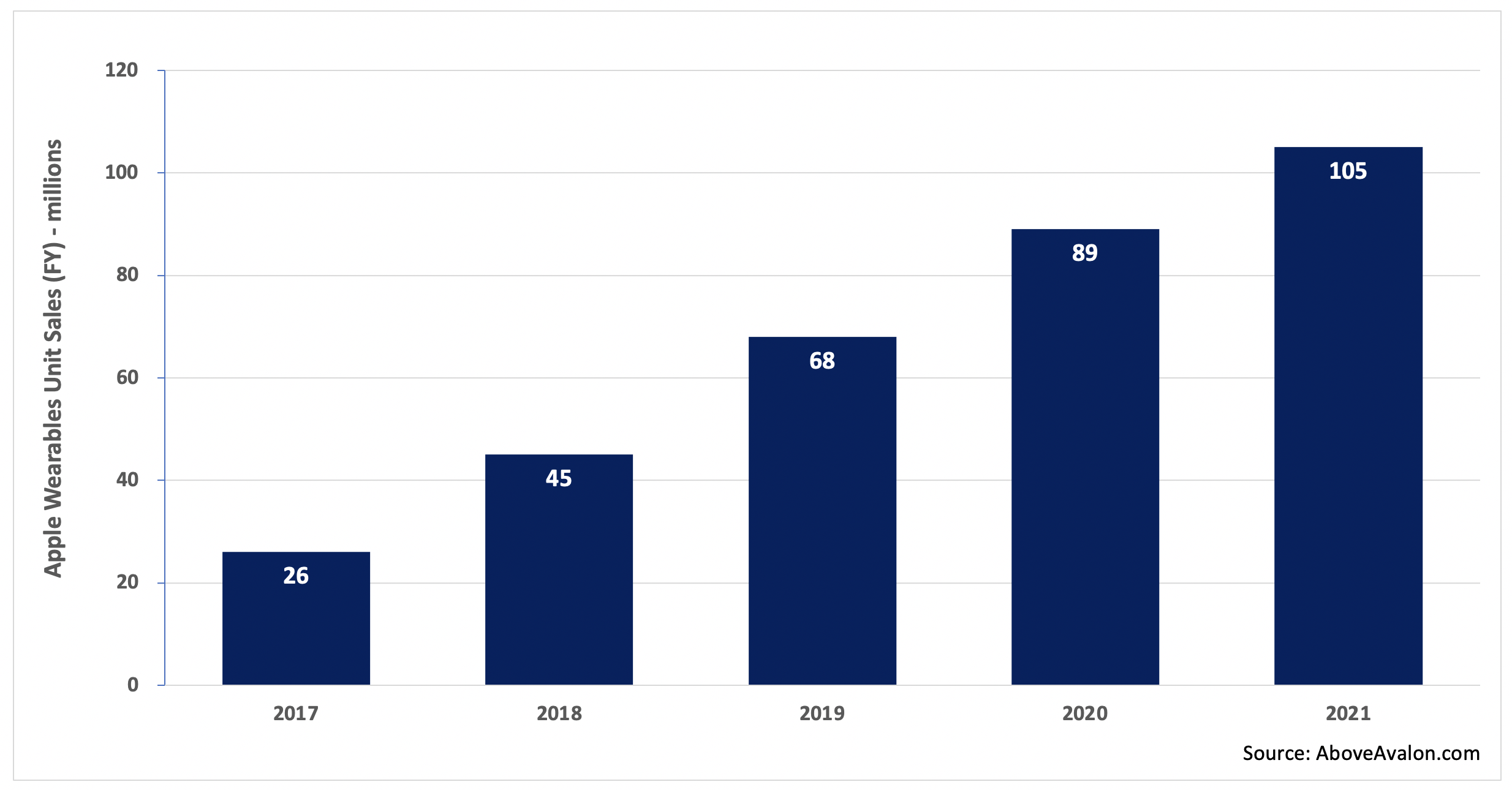

According to my estimate, Apple is on track to sell more than 100 million wearable devices in 2021. That total represents nearly 40% of the number of iPhones that will be sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Exhibit 1: Apple Wearables Unit Sales (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

On a revenue basis, Apple Watch, AirPods, and select Beats headphones are a $30 billion per year business. That would rank Apple wearables on a combined basis just shy of a Fortune 100 company. Assuming continued Apple Watch and AirPods momentum, along with Apple expanding its wearables platform by getting into face wearables (AR/VR headsets and glasses), Apple wearables will likely be able to generate up to $50 billion of revenue annually within a few years.

Exhibit 2: Apple Wearables Revenue (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Measuring Apple’s Lead

When Apple unveiled the iPhone in January 2007, Steve Jobs famously said that the iPhone was “literally five years ahead of any other mobile phone.” He ended up being mostly correct. It took the competition a number of years, and a whole lot of copying, to catch up with what Apple had just unveiled.

With wearables, my suspicion is Apple’s lead is longer than five years. There are three components to Apple’s wearables lead:

Custom silicon / technology / sensors (a four to five-year lead over the competition, and that is being generous to the competition)

Design-led product development processes that emphasizes the user experience (adds three years to Apple’s lead)

A broader ecosystem build-out in terms of a suite of wearables and services (adds two years to Apple’s lead)

Apple has at least a four-to-five year lead over the competition when thinking about just the technology powering its wearables. Everything from custom silicon and health monitoring sensors to audio and AR-focused technologies come together to set Apple apart from the competition. Only a select number of companies will likely be able to even compete with Apple on the technology front. Others will be forced to pursue partnerships.

Apple’s wearables lead extends beyond four to five years when taking into account attributes that set wearables apart from mobile devices. Succeeding on the technology front is not enough. Wearables need to be designed so that people want to be seen wearing them for extended periods of time. A smartwatch or wireless pair of headphones must also be able to work seamlessly with other devices and services. A competitor needs to have not only an answer for effectively competing with Apple Watch on the wearables front, but also answers for various services available on AirPods and Apple’s other devices. Looking ahead, Apple’s entry into face wearables will only make the hill to climb that much steeper for competitors trying to go after Apple Watch and AirPods.

For competitors, the intimidating part is that the pieces needed to compete effectively with Apple wearables are unable to be worked on concurrently (at the same time). A company needs to first spend the required years developing and researching the core technologies before turning its focus on ensuring the right kind of collaboration exists between engineering and design. Product sales will then need to materialize before a company has the means of leaning on an ecosystem to sell additional wearable devices.

Apple M&A

A different way of measuring Apple’s lead in wearables is to look at the company’s M&A activity. Apple has been busy buying tech and talent for its upcoming face wearables play for the past six years. In wearables land, the days of new products taking only two to three years to develop are over. The required technology and R&D required to get such devices off the ground require much more lead time.

Metaio - AR (2015)

SensoMotoric Instruments – AR glasses (2017)

Vrvana – AR / hand & positional tracking technology (2017)

Akonia Holographics – AR glasses (2018)

NextVR – content platform for wearables (2020)

Spaces – content platform for wearables (2020)

Examples of Apple’s Lead

There are a number of real-world examples demonstrating Apple’s significant lead in wearables.

AssistiveTouch vs. Facebook Reality Labs. Two months ago, Facebook gave the press a peek at how it is researching using a smartwatch-like device as an input method for a pair of AR glasses. The research, centered on electromyography, looked to be in the pretty early stages with many years needed before seeing the technology in a consumer-facing product. The video was intriguing as it showed research that was thought to be at the forefront of what is going on in technology R&D today. Apple then shocked everyone by unveiling AssistiveTouch for Apple Watch. Instead of showing a behind-the-scenes look at an R&D project, Apple unveiled a technology ready for users today. The technology, relying on a combination of sensors and technologies to turn the Apple Watch into a hand / finger gesture reader, was designed for those in need of additional accessibility. Of course, the technology can go on to have other use cases over time, such as controlling a pair of smart glasses like the ones Facebook is working on. AssistiveTouch does a good job of showing just how far ahead Apple is on the wearables R&D front.

Google I/O 2021. At its 2021 developers conference, Google showed signs of finally taking wrist wearables seriously by ditching Wear OS and partnering with Samsung on a new OS. While it is fair to be skeptical that the effort will end up being successful, the announcement was a marked change from prior Google I/Os when wearables were all but ignored. Diving a bit deeper into Google’s announcement, it’s easy to see how far behind Google truly is in wearables. The company doesn’t even have an OS capable of powering a smartwatch. This may be excusable if Apple Watch was just unveiled. However, last month marked Apple Watch’s sixth anniversary.

Snap Spectacles 4 / Microsoft HoloLens / Magic Leap. While we see a handful of companies release various kinds of prototype hardware for the face (AR/VR/mixed reality), nothing has stuck with consumers. The feeling in the air is that they all lack something – design thinking. This is an item that is not easy to recreate with most companies simply not structured to emphasis design. Many companies will need to rethink their face wearables strategies once Apple enters the market. None have viable answers for smartwatches or wireless headphones either, which make their face-focused efforts look incomplete.

How Did This Happen?

Apple’s lead in wearables wasn’t driven by any one factor or item. Instead, a series of events came together to give Apple an advantage.

Apple was early. One way to build a big lead against the competition is to get an early start. Wearables represent a paradigm shift in computing, and few companies other than Apple saw it coming. As for how Apple was able to see it so early, wearables are all about making technology more personal - a mission Apple has been on for decades. In a way, Apple was built to excel with wearables. Apple’s lack of fear in coming up with new products that may potentially impact sales of existing products also helped the company run wrist-first into wearables in the early 2010s.

Voice computing distraction. Even after Apple began to unveil its wearables strategy, many competitors balked at following the company. Competitors thought the actual paradigm shift materializing was found with voice computing. Most of these companies didn’t have the hardware expertise to do well with wearables out of the gate, so they pinned their hopes on voice assistants being piped through stationary speakers. Once the stationary smart speaker mirage became apparent, companies found themselves years behind Apple on the wearables front.

Wearables require design expertise. It’s not enough to just throw together some leftover smartphone components and ship wearables. People want to wear devices that they are OK with being seen in. This is one reason why so many companies have looked at Apple Watch for design cues. The lack of design talent and ability remains a major roadblock for many companies.

Ecosystem and technology advantage. Wearables are the ultimate ecosystem play. On the technology front, Apple was able to utilize lessons learned from mobile devices to push wearables forward. Not many companies are able to do the same. Consolidation in the smartphone space has left only a handful of companies even in a position to have a wearables and mobile ecosystem. The probability of there being a wave of smartwatch OEMs utilizing something akin to Android remains low.

No price and feature umbrellas under Apple. One reason Android found oxygen in the smartphone space is that Apple left a pretty wide price umbrella under the iPhone. In addition, Android positioned itself as giving users features that iPhone users may not have had access to. No such umbrellas exist in wearables. Entry-level AirPods sell for $159 and are often available for less at third-party retailers. Apple Watch is available starting at $199. It is very difficult for a hardware manufacturer to sell wearables for less than Apple and turn a profit. Meanwhile, companies that would look to make money in other ways, such as through data collection, are still stuck with the requirement of wearables needing to look good enough to be worn in public.

Six years after releasing the Apple Watch, it’s still not clear who is going to represent genuine competition for Apple in the wearables space. Apple’s success in wearables is finally being noticed by others, as seen by the growing number of companies selling products for the body (Amazon, Microsoft, Facebook, Google, Samsung, Huawei, Xiaomi, Garmin, and the list goes on). However, none are in as strong of a position as Apple was in a few years ago, let alone today. Apple’s wearables lead stands to grow further once the company enters face wearables. The next few years will likely dictate the power structure in wearables for the next 10 to 20 years. When it comes to competitors figuring out a way to slow Apple in wearables, it’s now or never.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

The Rise of Smaller Displays

Apple is a design company selling tools capable of improving people’s lives. Approximately 80% of those tools include a display. Apple is shipping about 300 million displays per year, from iPhones and iPads to Macs and Apple Watches. With Apple running as fast it can towards AR glasses, the number of displays that the company ships will only increase over the next five to ten years. While the pandemic is pushing people to embrace larger displays like iPads and Macs, the momentum found with smaller displays is still flying under the radar.

Display Spectrum

Back in 2017, I published the following chart that tracks Apple device unit sales by display size. The exercise involved breaking out iPhone, iPad, and Mac unit sales by model - something that Apple has never done itself but which the company provided enough clues for me to do on my own and have confidence in the estimates.

Exhibit 1: Apple Device Sales Mix by Display Size (2016 data)

Since Apple offers a finite number of display choices, Exhibit 2 turns the sales data from Exhibit 1 into a broader statement about preferred display size.

Exhibit 2: Apple Device Sales Mix by Display Size (2016 data - Smoothed Line)

The motivation in pursuing such an exercise was to place context around the number of large displays Apple was selling in the form of MacBooks and iMacs. Fast forward three years, and it’s time to revisit the topic. With the significant amount of change occurring in Apple’s product line since 2016, there is value in going through a similar exercise regarding display size preference with 2020 unit sales in mind. While Apple’s financial disclosures haven’t gotten better over the past four years - if anything, the disclosures have gotten worse - I am still confident in my ability to derive unit sales estimates for all of Apple’s products.

Exhibit 3: Apple Device Sales Mix by Display Size (2020 data)

Exhibit 4: Apple Device Sales Mix by Display Size (2016 data - Smoothed Line)

(All of my granular estimates and modeling that went into Exhibits 3 and 4 is available to Above Avalon members in the daily update published on December 7th found here.)

As seen in Exhibits 3 and 4, there is bifurcation in Apple display size popularity. The most in-demand displays fall into two (broad) categories:

Displays large enough for consuming lots of video and other forms of content that can still be comfortably held in a hand or stored in a pocket.

Displays small enough to be worn on the body (Apple Watch) and products lacking a display altogether (AirPods).

It hasn’t been difficult to miss Apple’s gradual move to larger iPhone displays over the years. The 6.7-inch iPhone 12 Pro Max is getting close to the maximum size for an iPhone display, at least when thinking about the current form factor. Such a reality has undoubtedly played a role in some smartphone manufacturers betting heavily on foldable displays for smartphones. Such a bet boils down to believing consumers will want larger smartphone screens to the point of being OK with tradeoffs in terms of device thickness and weight. Move beyond the iPhone and display popularity plummets as the iPad and Mac sell at a fraction of the pace. There are small sales peaks found at 10.2 inches, the size of the lowest-cost iPad, and 13.3 inches, the size of the MacBook Air and entry-level MacBook Pro.

With hundreds of millions of people embracing 4.7-inch to 6.7-inch displays via iPhone, the claim that consumers are embracing larger screens over time contains some validity. Many are now wondering if similar moves to larger displays will take over the iPad and Mac lines. However, focusing too much on large displays will make it easy to miss what is happening at the other end of the spectrum. The rise of wearables has given an incredible amount of momentum to small displays and devices lacking a display altogether.

Implications

There are four key implications arising from this display bifurcation observation.

Apple’s ecosystem naturally supports the idea of multi-device ownership.

As devices are given more roles and workflows to handle, there is a natural tendency for screen sizes to increase without changing the overall form factor much.

Power and value are flowing to smaller displays that are capable of making technology more personal.

Devices relying on voice as an input make more sense when paired seamlessly with devices with displays.

It is worth going over each in greater detail.

1) Apple’s ecosystem is characterized by hundreds of millions of iPhone-only users buying additional Apple products and services. This is a result of industry-leading customer satisfaction rates and subsequently very strong brand loyalty. However, there are more fundamental themes underpinning this trend. By controlling hardware, software, and services, Apple is able to sell a range of products that seamlessly work together. These tools don’t serve as replacements for one another but rather as alternatives. This leads to consumers being able to use multiple Apple devices aimed at handling different workflows in their unique way. Such a dynamic supports the idea of multi-device ownership over time with those additional Apple devices likely containing smaller displays or no displays at all.

2) Apple has given the iPad, iPhone, and Apple Watch larger displays over time. For the iPad, the 12.9-inch / 11-inch iPad Pro and 10.9-inch iPad Air are larger than the initial 9.7-inch iPad and subsequent 7.9-inch iPad mini. The 3.5-inch display found with the first few iPhone models looks downright tiny next to iPhone 12 flagships. Even the Apple Watch was given a larger display after being sold for three years. These moves may seem to be unnoteworthy reactionary outcomes to competitors and market forces. However, the move to larger displays over time ends up being connected to the product category handling more workflows over time. iPhones have become “TVs” for hundreds of millions of people. Today’s iPad Pro flagships are geared toward content creation. Apple Watch faces are being given more complications in order to provide additional new-age app interactions to wearers.

3) The two product categories seeing the strongest unit sales momentum have either the smallest displays Apple has shipped (Apple Watch) or no displays at all (AirPods). As wearables usher in a paradigm shift in computing by altering the way we use technology, new form factors designed to be worn on or in the body for extended periods of time are playing a role in helping to make technology more personal. This leads to an observation that may not be so obvious: Smaller displays require new user inputs and interfaces that force new ways of handling existing workflows while supporting entirely new workflows. Said another way, smaller displays end up playing a vital role in lowering the barriers between technology and humans.

4) The reason stationary smart speakers were one of the biggest tech head fakes of the 2010s is that consensus incorrectly assumed the future was voice and just voice. The idea of voice as a user input being enhanced by the presence of a display was skipped over. Jump ahead a few years and the HomePod is arguably made better by having nearby displays either simply around us (iPhones) or on us (Apple Watch). Some of the magic found with AirPods involves the seamless integration with various displays, especially the Apple Watch display. Voice just isn’t an efficient medium for transferring a lot of data and context. Relying on displays for such context makes it possible for devices without displays to shine by being allowed to do what they do best - either provide superior sound (HomePod) or convenient sound (AirPods).

Bet on Smaller Displays

One takeaway from the pandemic has been that social distancing in the form of distance learning and working from home has fueled momentum for some of the largest displays in Apple’s product line. The iPad is setting multi-year highs for unit sales and revenue. The Mac registered an all-time revenue record last quarter. There are a few reasons behind this momentum that include families needing newer (and faster) machines and employers funding work-from-home upgrades.

Instead of looking at this development as the start of a new era for large displays, the momentum found with larger displays shifts focus away from the actual revolution taking place with smaller displays.

Apple is on track to sell approximately 150M devices in FY2021 that either lack a display or contain a display that is less than two inches (5 cm). We are still in the early innings of this revolution. Looking ahead at AR glasses, Apple will eventually sell devices containing two small displays for the first time. Relying on conservative adoption estimates, Apple will sell hundreds of millions of devices per year that contain either small displays or no displays at all. We are seeing the rise of smaller displays, and the secret to witnessing it is knowing where to look.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

The Secret to Apple's Ecosystem

Apple’s ecosystem remains misunderstood. While consensus has come around to accepting the sheer size of Apple’s ecosystem (a billion users and nearly 1.6 billion devices), there is still much unknown as to what makes the ecosystem tick. From what does Apple’s ecosystem derive its power? Why do loyalty and satisfaction rates increase as customers move deeper into the ecosystem? Apple’s ecosystem ends up being about more than just a collection of devices or services. Apple has been quietly building something much larger, and it’s still flying under the radar.

Products

No company is able to match Apple in offering a cohesive and strategically forward-looking product line. Computers small and light enough to be worn on the body are sold next to computers so large that built-in handles are required. More impressively, all of these products are designed to work seamlessly together.

The Grand Unified Theory of Apple Products outlines how each of Apple’s major product categories is designed to help make technology more personal - to reduce the barriers that exist between technology and the user.

Products are designed to handle tasks once handled by more powerful siblings. New form factors are then able to handle new tasks in unique and different ways. It is the pursuit of making technology more personal that ends up being responsible for devices like Apple Watch and AirPods. The same dynamic is also paving the way for Apple to eventually sell wearables for the face in the form of smart glasses. (More on The Grand Unified Theory of Apple Products is found in the Above Avalon Report, “Product Vision: How Apple Thinks About the World,” available here for Above Avalon members.)

With 1.6 billion devices in use, it may be natural to conclude that devices are the source of Apple’s ecosystem power. This has led some to position the iPhone as the sun in Apple’s ecosystem with other products being the planets revolving around the sun. However, this is a misread of the role Apple devices are actually playing in the ecosystem. Just because the iPhone is used by more people than any other Apple device, it is incorrect to assume that will always be the case, or more importantly, that other devices are in some way inferior to the iPhone when it comes to handling workflows. There is something much larger at play here than just a billion users enjoying Apple hardware.

Services

With a $55 billion revenue annual run rate and 518 million paid subscriptions across its platforms, there is no longer a debate as to Apple’s ability to succeed with services. However, there is still a lack of consensus as to what role services play in Apple’s ecosystem. Decisions like bringing Apple Music to third-party speakers and the Apple TV app to third-party TV sets have confused many with some going so far as to conclude that Apple’s future is one of a services company.

In such a world, Apple devices lose much of their value to cheap third-party hardware. This school of thought is responsible for claims that Apple gave up selling accessories like the Apple TV box and HomePod because customers can access Apple content distribution services on cheaper non-Apple hardware. It’s difficult to think of a bigger misread of how Apple thinks and operates as a company than to claim that Apple’s future is one of a services company.

There are now others who look at Apple’s financial success with services as a negative - a sign of Apple milking existing users of as much profit as possible. This school of thought positions paid services as a long-term liability to the Apple ecosystem.

A Toolmaker

While consensus credits products (hardware) as the source of Apple’s ecosystem power, services are increasingly viewed as a hidden risk factor that can crack holes in the ecosystem. Neither are true. Nearly a billion people are not using iPhones simply because they enjoy the hardware. Vice-versa, having 518 million paid subscriptions is not a sign of Apple users needing to pay some kind of tax or bounty to remain in Apple’s ecosystem.

From where then does Apple’s ecosystem derive its power? What makes a customer want to move deeper into the Apple ecosystem?

To answer these questions, we need to step back from any one product or service and instead look at Apple as a company. It is still common for people to call Apple by whatever is its best-selling or most popular product at any one time. This also applies to whatever product is responsible for revenue growth. As a result, we hear all too often phrases like Apple is an iPhone company, a services company, or even a wearables company. The problem is that Apple shouldn’t be defined by any one product, but rather the process that led to Apple having an ecosystem of products and services.

Apple is a design company selling tools that can improve people’s lives. These aren’t just any tools either. Instead, Apple is very selective in selling tools that are able to foster experiences that people are willing to pay for - something that has become increasingly rare in the consumer tech space. By having a design-led culture, Apple is able to put the user experience front-and-center during product development.

This experiences mandate ends up being responsible for Apple’s high loyalty and satisfaction rates. The 975 million people with an iPhone aren’t likely to remain iPhone users because of stellar hardware or compelling software powering that hardware. Instead, loyalty is driven by the experiences associated with using an iPhone.

An Experiences Ecosystem

The secret to Apple’s ecosystem is that instead of selling products or services, Apple ends up selling experiences made possible by controlling hardware, software, and services.

Instead of thinking of Apple’s ecosystem in terms of the number of people or devices, a different approach is to consider the number of experiences Apple is offering. This is where Apple’s true ambitions become visible. By using an iPhone, a customer doesn’t just receive one experience per day. Instead, nearly everything that is consumed on the device has the potential of leading to a good (or bad) experience. This is why Apple’s control of hardware, software, and services plays such a crucial role. Apple’s ecosystem likely consists of tens, if not hundreds of billions, of experiences in a single day.

Having an ecosystem of experiences ultimately represents the biggest challenge to Apple competitors. Coming up with an iPhone alternative isn’t good enough for enticing users to jump from the Apple ship. Instead, competitors need to come up with even better experiences than those found in the Apple ecosystem. As a user moves deeper into the Apple ecosystem - in pursuit of additional premium experiences - competitors need to figure out a way of recreating that growing list of experiences. Can it even be done? When looking at the wearables industry, the answer as of today is “no.”

Non-Apple Hardware

One of the most intriguing aspects of Apple’s ecosystem is how nearly half of Apple users still only use just one Apple device: an iPhone. The idea that every Apple user owns a multitude of Apple devices and services is wrong. The implication is that Apple’s billion users own (and use) quite a bit of non-Apple hardware. Today, non-Apple hardware used by iPhone owners include TV sets, cheap stationary speakers, and CarPlay-equipped automobiles.

Since Apple’s product strategy and organizational structure rewards saying “no” more than “yes,” there will likely always be opportunities for other companies selling hardware to participate in the Apple ecosystem. This ends up being a Trojan Horse for Apple.

Instead of needing to have a new customer jump with both feet into the Apple ecosystem from Day 1, something that isn’t likely especially as the next marginal customer will be coming from the middle tier of the market, Apple merely needs this customer to buy or use one Apple tool.

Management is confident that one tool will eventually turn into two tools and then three since humans gravitate toward premium experiences. As one’s Apple tool collection grows, the number of experiences made possible by those tools increases. This has the impact of increasing customer satisfaction and loyalty. And the flywheel continues to turn. In order to get this flywheel moving in the first place, Apple must build bridges allowing new customers to move deeper into the ecosystem. Decisions like making Apple Music available on non-Apple hardware and bringing the Apple TV app to Samsung TVs are examples of such bridges.

Evolution

When thinking about how Apple’s ecosystem will evolve, the focus shouldn’t be on which new devices or services Apple can come up with, but rather on how Apple can offer new experiences to its customers. The blueprint for creating such experiences is already known: leveraging control over hardware, software, and services.

Technology’s battle lines are currently being redrawn with the goal being to capture the most valuable real estate in our lives: our health, homes, and transportation. Bets on software that completely reimagines the way we approach these verticals will likely prove to be good bets. Timing remains the big unknown.

This raises a question: How will Apple approach new verticals and industries? Would Apple attempt to recreate entirely new device lineups for each industry? Will The Grand Unified Theory of Apple Products be torn apart?

Instead of selling a $80,000 electric car or moving head-first into selling a range of first-party smart home hardware, Apple’s current ecosystem provides clues as to how the company can approach these new industries.

The point of Apple entering transportation wouldn’t be to sell cars, mopeds, or bicycles. Instead, it would be to sell experiences that Apple customers can consume on the road.

The point of Apple moving deeper into smart homes wouldn’t be to sell a plethora of small home gadgets and trinkets, some of which may require an electrician to install. Instead, it would be to sell experiences that Apple customers can consume in the home.

Apple developing an autonomous car remains difficult for many to wrap their minds around. The idea of Apple one day getting into housing is still considered a fantasy by most. However, such ideas make a lot of sense when thinking about how we consume experiences during the day.

An autonomous car is nothing more than a room on wheels. A house is a series of rooms connected to each other. With each, Apple would be looking to create environments that can support new experiences.

This brings us back to Apple’s current suite of products and services. It is incorrect to assume that Apple entering new industries would result in the company throwing its current products out the window. Instead, those tools stand to play major roles in delivering experiences in new industries.

Apple’s interest with Project Titan isn’t to beat or copy Tesla, but rather to figure out a way to have personal gadgets provide compelling experiences on the road. Such experiences could include Apple Glasses being used to find the right autonomous Apple Car to enter while Apple Watches can be used as identification for entry. Once inside the vehicle, the digital assistant found on the wrist or in front of our eyes could then be used to convert the car’s hardware to suit our needs. A similar dynamic would be found with smart homes - relying on personal gadgets, especially wearables, to come up with premium experiences in the home. We are seeing the early stages of this with products like HomePod and the way the device can be seamlessly used with Apple Watch.

The idea that Apple would enter the transportation and housing industries simply to come up with more areas for its users to engage with wearables may seem preposterous today. However, the idea that a single company would be able to deliver hundreds of billions of experiences per day by selling tools consisting of hardware, software, and services was similarly once a fantasy.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from July 23rd.

Above Avalon Podcast Episode 170: Pulling Away From the Competition

In episode 170, Neil examines how Apple is pulling away from the competition to a degree that we haven’t ever seen before. Given how we are just now entering the wearables era, implications of this shift will be measured in the coming decades, not years. Additional topics include WWDC 2020, Apple’s revised product strategy, the competitive landscape, and Apple’s lead in wearables.

To listen to episode 170, go here.

The complete Above Avalon podcast episode archive is available here.

Apple Is Pulling Away From the Competition

For the second year in a row, Apple held a developers conference that should frighten its competitors. Relying on a nearly maniacal obsession with the user experience, Apple is removing oxygen from every market that it plays in. At the same time, the tech landscape is riddled with increasingly bad bets, indifference, and a lack of vision. Apple is pulling away from the competition to a degree that we haven’t ever seen before. Given how we are just now entering the wearables era, implications of this shift will be measured in the coming decades, not years.

WWDC 2020

It speaks volumes that Apple held its strongest WWDC in years during the middle of a pandemic while two of its largest competitors, Google and Facebook, decided to skip their annual developers conferences. Just a few years ago, fortunes were reversed. Apple was coming under fire for WWDCs that appeared to be more reactionary to Google, Facebook, and Samsung. Apple was also struggling to contain growing unrest among its pro users who were tempted by Microsoft Surface hardware.

What changed?

The last two WWDCs stood out for two reasons:

A revised Apple product strategy. A few years ago, Apple was most aggressive with products capable of making technology more relevant and personal (iPhone and Apple Watch). As shown in Exhibit 1, in the pull strategy, the Apple Watch and iPhone were Apple’s clear priorities while the iPad, Mac portables, and Mac desktops ended up facing a battle for management attention as if they were located at the end of the rope that was Apple management was pulling.

Apple changed from a “pull” strategy in which some products like the iPad and Mac seemed to be having a hard time keeping up to a push strategy characterized by every major product category moving forward simultaneously. This shift appears to have been born in 2017, which would explain why we are still seeing the initial fruit of the effort. The iPad and Mac product categories have benefited the most from this revised “push” product strategy with more frequent and noteworthy updates.

Exhibit 1: Apple’s Changing Product Strategy

Apple has doubled down on its unique interpretation of innovation. During his opening remarks at the iPhone and Apple Watch event last September, Tim Cook said that Apple sells tools containing "[i]nnovations that enrich people's lives to help them learn, create, work, play, share, and stay healthy." Instead of defining innovation as either being first or doing something different, Apple looks at innovation as something that improves customers’ lives. A major consequence of this has been software and hardware releases that have prioritized feature quality over quantity. This year’s WWDC came in a full 20% shorter than previous keynotes. While having a digital format helped cut down on the timing due to quicker transitions, no clapping etc., there were also fewer new features announced. However, the features that were announced contained more significance when it comes to pushing the user experience forward.

A Stronger Apple

Unfortunately for Apple competitors, the combination of a revised product strategy and unique definition of innovation didn’t just make for strong WWDC keynotes. Consumers are noticing and wanting what Apple is selling. Consider the following trends:

Apple hasn’t just held its own in the smartphone space but rather is continuing to take share from Android. Of all the smartphone manufacturers, Apple saw the largest sales share increase in the smartphone industry last quarter, and that was during a pandemic.

Apple is adding approximately 20 million new iPad users per year despite the iPad being 10 years old and already having an installed base exceeding 300 million users.

Apple’s oldest major product category, the Mac, is adding 10 million new users per year.

Apple Watch and AirPods are quickly approaching 100 million user bases each.

Apple users are paying for 518 million subscriptions across Apple’s platforms, which is up 126 million in just a year.

All of the preceding items amount to an Apple ecosystem gaining momentum. A different way of highlighting Apple’s growing ecosystem over the past 10 years is to look at the number of people using at least one Apple device. As shown in Exhibit 2, Apple’s installed base recently surpassed a billion users.

Exhibit 2: Apple Installed Base (Number of Users)

While new user growth rates have slowed, Apple is still bringing tens of millions of users into the fold. Due to Apple’s views regarding innovation and its focus on the user experience, once someone enters the Apple ecosystem, odds are good that customer will remain in the ecosystem.

This is why one subtheme from last week’s WWDC keynote flew under the radar. (My complete WWDC 2020 review is available here for Above Avalon members.) It’s not just about Apple pushing multiple product categories forward at the same time. Instead, it’s about adding cohesiveness and commonality between product categories. Apple is making it easier for people to buy multiple Apple devices. As users move deeper into the Apple ecosystem, satisfaction and loyalty rates stand to go even higher. The end result is that Apple’s billion users aren’t just any billion users. Instead, they are a billion users less likely to use non-Apple devices and services going forward. For the competition, this is a highly concerning development.

More worrying for competitors, Apple is still in the early stages of bringing its users deeper into the ecosystem. According to my estimate, approximately 50% of Apple users still own just one Apple device: an iPhone. This group serves as a prime market for products like the iPad, Apple Watch, AirPods, and various Apple services. In a few years, that percentage may decline to something more like 30%. Such a development will remove much of the remaining oxygen from the markets Apple plays in.

Competition Is Weakening

While Apple sails forward with a strengthening ecosystem made possible by a clear product vision and a functioning organizational structure that prioritizes design (i.e. the user experience), the competition is rudderless.

Apple competitors have been striking out with one bad product bet after another. Few have long-term vision as to where computing is headed. Consider the following events, developments, and observations. By no means is this an inclusive list.

Samsung remains rudderless from a product vision perspective. With no clear direction as to where to go, the company aimlessly launches new products and features for no other reason than to say they are first. The strategy is no different than throwing things against the wall and hoping something sticks. Even worse, the products and features that Samsung is announcing aren’t even ready for public usage.

Google continues to prioritize technology over design. While new software features may seem compelling on paper, the lack of attention given to the user experience quickly becomes apparent. It has also become difficult to miss the growing enthusiasm gap between Android and iOS. On the hardware front, Google is struggling to match such efforts with its ambient computing future (which doesn’t make much sense to me).

Amazon’s massive bet on voice with Alexa and Echo was the wrong one. The stationary smart speaker space was a mirage. Amazon should have instead bet on wearables with voice as a user input. However, the company doesn’t have the corporate culture to excel with computers worn on the body.

Microsoft appears to be running into growing trouble with the consumer when it comes to Surface. What had been a genuine chance to rip into the iPad and Mac stronghold due to growing user unrest looks to have been successfully crushed by Apple. Microsoft Surface revenue is increasingly being driven by commercial clients (i.e. Microsoft is taking share from its OEMs rather than Apple).

Facebook ended up placing the wrong social bet. Instead of going after our closest social network, Facebook evolved to offer a curated version of the web via the News Feed. The company’s pivot back to a privacy-focused social platform built around messaging emphasizes this wrong bet. A message sent through Apple’s Messages is a message not sent through a Facebook property.

Snap, the company considered to have the best odds of competing with Apple on AR, botched its first major foray into AR hardware with Spectacles. The company has backed itself in a corner by management’s refusal, and then failure, to appeal to older demographics. This will serve as a headwind for mass market AR successes.

Spotify was not able to prevent Apple Music from gaining critical mass despite Apple Music not having a free tier. The same is now taking place with Netflix, which is unable to stop new entrants into paid video streaming from gaining traction. This ends up diffusing near universal praise in the press for first movers.

For an industry that was expected to put Apple in its place, that sure is a lot of fails, flops, and disappointments. When looking outside the U.S., the overall picture isn’t dramatically different. While some companies still have pockets of strength where Apple is not a major player, in geographies Apple is playing in, the company continues to see growing ecosystem momentum while the competition flounders. The number of paid subscriptions being run through Apple’s platform points to increased services and app adoption outside the U.S.

The never-ending tales of Apple being crushed by the local competition in China have been met with Apple seeing existing users move deeper into the ecosystem as measured by App Store, iPad, and wearables momentum. Huawei’s struggles in Europe appear to be benefiting Apple at the premium end of the market.

Changing Narrative

If there was still doubt about Apple’s momentum in the marketplace, one doesn’t need to look any further than the dramatic change in narrative facing Apple in the press.

For years, Apple was positioned as one iPhone update away from implosion. Low market and sales share were paraded around as signs of an incompetent product strategy. Simply put, Apple was framed as being weak and vulnerable, dependent on revenue sources that could disappear overnight due to consumers fleeing to the competition.

The narrative has completely shifted. The press is now infatuated with Apple’s power, its ironclad grip over the App Store, and the idea that Apple users are stuck or imprisoned in a massive walled garden where things like iMessage, Apple Watches, and AirPods force people to remain within Apple’s walls. Government regulators are viewed as the only entity capable of protecting Apple users from Apple.

If competitors actually believe this narrative, they are setting themselves for more failure. Thinking that Apple users are somehow being forced against their will to buy products like Apple Watches and AirPods is nothing more than looking for someone to blame for market failures when the problem is found internally with a bad vision, inadequate corporate culture, and lack of understanding as to what makes Apple unique.

Risks

On a list of risk factors facing Apple, greater regulation is far from the top. The same can be said about things like App Store policies and employee retention. While these items make for juicy headlines capable of grabbing people’s attention, they won’t play a major role in Apple’s future. Instead, Apple is where it is today by saying “no” more than “yes.” By remaining focused on making technology more personal, which is inherently about using a design-led culture to push the user experience, Apple is able to develop a dynamic, yet nimble, ecosystem of tools that people are willing to pay for. lf it were to lose focus, Apple would move that much closer to its competitors.

Apple ends up being its toughest competitor as it releases products that surpass the previous version. This is where betting on the user experience and taking a unique stance on innovation is critical.

Next Ten Years

When the iPhone was unveiled in 2007, Steve Jobs claimed that Apple had a five-year head start against the competition. He ended up being mostly right. By 2012, Samsung and Google were shipping credible iPhone alternatives, thanks partially to ruthless copying that led to time in the courtroom.

With wearables, my thinking has been that Apple has a lead that is closer to 10 years. This estimate reflects not just software or hardware advantages, but also the byproduct of Apple controlling both items and its resulting achievements with custom silicon.

As time passes, Apple has been facing less competition in wearables. This is remarkable considering how Apple Watch has already ushered in the next paradigm shift in computing. We are seeing the future today. Yet most companies either don’t see it or even worse, see it but are unable to respond.

Giving Apple a 10-year head start against the competition with wearables may end up giving too much credit to the competition. Excelling in wearables requires a corporate culture, product development process, and business model that few companies other than Apple possess. In many ways, Apple was built to excel in wearables. Apple should probably get used to being its own toughest competitor.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Spotify Is Evolving

Spotify sees the writing on the wall: It’s going to remain difficult to make a profit from streaming music. Despite years of remarkably strong user growth, the high variable costs found with music streaming continue to serve as a financial headwind. Spotify co-founder and CEO Daniel Ek isn’t standing still, however. Spotify is evolving, partly out of necessity, with the long-term goal of becoming the largest audio platform in the world. While the transition includes its fair share of challenges, Spotify has a few things going for it that should force competitors like Apple to take notice.

Spotify Earnings

Spotify's quarterly results have become predictable. Strong subscriber trends are offset by nonexistent profit and mediocre operating cash flow. Last week, Spotify reported 4Q19 earnings, and the results mostly fit the pattern. The company grew its subscriber total by 23 million in just three months (a very good number). Spotify’s cash flow showed a little bit of improvement although the numbers still don’t seem to reflect a company that grew its subscriber base by a whopping 65 million people in 2019.

As shown in Exhibit 1, the growth of Spotify’s ad-supported monthly active users (those on the free tier) and premium subscribers (those on the paid tier) is not showing any signs of slowing. Although ad-supported MAU growth had underperformed premium subscriber growth, that dynamic has reversed. This reflects that Spotify is seeing success in growing the streaming music pie by attracting new people into the fold. These new customers are more likely to enter through the ad-supported tier and then possibly migrate to the paid tier over time.

Exhibit 1: Spotify Subscriber Growth Trends

In taking a closer look at Spotify’s subscriber base, it becomes evident that the company continues to see much of its growth in geographies where Apple has little to no presence. This suggests that recent subscriber growth has resulted from Spotify becoming a preferred choice for Android users looking to free, ad-supported music.

The Music Streaming War Has Quieted Down

For years, the music streaming war between Spotify and Apple Music was fought over subscriber totals. The back-and-forth subscriber disclosures between Spotify and Apple Music were closely monitored. At first, consensus thought Spotify had received too large of a first mover advantage for Apple Music to find any traction. Once that theory was busted, attention turned to the pace of new subscriber growth.

In 2019, Spotify grew its premium subscriber total by a little more than 2.0 million per month while Apple’s paid subscriber growth figure for Apple Music was closer to 1.3 million per month. Given how Apple Music now has more than 60 million paying subscribers, we can confidently say that both Apple Music and Spotify have “won” in music streaming. Each company has enough scale to matter.

Spotify’s Problem

Even though Spotify continues to see strong subscriber growth, the additional scale hasn’t resulted in dramatically improved financials. The problem is found with the high variable costs associated with music streaming. For every dollar that Spotify brings in the door, only 25 cents is left to cover the costs of running the business after accounting for music rights and other cost of goods sold. For context, here are the most recent gross margins (on an annual basis) for the big five:

Facebook: 82%

Microsoft: 66%

Alphabet: 56%

Apple: 38%

Amazon: 20%* (estimated)

*Although Amazon may have a lower stated gross margin than Spotify, the numbers are misleading as the company is generating close to $40 billion of operating cash flow per year. The underlying business is kicking off cash although much of it has to be put back into the business to keep things running.

When considering the amount of R&D and marketing that is required to stay competitive with the giants, Spotify’s gross profit picture isn’t encouraging. As for attempts to improve its gross margins, Spotify has stressed items like charging content creators for various tools and trying to negotiate content cost savings. However, the elephant in the room is Apple Music. By having a successful alternative in the paid music streaming space, music rights holders are in a better position to retain their negotiation power when up against Spotify.

Music rights holders have been the big winners in the current music streaming landscape. Nearly 200M people are now paying somewhere between $5 and $10 per month for music between Spotify and Apple Music. Unfortunately, it has become harder than ever for music artists to find financial sustainability. Expectations regarding how music as an art form will be valued likely need to be reassessed.

An Evolution

In early 2019, Spotify began betting big on podcasts. Since the start of 2019, Spotify has spent more than $600 million buying Gimlet Media, Anchor, Parcast, and most recently, The Ringer. By getting into podcasts in a big way, Spotify is trying to evolve from a dedicated music streaming service dependent on music rights holders for achieving profitability to an audio company with a platform delivering audio entertainment to as many people as possible.

Spotify’s financial picture stands to improve if the company can better monetize its 280M subscribers. One of the primary goals in developing an audio platform consisting of podcasts is to generate higher gross margins by having subscribers spend time listening to something other than music. With a captive audience of hundreds of millions of people, Spotify is in an interesting position to be more of an advertising company. In the future, Spotify’s long-term strategy may include having third-party developers create new kinds of audio experiences.

The timing for such an evolution looks good for Spotify as we are in the midst of a headphones renaissance set within a wearables revolution. With the removal of wires, headphones are being transformed. We see Apple expand its wireless headphones portfolio to include various AirPods models and Beats headphones. According to my estimates, Apple is bringing in $9 billion of revenue per year from headphones. That is 25% higher than Spotify’s annual revenue. Apple’s $3 billion acquisition of Beats in 2014 is looking smarter by the day when thinking about the headphones piece of the acquisition. Beats headphones are now bringing in approximately $2 billion of revenue per year for Apple.

Roadblocks

Spotify faces an uphill battle while evolving into an audio company. The biggest obstacle is the lack of first-party hardware and other services like video streaming. The never-ending rumors that Spotify has been tinkering with hardware likely have merit. The company is at a severe disadvantage by not having first-party hardware solutions including stationary speakers, and more importantly, wearable devices.

Last year, Spotify declared war on Apple. Instead of fighting the battle in the marketplace over exclusive songs and albums, Daniel Ek wants to go after Apple in the courts and regulator backrooms with the goal of weakening Apple’s grip on the App Store and the broader Apple ecosystem. If successful in its pursuit, Spotify would find itself in a better position to leverage Apple’s ecosystem for its own ambitions versus the other way around, which is currently the case.

In the event of video and music bundling taking off, Spotify will find itself at another disadvantage as the company has limited financial resources that would allow it to get into video ($1.9 billion of cash, cash equivalents, and short-term investments). The company would need to continue relying on partnerships for bundling opportunities, which is far from ideal. Although Spotify has easy access to capital, the amount of cash flying around for original video content is daunting. This is another reason why Spotify hasn't been shy running into podcasting. While some of the valuations that Spotify has been willing to pay for podcast startups and talent may make people in the industry blush ($250M for The Ringer), on a relative basis to the video space, Spotify is able to make its cash go further with podcasts. Much of this is due to the podcast industry not being as developed a video from a monetization standpoint.

Advantages

Instead of cash or video, Spotify has something else going for it in its evolution: the ability to focus. Audio is commanding all of Spotify management’s attention as it represents everything for the company. Spotify is likely betting that the giants will continue to treat audio (not the same as voice) as a money-losing ancillary business.

Another way of thinking about this dynamic is that Apple’s $1.4 trillion market cap is 56x larger than Spotify’s $25 billion market cap. A doubling or tripling in Spotify’s market cap would be considered a huge validation in the company’s evolution strategy while Apple’s market cap fluctuates $25B to $50B on any given day.

Apple’s Perspective

In its current form, Spotify doesn’t pose much of a long-term threat to Apple. Spotify is a service that is consumed by a small percentage of Apple users mostly on Apple’s platform. However, Apple can’t and shouldn’t ignore Spotify’s evolution. One of the more effective ways for Apple to compete with Spotify over the long run is to figure out where the company is headed and get there first.

Success at building an audio platform with millions of engaged developers could give Spotify a beachhead in audio apps and make it an App Store alternative in a wearables world. In such an environment, audio stands to be a key ingredient capable of augmenting our surroundings.

It is in Apple’s best interest to recognize the threat that Spotify could pose and beat the company in establishing an audio platform. Apple can empower iOS developers to come up with new forms of content and workflows designed to be consumed on a range of wearables (along with mobile devices). Along with music and podcasts, there could be room for new mediums and experiences, many that can’t even be envisioned yet. In such a dynamic, Apple could then leverage its biggest advantage over Spotify: hardware and a broader platform with various services.

If consumers end up viewing an evolved Spotify as something consumed on Apple’s platform instead of looking at Spotify as a platform in of itself, Apple will have successfully countered Spotify’s evolution.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

The Big Question Now Facing Apple

Predictions are nothing more than attempts at manufacturing clarity for what is inherently a sea of unknown. With New Year predictions, two things need to happen. The person issuing the prediction needs to come up with what may happen, and the predicted event has to occur within an arbitrary time period. The probability of finding value in such an exercise is low.

Instead of coming up with predictions for Apple at the start of a new year, there is value found in embracing the unknown and looking at questions facing the company. This has led to my annual tradition of coming up with a set of questions facing Apple at the start of a new year. The irony found with questions is that asking the right ones is equivalent to coming up with a surf board for successfully catching waves in the sea of unknown.

Previous year’s questions are found below:

Questions for Apple in 2020

The topics that serve as source material for Apple questions in 2020 can be grouped into two buckets: growth initiatives and asset base optimization.

Growth Initiatives

iPhone Business. The narrative facing the iPhone business has been off the mark for years. Skepticism and cynicism has continued to mask what has been a resilient business. There is now too much talk of 5G kicking off some kind of mega upgrade iPhone cycle. Such a focus ignores what is ultimately taking place with the iPhone: The business is maturing. This presents a set of challenges that will require a fine-tuning of strategy. This involves changes to the device lineup, release schedule, pricing, and feature set.

Paid Content Distribution. Following a very busy 2019 for Apple’s content distribution arm, all eyes are on whether or not Apple will bundle its new paid content services. Ultimately, bundling is a tool that Apple has at its disposal to support a weaker service while increasing the stickiness found with its services.

Wearables. Apple’s wearables business is a runaway train with the company selling approximately 65M wearable devices in FY2019. Based on my Apple Watch installed base estimate (available here), just 7% of iPhone users own an Apple Watch. Similar ownership percentages are found with AirPods despite the product having been in the market for less time. The question isn’t if Apple wearables momentum will continue but instead how fast will adoption grow.

Margins. Apple follows a “revenue and gross margin optimization” pricing strategy. This has led to Apple’s products gross margin percentage declining by 10% over the past two years while products gross margin dollars have declined by only 2%. Apple is willing to let products gross margin percentages decline (via lower product prices and higher cost of goods sold relative to revenue) if it results in stronger customer demand for those products. Attention will be placed at determining the level at which Apple product pricing is too low in order to maximize gross profit dollars.

R&D. There have been two general themes found with Project Titan and Apple’s efforts related to developing a pair of AR glasses: 1) Continued progress and 2) Extended timelines.

Asset Base Optimization

Leadership. With Jeff Williams officially serving as the link between Apple’s design team and the rest of Tim Cook’s inner circle, it will be interesting to see if Apple makes any refinements to its leadership structure.

China. The boogeyman known as U.S. / China trade has been put to bed, for now. With rhetoric having been dialed back in a very big way, attention will shift to the various decisions Apple still has to make regarding its long-term approach to China. The company can continue to rely heavily on China for its supply chain and manufacturing apparatus, accelerate a diversification strategy away from the country, or follow more of a status quo approach that recognizes the benefits (and weaknesses) of being so dependent on one country.

Capex. In FY2019, Apple reported just $7.6 billion of capital expenditures (capex). This was a significant drop from the $16.7 billion of capex in 2018. The most likely reason for the decline in capex was a decline in tooling and manufacturing machinery. The company also slowed spending on corporate facilities. By not providing capex guidance for FY2020, the variable is accompanied by a greater level of intrigue as to what it means about Apple’s near-term product pipeline.

Capital Return. Apple shares were up 89% in 2019, exceeding the S&P 500’s 31% gain. For the first time with Tim Cook as CEO, Apple shares now trade at a premium to the overall market when looking at forward price-to-earnings multiples. This has led some financial writers to call for Apple to slow the pace of buyback and instead push a larger increase in the quarterly cash dividend. In the event that Apple’s market value exceeds intrinsic value, it’s not clear how Apple would remove tens of billions of dollars of excess cash still on the balance sheet in addition to nearly $60 billion of free cash flow generated per year. Special dividends aren’t great from a tax perspective while there are limitations found with simply funneling all of the excess cash into quarterly cash dividends.

The Big Question