Apple's Growing Bet on Hardware

Apple isn't a hardware company. Nevertheless, hardware's importance to Apple continues to grow. Apple is now overseeing a supply chain and manufacturing apparatus responsible for producing more than 300M gadgets per year. As Silicon Valley increasingly bets on services and intelligent assistants, many are making a critical mistake in downplaying hardware. As Alan Kay, a tech industry pioneer, once said, “People who are really serious about software should make their own hardware." Apple is betting that Kay's advice will remain relevant in the future. Apple is doubling down on hardware in order to become the most powerful software provider in the wearables era.

Hardware Strategy

The vast majority of Apple's products are assembled by contract manufacturers in Asia. This wasn't always the case. In the 1990s, Apple owned its own factories. However, the company was imploding financially from a bloated product line and a costly manufacturing apparatus. Apple's supply chain and network of factories just weren't efficient. In March 1998, Steve Jobs hired Tim Cook as SVP of Operations to save Apple, literally. Cook's initial tasks included quickly drawing down excess Mac inventory in addition to laying the groundwork for Apple's outsourcing strategy.

Cook began to rethink Apple's supply chain, going so far as to get suppliers to move closer to Apple's new assemblers. Apple soon discovered that manufacturers and assemblers in China were capable of meeting the company's high standards like no other. It was around this time that Apple began its long-standing partnership with Foxconn, the company's largest product assembler. Cook also instituted a just-in-time inventory production system which addressed excess inventory issues that nearly crippled Apple.

While much attention has been placed on Apple's contract manufacturers, little is reported on the degree to which Apple works with its suppliers and assemblers. It is not uncommon for Apple designers to spend weeks, or even months, at factories in China. Apple does not design a product in California and just send final manufacturing instructions to its assemblers. The amount of collaboration that occurs between Apple and its various suppliers and manufacturers would surprise most outsiders.

Even though Apple doesn't own factories, the company does own a significant amount of equipment and machines housed in third-party factories. As of the end of September, Apple held $54B of machinery, equipment and internal-use software on its balance sheet. A significant portion of this total is machinery used in the production of Apple's products.

Expanding the Bet on Hardware

Apple's bet on hardware continues to grow. In the past, controlling hardware still amounted to Apple being dependent on others to provide the core technology and components. Apple began to see the value in controlling its own destiny by owning the core technology powering its devices.

In 2010, Apple unveiled the iPad. The device was powered by an A4 processor, the first Apple-designed chip. The A4 was made possible by Apple's P.A. Semi acquisition two years earlier. Jumping ahead seven years, Apple now has a range of processors:

- A Series: iPhone and iPad

- S Series: Apple Watch

- W Series: AirPods, Beats, and Apple Watch

- T Series: Mac

Back in September, Apple introduced the A11 Bionic chip in iPhone 8, 8 Plus, and X. The chip includes the first Apple-designed GPU solution. There is now an increasing amount of evidence that Apple is moving into modem design and power management chips. Apple's end goal is to create a system-on-a-chip (SoC) that includes Apple Ax processors, GPUs, and LTE modem chips.

Apple's current hardware strategy is all about controlling the experience found with its products. In the past, differentiation came from simply doing both hardware and software. Differentiation is now found when there is tighter control over the core components powering products.

Scale

It's easy to think of Apple as just an iPhone maker. More than 210M iPhones are sold per year, and no other Apple product comes close to surpassing iPhone in terms of unit sales. However, iPhone is only one piece of Apple's hardware story.

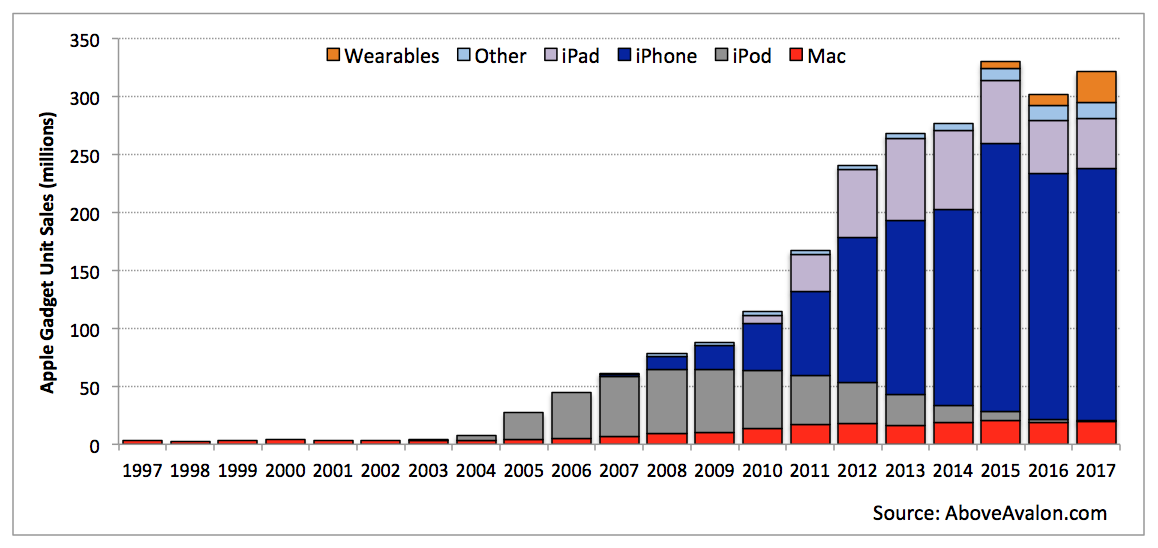

According to my estimates, Apple sold 322M gadgets in FY2017. This total includes unit sales from every major product category and accessory powered by Apple software (iPhones, iPads, Macs, Apple Watches, AirPods, iPods, Apple Pencils, Beats headphones, and Apple TVs). After a down year in 2016, when Apple shipped 8% fewer devices than in 2015, the company returned to unit sales growth in 2017. In fact, Apple shipped 7% more devices in 2017 than in 2016.

Exhibit 1: Apple Gadget Unit Sales

Apple gadget sales include: iPhones, iPads, Macs, Apple Watches, AirPods, iPods, Beats headphones, Apple Pencils, and Apple TVs.

Additional accessories such as Apple Watch bands, iPhone and iPad cases and covers, and various charging cords and cables push the total number of Apple products sold in FY2017 well past 400M.

Along with demonstrating Apple's success at selling mass-market items, these sales numbers illustrate the ability of Apple's supply chain and manufacturing apparatus to produce hardware at scale. In fact, there aren't too many companies operating at Apple's hardware scale. While Samsung doesn't disclose smartphone sales, industry estimates peg the company at selling approximately 300M smartphones per year, which includes a wide range of models. Every other smartphone manufacturer is selling fewer smartphones than Apple is selling. Meanwhile, the world's largest PC makers and other consumer electronics companies don't have the sales required to come close to matching Apple in terms of hardware sales.

Wearables

Apple's hardware scale is about to undergo significant changes. The upcoming wearables era will prove to be a game changer for hardware sales. As there are a little under a billion users, it is not inconceivable for Apple to eventually ship a billion gadgets per year. While this may seem hard to believe considering Apple sold 322 million gadgets in FY2017, the wearables era will likely be defined in terms of ecosystems consisting of different wearable devices. An Apple product line including Apple Watch, AirPods, Beats, and Apple Glasses, combined with a user base of more than one billion people, will lead to massive demand for hardware.

We are already starting to see the beginning stages of wearables impact Apple's manufacturing apparatus. According to my estimates, Apple sold nearly 30M wearable devices in FY2017, up from 10M devices in FY2016. Nearly one out of ten gadgets Apple sells is a wearable. Looking ahead, it is possible we will see Apple sell 50M wearable devices in FY2018 as Apple Watch and AirPods are seeing remarkable momentum in the marketplace. Both Apple Watch and AirPods are products that contain the potential of one day selling in the hundreds of millions of units per year. Meanwhile, it is inevitable that Apple will one day sell a pair of augmented reality glasses.

Exhibit 2: Apple Gadget Unit Sales by Product

Note: "Other" includes Apple Pencils, Apple TVs, and Beats headphones. Wearables include Apple Watches, AirPods, and select Beats headphones.

Hardware Prowess

In many ways, Apple's product event this past September at Steve Jobs Theater demonstrates the scope of Apple's hardware prowess. Apple unveiled a cellular Apple Watch and iPhone X, two products made possible only after years of intensive collaboration throughout Apple. The amount of collaboration required puts the company's extensive efforts with Apple Park, a campus designed to improve collaboration within Apple, into perspective.

Everything from the iPhone X's OLED display to the neural engine found inside the A11 Bionic chip come together to produce an experience that would be impossible to create by a company focused just on software or hardware. Similarly, the W2 and S2 chips found in Apple Watch Series 3, along with the ability to include cellular without jeopardizing device thickness or even battery life, is remarkable. After placing big bets on hardware for decades, Apple is now in a position where its hardware capabilities are opening doors for Apple software and services.

While Apple's hardware bets are already providing the company a competitive advantage over peers with smartphones, tablets, and wearables, the long-term implications of Apple's hardware strategy are still being underestimated. Apple is well-positioned to build the most formidable supply chain and manufacturing apparatus for wearables. Apple now finds itself making bets in terms of controlling core components in products. The company is also investigating new manufacturing techniques and processes that will give the company an advantage over peers in the wearables space. This may be better measured in decades than in years. Apple has never seen a scenario like this play itself out before. This is unchartered territory.

Google, Microsoft, Amazon, and Facebook have been busy talking about a "post device" era in which the very idea of a device fades away. Instead powerful voice assistants and cloud services powered by artificial intelligence ultimately gain power at the expense of hardware. Apple is betting on a very different future. Apple sees a world in which hardware gains power in our lives. Apple is moving to the point at which it will have near complete control over every major component powering its device. Whether it is seen in new kinds of displays, smarter cameras, or custom silicon, hardware has a role to play in pushing more intelligent software and services. Instead of tomorrow's winners being those companies controlling powerful software and services, the winners will be companies shipping hardware that can melt away allowing the user to interact with software with as few barriers as possible.

Receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week). To sign up, visit the membership page.