It's Time for Apple to Disclose Apple Watch Sales

Apple Watch is a resounding success, and it's time for Apple to make it official by providing quarterly sales data. The question of whether Apple should disclose Apple Watch sales has never had a simple "yes" or "no" answer. Instead, the positives and negatives found with disclosure have to be weighed against each other. There is now more upside found in Apple disclosing quarterly Apple Watch sales than in keeping them private and just providing sales clues.

The Initial Decision

In late 2014, six months before Apple Watch went on sale, Apple announced that it would not be disclosing quarterly Apple Watch revenue and unit sales. The company would include Apple Watch in a new financial line item. The category, called "Other Products," would serve as a catch basin for a variety of products including iPod, Beats, Apple TV, other Apple accessories, and a range of third-party accessories sold through Apple Retail.

Apple's decision to withhold Apple Watch sales was a controversial one. Apple Watch represented Apple's first genuine new product category in the Tim Cook / Jony Ive era. Expectations were high as observers positioned Apple Watch as a litmus test for Apple's ability to innovate following iPhone and iPad. The lack of disclosure meant analysts would have to back into Apple Watch sales estimates using their own earnings models. This process guaranteed there would be a discrepancy when it came to Apple Watch estimates.

A number of theories were put forth regarding why Apple made the initial decision to lump Apple Watch in with Other Products. The official reasoning according to Apple management was that given how Apple Watch was a new product with no revenue, it made sense to lump the product with other products. In addition, the lack of disclosure was said to make it difficult for competitors to assess Apple Watch demand and market trends. The much simpler explanation was that Apple just didn't stand to benefit from disclosing Apple Watch sales out of the gate. Apple faced a number of benefits associated with keeping Apple Watch sales hidden, such as:

- Keeping competitors in the dark.

- Avoiding negative press coverage focused on the wide discrepancy between Apple Watch and iPhone sales.

- Avoiding investor and analyst disappointment if Apple Watch sales missed very high expectations.

- Moving the Apple narrative on Wall Street beyond unit sales growth.

Meanwhile, the downsides associated with keeping Apple Watch sales hidden included:

- Portraying a lack of confidence in Apple Watch.

- Being unable to control the Apple Watch narrative in the press.

In early 2015, there was very little upside for Apple found with disclosing Apple Watch sales. While management was confident that Apple Watch would become a hit product, there was no reliable way of converting that optimism into multi-year sales projections. The product had an unknown adoption curve, and Apple did not have a recent product to use as a proxy to estimate adoption. The iPad was released five years earlier, but the product had proven to be a sales outlier by riding the iPhone's coattails. In addition, management knew initial Apple Watch sales would pale in comparison to iPhone sales, potentially leading to negative stories in the press. Apple made the correct decision to keep initial Apple Watch sales hidden.

Sales Clues

On the surface, Apple's decision to withhold quarterly Apple Watch sales data would make it difficult to assess performance. As seen in Exhibit 1, Other Products revenue, which includes Apple Watch sales, doesn't provide many clues regarding Apple Watch demand. If anything, the most likely takeaway is that Apple Watch sales haven't been impressive. However, this assessment is grossly inaccurate.

Exhibit 1: Apple "Other Products" Revenue

In what came as a surprise, soon after Apple Watch launched, Apple management began to provide clues regarding Apple Watch sales. The sales clues have now become so helpful at reaching Apple Watch sales estimates, management appears to be systematically undermining its initial decision to withhold sales data. Some of the more noteworthy sales clues over the past two-and-a-half years include:

- Apple Watch revenue accounted for "well over 100% of the growth" in Other Products in 3Q15 (two months of sales). In addition, Apple Watch sell-through was higher in 3Q15 than in the comparable launch periods for iPhone and iPad.

- Apple Watch unit sales were up sequentially in 4Q15 and once again in 1Q16.

- Apple Watch unit sales exceeded sales of iPhone during its first year. Apple Watch was the second best-selling watch brand in CY2015 (revenue).

- Apple Watch experienced a unit sales and revenue record in FY1Q17. Apple Watch sales "nearly doubled year over year" in 2Q17 and have been up "over 50%" in 3Q17 and 4Q17.

- Apple Watch was the best-selling watch brand over the twelve months ending in June 2017 (revenue).

Taking the preceding clues into consideration and adding them to my Apple financial model leads to the Apple Watch unit sales estimates found in Exhibit 2. Apple has sold 30M Apple Watches to date. More detail on the size of the Apple Watch installed base and user base is available for Above Avalon members here.

Exhibit 2: Apple Watch Unit Sales (Above Avalon Estimates)

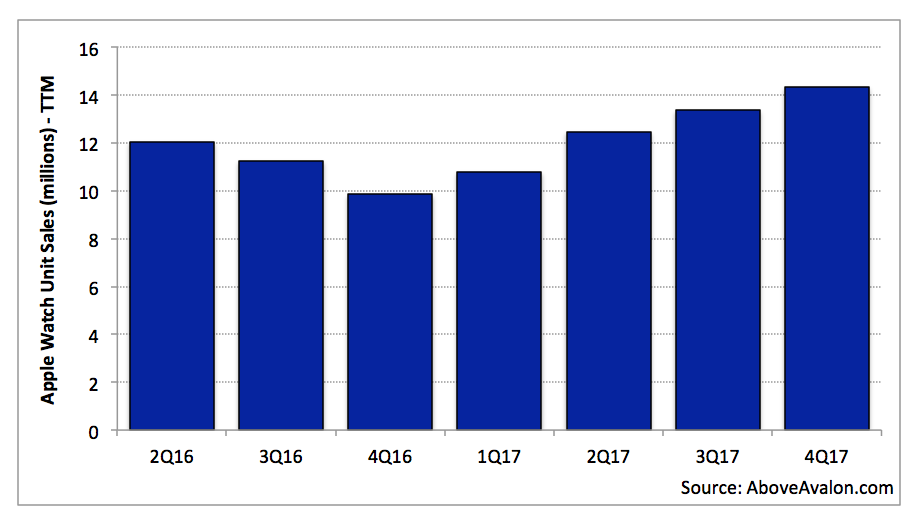

In order to remove the seasonality found with Apple Watch (sales are concentrated in the holiday quarters - 1Q16 and 1Q17), Exhibit 3 shows Apple Watch sales on a trailing twelve month basis. Apple Watch momentum becomes much easier to observe. Apple Watch unit sales have been steadily increasing over the past year with unit sales up nearly 50% year-over-year on a trailing twelve month basis.

Exhibit 3: Apple Watch Unit Sales - TTM (Above Avalon Estimates)

Time for Change

Four major changes have swung the disclosure debate in favor of Apple providing Apple Watch data on a quarterly basis.

- There is no smartwatch market. After more than two-and-a-half years of competition, it is clear that Apple Watch doesn't have much genuine competition. Instead of there being a smartwatch market, there is just an Apple Watch market. In the beginning, some thought low-cost, dedicated health and fitness trackers would pose a major long-term sales risk to higher-priced, multipurpose wearable devices like Apple Watch. This has proven to be incorrect. Apple Watch is seeing growing sales momentum while dedicated fitness trackers are quickly fading in the marketplace. Samsung, Garmin, Fossil are the only companies selling at least 100,000 smartwatches per quarter on a regular basis. The rationale for withholding Apple Watch sales data "due to competitive reasons" is getting weaker as time goes on. In addition, competitors already have a very good idea of how Apple Watch is performing in the marketplace thanks to the sales clues provided by Apple. (In addition, I have been providing Apple Watch sales estimates to Above Avalon members for years.)

- Additional Apple Watch sales data. Apple has a much better handle on Apple Watch demand trends given 10 quarters of Apple Watch sales data. Management is well aware of the seasonality found with Apple Watch sales. In addition, much of the unknown found with the quarterly swings in Apple Watch sales has been removed. Year-over-year growth projections for Apple Watch now serve as a more reliable way of forecasting sales.

- Low Apple Watch expectations. Wall Street no longer has high expectations for Apple Watch sales. Accordingly, Apple is no longer facing the same level of risk of missing Apple Watch sales expectations.

- New Wall Street focus. There is evidence of Wall Street focusing much less on Apple's unit sales growth. Instead, Wall Street is increasingly focused on Apple's balance sheet. The result is an environment in which Apple doesn't have to worry as much about slowing Apple Watch unit sales posing a threat on Wall Street.

Apple has been trying to play both sides of the Apple Watch disclosure debate. On one hand, the company still doesn't want to face the pressure and scrutiny found with disclosing Apple Watch revenue on a quarterly basis. However, management is providing increasingly detailed sales clues in an effort to tell the world that Apple Watch is selling well and gaining momentum.

Apple now stands to benefit more from disclosing Apple Watch sales than keeping them hidden. What were once incentives for not disclosing Watch sales have reversed and now represent reasons to provide sales data.

- Apple is missing positive press coverage associated with strong Apple Watch sales figures.

- Apple can improve its Wall Street narrative by talking up Apple Watch as a primary computing platform. Sales data will help Apple in such efforts.

The recurring theme found with Apple's disclosure philosophy is providing numbers when doing so benefits the company. A few recent examples include Apple beginning to disclose the number of paid subscriptions across the various App Stores and more detailed numbers related to Apple Retail traffic. The paid subscriptions disclosure goes a long way in painting Apple as having the best ecosystem for paid third-party services. Meanwhile, the Apple Retail and online store traffic disclosure paints a picture of an expanding Apple ecosystem in China and emerging markets.

Best of Both Worlds

Since Apple won't be required to disclose Apple Watch sales in the near-term given their small percentage of overall revenue, there is a way for management to have the best of both worlds when it comes to Apple Watch disclosure. Management can begin disclosing quarterly Apple Watch unit sales while keeping revenue lumped in with "Other Products." By disclosing unit sales, Apple is able to receive all of the upside found with Apple Watch disclosure. However, by not disclosing revenue, management would be able to keep Apple Watch average selling price (ASP) data hidden for competitive reasons. While the world would know how many Apple Watches are sold every quarter, estimating would still be required to assess which Apple Watch models are selling well. Apple has done something similar in the past with Apple TV when the company periodically disclosed unit sales without breaking out revenue.

By providing just Apple Watch unit sales on a quarterly basis, Apple can beginning taking back the Apple Watch narrative. As of today, there is still a remarkable amount of skepticism pointed toward Apple Watch. Since there is no rational reason for such skepticism to exist given management's Apple Watch sales clues, the lack of official Apple Watch unit sales data is likely a contributing factor. Official Apple Watch unit sales would go a long way in positioning Apple Watch as a compelling computing platform. Some consumers may become interested in Apple Watch once knowing how many other people are buying and wearing the product. Compared to the lack of sales disclosure from companies like Amazon, Google, and Samsung, providing quarterly Apple Watch unit sales would garner much more positive press for Apple Watch.

Meanwhile, there is a declining number of downsides and risks found in disclosing Apple Watch unit sales. Apple Watch has significant momentum in the marketplace, and Apple's engineering and design teams are running as fast as they can with the product category. Apple is leading the market with a cellular Apple Watch and being able to apply fashion/luxury attributes to design and technology. These items will very likely continue to fuel sales momentum for Apple Watch. No other company is close to Apple when it comes to selling multipurpose computers on the wrist at volume.

Financial Disclosure

Apple will eventually have no choice but to disclose Apple Watch revenue. Once "Other Products" begins to account for 10% to 15% of Apple's overall revenue, pressure will build for management to break up the line item to make it easier for analysts to model. Other Products currently accounts for 6% of Apple's overall revenue. The iPad represented close to 15% of Apple's overall revenue immediately after going on sale. Apple likely had no choice but to break out iPad sales. Meanwhile, Apple stopped reporting iPod sales once it declined to 1% of overall sales.

The Other Products line item has been effective up to now since it represents a small fraction of overall Apple revenue. This was the primary motivation behind Apple creating the category in the first place - to serve as a catch basin for products bringing in a small percentage of overall revenue. If Apple Watch continues to see significant revenue growth, pressure will build for Apple to rearrange its financial disclosure in order to break out Apple Watch revenue. While this scenario won't happen in the near term, a few more years of strong Apple Watch sales growth will make it a very real possibility.

Holiday Quarter

Apple's next earnings report marks a great opportunity for Apple to begin disclosing Apple Watch unit sales. Apple will likely sell more than 9M Apple Watches during the holiday quarter, which would represent a sales record and exceed Mac sales by a wide margin. Looking ahead, Apple Watch is on track to reach a 25M unit sales per year pace in 2018. It's time for Apple to begin disclosing Apple Watch unit sales data and become much more vocal in telling the Apple Watch story.

Receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week). To sign up, visit the membership page.