Apple 1Q18 Earnings Expectations

If Apple's 4Q17 amounted to a throwaway quarter, 1Q18 earnings will prove to be much more important for Apple. For the first time in six years, Apple's FY1Q results will reflect a full flagship iPhone launch. Typically, iPhone launches have been split between Apple's FY4Q and FY1Q. On top of it all, this wasn't just any iPhone launch as it was Apple's first flagship iPhone to begin at $1,000. The iPhone X will have a major impact on Apple's 1Q18 results.

The following table contains my Apple 1Q18 estimates. The ingredients are in place for Apple to beat consensus and its own revenue guidance.

My full perspective and commentary behind these estimates are available to Above Avalon subscribers. (Become a subscriber to access my 6,000-word Apple 1Q18 earnings preview available here. To sign up, visit the subscription page.)

Items Worth Watching

There are five variables worth watching when Apple releases earnings on Thursday.

- iPhone ASP. iPhone unit sales won't tell the full story as to how the iPhone business performed during 1Q18. Instead, iPhone average selling price (ASP) will provide useful clues for determining how iPhone X sold. I expect Apple to report the largest quarterly sequential jump in iPhone ASP on record because of strong iPhone X sales. The dramatic jump in iPhone ASP is the primary reason why my revenue estimate is 10% above the top of Apple's 1Q18 guidance range.

- iPad ASP. While Apple is expected to report continued iPad unit sales growth, iPad ASP will provide clues as to whether the low-end 9.7-inch iPad, the iPad Pro, or a combination of the two sold well.

- Other Products. The "Other Products" line item will include Apple Watch and AirPods revenue. Both products likely saw very strong sales momentum during the holiday season as Apple wearables are quickly connecting with the mass market.

- China. The underlying fundamentals found with Apple's China business have been trending stronger than consensus assumes. There is a possibility that China was the primary driver for iPhone X sales, which will have a major impact on Apple's overall results. In addition, there have been signs of broad Apple ecosystem strength in China as seen with non-iPhone sales.

- 2Q18 Guidance. There's never an Apple quarter in which management's revenue guidance isn't an item worth watching. Apple's 2Q18 revenue guidance will give us a look at how the company is thinking about the broader iPhone upgrade cycle as we move away last year's iPhone launches.

1Q18 Expectation Meters

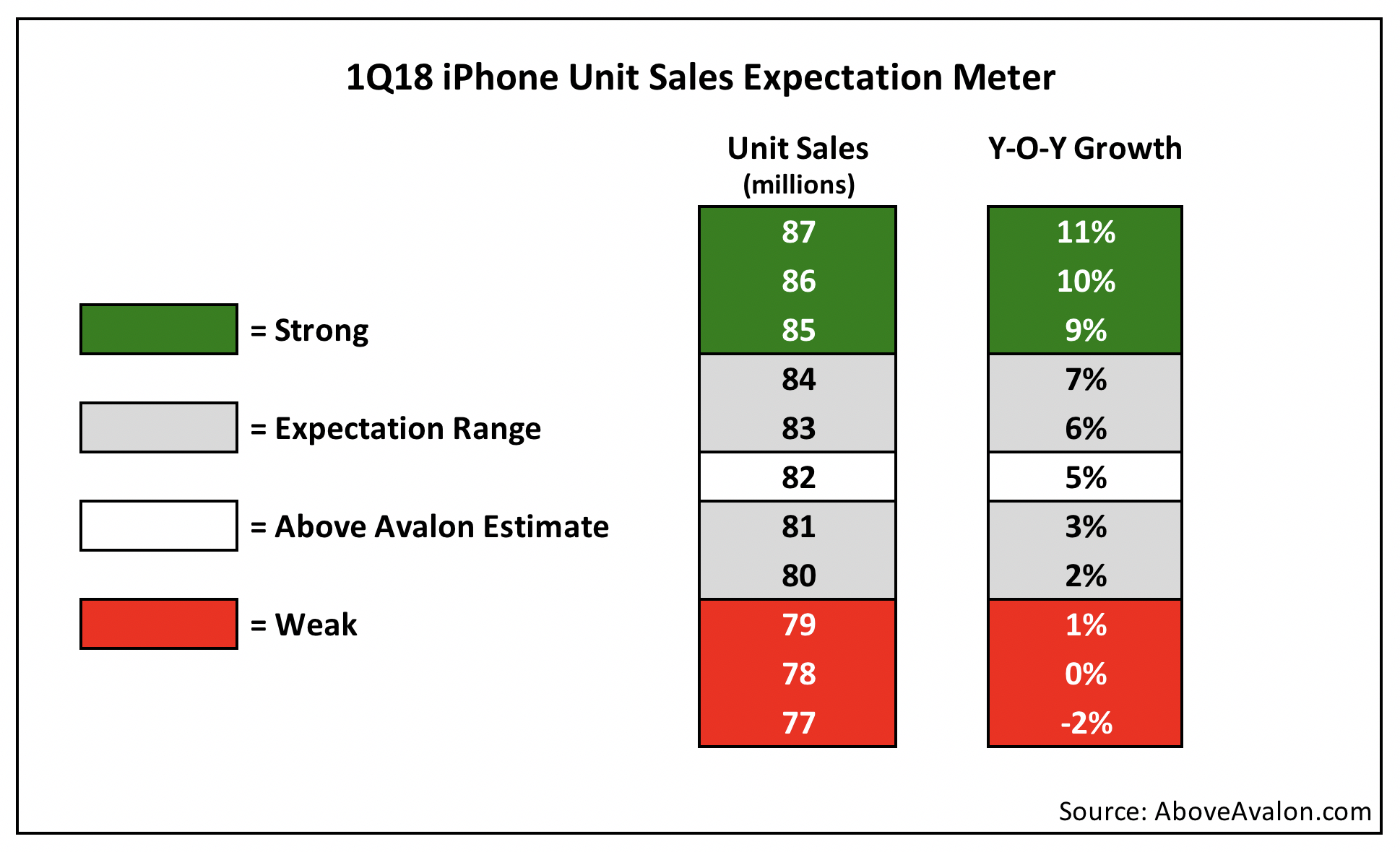

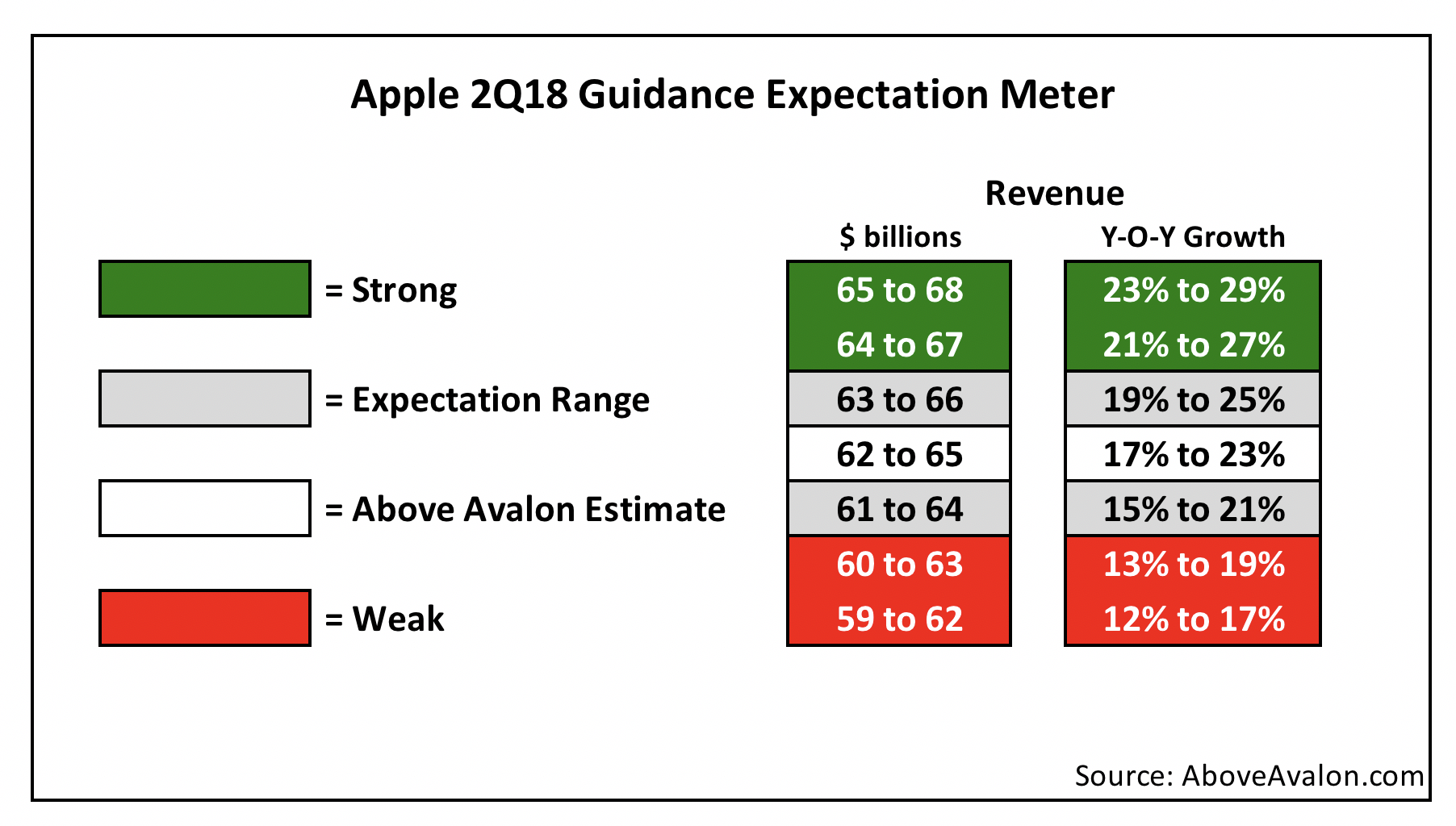

Each quarter, I publish expectation meters ahead of Apple's earnings release. Given the significant amount of modeling work that goes into each of my Apple financial estimates, these expectation meters turn single-point estimates into ranges in order to more accurately judge Apple's quarterly performance.

In each expectation meter, the grey shaded area is my expectation range. In most cases, a result that falls within this range signifies that the product or variable being measured is performing as expected. A result that lands in the green shaded area denotes strong performance and likely leads me to raise my assumptions and estimates going forward. Vice-versa, a result that lands in the red shaded area has the opposite effect and leads me to reduce my assumptions.

I am publishing four expectations meters for Apple's 1Q18: iPhone unit sales, iPhone ASP, iPad unit sales, and 2Q18 guidance.

My iPhone unit sales expectation range stretches from 80M to 84M iPhones. An iPhone unit sales result within this range would be labeled as "expected." A result that exceeds 84M iPhones would be viewed as strong, while a sub-80M iPhone result would lead me to reassess my sales expectations going forward.

For the first time, an iPhone ASP expectation meter is being shared. This reflects the importance found with the variable for Apple's 1Q18 earnings. An iPhone ASP below $750 would come in well below my expectations and point to sales momentum being found with lower-cost iPhone options.

The iPad is the second-best selling Apple product category. Accordingly, the product remains a good reflection of how the broader Apple ecosystem is trending, especially in terms of emerging markets, enterprise, and education.

Based on consensus, sell-side analysts expect Apple to earn $68B of revenue in 2Q18. Expectations have been declining in recent weeks as a growing number of analysts think strong 1Q18 iPhone results may have been a result of demand being pulled ahead from 2Q18.

Revenue guidance in the $65B to $70B vicinity would likely be viewed positively while revenue closer to $60B would be viewed more negatively. It is worth pointing out that Apple reported $54B of revenue in 2Q17.

Above Avalon subscribers have access to my full 1Q18 earnings preview (four parts):

- Setting the Stage

- iPhone Sales Estimate

- iPad, Apple Watch, Mac, Services Estimates

- Revenue, EPS, 2Q18 Guidance, Big Picture

Subscribers will also receive my exclusive earnings reaction emails containing all of my thoughts and observations on Apple's 1Q18 earnings report and conference call. To read my Apple earnings preview and receive my earnings reaction notes, sign up at the subscription page.